Why did 140,000 Bitcoins transfer out of the Mentougou address?

Written by Joyce

Today, ten years after bankruptcyexchange A large amount of transfer suddenly appeared in the Mt.Gox account address. In the next 6 hours, Mt.Gox transferred 141,685 bitcoins in 10 transactions, with the amount of each transaction ranging from US$200 million to US$2.3 billion, with a value of approximately US$9.8 billion.

This is the cold of Mt. GoxwalletThe first move of the address in five years, the transfer of 140,000 bitcoins worth nearly 10 billion US dollars attracted attentionCommunityCompared with the total increase in the value of Bitcoin ETF today, which is 3,028 pieces, Wall Street ETF giants such as BlackRock and Grayscale each hold a total of about US$20 billion in Bitcoin. The number of Bitcoins transferred from the Mt. Gox address today accounts for nearly half of the number of Bitcoins held by BlackRock and Grayscale respectively.

This huge transfer indicates that one of the most important news in the history of cryptocurrencies, the Mt.GoxstealThe bankruptcy incident is coming to an end, and the 10-year compensation process is entering its final step.

As early as January this year, dForce founder Mindao released an email on Twitter that he received as a creditor of Mt. Gox. In the email, Mt. Gox confirmed to the user that theexchangeThe address account ownership is used as the BTC/BCH receiving address, and it is stated that "200,000 bitcoins will be unlocked in the next two months to pay creditors." According to the latest balance sheet at the time, the exact number of bitcoins unlocked by Mt. Gox in the next two months will be 141,000.

BlockBeats 就今早 Mt.Gox 转出 14 万枚比特币的情况采访了 Mindao,他表示「今年年初债权人都已经登记了收款地址,之后会在 Kraken 等交易所收到TokenThis time (large amount of transfer) should be that Mt. Gox is preparing to distribute Bitcoin."

Will 140,000 Bitcoins Create a "Mentougou Pit"?

For this transaction, someCommunityThe members’ first reaction was panic.

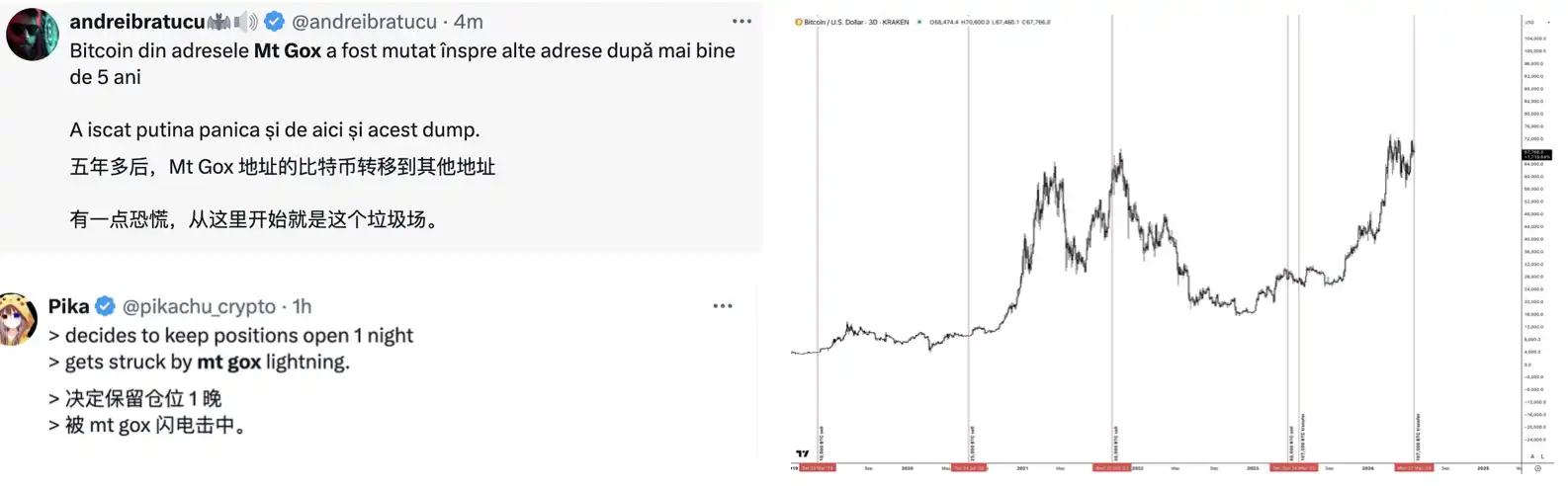

A community member released the timing of Mt. Gox liquidation lawyer Nobuaki Kobayashi's previous sale of Bitcoin. He sold 35,800 Bitcoins through over-the-counter transactions between December 2017 and February 2018 to repay users' losses, and all of them were sold at high points at the time. Combined with the recent market's fatigue, many people believe that the market may have a downward trend. This morning, Bitcoin fell after breaking through $70,000, and the decline has exceeded 3%.

Will the liquidation of 140,000 bitcoins really cause a significant sell-off? As far as this event itself is concerned, the market believes that "there will be some impact, but it should not be too big."

In the repayment plan provided by Mt.Gox to creditors, the repayment amount includes "basic repayment" and "proportional repayment". The amount of the basic repayment is the same, and the proportional repayment can choose "mid-term repayment and final repayment" or "early lump sum repayment". Mt.Gox has not announced the specific situation in the future, which means that creditors will not receive all the compensation assets at once.

Mindao said, "Because most creditors have already sold their money to those funds, this part of the selling pressure has long been hedged. And people like us who have held on to the end will definitely not sell at this time."

Looking back over the past few years, the panic over Mt. Gox has become a "compulsory course for retail investors" and "an annual scare". Since Mt. Gox was ordered to compensate creditors with 140,000 bitcoins in 2019, the "Mt. Gox incident" has become a negative time bomb for several years, and the story of "the wolf is coming" has been staged repeatedly, stimulating market sentiment.

Although with the passage of Bitcoin ETF, todaycryptocurrencyInstitutions have gradually become the main force in the market, and the impact of 140,000 bitcoins on the trading market will gradually decrease. Excluding the impact of selling pressure, some people believe that fear may still have a greater impact.

Crypto KOL Riyue Xiaochu said on Twitter, "Many people use Grayscale for comparison and think it will not have an impact on the market. I don't agree... If compensation is made, the market will definitely react... Panic often lasts for a while. The real situation is that the selling pressure is not as great as imagined, so it will be a good opportunity to buy the bottom in advance."

According to a previous announcement released by Mt. Gox, the debt repayment deadline for the 140,000 bitcoins is October 31, 2024.

Looking back at the "crypto-earthquake" 10 years ago

The Mt.Gox bankruptcy wascryptocurrencyOne of the most famous events in history. Mt.Gox was originally created in 2010 and accounted for more than 90% of Bitcoin transactions at its peak.

In 2011, Mt.Gox was hacked for the first time, resulting in the theft of thousands of bitcoins. In 2014, Mt.Gox suddenly announced that about 850,000 bitcoins (worth aboutXiaobai Navigation The company was hit by a theft of $450 million in funds and subsequently suspended all transactions and filed for bankruptcy protection. This incident caused an "earthquake" in the crypto market, with the price of Bitcoin falling from $951, the highest level of the year, to $309, a drop of 67%.

Since the declaration of bankruptcy and liquidation, Mt. Gox and its creditors have been in a stalemate for several years. In the following years, the price of Bitcoin continued to rise, reaching $19,000 in 2019.

In 2019, the Tokyo District Court ruled that Mt. Gox should recover 141,000 bitcoins and deliver them to a trust for safekeeping, and negotiate a vote among all creditors to choose a repayment plan. According to Mt. Gox's balance sheet in 2019, its debtors held approximately 142,000 BTC, 143,000 BCH, and 69 billion yen (about $510 million at the time).

However, the 140,000 bitcoins confirmed in 2019 had a maximum unit price of around $10,000 at the time. Two years later, the price of Bitcoin exceeded $60,000, which delayed Mt. Gox's compensation procedure again and again.

In 2022, Mt. Gox announced that its Bitcoin repayment process had been accepted by the court. Django Bits, the operator of Mt. Gox's creditor channel, said that the repayment process may "last months or even years."

If Mt. Gox does not "dove" this time, five months later, this decade-long bankruptcy crisis involving 800,000 bitcoins will come to an end. Mt. Gox's return to the center of community attention has also caused a wave of nostalgia among OGs. Ten years ago, when Mt. Gox announced the loss of 800,000 bitcoins, Ethereum was also born during that time and gradually became the center of the crypto world. Ten years later, Bitcoin ETF and Ethereum ETF have been passed one after another, and the crypto field is moving towards the next stage.

The article comes from the Internet:Why did 140,000 Bitcoins transfer out of the Mentougou address?

Narrative speculation based on technological innovation has a stronger chance of recovery after the first wave of hype cools down.Blockchain The Bitcoin halving is 3 days away and Rune Protocol will be live at the same halving block time! I’m sure you’ve heard of Rune Protocol but I wanted to share my perspective on why I’m short term bearish but long term…