Everything you need to know about the Bitlayer ecosystem

author:Revelo Intel

Compiled by: Xiaobai Navigation coderworld

Over the past few weeks and months, Bitcoin’s status as an asset has declined from its position in the 70s. Market participants had been expecting the market leader to break out to a new all-time high (ATH), but in the second quarter of 2024, this has yet to materialize.Bitcoin Layer 2 Network (L2) is becoming increasingly competitive.Starknet宣布将推出他们自己的比特币L2,名为Catnet。这个计划涉及创建一个自定义的signet,并启用OP_CAT操作码;如果比特币在早期开发阶段没有移除这个操作码,它将允许比特币从一开始就托管智能contractNow, Babylon, a project that provides BTC staking and collateralization services, is gaining more attention. The protocol is currently in the testnet stage and has recently raised about $70 million from companies such as Paradigm.

Despite Bitcoin's price fluctuations,Bitlayer has become a leader in the Bitcoin ecosystem due to its unique BitVM implementation approach and ability to attract liquidity and users.Bitlayer has shown significant growth since we first reported on this emerging protocol a few weeks ago. The team just participated in GM VietnamBlockchainThe Bitlayer team is currently working on a new blockchain called Bitlayer, which is based on the Bitlayer protocol. The team will be appearing at the EthCC conference next month to actively promote their work and the philosophy of BitVM. Bitlayer’s median gas fee is currently quoted at $0.4, and the protocol’s total locked value (TVL) has almost tripled to about $354 million. This puts Bitlayer second in the TVL ranking of Bitcoin chains, second only to Merlin Chain. Notably, Merlin Chain’s TVL more than doubled in one day last month. The Bitlayer ecosystem has grown to have more than 100 decentralized applications (dApps).

Bitlayer has only been live for a few weeks and is already showing incredible growth. The chain has surpassed 1 million transactions, with activity peaking in tandem with the rise in Bitcoin’s price. In our last report, we briefly covered the Ready Player One airdrop, a $50 million event for developers and protocol teams, with $20 million earmarked for leaderboard competitions. Bitlayer has since implemented a new $23 million Mining Gala event, which concluded earlier this week. In today’s post, we’ll detail some of the key partner projects participating in this event, which make up a large portion of Bitlayer’s total TVL, user base, and activity.

Avalon Finance

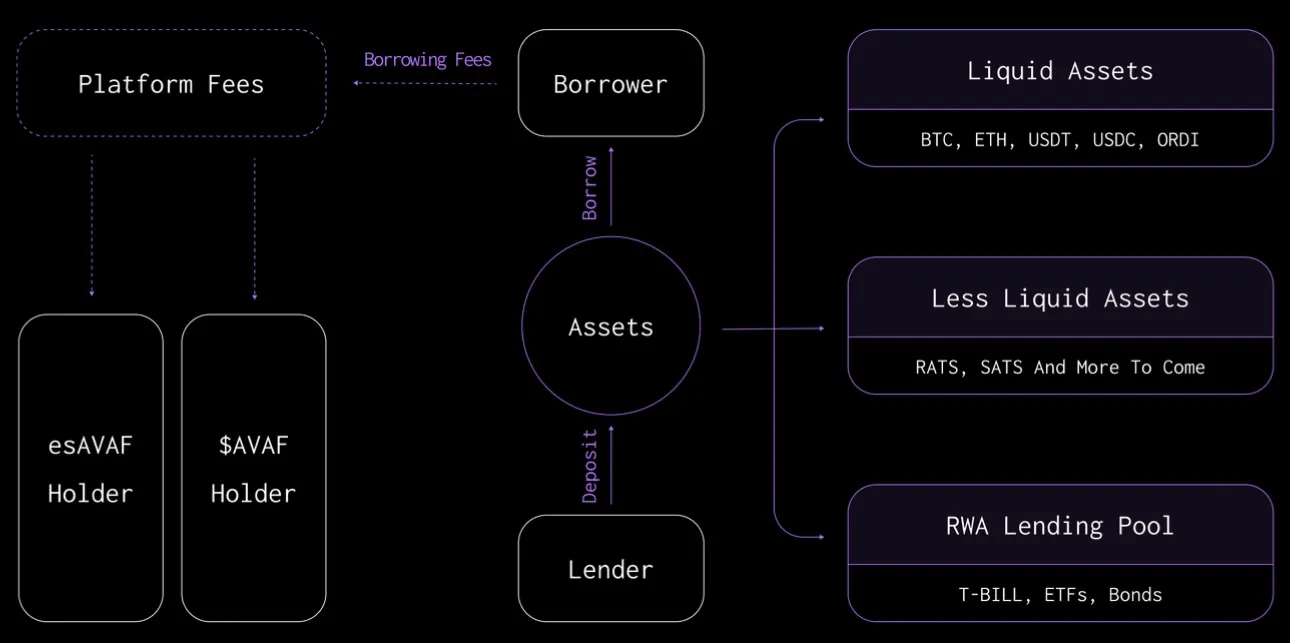

Avalon claims to be the first “CeDeFi” lending market. The protocol has a TVL of over $120 million on Bitlayer, and its nativeTokenAVAF and esAVAF can be staked to obtain protocol income and esAVAF rewards.

The modular protocol’s main product is its overcollateralized lending market, where users can deposit funds into separate pools to serve as collateral for borrowing.TokenAll can be deposited, but currently only Bitcoin can be used as collateral for borrowing. Currently, nearly $86 million of WBTC has been lent out, and total deposits are about $180 million. Deposits earn 2x points, while borrowing earns 6x points. Therefore, the maximum borrowing limit of 1,300 WBTC is almost full, with a utilization rate of about 43%. Borrowers can use a loan-to-value ratio (LTV) of up to 60%, a liquidation ratio of 85%, and a liquidation penalty of 10%. Users can track their point accumulation on the project's integrated leaderboard.

Pell Network

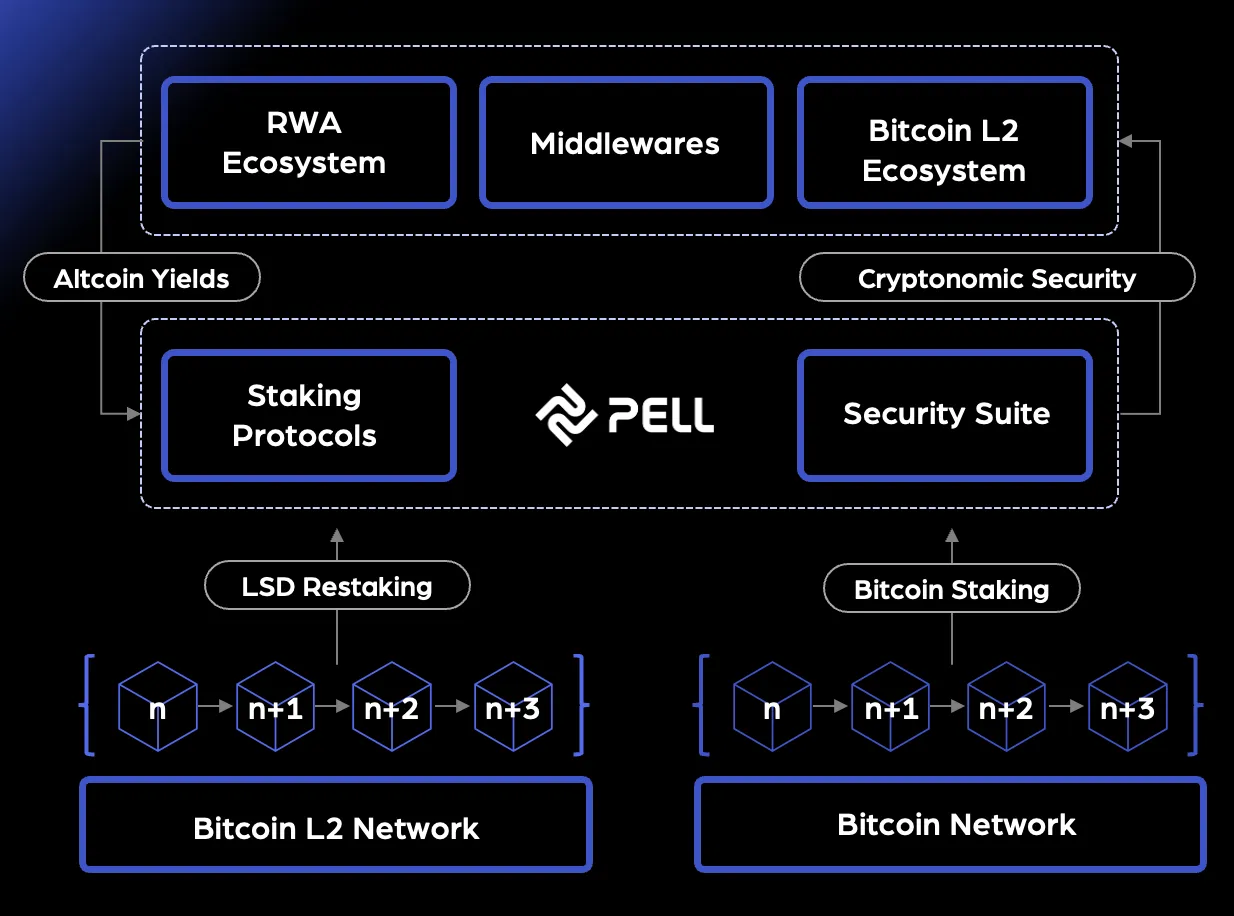

Pell Network在Bitlayer上的TVL约为9500万美元。Pell Network为新兴的比特币L2市场提供一系列服务,包括网络SafetyFunction,BlockchainOperational infrastructure and yield enhancement. Pell Network also participates in Bitcoin re-staking, aiming to diversify the yield of Bitcoin L2 and enhance theSafetysex.

On Bitlayer, users can "re-stake" various assets to receive 15% Pell points rewards. In addition to WBTC, users can also deposit various Bitcoin LSDs into the protocol, of which stBTC accounts for the majority of Bitlayer TVL. Users can receive additional points rewards by using the protocol for the first time and extending the deposit time, in addition to earning points through some basic social interaction tasks.

On the backend, Pell Network essentially aggregates native Bitcoin staking returns and returns from LSD, creating a network where stakers can choose to validate new modules built in the ecosystem.

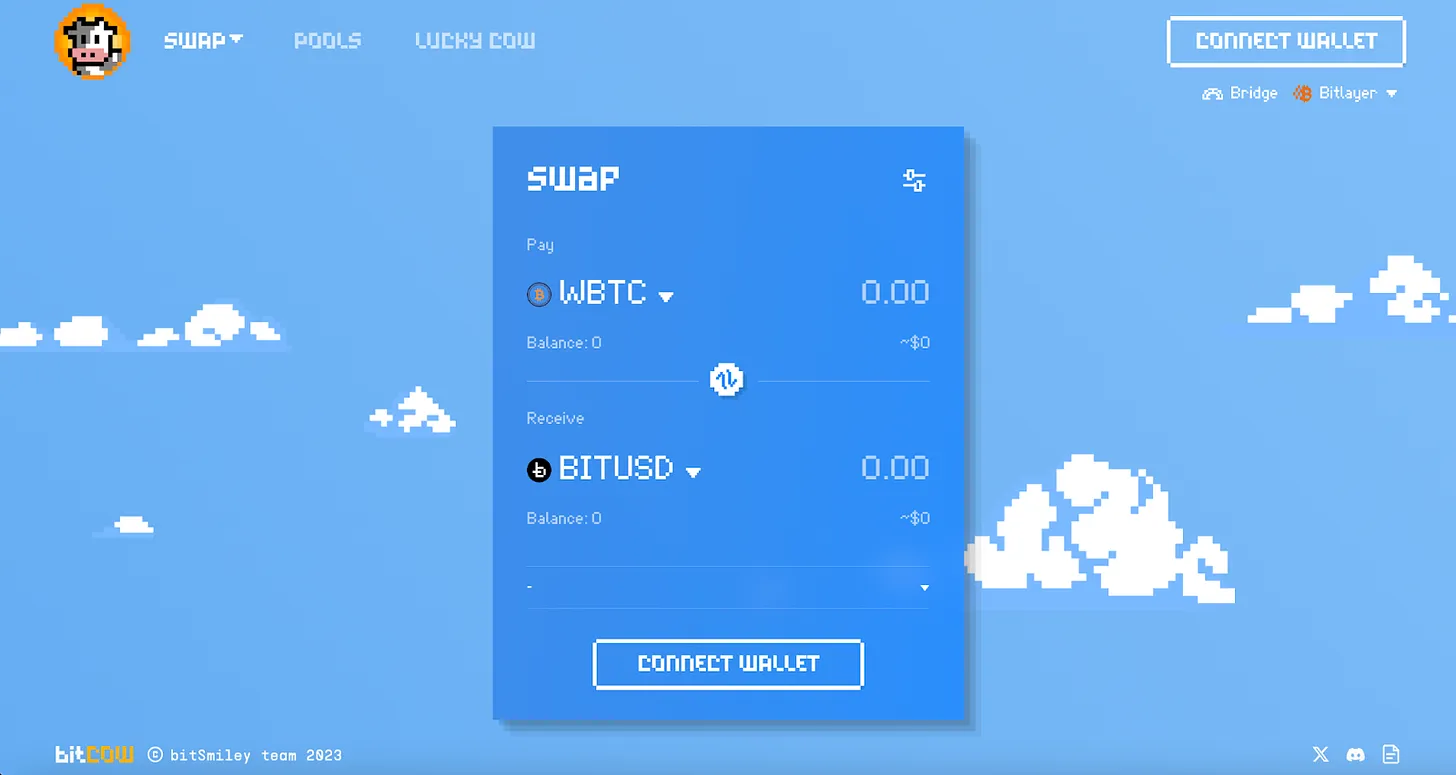

BitCow

BitCow is the third-largest protocol on Bitlayer with a TVL of approximately $35 million. BitCow acts as an automated market maker (AMM) that provides stablecoin exchange and centralized liquidity services. The protocol is specifically designed to serve the expanding Bitcoin L2 ecosystem. In its v1 version, BitCow provides stable exchange services for stablecoins and LSD assets while maintaining minimal gas fees and maximizing capital efficiency. The equilibrium price is also adjusted over time to take into account the gradually increasing value of LSD assets.

BitCow V2 focuses on centralized liquidity for swaps on volatile currency pairs. Features include automated pricing, 0 IL, and transparent profit and loss information. Automated pricing is achieved through the use of external oracles, which allows centralized liquidity without the need to manage price ranges. All liquidity for a particular asset is automatically concentrated around the price determined by the oracle. This compromise approach results in higher returns for LPs while eliminating the need for LP management.Xiaobai NavigationProtocols and the complexity trade-offs associated with centralized liquidity.

在其v2版本中,BitCow还采用了双代币LP解决方案,其中一对代表对中的波动性资产,另一对代表稳定币。这允许波动性代币LP持有者在资产价值变化时拥有其资产的权利。而稳定币LP持有者则保持市场中立,并从对中累积交易收入。此外,协议的Trumeme功能允许用户在测试网上创建自己的memecoin并提供初始流动性。

The article comes from the Internet:Everything you need to know about the Bitlayer ecosystem

Through OKX's centralized exchange, Dutch residents can now use spot trading, exchange and earning services. On June 3, 2024, OKX, a leading global virtual asset exchange and Web3 technology company, announced today the official launch of its centralized virtual asset exchange and OKX wallet in the Netherlands. In terms of centralized exchanges, Dutch customers can now enjoy spot (buy and sell) trading...