A “routine” operation to withdraw cryptocurrency liquidity turned out to be a scam

Written by: Huang Peng and Mao Jiehao, senior lawyers at Shanghai Mankiw LLP

According to The Paper, a post-2000 college student named Yang launched a virtual currency called BFF on a foreign public blockchain.Xiaobai NavigationCaught in a legal whirlpool for withdrawing liquidity – The procuratorate accused him of issuing fake virtual currency and misleading others to recharge 50,000 USDT, and then quickly "withdrawing funds" to cause losses to others. On February 20, 2024, the People's Court of Nanyang High-tech Industrial Development Zone, Henan Province, sentenced Yang to 4 years and 6 months in prison and a fine of 30,000 yuan at first instance. On May 20, 2024, the case was tried in the second instance at the Nanyang Intermediate People's Court.

As the first case to enter judicial proceedings due to the withdrawal of liquidity, this case has attracted much attention from the crypto and legal industries. So, why does "withdrawal of liquidity" constitute "fraud"? First, attorney Mankiw will review this incident.

01 Event Review

* Map based on reports from The Paper

The trigger of this incident was that after Luo recharged liquidity to the liquidity pool and exchanged a large number of BFF coins, Yang withdrew liquidity, causing the coin price to plummet and Luo to suffer losses. So what is "Liquidity Withdrawal?

02 cryptocurrencyLiquidity withdrawal in trading

Liquidity pools and how they work

Liquidity pool is one of the core mechanisms on decentralized finance (DeFi) platforms, which allows users to provide liquidity by depositing crypto assets into the pool, thereby supporting decentralizedexchangeThe smooth operation of DeFi (DEX) and other DeFi applications. The basis of the liquidity pool is the Automated Market Maker (AMM) model.contractAutomatic execution of transactions allows users to trade directly in the pool without the need for traditional order book matching, ensuring that there are enough buyers and sellers in the market, reducing the friction of the traditional order book model. Assets in the liquidity pool usually exist in pairs. For example, in this case, the liquidity pool added by Yang contains both BFF and BSC-USDT issued by Yang, which constitute a trading pair.AMMs make market making easier since anyone can become a liquidity provider.

Liquidity reserves are deposited by liquidity providers into smartcontractWhen investors execute trades on AMM, they no longer need a counterparty in the traditional sense. Instead, investors will execute trades based on the liquidity in the liquidity pool. When buyers buy, there does not necessarily need to be a seller, as long as there is enough liquidity in the reserve.

When transactions based on a liquidity pool are relatively active, the price may fluctuate greatly due to the "depth" or "shallowness" of the liquidity pool. At this time, it is necessary to set the "slippage" to better conduct transactions.

Characteristics of Liquidity Pools

-

Efficient trading:The AMM model ensures smooth transactions without the need for matching through traditional order books.

-

Decentralized Management:All transactions are executed through smart contracts, reducing dependence on centralized institutions.

-

Revenue Opportunities:Liquidity providers earn income through transaction fees and liquidity mining.

-

Impermanent loss risk: LPs may face impermanent losses when asset prices fluctuate.

-

Broad participation:Anyone can become a liquidity provider, lowering the threshold for participation.

The role of liquidity providers

Liquidity providers (LPs) are users who deposit assets into the liquidity pool. In return, they receive LP tokens representing their share. Token,TheseTokenIt can be used to earn a portion of the transaction fees. When someone trades in the pool, the fees they pay are distributed proportionally to all liquidity providers. Therefore, generally speaking, a well-functioning liquidity pool will usually have multiple users injecting funds to provide liquidity.

In this case, the liquidity of BFF was provided by Yang alone. As an issuer, the main purpose of providing liquidity is to ensure that the trading of its virtual currency in the market has sufficient depth and liquidity, so as to attract more traders and investors.Only provided by the virtual currency issuer or a few individual users, you need to consider the risks brought about by liquidity withdrawal.

Liquidity Withdrawal

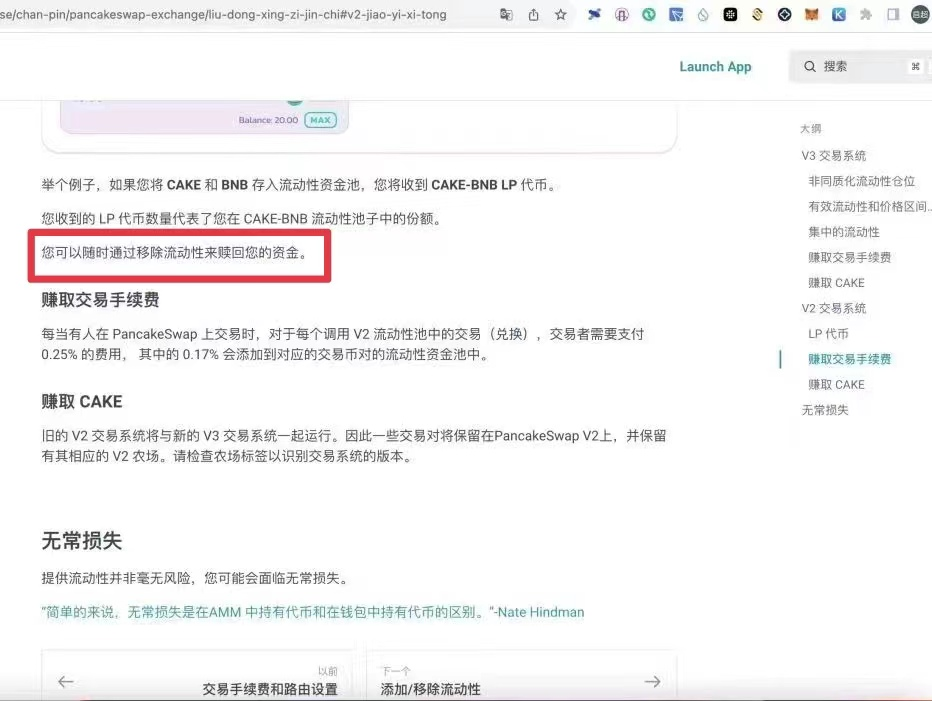

In cryptocurrency trading, “liquidity withdrawal” refers to the withdrawal of funds from a decentralizedexchangeThe process of retrieving the virtual currency assets you provided from a Decentralized Exchange (DEX) or other liquidity pool. In some projects, the provider of the liquidity pool will lock the pool for a certain period of time or make it permanently irrevocable. However, according to the rules of the trading platform involved in this case, the liquidity pool in question is in aRemove liquidity at any timeIn this state, users inject funds into the pool and then the issuer withdraws liquidity.

* Source: The Paper

It is worth noting that “liquidity withdrawal” (also known as “Rug Pull”) by virtual currency issuers is a highly controversial practice.

* Image source: TabTrader Team

The withdrawal of liquidity by virtual currency issuers usually involves the issuer or major liquidity provider suddenly withdrawing their funds in the liquidity pool, resulting in a sharp decrease in the remaining funds in the liquidity pool, a sharp drop in prices, and even an inability to conduct large-scale transactions, which may directly lead to serious losses of funds for other liquidity providers and traders. For example, in this case, Yang's withdrawal of liquidity caused a sharp drop in prices, and Luo finally only redeemed 21.6 BSC-USDT.

Some jurisdictions may regard “Rug Pull” behavior as market manipulation or fraud, and issuers may face legal action and penalties. However, there are no reports of cases of liquidity withdrawal. In China, this is the first time that a case has been filed for review due to liquidity withdrawal. Therefore, during the first trial, the procuratorate and the defense lawyer had a heated debate.

03 Focus of controversy: Fraud or "normal" operation?

In fact, in normal DeFi gameplay, the withdrawal of liquidity by normal participants can be considered as leaving the market, which is a normal operation. However, in this case, Yang, as the token issuer, creator of the liquidity pool, and main provider of liquidity, has different behavior from regular exits.

So is his behavior a fraud? First, let’s look at the definition of fraud – It usually refers to the act of fraudulently fabricating facts or concealing the truth to cause the victim to misunderstand and hand over a large amount of money.Regarding this definition, the prosecution and the defense had a heated debate in the first instance over whether it constituted fraud.

The People's Procuratorate of Nanyang High-tech Industrial Development Zone accused:

-

The defendant Yang created a virtual currency with the same name and issued the same promotional materials as Qudong Future.

-

After recharging 300,000 USDT coins as bait to lure the victim Luo to recharge 50,000 USDT coins, Yang withdrew a total of more than 350,000 USDT together with the 300,000 USDT he recharged.

-

Luo's loss was 50,000 USDT coins. After multiple exchanges and conversions between BSC-USD and USDT, USDT and US dollars, and US dollars and RMB, the prosecution accused Yang of defrauding Luo of RMB 330,000.

Defense attorneys argued:

-

Although the virtual currency issued has the same English name as District Future, this does not mean that it is a fake BFF coin, because the BFF coin issued by Yang has a unique and unalterable contract address and can be exchanged normally.

-

There are many coins with the same name on the virtual currency platform. In this case, before Yang issued BFF coin, related entities had already issued multiple BFF coins with the same name.

-

Qudong Future did not issue BFF coins, but BFFT and BFFA coins.

-

Luo is a veteran player and should have a clear understanding of the gambling nature and risks of virtual currency transactions.

-

Virtual currency investment is not protected by law, and both parties are engaged in illegal financial activities. Even if investors suffer losses, they should not be protected by law. The first instance court’s determination is a “disguised support for the redemption transaction between virtual currency and legal currency.”

-

The transaction records show that within less than 7 minutes after Luo redeemed 21.6 BSC-USD coins, he “bottomed out” the BFF coins issued by Yang three times, but then Luo reported to the public security authorities that he had been defrauded. As of the trial, the BFF coins issued by the defendant had appreciated significantly due to increased liquidity. Luo’s last number was 3A22. walletHe still holds 72381.7198 BFF coins, which can be exchanged for 64065.7134 USDT coins. "Regardless of whether virtual currency is property or not, as far as the increase in the amount of USDT is concerned, Luo has not suffered any loss."

The court of first instance found that:

-

"According to relevant policies of our country, this virtual currency does not have monetary attributes, but in real life, based on its stability, it can be traded on many international trading platforms and bring economic benefits. Its property attributes are undeniable." Therefore, it was recognized that the 50,000 USDT coins involved in the case should be converted into RMB value as a sentencing factor.

-

As to whether the victim later bought and sold the BFF coin, whether the coin still has value according to the trading rules of the BoBian platform, and how much value it has, none of these will affect the fact that Yang Qichao has committed a completed fraud crime.

As an emerging industry, virtual currency has always been controversial in terms of judicial and regulatory issues. Due to the inherent lag of the law, there is currently no definitive legal support for the ever-changing crypto industry. Therefore, how to protect citizens' property interests and coordinate within the current criminal law system?cryptocurrencyVarious regulatory policies test the wisdom of judicial organs.

04 Attorney Mankiw’s Opinion

Although the domestic market for virtual currency trading has been banned and various related financial businesses have been classified as illegal, a large number of Chinese players and users continue to participate in trading activities through overseas markets. In this case, when Chinese citizens suffer losses due to improper behavior such as "liquidity withdrawal", should their interests be protected? If so, does it mean that virtual currency is implicitly recognized as legal property? Is it implicitly supporting the redemption transaction between virtual currency and legal currency? Is it implicitly promoting virtual currency transactions?

Similar dilemmas are not only testing Chinese regulators, but also global regulators. The virtual currency market, which takes "decentralization" as its value concept, cannot actually break away from the various centralized regulatory systems in reality. "Decentralization" without governance capabilities will only turn the crypto market into a barbaric place where the law of the jungle applies.

The article comes from the Internet:A “routine” operation to withdraw cryptocurrency liquidity turned out to be a scam

friend.tech offers an interesting concept in the field of SocialFi platform. Written by: Greythorn ● Introduction According to the 2024 Global Social Market Report, the social media industry has undergone significant expansion, and its market value is expected to grow from US$219.06 billion in 2023 to US$251.45 billion in 2024,…