Dovey Wan’s new article: Tokens are a financialized belief system

author:Dovey Wan

Compiled by: Xiaobai Navigation coderworld

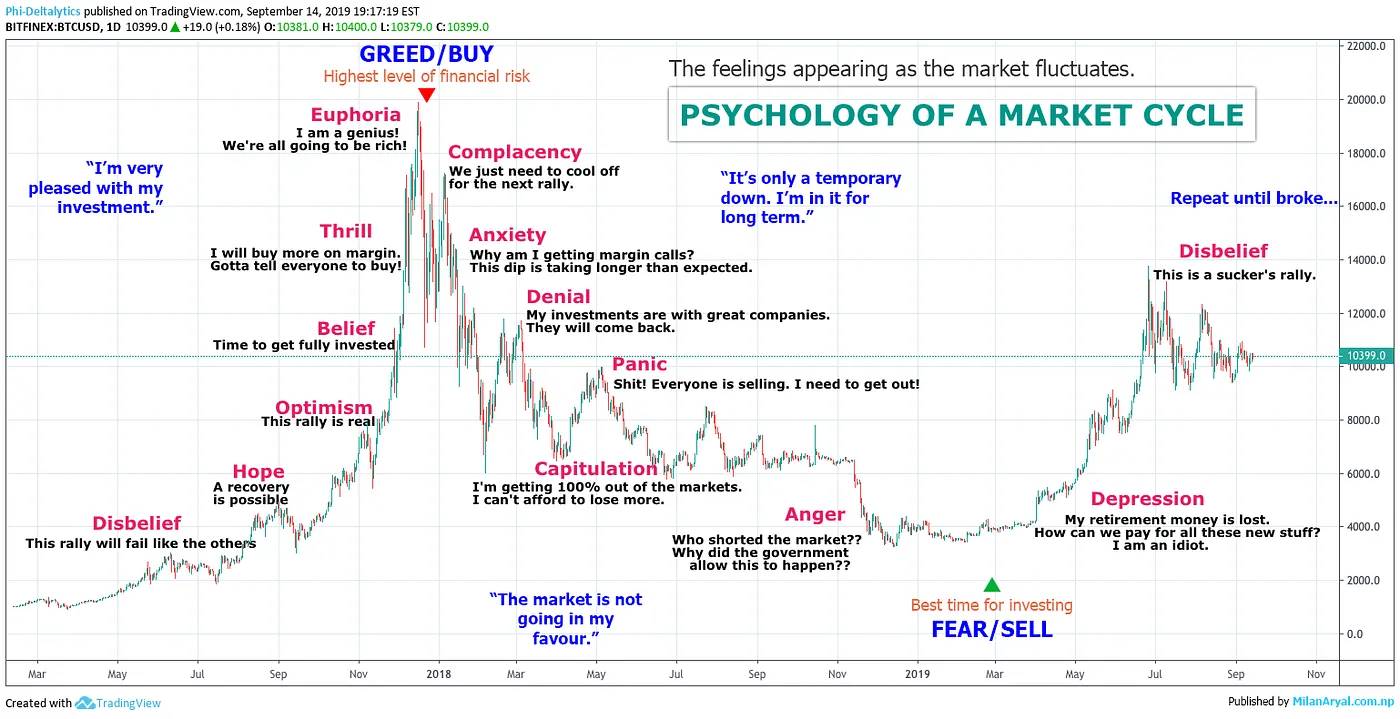

Token代表了一种金融化的信念系统,其中代币的波动性是最强大的市场进入策略。许多首次涉足cryptocurrencyFounders of cryptocurrencies adopt a bottom-up, milestone-based mentality, similar to founders of tech startups, believing that as long as meaningful value is created, the price will eventually increase. However, the growth trajectory of a successful crypto project usually follows a different sequence:

-

Prices guide emotions.

-

Emotions guide the narrative.

-

Narratives guide cognition.

-

Cognitive GuidanceCommunity.

-

CommunitySteering adoption and protocol market fit (PMF).

Barbell Distribution and the Sunk Cost Fallacy

cryptocurrencyIt embodies the intersection of financial populism and technological liberalism.对于代币的最佳分发策略是“杠铃分布”,即同时瞄准用户的两极——核心用户和边缘用户,从IQ 150到IQ 50。这种方法形成了信念形成过程的上层漏斗。许多创始人试图限制初始代币供应以避免“抛压”,但往往未能实现上层漏斗的增长。首先成功地吸引一端的用户,然后再拓宽杠铃是至关重要的。

In its early days, Bitcoin served either core users (cypherpunks, miners, and billionaires who want to avoid wealth redistribution) or fringe users (ordinary people whose local monetary systems collapse or who want to circumvent sanctions or capital controls). Early DeFi also reflected this model, best suited for crypto-native core users (self-custody enthusiasts, large players who want transparent transactions, large long-tail asset issuance) or fringe users (those who do not have good access to centralizedexchangeor financial infrastructure, driven by a “price increase” narrative). Most of the intermediate users remain apathetic or poorly motivated due to high psychological and product switching costs.

对于核心用户来说,不采用加密货币的机会成本太高。对于边缘用户来说,机会成本很低,因此他们更可能尝试。

“Miners” in most token economic environments are highly mercenary, influenced by their sunk cost levels. The higher the sunk cost, the closer they are to the core users.Xiaobai NavigationBitcoin miners rarely retain coins because there is no substantial sunk cost to recover. Post-ASIC miners retain coins to cover their sunk costs and operating expenses. PoS stakers hold coins at the opportunity cost of capital. The less productive a PoS coin is, the harder it is to build a strong core user base. Locking (including TVL locking) and airdrop farms are the worst forms of token distribution. The sunk costs of these actions are often proof of meaningless work, which is difficult to assess the "cost" and difficult to attract core or fringe users.

Active circulation through volatility

A few rounds of turnover during a market cycle are the best greenhouse for cultivating a belief system and a touchstone for testing the founder's adaptability and commitment.In the cryptocurrency space, these cycles are significantly accelerated, five times faster than in traditional finance. This dynamic works like a natural selection process, where passionate advocates who hold early tokens amplify the message and spread it like an idea virus. This shift changes the environment from player vs. player (PvP) to player vs. environment (PvE).

The keys to this transformation are strong leadership, a positive feedback loop of delivering on promises, and healthy engagement with key upper-funnel members.This effectively switches the funnel within crypto. Certain areas, like memes and NFTs, require a higher intensity of focus and mental agility, moving at a rate five times faster than the already accelerated crypto cycle, and 25 times faster overall.

For memecoin founders, it’s a statistical game with a very low hit rate, similar to a roulette wheel spinning wildly. Memecoins have played a role in the history of financial populism:They are not the product of financial nihilism but of financial absurdism and populist movements.Camus said this out loud 100 years ago. Cultural fluidity, identity crises, the twin deaths of traditionalism and modern liberalism have all contributed to a vast void of meaning for the modern autistic monkey. From consumerism to internet tribalism, trends, narratives, and products have emerged to fill that void.

As a result, the narrative and identity alignment within each coin now becomes a new means of expressing meaning and connecting with like-minded people - just like the early days of the internet when normally introverted, socially awkward cat owners finally found an outlet to post photos of their beloved cats. Unlike large corporations or venture capital coins, which may insist on some grand vision and brand legitimacy, meme coins provide a place for all those who don't care about "what is meaningful in the long run". Only the most absurd, short-lived, but most intense dopamine hits can retain this group of warriors who have no other wars to fight (but must release their ADHD power somewhere). This is a great PMF in crypto, perfect for a culture centered around depravity.

This environment is characterized by the most extreme survivorship bias and power laws, and users and traders are fickle in nature. This is why most tokens have only a 1-3 month lifespan in terms of liquidity and volatility, and very few are able to remain relevant after a cycle. When there is no liquidity, the token dies. Information is entropy, attention is currency. Liquidity is the HRV of a token.

Make diamond hands rich

Reward early loyalists generously and build a motivational drive system that reinforces commitment in this belief system funnel. Imagine a pyramid, the width of the base determines its height; the diamond hand forms the base and determines the height of the FDV.Price always leads the narrative.

Failure to make diamond hands rich naturally invalidates the conversion path of this belief funnel, and then it becomes PvP rather than PvE. Rewards are more than just financial gain, they can also serve as a form of identity recognition and enhance self-esteem. As a token community rooted in a belief system, you can provide social and psychological value by cultivating a sense of shared identity among holders. The decline of traditionalism and modern liberalism has left a huge survival gap for today's keyboard apes. Trends, narratives, and tokens have emerged to fill this gap, providing people with a sense of purpose and connection: just like the early days of the Internet, when cat owners, who are usually introverted and unsociable, finally found a channel to post photos of their beloved cats.

Diamond hands exist not only for the wealth effect, but also for the alignment of culture and beliefs. Wealthy Diamond hands will further enhance the overall cultural influence of the token, strengthen the belief system, and make it more self-fulfilling.

final,Tokens represent a financialized belief system.Market dynamics, human nature, and psychological biases are not only obstacles to overcome, but are fundamental building blocks for growth and adoption. Understanding and leveraging this belief system is critical to navigating and succeeding in the crypto ecosystem.I have been looking for founders who have both solid technical skills and a deep understanding of human nature. Cryptocurrency entrepreneurship is a process that requires a full grasp of the rules of the capital market game, cultural development, and technological progress.

The article comes from the Internet:Dovey Wan’s new article: Tokens are a financialized belief system

Related recommendation: Coinbase: Understanding the EigenLayer AVS landscape in one article

With re-staking and sharingSafetyFurther development of the modelBlockchainThe impact on the ecosystem will become increasingly apparent. Written by: JK, Coinbase Ventures Translated by: Jinse Finance xiaozou Abstract: EigenLayer is an Ethereum-based protocol that introduces a restaking mechanism —…