Freeing the “Prisoners of Babylon”, how did Lorenzo rebuild the Medici financial empire?

Written by Peng Sun, Foresight News

* Preface: The “Babylon Prisoner” metaphor only refers to the current liquidity restrictions on BTC staked through Babylon. The author is very optimistic about Babylon, whose native BTC stake is a sharedSafetyIt has indeed opened the door to Bitcoin ecological finance, and how to fully release BTC liquidity based on Babylon and provide users with more sources of income is the direction that Lorenzo is currently actively exploring.

We talk about the Bitcoin Renaissance, but few people know what is behind the Renaissance. In fact, the Medici family is the "godfather of the Renaissance", and the Medici Bank is the "financial promoter" behind the Renaissance.

If the famous families in medieval Europe are compared to the starry sky on a summer night, then the Medici family is the most dazzling superstar. They were not only the actual rulers of Florence, but also produced three popes and two French queens. They recruited and sponsored artists, including Botticelli, Leonardo da Vinci, Michelangelo, Raphael, etc. Most of these big works came from the hands of the fourth-generation successor of the Medici family, Lorenzo di Piero de' Medici.

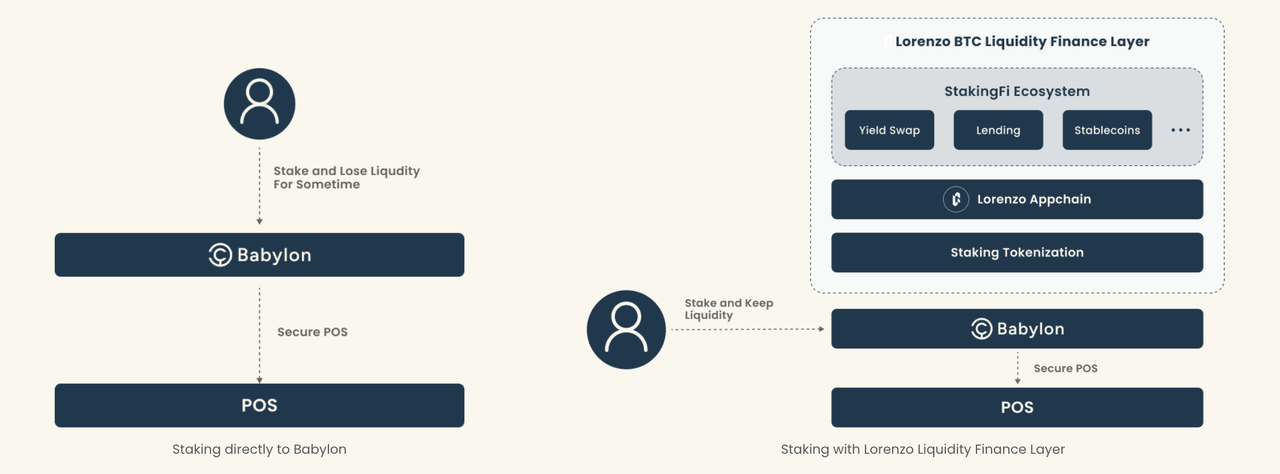

The Italian Renaissance was based on the liquidity finance of the Medici Bank. The same is true for the Bitcoin Renaissance, which is to stimulate and release the liquidity of BTC and build a richer and more complex BTC asset financialization scenario. Babylon has realized the native staking of BTC on the Bitcoin mainnet and can provide sharedSafety, opened the door to Bitcoin ecological finance, but BTC's liquidity has not been fully released. At this stage, Babylon's liquidity restrictions are like "Babylonian prisoners". There are many projects that hope to solve this problem, but they are far from going as deep as Lorenzo, and the release of liquidity finance is not thorough enough.

Today's LorenzoThe positioning is just right. It aims to build a Bitcoin liquidity financial layer that integrates Lido + Renzo + Pendle, provide income based on Babylon's native BTC, and open up the entire process of liquidity pledge, re-pledge, principal and interest separation, StakingFi, etc. In other words, Lorenzo will become the capital entrance for users to enter various BTC financial products. Currently, Lorenzo has received investment from Binance Labs and has launched the mainnet beta version. The mainnet V2 will be launched in June. In addition, Lorenzo has recently launchedBitcoin pre-staking Babylon and Bitlayer joint mining activitiesTo thank early supporters, Lorenzo set up incentive pools and launched multiple incentive plans for users to participate in pre-staking Babylon, bridge stBTC to Bitlayer to participate in ecological projects, and other Lorenzo cooperation projects.

So, how will Lorenzo maximize the liquidity of Bitcoin and recreate the financial empire of the Medici Bank, and what kind of Renaissance will he lead Bitcoin to?

Lorenzo: The Pope's wealth manager

In the Middle Ages, the Pope was the main customer of Italian banks and trading companies. He was the only ruler who had the right to levy taxes in all corners of Europe. Banks were financial institutions that provided financial management services for him, including collecting taxes, receiving and transferring taxes, exchanging currencies, and providing loans. The Medici Bank became the manager of the Pope's wealth very early. In the confidential account books, the account of the Pope's Treasury was in the name of the Rome branch, which is equivalent to the account of the US Treasury at a Federal Reserve Bank today.

During the Lorenzo era, the church, the dignitaries, and the princes and nobles once believed that the Medici Bank had the ability to lend unlimited amounts. The reality was that the Medici Bank borrowed excessive amounts, and the church was unable to repay. In 1494, the Medici Bank was on the verge of bankruptcy, and the mainstay of the Rome branch was trapped in the loan issued to the Pope's Treasury. As the Pope's wealth manager, the Medici Bank was too deeply involved in politics. With the shortage of wool in England and the decline in silver prices, the Medici Bank's reinvestment opportunities were sharply reduced, the source of income was seriously scarce, and the cash reserves were far less than 10% of total assets, and it eventually fell into a liquidity crisis.

Today, Lorenzo is also the manager of "religious wealth". Bloomberg calls Bitcoin "the first true religion of the 21st century", and Bitcoin fundamentalists and Bitcoin holders are its believers. From a financial perspective, today's public blockchain is like a bank, and various financial products are derived from banks, including deposits, loans, mortgages, exchanges, structured products, insurance products, etc. However, due to the limitations of Bitcoin scripting language and technology, it is impossible to build native blockchains on Bitcoin. DApp,比特币始终未能构建属于自己的流动性金融。这也造成一种普遍的现象,过去四年持有 100 枚 BTC 以上的地址数一直稳定在 1.6 万上下。尽管当前最大的封装代币 WBTC 市值约 105 亿美元,但 BTC 总市值足足 1.3 万亿,占比不过 0.8%,加之比特神教对于「Not your keys, not your coins」的信仰极深,很少有人愿意冒着风险参与跨链与其他链上的 DeFi 协议。

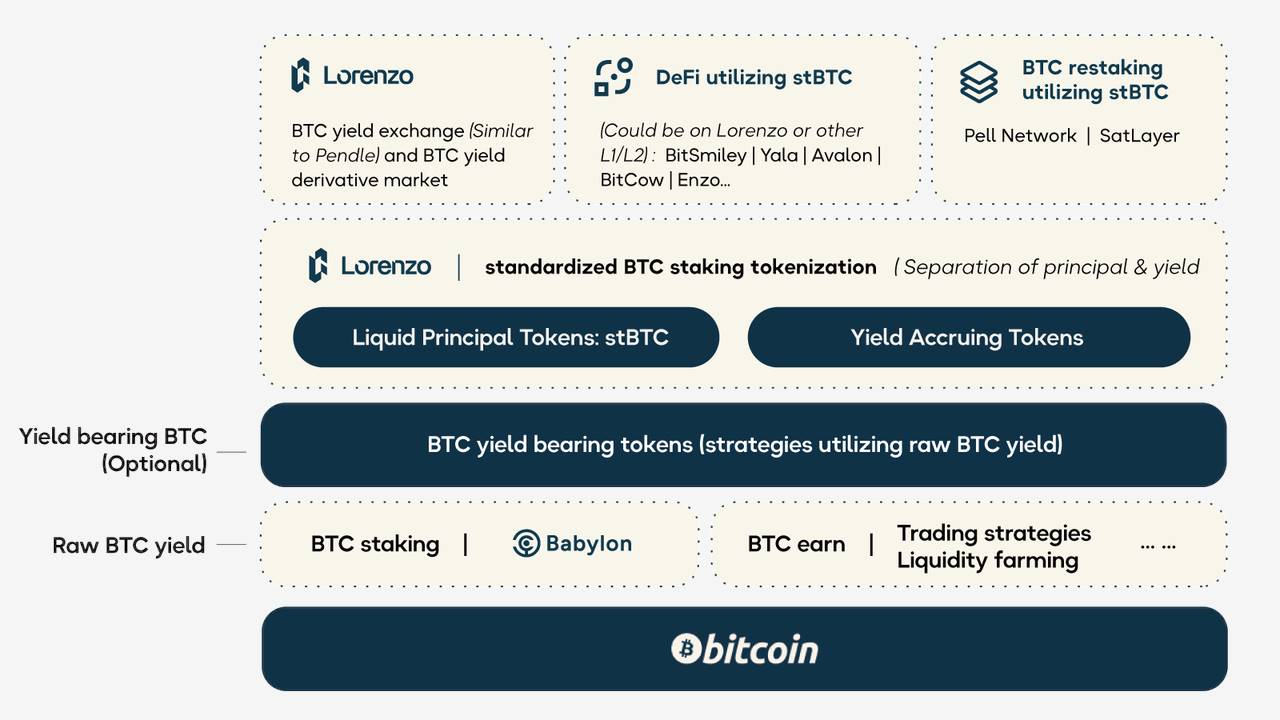

Lorenzo 所面向的正是这些尘封已久的 BTC,它是首个基于 Babylon 的比特币流动性金融层,也是针对比特币流动性质押代币的发行交易与结算平台,首次为比特币用户提供真正SafetyThe original income of Lorenzo is to issue LST with principal and interest separation for different Bitcoin pledge projects. Lorenzo can be understood as a combination of Lido, Renzo and Pendle, thus building a super large bond market, providing matching, issuance, settlement, and structured financial products, completely releasing the liquidity of pledged BTC, activating the financialization scenario of BTC assets, and supporting the construction of the downstream DeFi ecosystem.

LRT competition market based on Babylon

2024 年可谓比特币生态元年,在铭文、符文等资产发行叙事之后,比特币生态也进入了生息资产叙事。以往,由于采用中本聪共识,比特币无法像 PoS 一样质押并产生收益。但今天,用户只需向 Babylon 在比特币主网上的自托管存款地址存入 BTC,通过时间戳协议将 PoS 验证信息纳入比特币区块即可为现有 PoS 链提供共享安全,并获取质押收益,无需任何第三方托管 / 跨链 / 封装。同时,Schnorr 签名与可提取的一次性签名(EOTS)机制也使得 BTC 成为可罚没资产,有效避免双花攻击。

Babylon 的共享安全机制为比特币生态金融提供了可能,潜力无限。但当前的问题是,为 PoS 链提供质押的 BTC 同样失去了流动性,成为了「巴比伦之囚」,影响了资本利用效率,收益来源单一。那么,如何在 Babylon 的基础上充分释放 BTC 流动性,并且为用户提供更多收益来源?

With this in mind, re-staking protocols such as Uniport, Chakra, BounceBit, Bedrock, Solv Protocol, and StakeStone have emerged on the market, aiming to further release BTC liquidity. Let’s take a look at them one by one:

-

Chakra is a Bitcoin re-staking protocol based on ZK. It cross-chains Bitcoin and Ethereum mainnet BTC and ETH to the Chakra chain to form BTC L2 的资产结算中心,并通过轻量级客户端跨链技术将 ChakraBTC 与 ChakraETH 部署至其他 BTC L2 上。Chakra 基于 SCS(结算消费服务),为 PoS 链提供再质押服务。这与 Babylon 要做的事一样,但 BTC 并未原生质押在比特币主网上。为解决这一问题,Chakra 现已集成 Babylon,Chakra 可通过 Chakra 网络的无信任结算服务 / 层将通过 Babylon 质押的 BTC 映射到任何生态系统中,Babylon 通过利用 Chakra 质押的 BTC 来确保其协议内 PoS 系统的安全,允许质押者分享验证奖励;Chakra 生成的 ZK-STARK 质押证明使用户能够在 Chakra Chain、Starknet 和其他各种BlockchainObtain current assets.

-

BounceBit is a Bitcoin re-staking infrastructure that uses a dual-token PoS structure. It is based on the wrapped token BTCB instead of native BTC, and converts BTCB into BBTC. The shared security mechanism is based on the LRT stBBTC of the staked BBTC. BBTC is designed to solve the problem of low liquidity and fewer application scenarios of Bitcoin on the native chain, but compared with the Babylon solution, BTC's nativeness is relatively weak. Although its BTC Bridge will also allow native BTC to cross-chain directly into BBTC, there will always be risks with cross-chain bridges and oracles.

-

Uniport is a Bitcoin re-staking chain that uses the UniPort zk-Rollup Chain built on the Cosmos SDK to achieve multi-chain interoperability of BTC ecosystem assets. Its cross-chain solution converts native BTC into UBTC and uses a centralized multi-signature cold chain.wallet(Multi-signature will be used in the futurecontract) for management, UBTC will be deeply integrated with Babylon.

-

Bedrock is a multi-asset liquidity re-staking project. It has launched the LRT token uniBTC in cooperation with Babylon. Users can stake WBTC on Ethereum and obtain uniBTC. In this process, Bedrock uses proxy staking and direct conversion to establish a connection with Babylon. The proxy mechanism is that when users stake wBTC on Ethereum, they also stake the corresponding amount of native BTC on Babylon; direct conversion is to directly convert WBTC into BTC and stake it on Babylon. Holding uniBTC can obtain BTC income and can be used for other DeFi protocols.

-

Solv Protocol is a full-chain yield and liquidity protocol that exchanges WBTC on Arbitrum, M-BTC on Merlin, and BTCB on BNB Chain for interest-bearing assets solvBTC, not native BTC.

-

StakeStone is a full-chain liquidity infrastructure that deposits native BTC into Babylon for pledge and issues full-chain liquidity interest-bearing BTC STONEBTC.

-

SataBTC is a Bitcoin re-staking layer that has not yet been launched.

After a comprehensive comparison, it can be found that LRT projects in the same track are actively exploring their own ways. BounceBit, Bedrock and Solv Protocol give priority to absorbing the existing market. The underlying assets are packaged BTC rather than native BTC to unify liquidity and provide interest-bearing ability for BTC, but their inherent risks are consistent with packaged tokens such as WBTC. Other projects have begun to target Babylon's LRT market. Chakra, Uniport, and StakeStone are eyeing the new incremental market brought by Babylon. They choose Babylon as the basic source of income for the underlying assets and issue LRT tokens to release the liquidity of pledged BTC, but all stop at Restaking and LRT.

In fact, LRT with income also has the problem of high volatility and cannot meet the needs of users with different risk preferences. Think about Ethereum, any income-generating assets eventually flow to Pendle, which is the missing part of Bitcoin DeFi. This is exactly what Lorenzo is going to do, but they are not in a competitive relationship before, but will generate more cooperation.

Lido + Renzo + Pendle: How does Lorenzo build Bitcoin liquidity finance?

Some people say that Bitcoin took 9 months to complete the journey that Ethereum took 9 years to complete. Then, the journey of interest-bearing assets that Ethereum took 4 years and 3 generations of products to complete can be completed by Lorenzo with just one protocol.

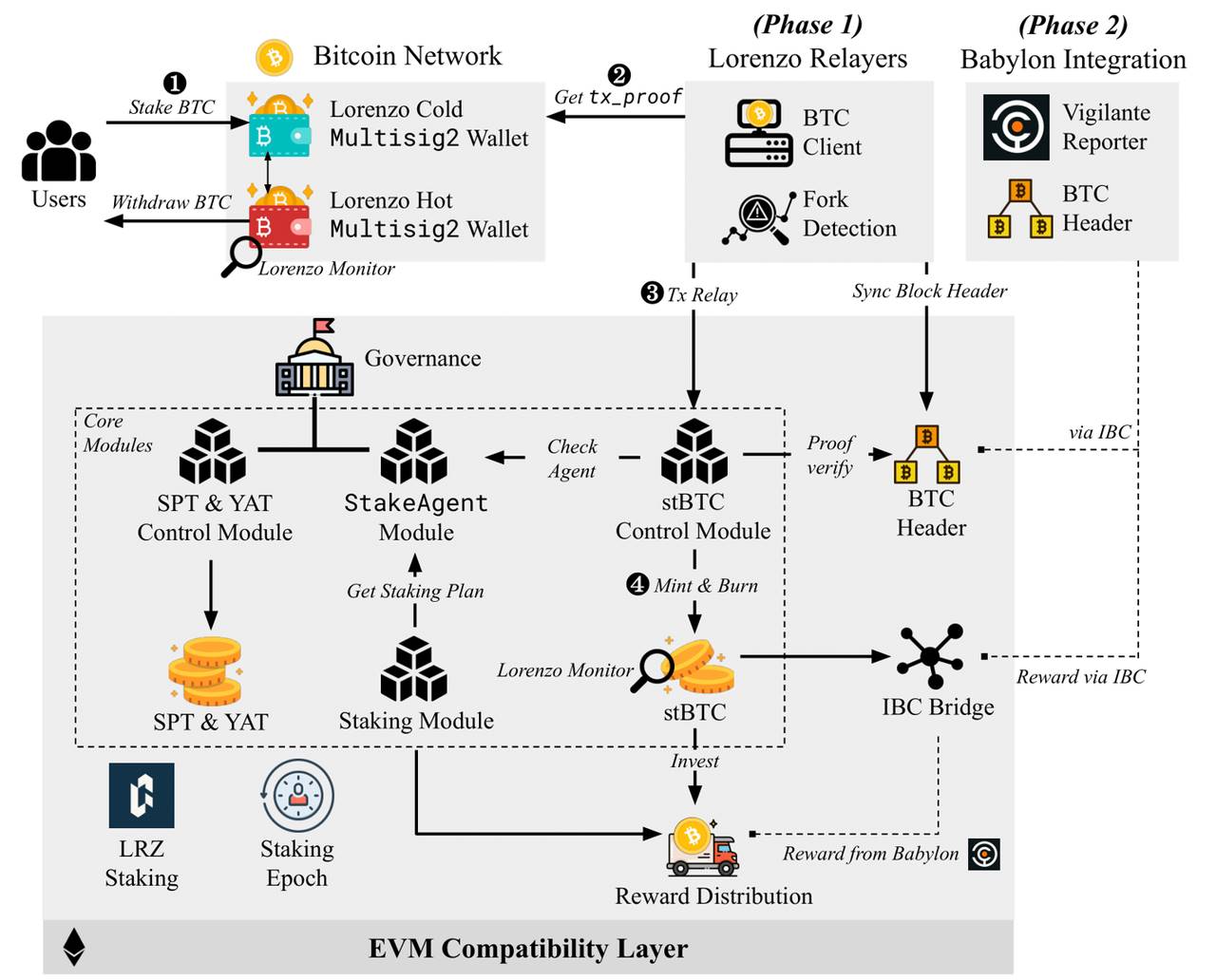

Communication path between Bitcoin mainnet and Lorenzo

Let’s first look at the Lorenzo protocol architecture. As shown in the figure below, it consists of the Lorenzo Chain, Bitcoin repeaters, and a complete set of smartcontractThree major components:

-

Lorenzo Chain (corresponding to the EVM compatibility layer) is a Cosmos application chain built using Cosmos Ethermint, which is compatible with EVM and mainly provides the underlying infrastructure for liquidity-based staking tokens;

-

Bitcoin relayer: can relay Bitcoin mainnet information to the Lorenzo application chain;

-

A set of smart contracts that verify off-chain information and manage the issuance and settlement of liquidity staking tokens.

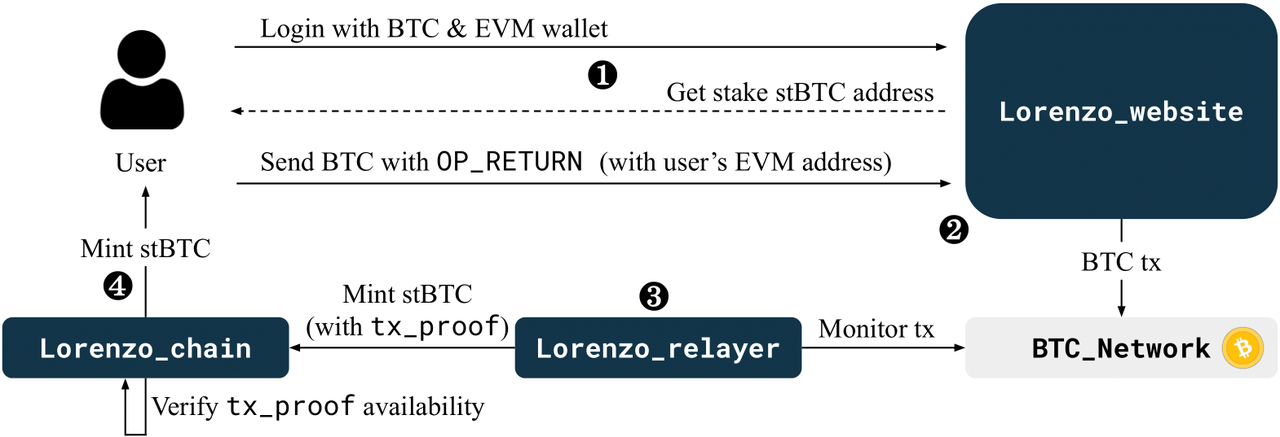

The initial logic is that when a user sends a cold call to Lorenzo on the Bitcoin mainnet on the Lorenzo website,wallet与热钱包多签地址存入 BTC 以获取 Lorenzo 流动性代币 stBTC 时,Lorenzo 的比特币中继器将会监控存款地址是否有传入交易,一旦交易确认,中继器就会获取交易的 Merkle 证明并提交给 Lorenzo Chain,并调用「Lorenzo YAT_Control_Module」模块的 mint 函数,在内部验证交易证明是否合法。验证成功后,Lorenzo 将为用户的 EVM 账户铸造等量的 stBTC。

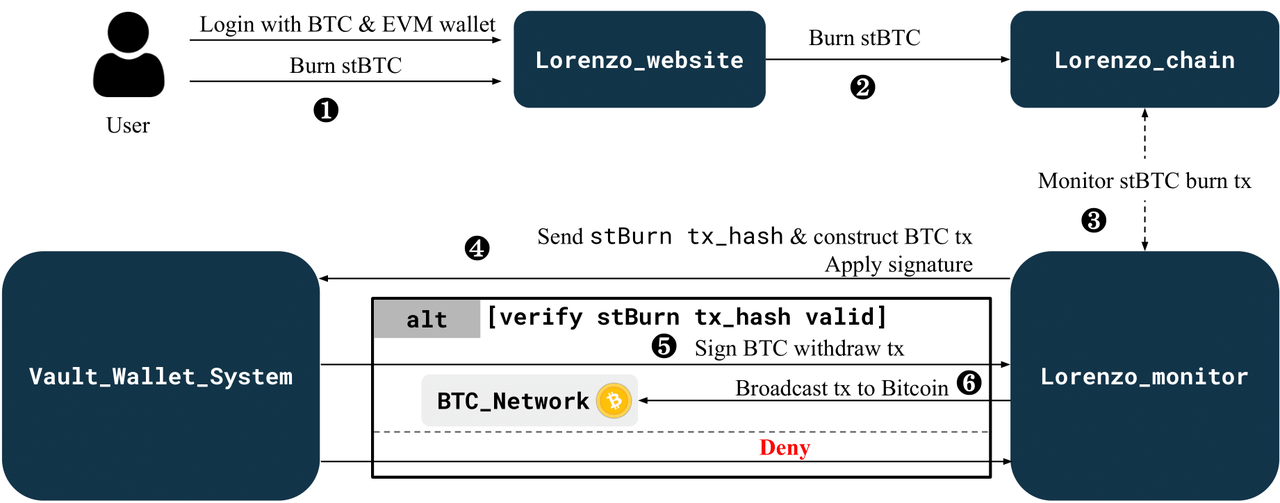

If the user needs to exchange stBTC back to BTC, he/she will initiate a request to destroy stBTC on the Lorenzo website. Lorenzo Monitor will monitor the destruction of stBTC on the Lorenzo chain, send the stBTC destruction transaction hash and the constructed BTC withdrawal transaction to the multi-signature service Vault Wallet System, and apply for a signature. After verifying the legitimacy of the destruction transaction, the final signature is generated and sent back to Lorenzo Monitor. After receiving the BTC signature, Lorenzo Monitor broadcasts the signed transaction to the Bitcoin mainnet to complete the user's withdrawal operation.

Unleashing liquidity, freeing the “Babylon prisoners”

Lorenzo uses Babylon as the basic income layer, providing users with natural and truly safe native income with almost no staking risk. In addition, like the early EigenLayer, Babylon will also set a deposit limit after the mainnet is launched. As mentioned above, Babylon currently has liquidity restrictions like the "Babylonian Prisoner" and has entry barriers.

But this is not the end of Babylon's narrative. It is the financial foundation of the Bitcoin ecosystem and provides Lorenzo with possibilities. The first step for Lorenzo is to complete the construction of Bitcoin Lido, release the liquidity of pledged BTC, and solve the deposit limit problem of Babylon. Users can deposit BTC directly into Babylon through Lorenzo, and Lorenzo acts as an asset issuance and settlement platform, tokenizing BTC pledges and providing users with liquidity pledge tokens, which is similar to Lido's stETH, but also different, which we will elaborate in the next section.

Of course, as a Bitcoin liquidity financial layer, just like Ethena, in addition to BTC staking income, the BTC deposited by users can also be used for other trading strategies, liquidity mining and other income sources. Currently, Lorenzo has cooperated with Bitlayer to integrate 7 to 8 downstream DeFi projects through the Bitlayer Mining Gala, which can participate in on-chain activities such as staking and lending.

Separate principal and interest bonds and re-pledge plans: an attempt to unify liquidity

Similar to stETH, Lorenzo's LST is also a BTC interest-bearing asset, and its essence is a Bitcoin bond with income. However, since the pledge of Babylon is actually a pledge of different PoS chains, rather than anchoring ETH like Lido's stETH, different liquidity pledge tokens may be generated for different pledge projects. If different LSTs are issued for different pledge projects, it will obviously cause liquidity fragmentation.

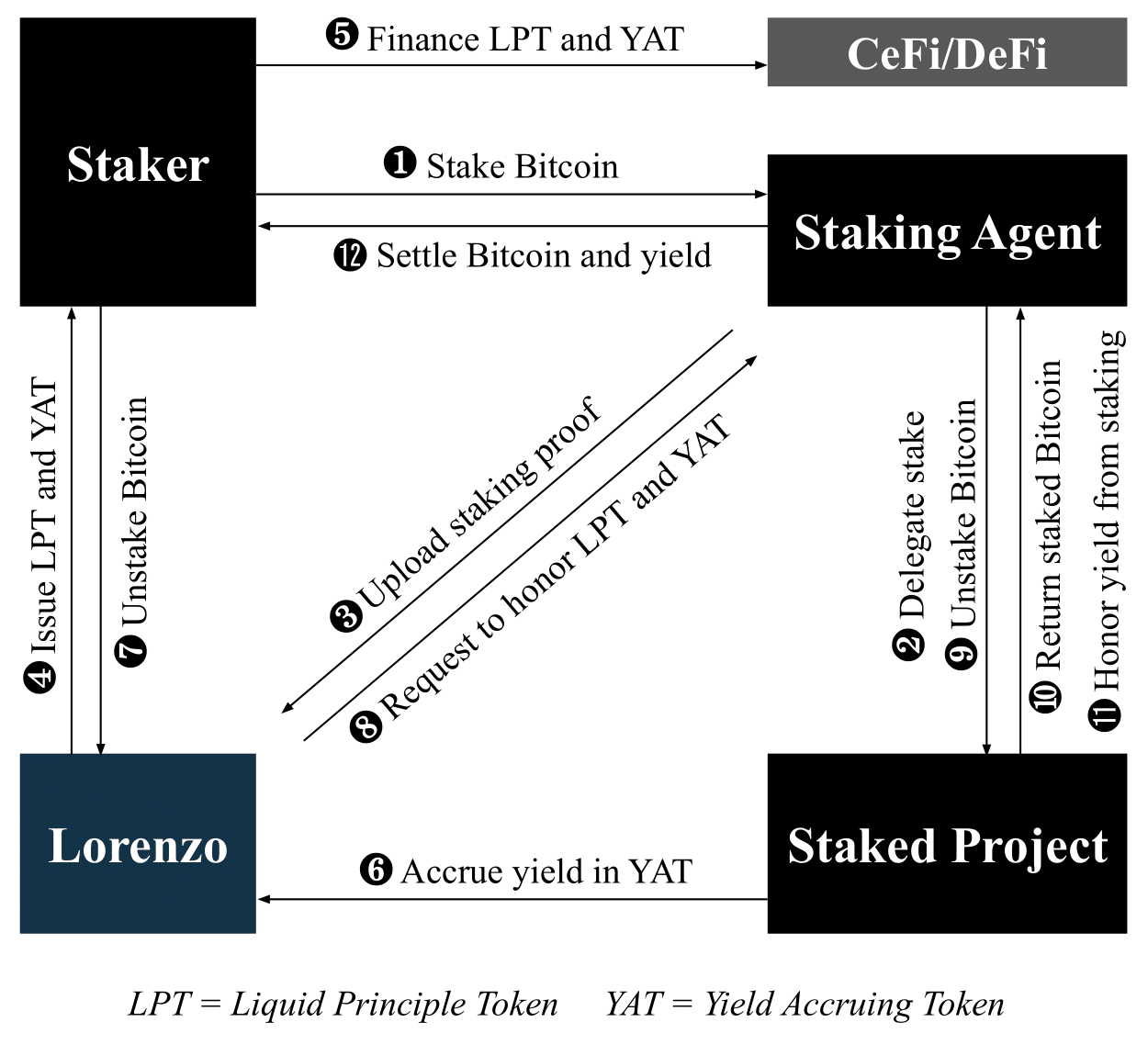

How to solve the liquidity fragmentation problem more effectively? Lorenzo came up with a Pendle-like principal and interest separation model, and adopted the Bitcoin Liquidity Restaking Plan (BLRP) based on Babylon staking to avoid the liquidity dispersion of income-generating tokens due to different projects and different staking times. Lorenzo will pre-define the BLRP staking plan, which includes the staking project (PoS chain) and the staking start and end time. Users can only choose the plan they want to stake before the staking plan starts.

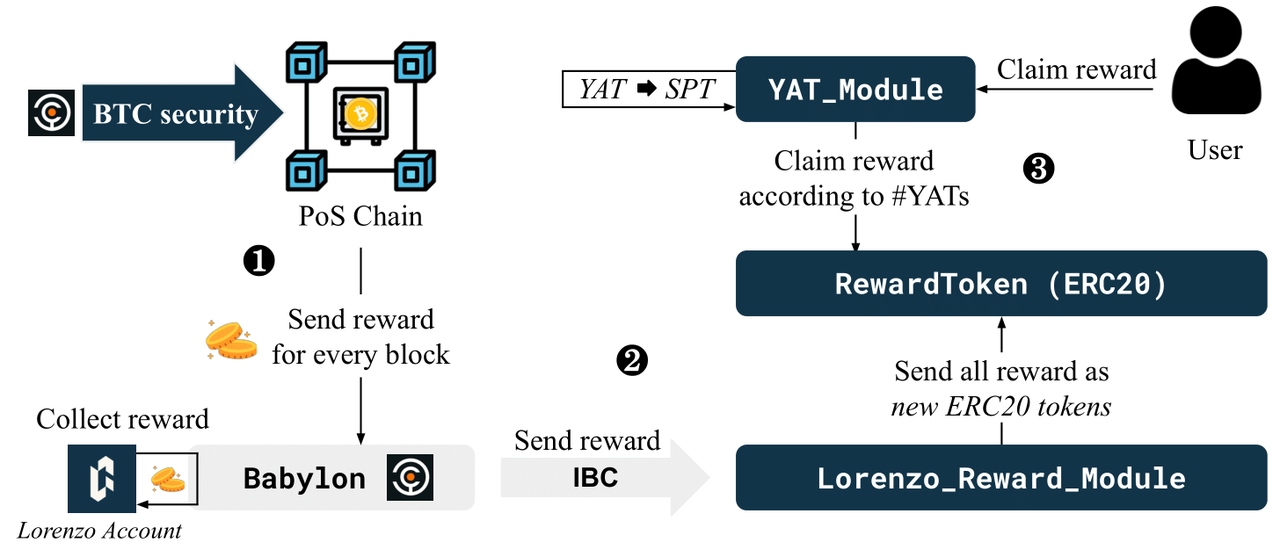

That is to say, assuming that the user chooses the "Babylon-Lorenzo-01" staking plan on Lorenzo, the user will get two tokens, Liquid Principal Tokens (LPT) and Yield Accruing Token (YAT), after depositing BTC to Babylon. Lorenzo issues the same LPT for all low-risk staking projects. This LPT is stBTC, which is anchored 1:1 with the pledged BTC, unifying the BTC liquidity of different ecosystems. StBTC holders can redeem the pledged BTC principal after the pledge ends. YAT is an ERC-20 token issued through BLRP, which can be understood as a bond with future income, representing the income generated by the pledge. YAT has its own re-staking plan, start and end time. YAT can be traded and transferred before expiration, and holders can also receive PoS chain rewards. YAT issued by the same BLRP can also be exchanged.

{ name: YAT token name symbol: YAT token ticker planDescUri: project description planId: stakePlanId, incremental ID for restaking plan agentId: stakeAgentId, Staking Agent ID subscriptionStartTime: Subscription starts subscriptionEndTime: Subscription ends endTime: YAT maturity time}

After YAT expires, holders can obtain the profits of Babylon, PoS chain and Lorenzo at one time.

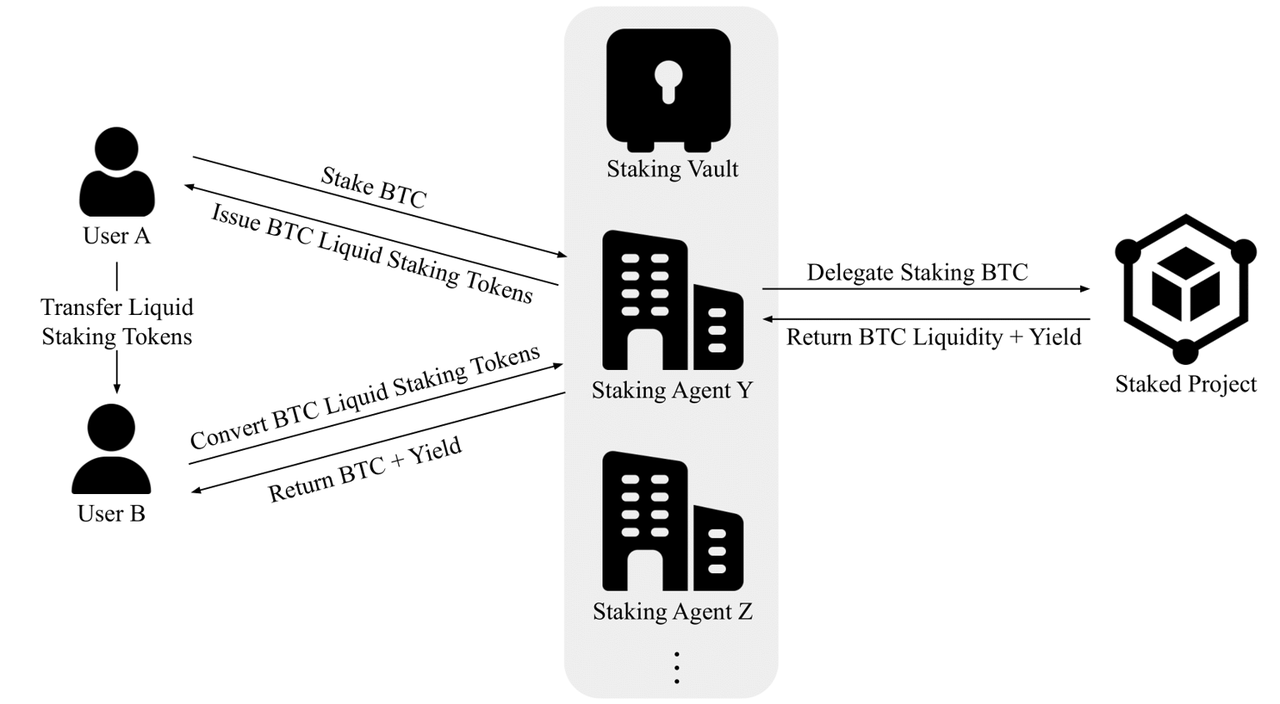

Staking Agent: Asset Issuance and Settlement System Based on CeDeFi

Both stBTC and YAT belong to Lorenzo’s asset issuance side, but it is also an asset settlement platform.Previous articleAs mentioned in the article, due to the paradigm change of the asset issuance layer, DeFi has entered the active asset management stage in terms of asset management, and Lorenzo is also the embodiment of this generation's characteristics. As the issuance and settlement layer of stBTC, it is also the asset manager of the native BTC and can determine the destination of the pledger's BTC.

Lorenzo admitted that he does not provide the stakers with an inherent guarantee that the BTC they manage will not be abused, but at the same time, due to the limited programmability of the Bitcoin network, it is impossible to build a completely decentralized settlement system in the short term. Therefore, Lorenzo chose CeDeFi, the "middle road" between centralization and decentralization. It introduced the Staking Agent mechanism, in which top Bitcoin institutions and TradFi institutions jointly act as the issuance and settlement layer of assets. Lorenzo is also one of the staking agents. If the staking agent has improper behavior, his agency qualification will be revoked.

The staking agent is responsible for the entire asset issuance and settlement of Lorenzo. In simple terms, it creates a staking plan for users, accepts users' BTC and deposits it into Babylon and the PoS chain, then sends the Restaking certificate to the Lorenzo protocol and issues stBTC and YAT to users. When the staking plan expires, it will keep the BTC returned by the project for the user, and cash out the expired stBTC and YAT, converting them into BTC principal and income.

In terms of fund settlement, Lorenzo also set up a sorting mechanism. In the first phase, Lorenzo did not introduce YAT, and users only needed to destroy stXiaobai NavigationBTC can be redeemed for native BTC. However, after the issuance of YAT in the second phase, if users want to redeem BTC, they must not only destroy the corresponding stBTC, but also destroy an equal amount of Staking Proof Token (SPT), and then Lorenzo will return BTC to users.

SPT plays the role of sorting, destroying stBTC, and redeeming BTC certificates. When YAT expires, the Lorenzo revenue distribution contract will distribute revenue to YAT holders and convert YAT into an equal amount of non-tradable SPTs, which will enter a unified queue and be placed at the end of the queue, thereby determining the order of destruction of stBTC. The proxy ID associated with the destroyed SPT will determine which pledge agent will redeem BTC. Users who generate SPT by receiving YAT can use their own generated SPT to destroy stBTC that does not exceed the number of generated SPTs, or they can only receive YAT revenue to generate SPTs without destroying stBTC. If the user does not hold YAT but needs to redeem BTC, and there happens to be no SPT in the queue, they must wait for new SPTs to enter.

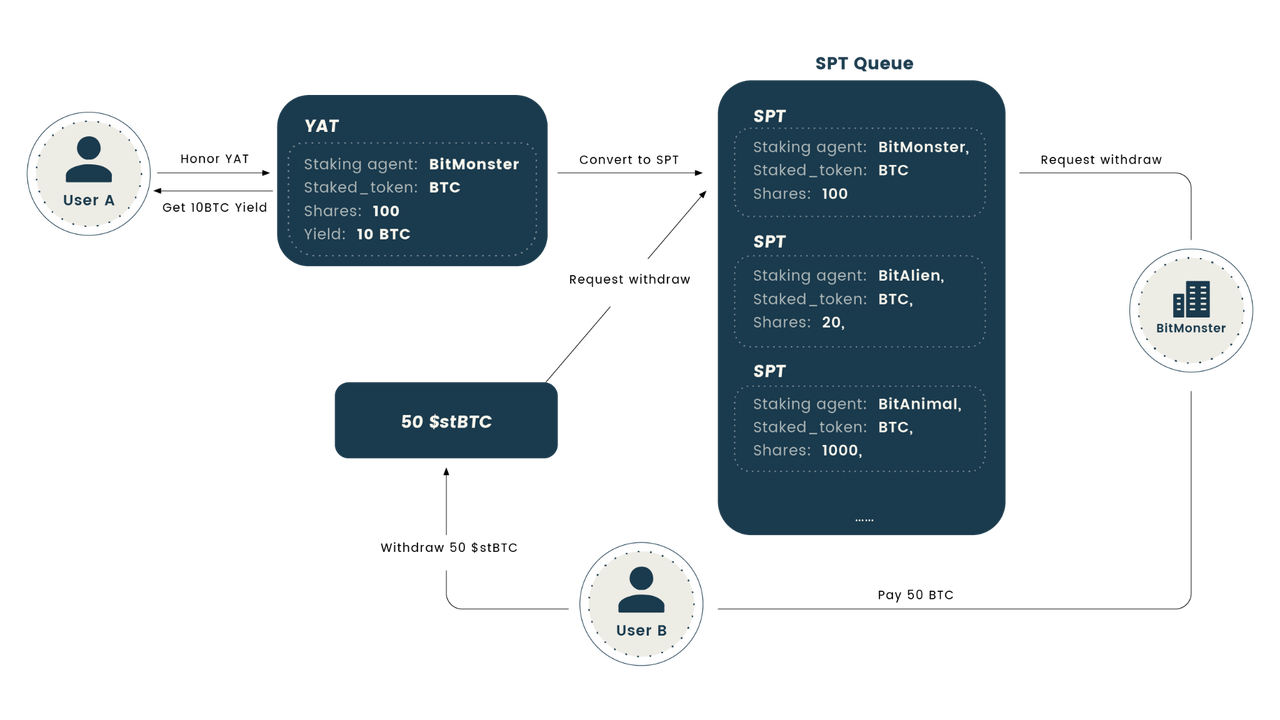

Take the following figure as an example. User A pledges 100 BTC and earns 10 BTC. When A cashes YAT for 10 BTC, he generates an equal amount of SPT in the BitMonster staking agent, and does not destroy stBTC. User B buys 50 stBTC in the market and wants to exchange them for BTC, but does not have YAT. Then BitMonster must hold an equal amount of SPT as 50 stBTC to redeem 50 BTC, otherwise B needs to wait in line for other users to generate SPT. Once all the BTC in "Staked_token" are redeemed, the SPT will be popped out of the queue.

The issuance and settlement system based on the pledge agent actually fully releases the liquidity of BTC and expected returns, allowing users to obtain and trade income tokens in advance. Lorenzo's SPT settlement method determines that if users want to withdraw BTC, they must have sufficient returns, which is why there is a pledge plan, because without the return of the pledge expiration, there will be no BTC to withdraw. In other words, we can imagine the pledge agent structure as a large capital pool. As long as the underlying Babylon's BTC income source is rich and stable, and the more funds users deposit, the more income they will get, and the liquidity of Lorenzo's dual currency will be better.

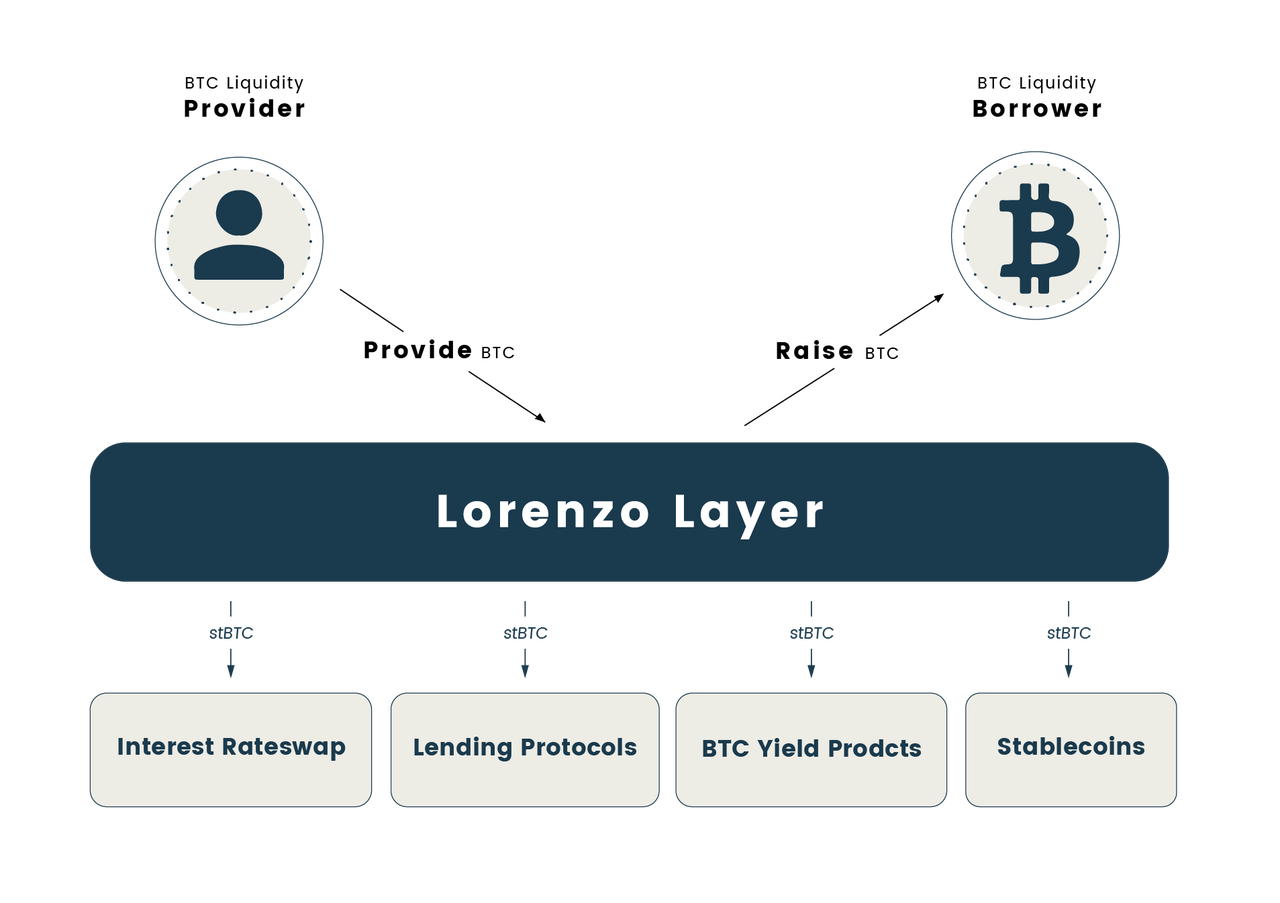

StakingFi: Financialization of BTC Assets

Of course, Lorenzo not only hopes to release the liquidity of pledged BTC, but also hopes to provide a good token structure for this part of the pledged liquidity. Due to the uncertainty of interest rates, the separation of principal and interest essentially reduces the risk of reinvestment. For users who want to avoid volatility, they can buy stBTC anchored to BTC and short the income; for risk-seeking users, they can buy YAT to go long the yield. Compared with other BTC LRT projects, this principal and interest separation mechanism can also support the construction of more complex downstream DeFi products, not just simple income and interest.

Currently, Lorenzo's stBTC can be used across chains to Bitlayer. In the future, stBTC and YAT will be used in the following financial scenarios:

-

Interest rate swap: refers to the exchange of fixed interest rate and floating interest rate between two funds with the same currency, the same debt amount (same principal), and the same term. stBTC can be regarded as another form of wrapped BTC, which can eventually replace WBTC in almost all scenarios. The value of YAT comes from accumulated returns and speculation on future returns. There will be a basic trading pair between stBTC and all YAT. YAT with the same staking plan can be swapped. There may also be trading pairs between stBTC, YAT and other mainstream assets.

-

Lending Protocol: stBTC and YAT can be used as collateral to borrow any assets desired, ensuring stakers have greater control over their investments and liquidity.

-

Structured BTC income products: For example, Bitcoin fixed-income products that protect principal can be built based on stBTC and YAT, as well as option-based financial derivatives that enhance returns.

-

Bitcoin-backed stablecoins: stBTC can support stablecoins.

-

Insurance products: used to reduce the risk of native BTC being confiscated by Babylon.

Roadmap and future planning

Lorenzo will launch the testnet and mainnet in stages. The mainnet beta version was launched at the end of May, and the mainnet V2 is expected to be launched in June. By then, Lorenzo will introduce a principal and interest separation mechanism. In addition to stBTC, Lorenzo will support more yield-accruing tokens (YAT). At the same time, the pledge proxy model and SPT will also be launched in V2, making Lorenzo's asset issuance and settlement more decentralized. In addition, Lorenzo also plans to support more PoS projects in the Babylon ecosystem to provide users with more profit scenarios.

Conclusion

Like any current BTC LRT project, Lorenzo is also trying to activate the BTC liquidity with a market value of $1.3 trillion. This is a blue ocean market of more than $100 billion, and building DeFi around BTC LRT will have unlimited potential. "Babylon Prisoner" is temporary. What's important is that Babylon has laid the foundation for the entire Bitcoin liquidity finance, and it is the basic source for Lorenzo to build interest-bearing assets. Unlike other BTC LRT projects, Lorenzo is the first Bitcoin liquidity hub based on the Babylon ecosystem, and introduces Pendle-like principal and interest separation, which can provide more complex liquidity financial scenarios for principal tokens and interest tokens, meet the venture capital needs of different users, and completely release the liquidity of BTC.

However, in my opinion, the pledge proxy model still has centralization risks. The underlying Bitcoin UTXO opcode can impose an output restriction on BTC spending conditions, but it cannot impose security restrictions on pledge proxy settings. The Solv team has developed Solv Guard specifically for this problem, which can be an additional security layer set for third-party fund managers. It may be possible to set restrictions on BLRP's investment strategy, specify investment targets, smart contracts, etc., and separate the right to use funds from the right to govern. For this problem, Lorenzo may adopt a similar solution in the future.

The article comes from the Internet:Freeing the “Prisoners of Babylon”, how did Lorenzo rebuild the Medici financial empire?

相关推荐: 「捡钱」时代已过,散户通过比特币等加密资产赚钱将越来越难

Do retail investors still have a chance in the crypto market? Written by Terry In the past year, have you encountered a Rug Pull (withdrawal from the pool, running away) project? Have you encountered a "buy-to-peak" situation due to the advocacy of a KOL? Or suffered losses due to increasingly rampant phishing attacks? Or have you bought a newly launched token on a top platform and then kept falling? …