Galaxy Partners: MEV will play an important role in the blockchain space market

By Will Nuelle, General Partner, Galaxy Ventures

Compiled by: Luffy, Foresight News

introduce

We previously discussedBlockspace Business Model》 pointed out that the sale of block space iscryptocurrencyOne of four market segments that can generate repeatable, robust product-market fit. Over time, we expect the blockchain space to become second only toexchangeThe second largest gross profit segment, and may even become the largest gross profit segment as trading volume shifts from CEX to DEX. This is a B2B2C business model.BlockchainAttract application developers, who in turn attract consumers (both individuals and businesses) to use blockchain space through their applications.

We also believe that blockspace is a network effects-based business, in stark contrast to its similar business model, centralized cloud computing, which has economies of scale but no network effects.BlockchainThe network effects in blockchain exist in (i) application developers, (ii) application deployment, (iii) users, (iv) liquidity in the protocol, and (v) seed capital.

Galaxy predicts that block space consumption (measured in terms of the total amount of money spent consuming block space) will accelerate over time,BlockchainAny increase in capacity will be filled by demand.

MEV Economics

In this article, we will evaluate the proportion of block space consumed by MEV transactions and discuss why it is important for evaluating block space as a business model.

MEV transactions are very different from non-MEV transactions. The demand for MEV comes from within the system (endogenous), while the demand for non-MEV transactions comes from outside the system (exogenous). MEV is an amplified version of the demand for block space, which is generated simply by other people using the system.

-

Non-MEV transactions: Users are willing to pay for this because they have an exogenous demand to use the application, such as paying stablecoin transaction fees or depositing into Compound.

-

MEV transactions: Users are able to obtain risk-free profits (or statistical risk-free profits) based on the state of the system. The exogenous demand for using the system creates the demand for consuming block space. In other words, it is endogenous demand.

In my research on blockspace as a business model, I have been thinking: how much demand does MEV contribute to it?

MEV is a driver of block space demand

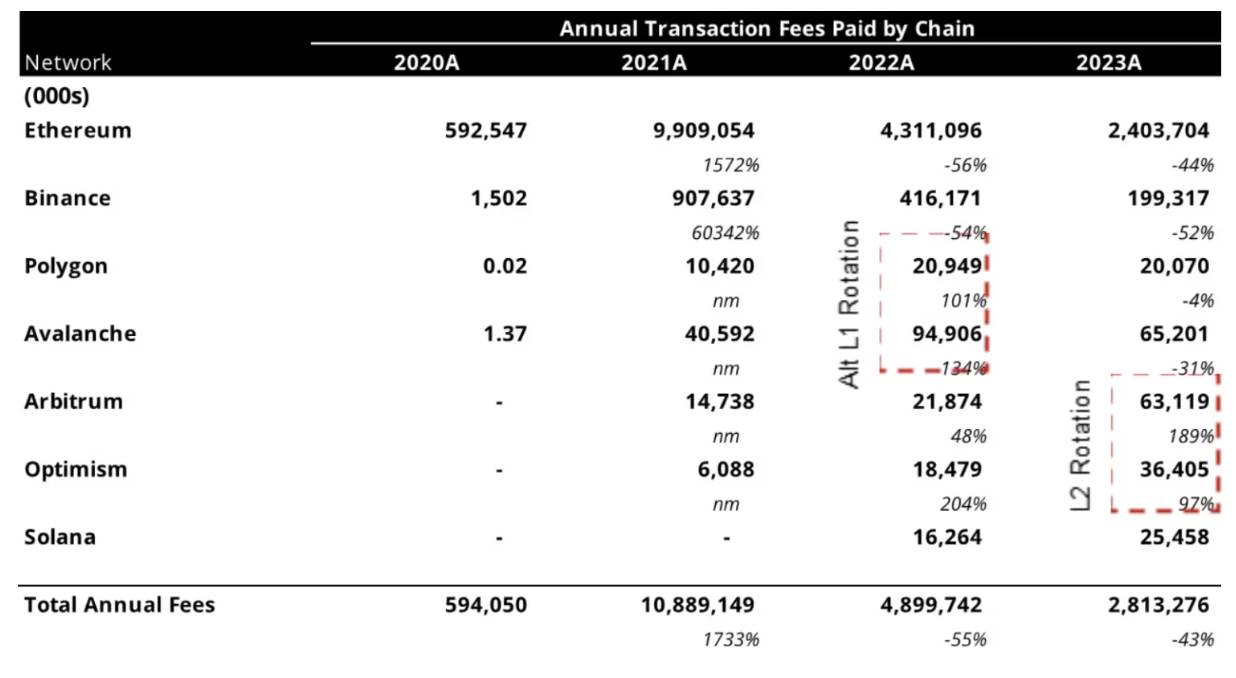

从此前《区块空间商业模式》一文中可以看出,顶级收费区块链上对区块空间的总需求达每年数十亿美元,且呈幂律分布:

Source: Will Nuelle, Galaxy Ventures

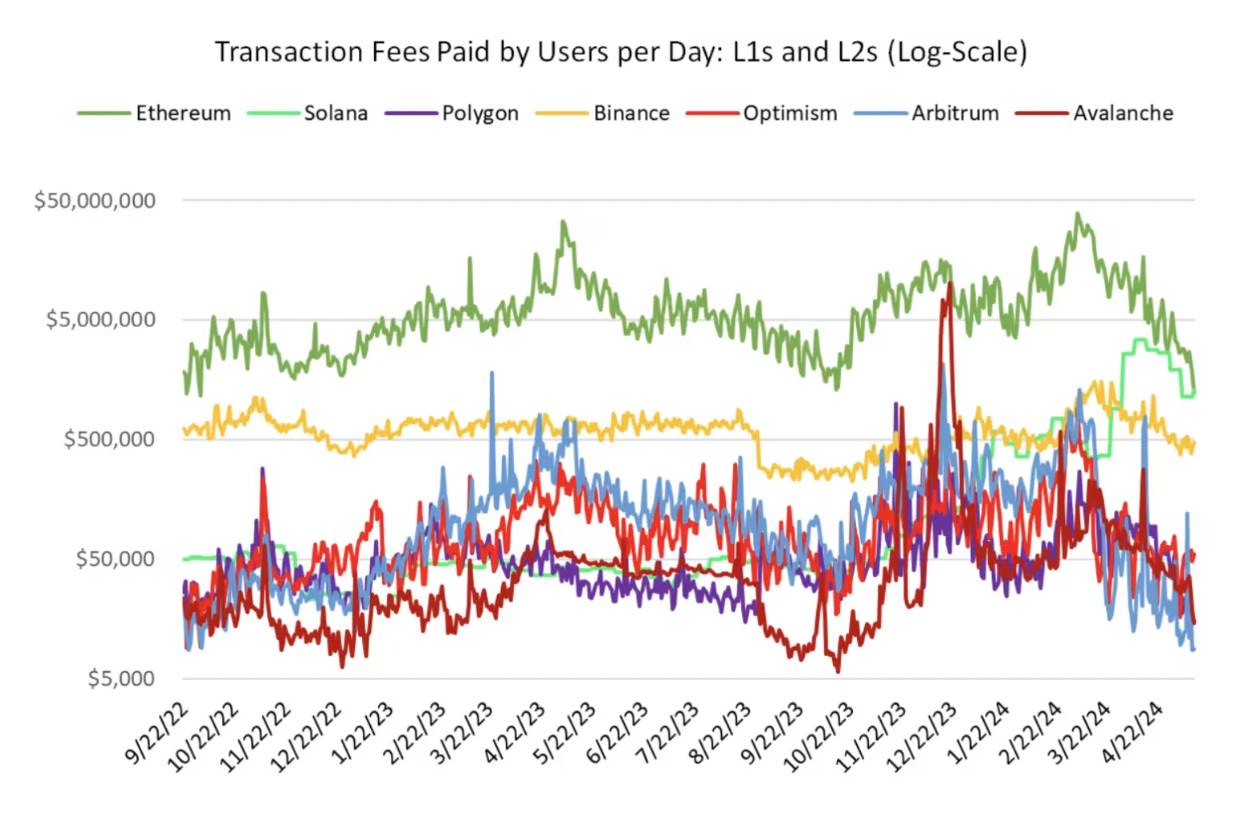

The daily transaction fees paid by users since September 2022 are as follows (time series are shown on a logarithmic scale):

Source: Will Nuelle, Galaxy Ventures

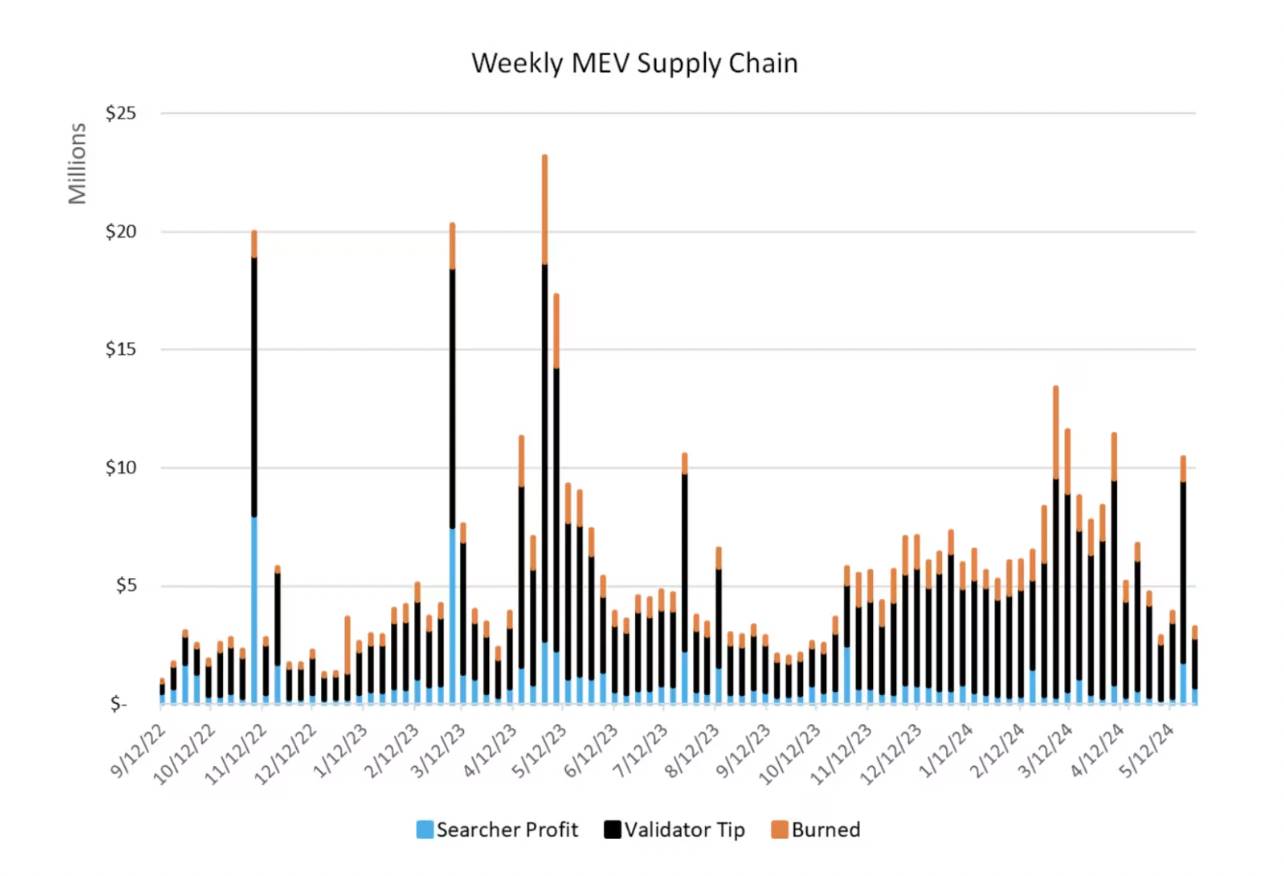

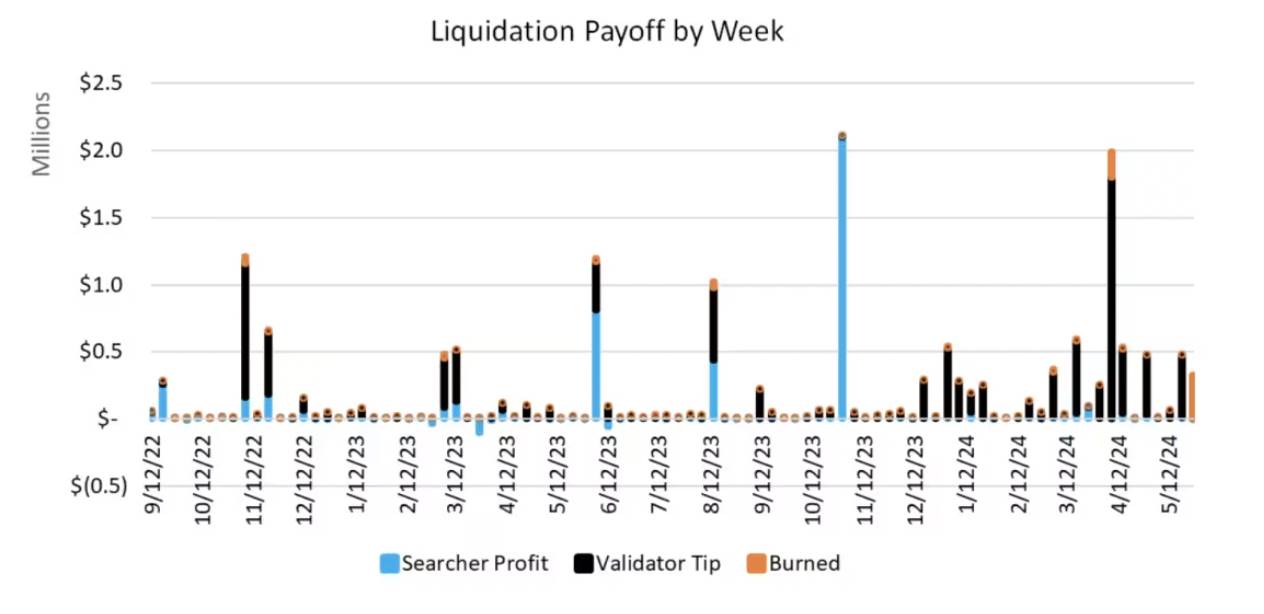

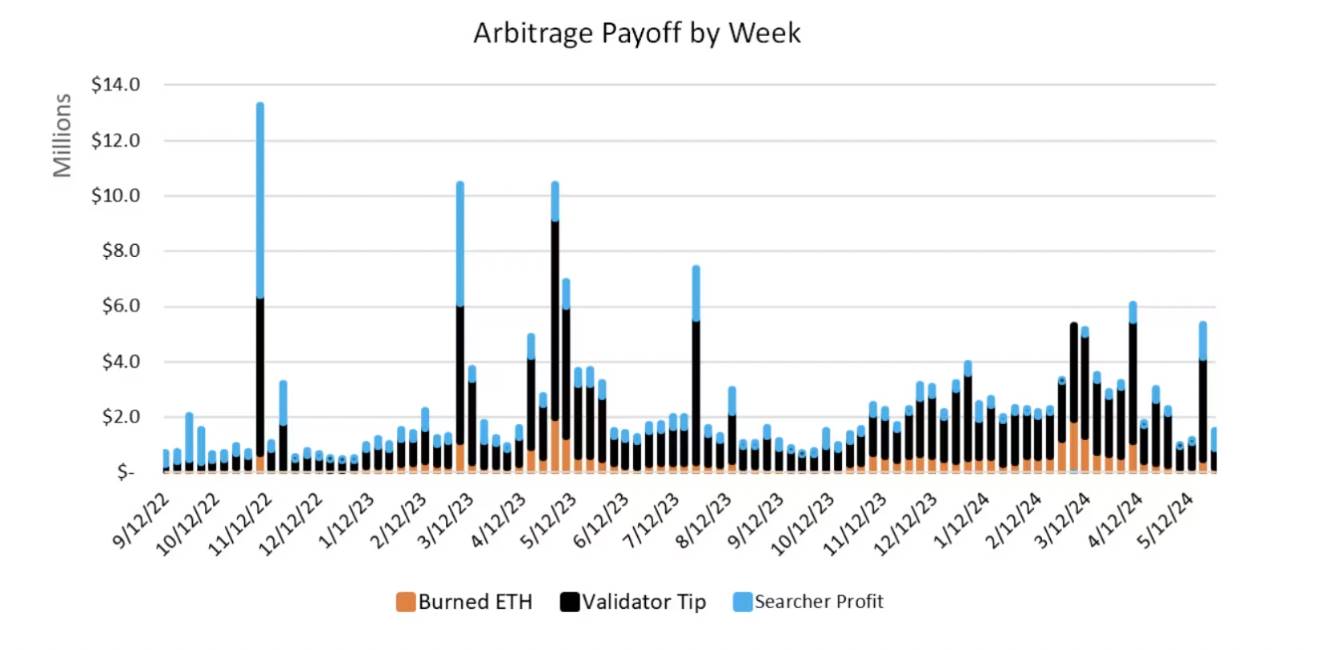

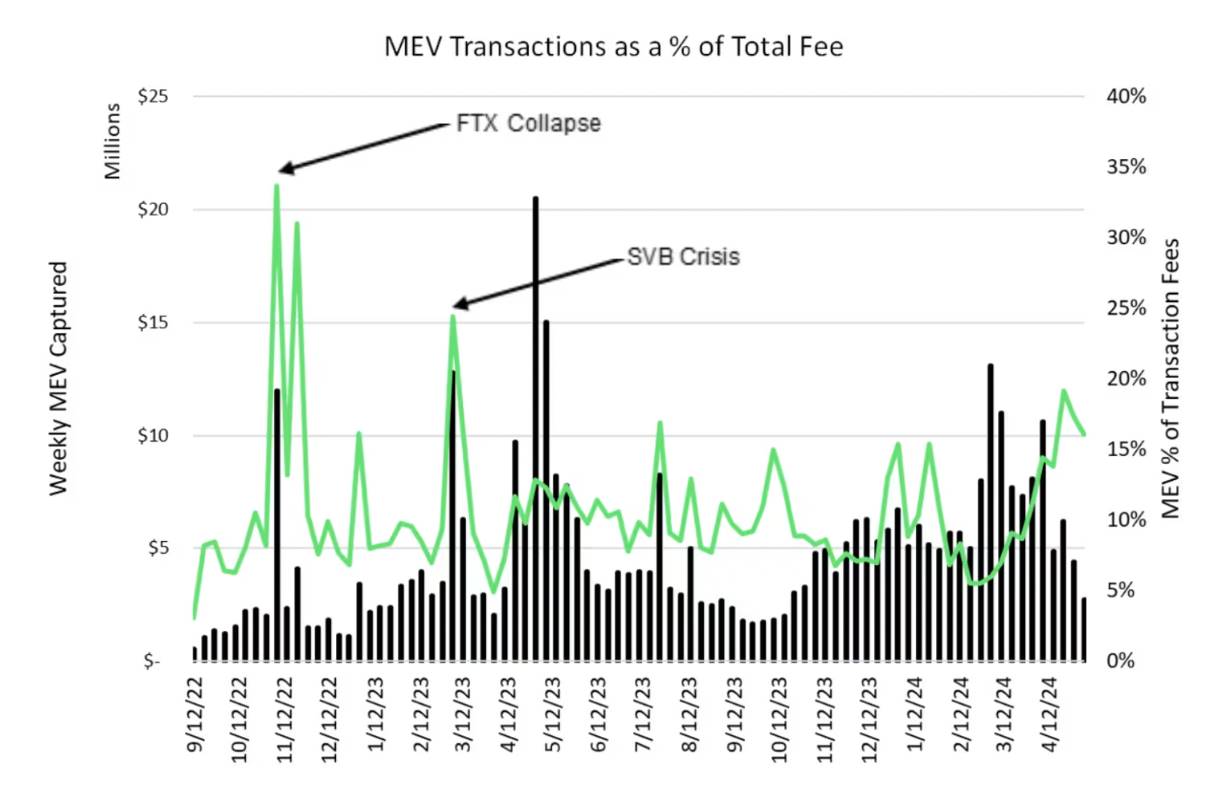

MEV is a permanent feature of the blockchain and a permanent consumer of block space. The chart below shows MEV on Ethereum (the only chain with good public MEV data) as of the end of February 2024, distributed between MEV searcher profits, validator tips, and ETH burned. These numbers do not include DeFi-CeFi arbitrage, which is statistical in nature, not atomic, and occurs both on-chain and off-chain.

Source: Will Nuelle, Galaxy Ventures

Searchers look for MEV opportunities and pay transaction fees for the chance to include them in a block. Competition between searchers forces them to pay more transaction fees than normal blockchain transactions to ensure inclusion, so most of the transaction fees paid for MEV go into the pockets of validators, manifesting as the final returns received by validators being slightly higher than the returns from staked ETH. Some of this is destroyed according to EIP-1559, ultimately benefiting all ETH holders; some of it ends up being profits from the work of searchers. In 2023, the full MEV supply chain averaged $6.6 million in weekly revenue, with a peak of more than $20 million in May (excluding returns from CeFi-DeFi arbitrage).

MEV Strategy

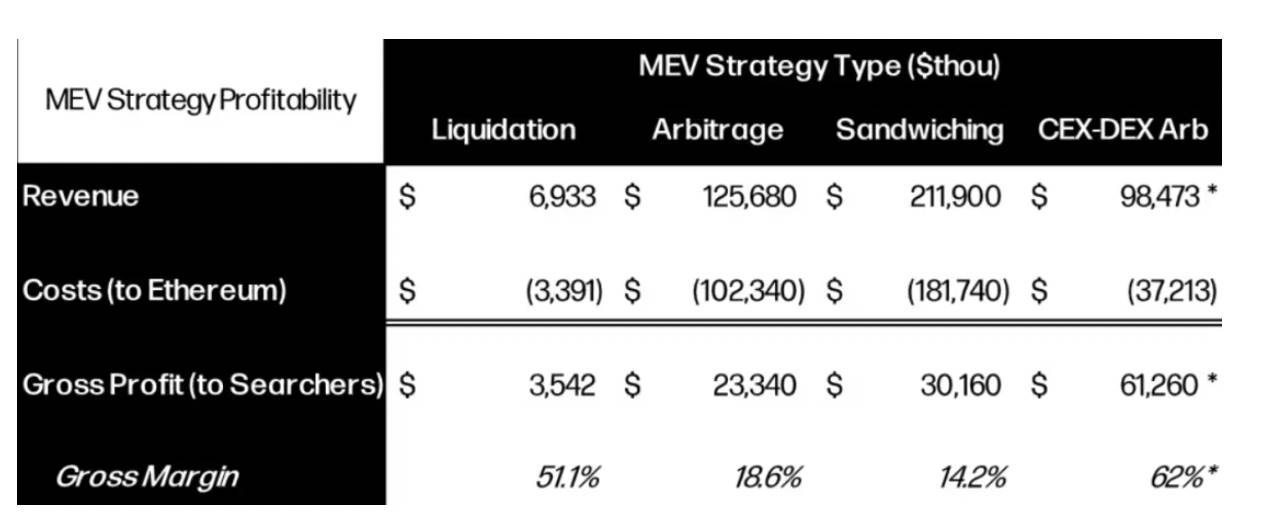

Different MEV strategies have different benefits and profit margins. Data shows that sandwiching, a parasitic form of MEV, generated $212 million in revenue on Ethereum last year by launching front-running and reverse trades on casual DEX users. Atomic arbitrage is more beneficial because it has the effect of equalizing prices in the DEX pool, generating $126 million in total revenue in 2023. Liquidation (rewards for clearing bad debts in lending protocols such as Maker, Aave, and Compound) generated only $7 million in revenue in 2024. In addition to this, there are some other forms of MEV, but they are more customized than systematic.

Source: Will Nuelle, Galaxy Ventures

CeFi-DeFi arbitrage is a more difficult strategy to measure, and there is no public data to quantify the gains of CeFi-DeFi arbitrage (because CeFi is partially opaque). Data obtained by Galaxy tracking shows that CeFi-DeFi arbitrage earned about $98.5 million in 2023, but only accounted for about 60% of market share. This is based on simulations of CeFi quote data, but may be higher or lower, depending on the specific Builder strategy. Note that the confidence interval for CEX-DEX arbitrage is large.

More interestingly, the gross margins of different strategies indicate which strategies are more profitable for Ethereum/validators and which strategies are more profitable for searchers. The gross margins of the Arbitrage and Sandwich strategies are 18.6% and 14.2% respectively, which means that these strategies are (i) highly competitive and (ii) they accumulate more value for the base layer (Ethereum) in terms of fees. Meanwhile, the Liquidation strategy has a gross margin of 51.1%, but it has difficulty in achieving scale and is therefore less competitive (and less important in this discussion). CeFi-DeFi Arbitrage has some scale, but is less competitive due to deeper moats in terms of order flow, builder concentration, and general statistical arbitrage complexity.

Source: Will Nuelle, Galaxy Ventures

Source: Will Nuelle, Galaxy Ventures

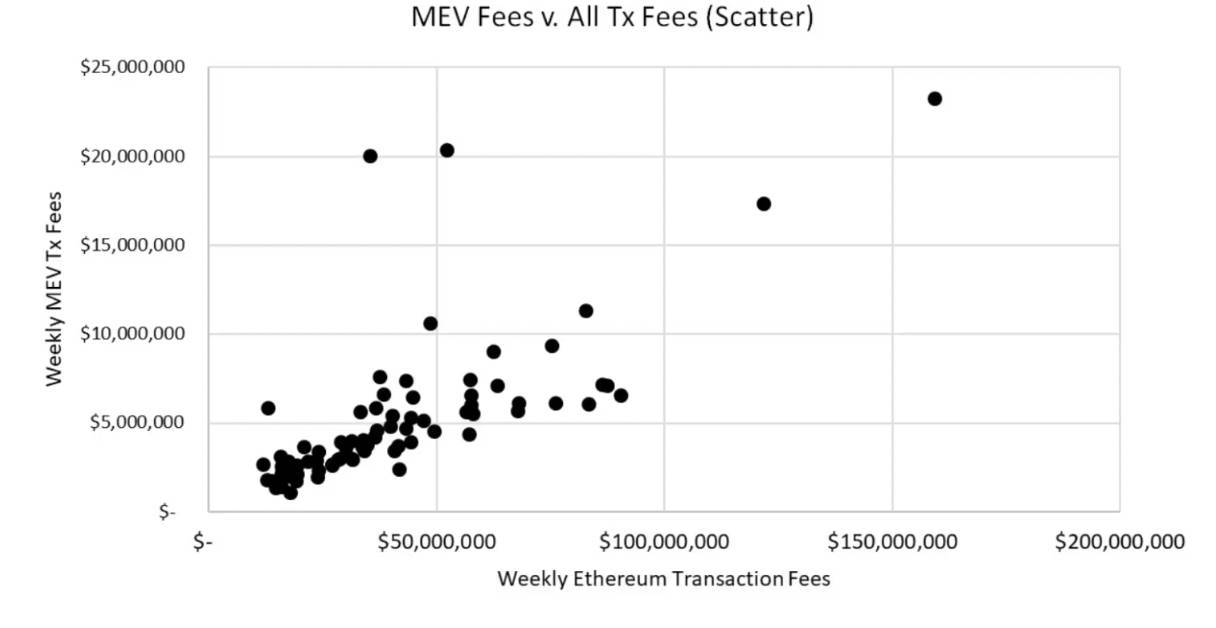

There is a stable relationship between MEV and block space demand

MEV as a percentage of transaction fees paid has remained stable over time, neither rising nor falling. As can be seen in the above figure, MEV as a percentage of block space hovers around 10% per week. In weeks with large price and volume fluctuations such as the FTX crash, this percentage may rise to 30% of transaction fees. The week of the Silicon Valley Bank crisis, MEV also reached 25% of transaction fees. This is a mean-reverting time series with fluctuations very much like financial markets. In fact, MEV activity may be closely related to volatility itself.

Source: Will Nuelle, Galaxy Ventures

Source: Will Nuelle, Galaxy Ventures

In other words, if the transaction fee consumption in a given week is $100 million, we can simply predict that 90% of it comes from exogenous demand for using the application, and 10% is endogenous due to risk-free profits from the change of state in that week. If 30% is created by MEV and 70% is created by non-MEV, then it is reasonable to believe that there is a high probability that it will return to normal next week. We will keep a close eye on this situation to see how it changes over time.

It is worth noting that this 10% or so invariance only applies to financial applications on the blockchain (DEX and lending protocols). These applications generate MEV, not stablecoin applications or games. If the dominance of financial applications declines over the long term, then the relevance of MEV will also decline in the absence of the discovery of new forms of stablecoins or game MEV.

Summary: MEV currently plays a small role, but will play an important role in the future

While MEV has the power to disrupt protocol incentives and is a perpetual consumer of blockspace, MEV’s actual financial contribution to Ethereum is relatively small at the moment, accounting for only 10% of transaction fees. In the weeks following a black swan market event like FTX or Silicon Valley Bank, this percentage may rise to 25% or more, but this is the exception, not the norm, and historically, this percentage has returned to a steady state. So what role does MEV play in the blockspace business model? In some ways, it is a demand multiplier effect, multiplying the exogenous demand to use an application by 1.1-1.3 times.

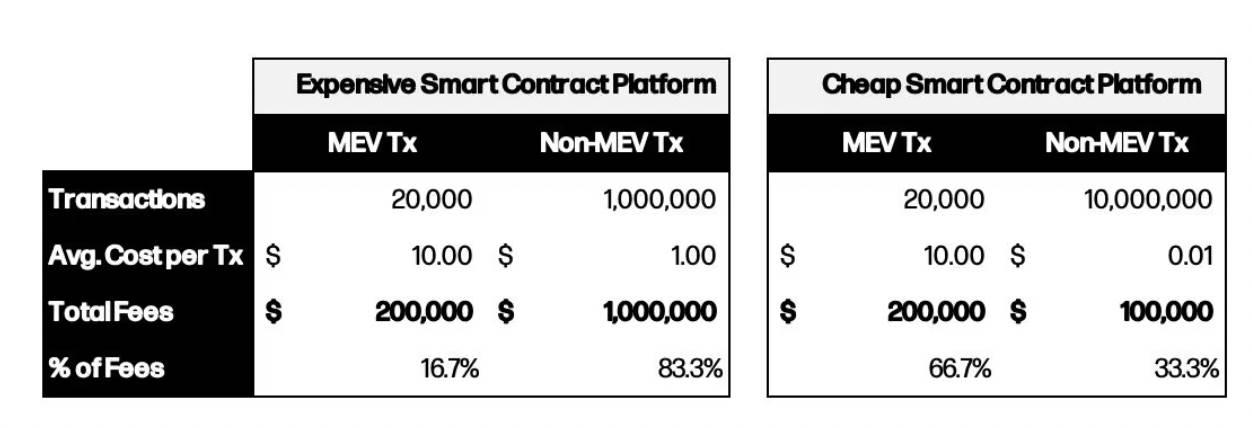

Nonetheless, the impact of MEV on future blockspace consumption could be significant. Blockchains like Solana and Monad have much cheaper per-transaction fees, and MEV could consume a larger percentage of blockspace on low-fee chains than on high-fee chains like Ethereum. To illustrate:

Source: Will Nuelle, Galaxy Ventures

The futuremake moneyThe blockchains that will be most likely to be those that simultaneously (a) reduce transaction fees and stimulate demand for network activity, and (b) primarily leverage network activity in the form of validators/sequencers/destruction of captured MEV.

The existence of phenomena such as MEV is just another reason why blockspace has become an unprecedented business model. Its unique characteristics make it a good business model and worthy of long-term investment. Finally, let's reiterate the advantages and disadvantages of blockspace:

Advantage:

-

Strong net revenue margins. Blockspace sales are the only business model with zero operating costs. Ethereum's net revenue margins fluctuate widely, but since January 2023, its average net revenue margin has been 33.9%.

-

Easy to generate network effects. Generally speaking, SaaS products do not have network effects, while social media applications and markets do. As more applications and capital join, the block space improves, which continuously drives up transaction fees with network effects. Network effects can generate additional income through MEV.

-

As time goes by, the blockspace size continues to increase. Some blockspaces will benefit from increased size, such as L2, they have the potential to grow further.

-

MEV has an exogenous demand multiplier effect. MEV is a blockchain system that always exists.Xiaobai NavigationAlthough MEV may damage consensus, it will contribute fees to the ecosystem on a large scale. For every $1 in transaction fees on Ethereum, about $0.10-0.30 in MEV fees will be generated.

weakness:

-

Gross margins are low, but improving. It is expensive to produce one unit of blockspace (e.g. 1M gas), and may require more than 66% of future profits from that blockspace. Blockspace is a low gross margin business.

-

Highly cyclical. The revenue from selling block space is highly cyclical. It depends on market conditions and is often closely tied to market volatility.

The article comes from the Internet:Galaxy Partners: MEV will play an important role in the blockchain space market

Related recommendations: 9 catalysts and airdrop opportunities worth watching this week

Sanctum is an ecosystem for liquid staking on Solana. The protocol has launched a first-of-its-kind loyalty rewards program that rewards users in a gamified way. Written by: The DeFi Investor Translated by: Xiaobai Navigation Coderworld Welcome to the second issue of the "Monday Alpha" series, this issue will include: This...