Bitget Research Institute: US SEC approves Ethereum spot ETF 19b-4, ETHFi and other ecological assets are expected to continue to rise

Written by: Bitget Research Institute

Summary

cryptocurrencyPrices saw significant volatility on Thursday, with liquidations for all leveraged crypto derivatives positions surging to over $360 million that day, the highest level since May 1:

- The sectors with strong wealth-creating effects are: RWA sector and Ethereum staking sector;

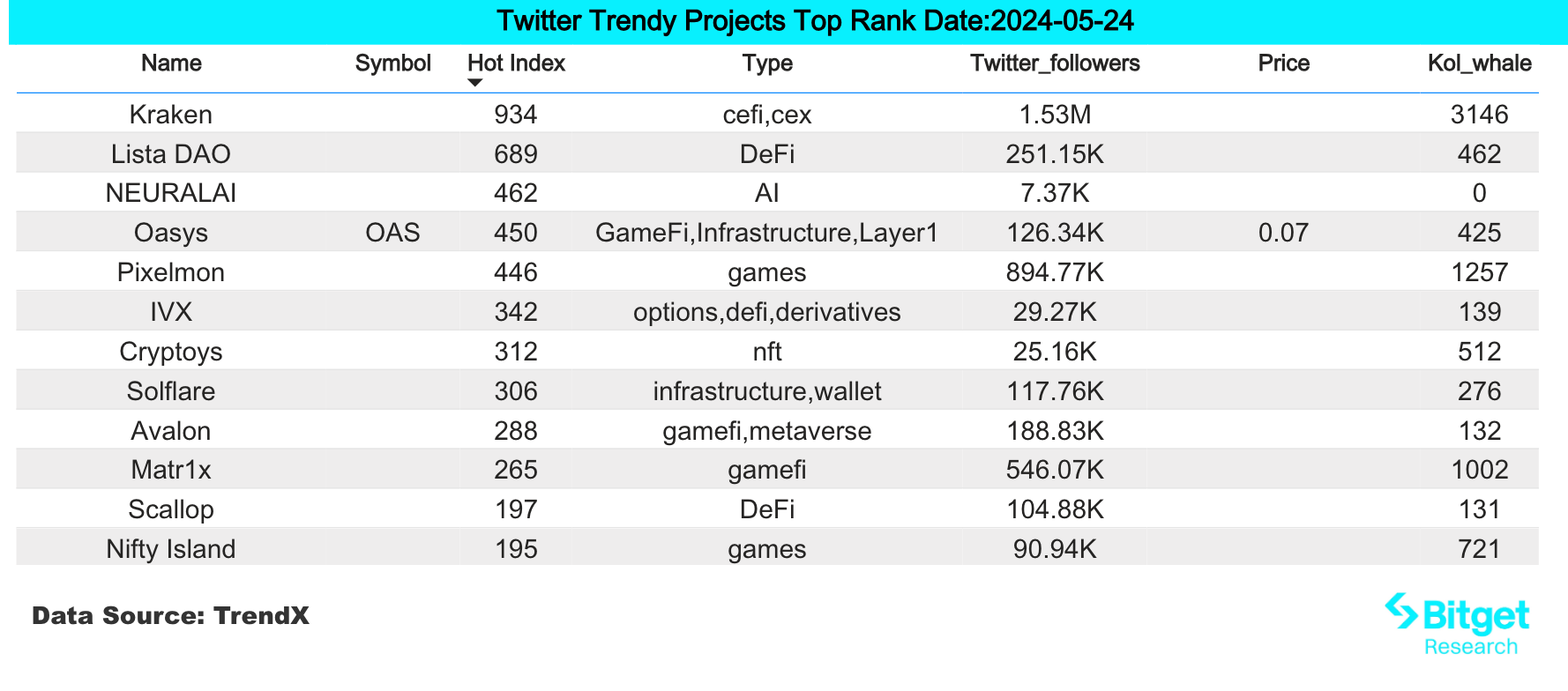

- User Hot SearchToken& Topics: Plume Network, Lista (LISTA);

- Potential airdrop opportunities include: Sanctum, Synthr;

Data statistics time: May 24, 2024 4:00 (UTC+0)

1. Market environment

cryptocurrencyPrices saw significant volatility on Thursday. Before the approval, ETH first dropped to $3,500 around the closing time of the traditional U.S. market, then surged to around $3,900, and finally stabilized above $3,800 after confirmation. Bitcoin also dropped to a low of $66,000, then surged to $68,300 before falling back below $68,000.

According to data from CoinGlass, during this turbulent period, liquidations of all leveraged crypto derivatives positions soared to more than $360 million that day, the highest level since May 1. Most of the liquidated positions were long positions, worth about $250 million, indicating that highly leveraged traders were concentrated on betting on an immediate surge after the ETF was approved. ETH traders were hit the hardest, with liquidations reaching $132 million.

2. Wealth-making sector

1) Sector changes: RWA sector (ONDO)

Main reason: This bull market mainly originated from the traditional market buying brought by ETFs. As a way to introduce traditional financial markets, RWA has been constantly updating its products and raising funds. Recently, RWA layer 2 network Plume Network completed a $10 million seed round of financing.

Rising situation: ONDO's daily increase today is 13.46%;

Factors affecting the market outlook:

- Changes in macro monetary policy: In terms of the macro environment, the rise in the yield of the 10-year U.S. Treasury bond supports the fundamentals of the RWA track; we need to pay attention to the subsequent changes in the U.S. dollar index, U.S. Treasury yields and the crypto market, and dynamically adjust trading strategies;

- Changes in project TVL: RWA track projects are basically supported by TVL. You can pay attention to the changes in TVL of the RWA track. If the TVL of a project continues to rise/suddenly rises, it is usually a signal to buy;

2) Sector changes: Ethereum staking sector (LDO, SSV, ETHFI)

主要原因:美国证券交易委员会今日批准了多个以太坊现货 ETF 的 19b-4 表格,其中包括贝莱德、富达和灰度的 ETF,由于 ETF 只允许以太坊代币,不允许质押,这条规定对于 ETF 投资者的吸引力大大降低,因此以太坊再质押板块将迎来实质性利好。

Rising situation: LDO rose by 10.8% in the past 4 days, SSV rose by 7.97% in the past 7 days, and ETHFI rose by 22.85% in the past 4 days;

Factors affecting the market outlook:

- Fund inflow after ETH ETF is approved: At present, the ETF is in the countdown for listing after approval. If a large amount of funds flow in after approval, it will further push up the ETH price.

- Protocol trends: The cash flow of staking projects is relatively stable and easy to predict. They are a type of project whose token prices can be estimated more accurately. The main influencing factors are the protocol TVL, income distribution method, token destruction, etc.

3) The sector that needs to be focused on in the future: TON ecosystem

main reason:

- Pantera's investment in TON may be at least over US$250 million, which is Pantera's largest investment in cryptocurrency in history.

- Notcoin, a high-traffic project in the TON ecosystem, has been listed on Binance, but the TON token itself has not yet been listed on Binance. The market expects that it is only a matter of time before TON is listed on Binance.

- The infrastructure of the TON ecosystem is in its early stages. Currently, high-traffic projects such as Notcoin and Catizen have emerged, demonstrating a huge user base backed by Telegram.

- The issuance of stablecoins in the ecosystem has brought financial vitality. The supply of USDT on the TON chain reached 130 million in two weeks, becoming the eighth largest USDT issuance.Blockchain.

Specific project list:

- TON: The native token of the Ton chain, currently available on OKX, Bitget, etc.exchange.

- FISH: Ton ecosystem head meme token.

- REDO: A dog-themed meme coin on the Ton chain.

3. User Hot Searches

1) Popular Dapps

Plume Network:

Modular RWA L2 网络 Plume Network 宣布在 Arbitrum Orbit 上线。Plume 是一个专用于现实世界资产(RWA)的模块化 L2 Blockchain, integrating asset tokenization and compliance providers directly into the chain. Plume Network team members come from companies and projects such as Coinbase, Robinhood, LayerZero, Binance, Galaxy Digital, JP Morgan, dYdX, etc. Yesterday, it completed a $10 million seed round of financing, led by Haun Ventures, with participation from Galaxy Ventures, Superscrypt, A Capital, SV Angel, Portal Ventures and Reciprocal Ventures. The funds raised will be used for engineering design, marketing andCommunityThe Plume Network open incentivized testnet will be launched in the coming weeks, followed by the mainnet later this year.

2) Twitter

Lista (LISTA):

Binance Megadrop 将上线流动性质押和去中心化稳定币协议 Lista(LISTA)。其中代币最大供应量为 10 亿枚,初始流通量为 2.3 亿枚(占供应量 23%),Megadrop 总量为 1 亿枚(占供应量 10%)。币安将于 Megadrop 完成后上市 LISTA,具体上市计划将另行公告。Lista DAO 是流动性质押和去中心化稳定币借贷协议。用户可以在 Lista 上进行质押和流动性质押,以及使用一系列去中心化抵押品借入 lisUSD。报告还介绍了 LISTA 代币:LISTA 是 Lista DAO 的治理代币,用于以下功能:治理、协议激励、投票、费用分享。该协议由以下协同配合的主要部分组成:去中心化稳定币 lisUSD 以及 BNB 流动质押代币 slisBNB。

3) Google Search & Region

From a global perspective:

ETH ETF: A new compliance milestone in the crypto world: Ethereum spot ETF is finally approved. On May 23rd, local time in the United States, the U.S. Securities and Exchange Commission (SEC) officially approved all Ethereum ETFs, providing investors with a new opportunity to invest in Ethereum through traditional financial channels. This decision is seen as a major endorsement of the cryptocurrency industry, becoming the second cryptocurrency ETF approved by the SEC after the spot Bitcoin ETF. After approval, the price of Ethereum rose slightly and fluctuated around $3,800, reaching a high of $3,856. It is currently reported at $3,807, with a 24-hour increase of 1.3%. The fluctuation after the news was not as large as in the previous few days, but in the wholeXiaobai NavigationThis caused quite a stir on the social media platform Twitter.

From the hot searches in each region:

(1) Europe and CIS regions show a certain degree of interest in MEME:

As the crypto market rebounded significantly, PEPE tokens continued to hit new highs, and users began to buy back their chips into MEME coins to gain higher returns. From the searches of European users, it can be seen that European users generally search for MEME coins more frequently, which also means that users in the European market are more involved in the MEME coin market.

(2) The Asian region has shown a clear increase in attention to BTC, ETH ETFs, etc.:

Influenced by Bloomberg's report that Hong Kong may pass BTC and ETH ETFs this week, searches in the Asian region have clearly increased their attention to the event. As the core region of Asian finance, Hong Kong has always been at the forefront of financial innovation. With the passage of ETFs, it has once again become the focus of Asia. Traditional finance and large funds can enter the encryption field through this channel, which has a positive impact on both industry development and retail investment.

Potential Airdrop Opportunities

Sanctum

Solana Ecosystem LST Protocol Sanctum officially announced the launch of the loyalty program Sanctum Wonderland. According to reports, Sanctum Wonderland aims to make full use of SOL to gain benefits through a gamified experience. Users can collect pets and earn experience points to upgrade by staking SOL, and earn EXP through pets.

Previously, the Solana ecosystem liquidity staking service protocol Sanctum completed its seed round extension round of financing, led by Dragonfly, with participation from Solana Ventures, CMS Holdings, DeFiance Capital, Genblock Capital, Jump Capital, Marin Digital Ventures and others. The total financing has now reached US$6.1 million.

How to participate: Open the link, connectwallet,填写邀请码,②用 Sol 换 Infinity,存入至少 0.122SOL+0.05 的手续存款 钱包至少需要准备 0.172 个 SOL,存入至少 0.11SOL,宠物才会自动成长并赚取 EXP,一旦 LST 余额低于 0.1SOL 宠物就会进入冬眠状态并停止赚取 EXP,有能力的建议存 1SOL 以上,1SOL 每分钟获得 10EXP,可随时取出,且 GAS 费极低。

Synthr

Synthr is a full-chain synthetic protocol that allows cross-chain minting and transfer of synthetic assets without the need for cross-chain bridges. The project mints assets on-chain through synthetic assets (Synthetix), which means that its technology can easily bring RWA to the chain, such as real estate, bonds or stocks, for cross-chain transactions and transfers.

The project raised $4.25 million from top funds including MorningStar Ventures, Kronos Research, and Axelar Fdn.

具体参与方式:目前该项目刚开放测试用,用户可以通过进入测试网,注册钱包,通过水龙头领取测试币的方式参与早期交互。持续关注项目后续的进展,积极参与各类链上交互。

The article comes from the Internet:Bitget Research Institute: US SEC approves Ethereum spot ETF 19b-4, ETHFi and other ecological assets are expected to continue to rise

This year, the RWA narrative was the second best performing narrative, beatingAI. Written by: The DeFi Investor Compiled by: Xiaobai Navigation Coderworld The field of real-world assets (RWA) is one of the fields with the highest long-term potential. This is obviously not just a short-term narrative. The tokenization of real-world assets brings many benefits: More convenient…