Crypto AI projects are not all nonsense. How to identify real scenarios and false needs?

author:563

Compiled by: Xiaobai Navigation coderworld

Navigating the intersection of crypto and AI.

In the search for new alpha, we inevitably come across some junk. When a project can quickly raise 5-6 figures with just a semi-clear brief and some decent branding, speculators will latch onto every new narrative.AIThe problem is exacerbated by the “crypto AI” narrative.

The problems with most of these projects are:

-

Most crypto projects don't needAI

-

mostAIProject does not requirecryptocurrency

Not all decentralizedexchange(DEX) needs a built-in AI assistant, and each chatbot does not need an accompanyingTokenThis hard-core combination of AI and cryptography allowsWhen I first delved into this narrativeAlmost collapsed.

The bad news? Continuing down the current path, further centralizing this technology,will only end in failure, and a large number of false "AI x Crypto “projects will also hinder our ability to reverse the downward trend.

好消息是什么?隧道尽头有曙光。有时,AI 确实能从加密经济学中获益。同样,在一些加密货币的使用案例中,AI 也能解决一些实际问题。

In today’s article, we’ll explore these critical intersections. The overlap of these niche innovative ideas forms a whole that is greater than the sum of its parts.

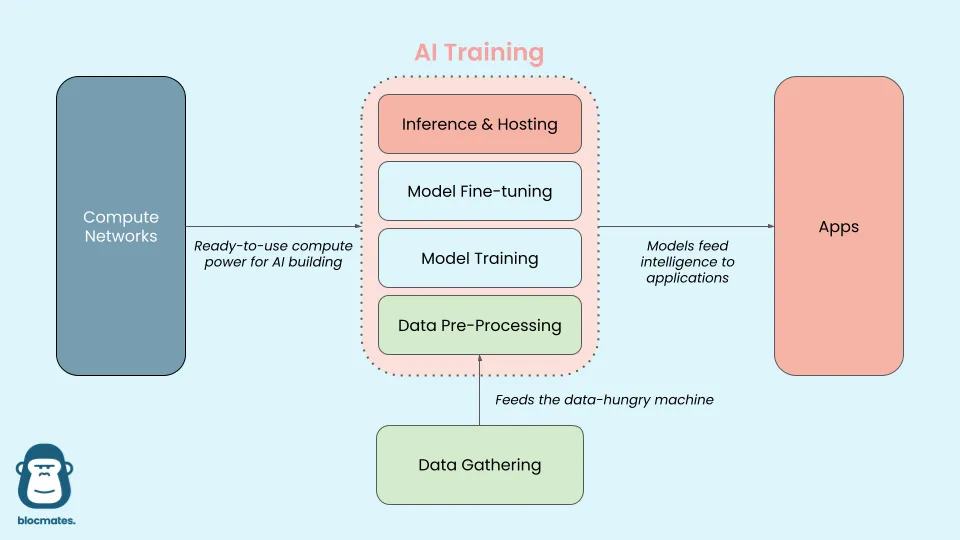

A high-level view of the AI stack

Here are my thoughts on the different verticals in the Crypto AI ecosystem (if you want to learn more, you can refer toTommy's Articles). Note that this is a very simplified view, but hopefully it helps to lay the foundation.

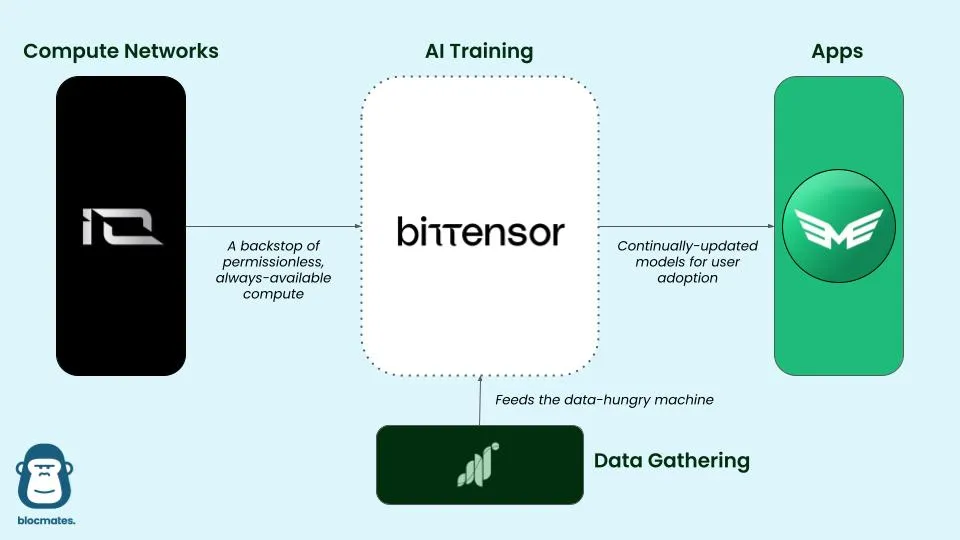

At a high level, here’s how it all works together:

-

Collect data at scale.

-

Process this data so that the machine understands how to ingest and apply it.

-

Train the model on this data to create a general model.

-

It can then be fine-tuned to handle specific use cases.

-

Finally, these models are deployed and hosted so that applications can query them for useful insights.

-

All of this requires massive computing resources, which can be run locally or sourced from the cloud.

Let’s explore each of these areas, focusing specifically on how different cryptoeconomic designs can actually improve upon standard workflows.

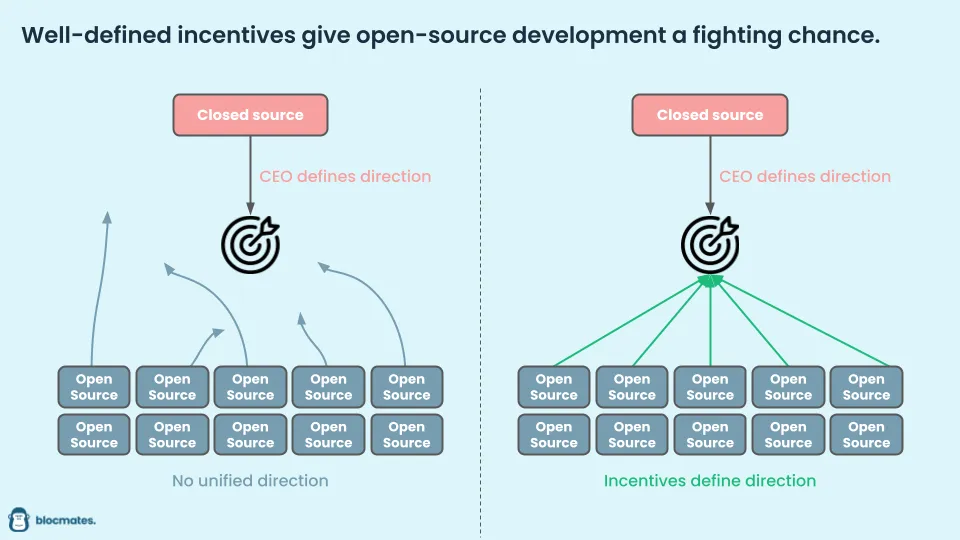

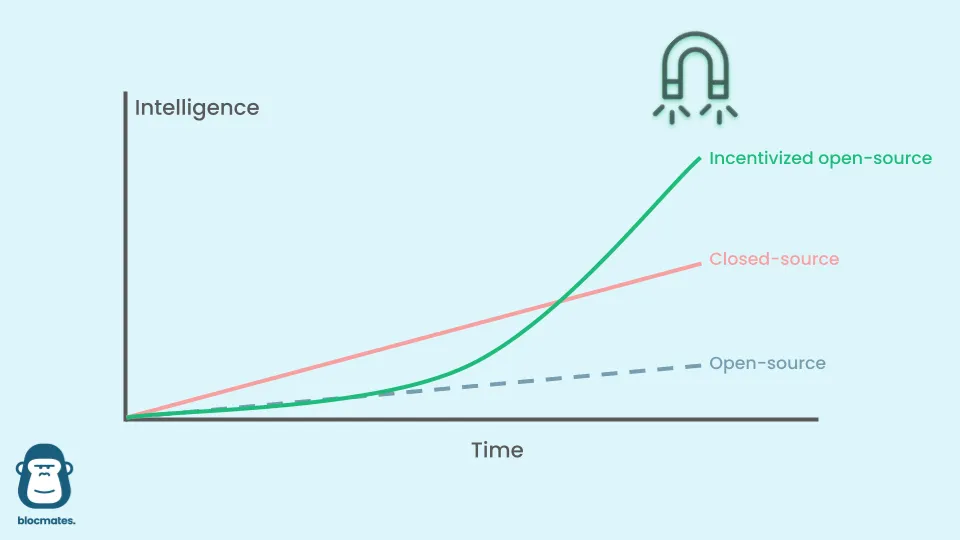

Encryption gives open source a fighting chance

The debate over "closed source" vs. "open source" development approaches can be traced back to the Windows-Linux debate andEric Raymond's famous "Cathedral and Market"Theory. Although Linux is widely used among enthusiasts today,About 90% usersChose Windows. Why? Because of incentives.

Open source development has many benefits, at least from the outside. It allows the largest number of people to participate in and contribute to the development process. But in this headless structure, there is no unifying directive. The CEO is not proactively trying to get as many people as possible to use their product to maximize their bottom line. In the open source development process, there is a risk that the project will evolve into a "chimera" that splits off in different directions at every intersection of design philosophy.

What is the best way to align incentives? Build a system that rewards behaviors that drive achievement of your goals. In other words,Putting money in the hands of actors who can get us closer to our goalsWith cryptocurrency, this can be hard-coded into law.

We’ll look at some projects that are doing just that.

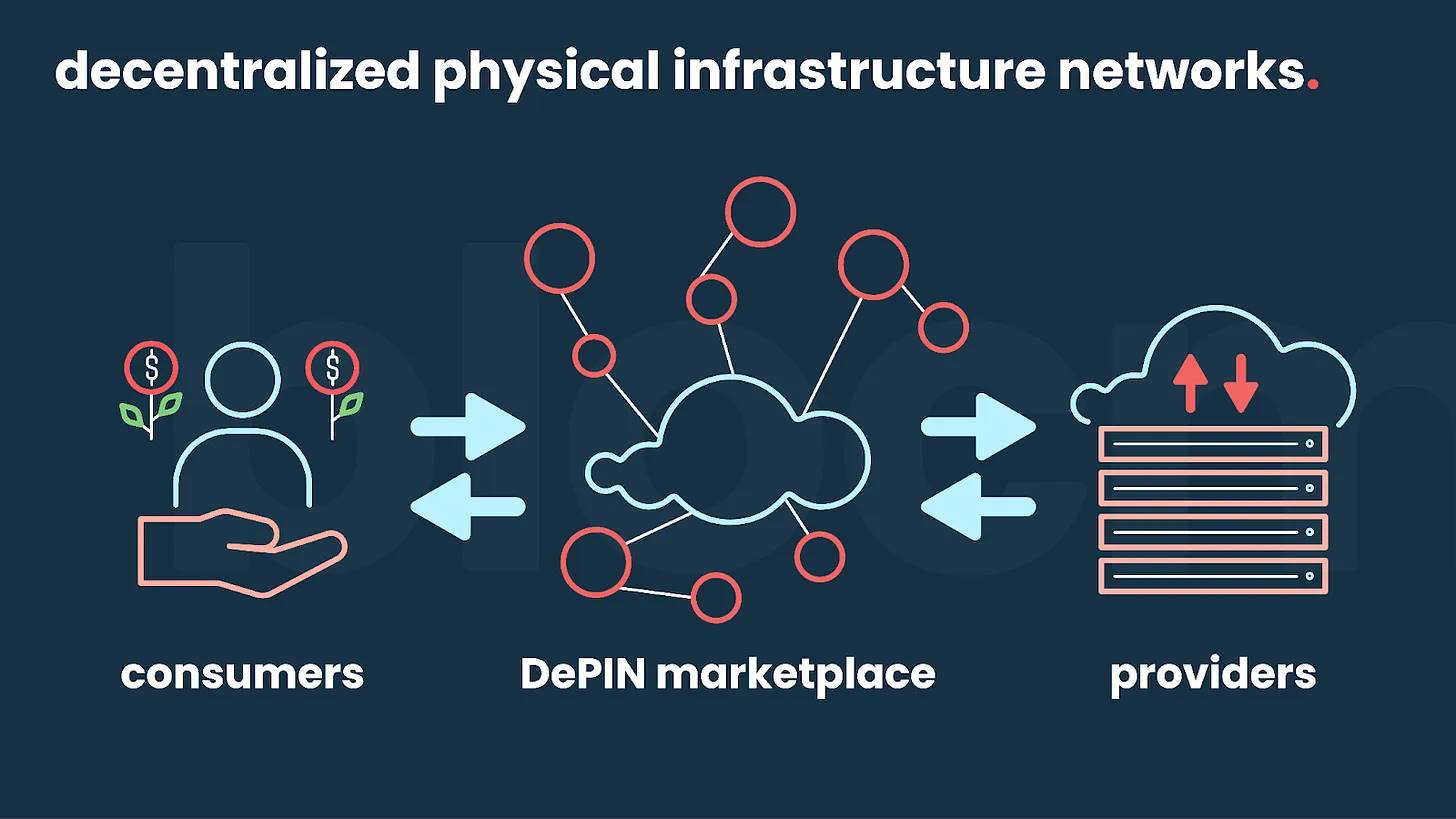

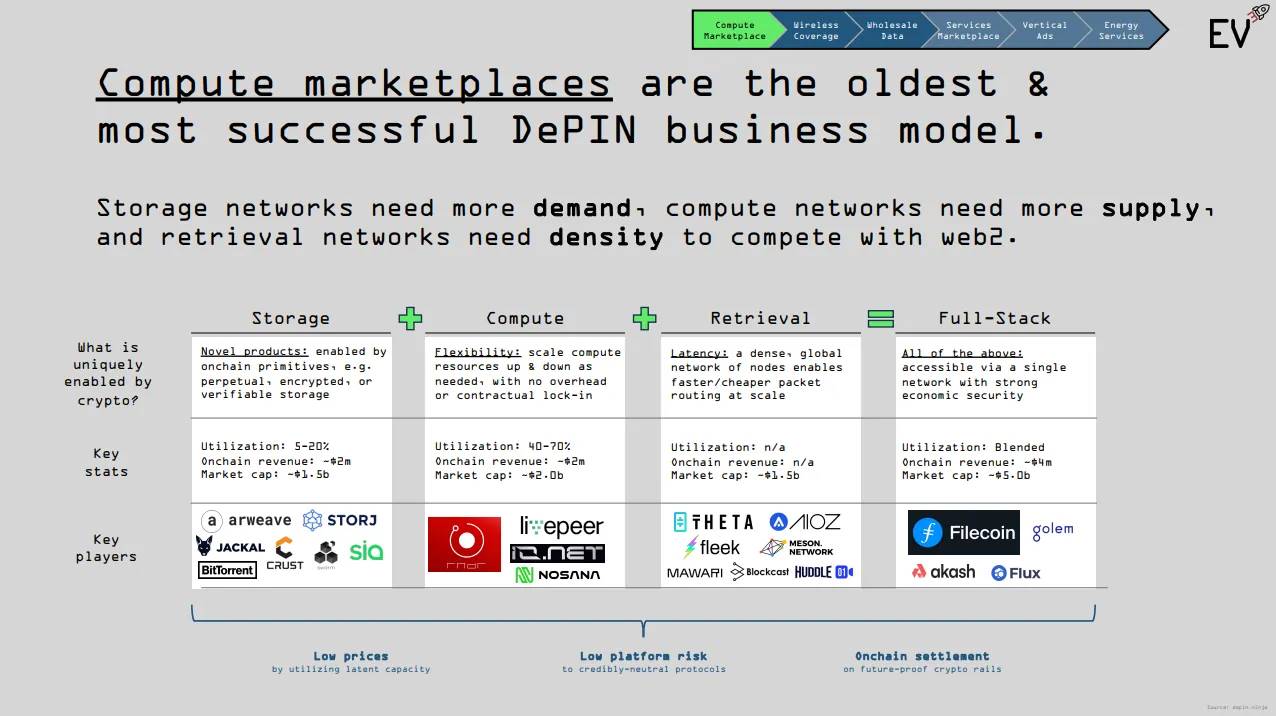

Decentralized Physical Infrastructure Networks (DePINs)

“Oh come on, this again?” Yes, I know the DePIN narrative is almost as overused as AI itself, but hang on for a second. I want to believe that DePINs are a crypto use case that has a real chance to change the world. Think about it.

What is encryption really good at?Remove intermediaries and incentivize activities.

Bitcoin’s original vision was a peer-to-peer currency designed to exclude banks. Similarly, modern DePINs are designed to exclude centralized power and introduce provably fair market dynamics. As we will see, this architecture is ideal for crowdsourced AI-related networks.

Early use of DePINsTokenIssuance to increase the supply side (providers) in the hope that this will attract sustainable consumer demand. This is intended to address new marketsCold start problem.

这意味着早期的硬件/软件(“节点”)提供者赚取大量代币和少量现金。随着用户利用这些节点(在我们的例子中是机器学习构建者)带来的现金流,这开始抵消随着时间减少的代币发行,直到一个完全自给自足的生态系统建立起来(可能需要几年时间)。早期的采用者,如Helium and Hivemapper, demonstrating the effectiveness of this design.

Data Network, the Case of Grass

GPT-3 was reportedly trained with 45 TB of plain text data, equivalent to about 90 million novels (But it still can't draw a circle). GPT-4 and GPT-5 The amount of data required is greater than what exists on the surface web, so calling AI “data-hungry” is the understatement of the century.

If you are not a top player (OpenAI, Microsoft, Google, Facebook), getting this data is very difficult. The common strategy for most people is web scraping, which is all well and good until you try to step up. If you use a single Amazon Web Services (AWS) instance to try to scrape a large number of websites, you will quickly run into rate limits. This is where Grass comes in.

Grass connects more than two million devices, organizing them to crawl websites from users' IP addresses, collecting, structuring and selling them to AI companies that are hungry for data. In return, users who participate in the Grass network can earn a steady income from AI companies that use their data.

Of course, there are no tokens yet, but future $GRASS tokens might make users more willing to download their browser extension (or mobile app), even though they have already attracted a large number of users through an extremely successful referral campaign.

GPU Networking, the Case of io.net

Perhaps even more important than data is computing power. 2020Year and2021In 2017, China spent more on GPUs than on oil. That’s crazy, but it’s just the beginning. Goodbye Petro, make way for Computecoin.

Now, there are many GPUs on the market. DePINs, their working principle is roughly as follows.

-

Urgent need for calculationMachine LearningEngineer/Company.

-

On the other hand, there are data centers, idle mining machines and those with idle GPU/CPU Amateurs.

Despite the huge global supply, there is a lack of coordination. It is not easy to contact 10 different data centers and have them bid for your usage. A centralized solution would create a rent-seeking intermediary whose incentive is to extract the most value from each party, but crypto can help.

Crypto is very good at creating a market layer that efficiently connects buyers and sellersA piece of code need not be accountable to the financial interests of shareholders.

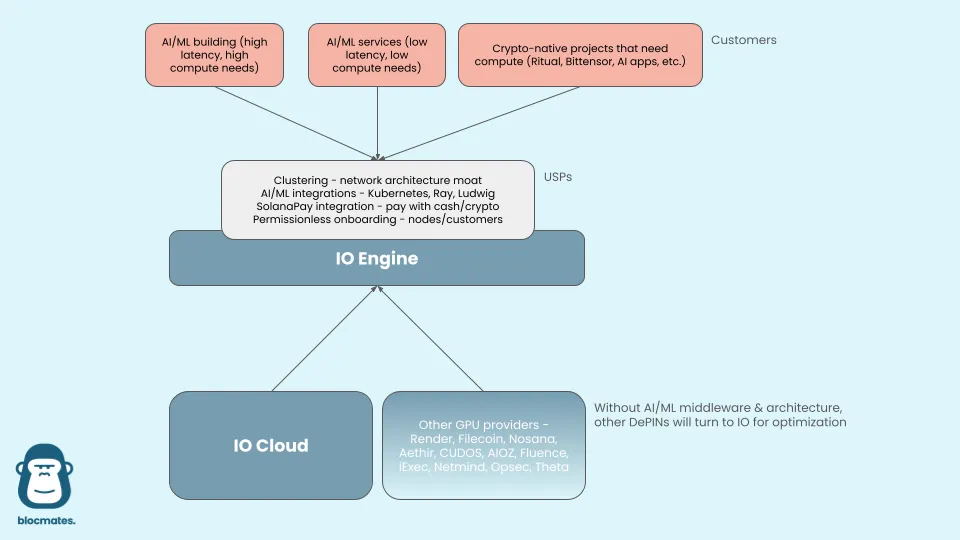

io.net stands out because it introduces some cool new technology that is critical for AI training - their cluster stack. Traditional clustering involves physically connecting a bunch of GPUs in the same data center so that they can work together to train models. But what if your hardware is distributed all over the world? io.net has partnered with Ray (used to create ChatGPT) to develop cluster middleware that can connect non-co-located GPUs.

Also, the AWS sign-up process can take several days. A cluster on io.net can be started permissionlessly in 90 seconds.For these reasons, I can see io.net becoming the hub for all other GPU DePINs that can plug into their "IO Engine" and unlock built-in clustering and a smooth onboarding experience. All of this is only possible with the help of cryptography.

You’ll notice that most of the ambitious decentralized AI projects (likeBittensor, Morpheus, Gensyn, Ritual, Sahara) have clear “computing” requirements - this is where GPU DePINs should be inserted, decentralized AI requires permissionless computing.

Use of incentive structures

Back to the revelation of Bitcoin. Why do miners keep calculating hash values quickly? Because this is how they are rewarded - Satoshi Nakamoto proposed this architecture because it prioritizes optimization.SafetySex. What's the lesson?The incentive structures built into these protocols determine the end products they produce.

Bitcoin miners and Ethereum stakers are the participants who absorb all of their native tokens because this is what the protocol wants to incentivize - participants to become miners and stakers.

In an organization, this might come from the CEO, who defines a “vision” or “mission statement.” But people are fallible and can lead a company off course. Computer code, on the other hand, can keep people focused better than the roughest wage slave. Let’s take a look at a few decentralized projects that have built-in token effects that keep participants focused on lofty goals.

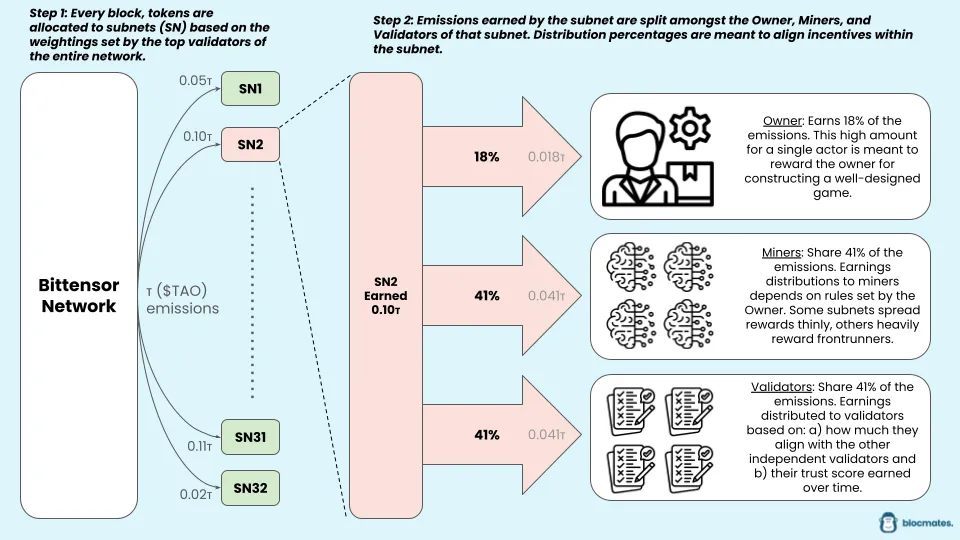

AI builds networks and discusses Bittensor

What if we let Bitcoin miners build AI instead of solving useless math problems? That’s how you get Bittensor.

Bittensor aims to create several experimental ecosystems to run experiments, with the goal of producing "commoditized intelligence" within each ecosystem. This means that one ecosystem (called a subnet, or "SN") might focus on developing language models, another on financial models, and still more on speech synthesis, AI detection, or image generation (See currently active projects).

For the Bittensor network, it doesn’t matter what you want to do. As long as you can prove that your project is worth funding, the incentives will flow. This is the goal of the subnet owner, who registers the subnet and adjusts the rules of the game.

The participants in this "game" are called miners. These are the ML/AI engineers and teams that build models. They are locked in a constantly audited "Thunderdome" and compete with each other to get the most rewards.

Validators are another side that is responsible for conducting reviews and scoring the miners’ work accordingly. If a validator is found to be colluding with a miner, they will be expelled.

Remember the incentives:

-

Miners earn more when they beat miners in other subnets - this drives the development of AI.

-

Validators earn more when they accurately identify high- and low-performing miners — this maintains the fairness of the subnet.

-

Subnet owners earn more when their subnet produces more useful AI models than other subnets - this encourages subnet owners to optimize their "game".

You can think of Bittensor as a perpetual reward machine for AI development. Emerging machine learning engineers can try to build something, pitch to VCs and try to raise some money. Or they can join one of the Bittensor subnets as a miner, make a killing, and earn tons of TAO. Which is easier?

Some of the top teams are building on the network:

-

Nous Research are the kings of open source. Their subnets have disrupted tradition in fine-tuning open source LLMs. They use continuous synthetic data streams to test their models.Leaderboards cannot be manipulated(Unlike traditional benchmarks such as HuggingFace).

-

Taoshi ofProprietary training networkBasically, it is an open source quantitative trading company. They ask ML contributors to build trading algorithms that predict asset price movements. Their API provides both retail and institutional usersQuantitative trading signals, and is rapidly heading towards significant profitability.

-

Depend on The Corcel Teamdeveloping Cortex.t There are two purposes. First, they incentivize miners to provide API access to top models (such as GPT-4 and Claude-3) to ensure continued availability for developers. They also provide synthetic data generation, which is very useful for model training and benchmarking (which is why Nous uses it). Check out their tools -chatandsearch.

If nothing else, Bittensor reaffirms the power of incentive structures, all enabled by cryptoeconomics.

Intelligent Agents, Exploring Morpheus

Now, let's look at two aspects of Morpheus:

-

Cryptoeconomic structures are building AI (crypto helps AI)

-

AI-enabled applications enable new use cases in encryption (AI helps encryption)

“Intelligent Agent"Just trained in intelligencecontractTrained AI models. They understand the inner workings of all the top DeFi protocols, know where to find yield, where to bridgeXiaobai NavigationHow to spot suspiciouscontractThey are the "auto-routers" of the future and in my opinion they will be the devices everyone will be using with their computer in 5-10 years.BlockchainIn fact, once we get to that point, you may not even know you are using crypto. You will just tell the chatbot that you want to move some of your savings into another investment, and everything will happen in the background.

Morpheus embodies this part of the "incentivize them and they will come" message. Their goal is to have a platform where intelligent agents can spread and flourish, each building on the success of the last, in an ecosystem that minimizes externalities.

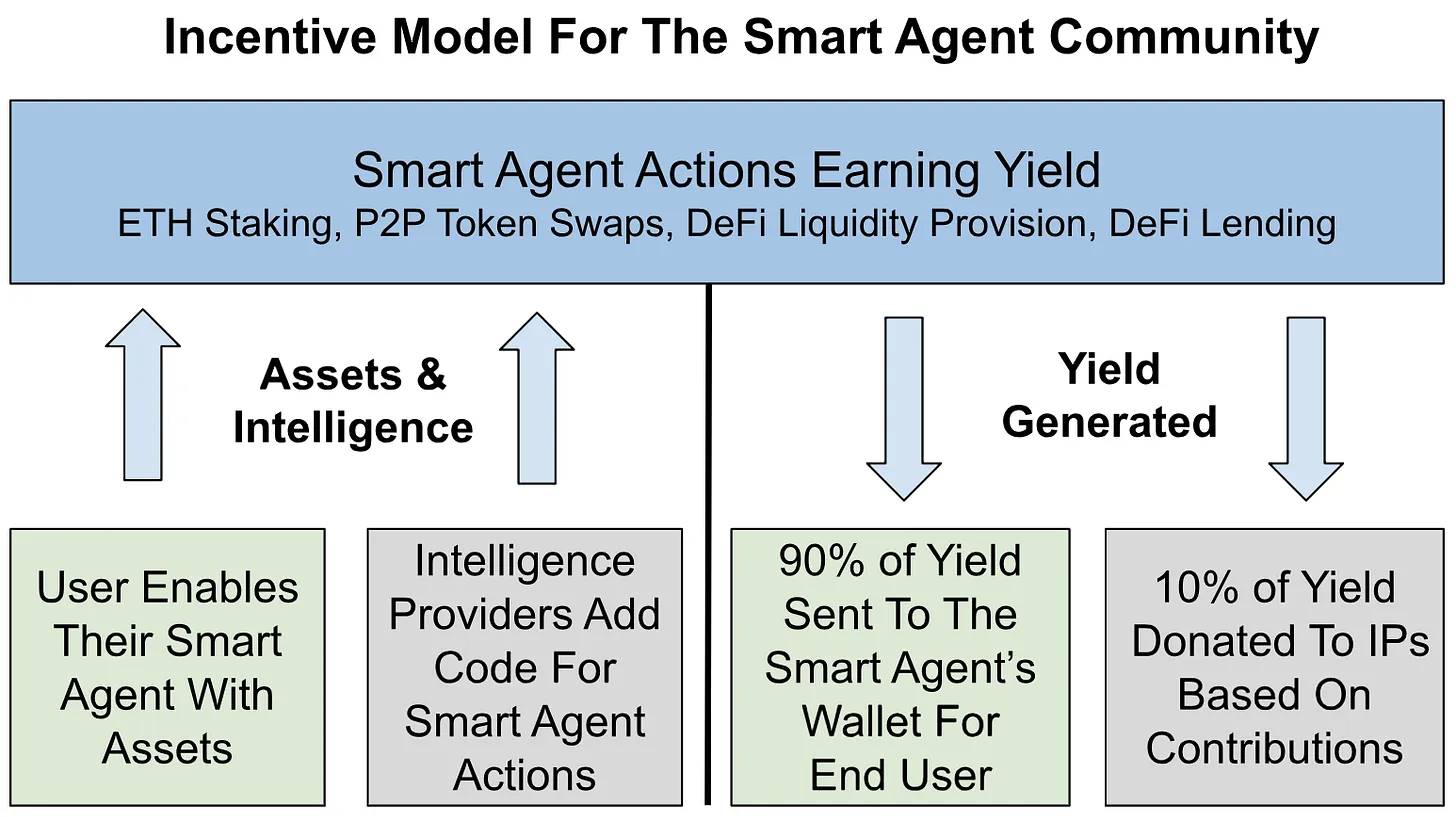

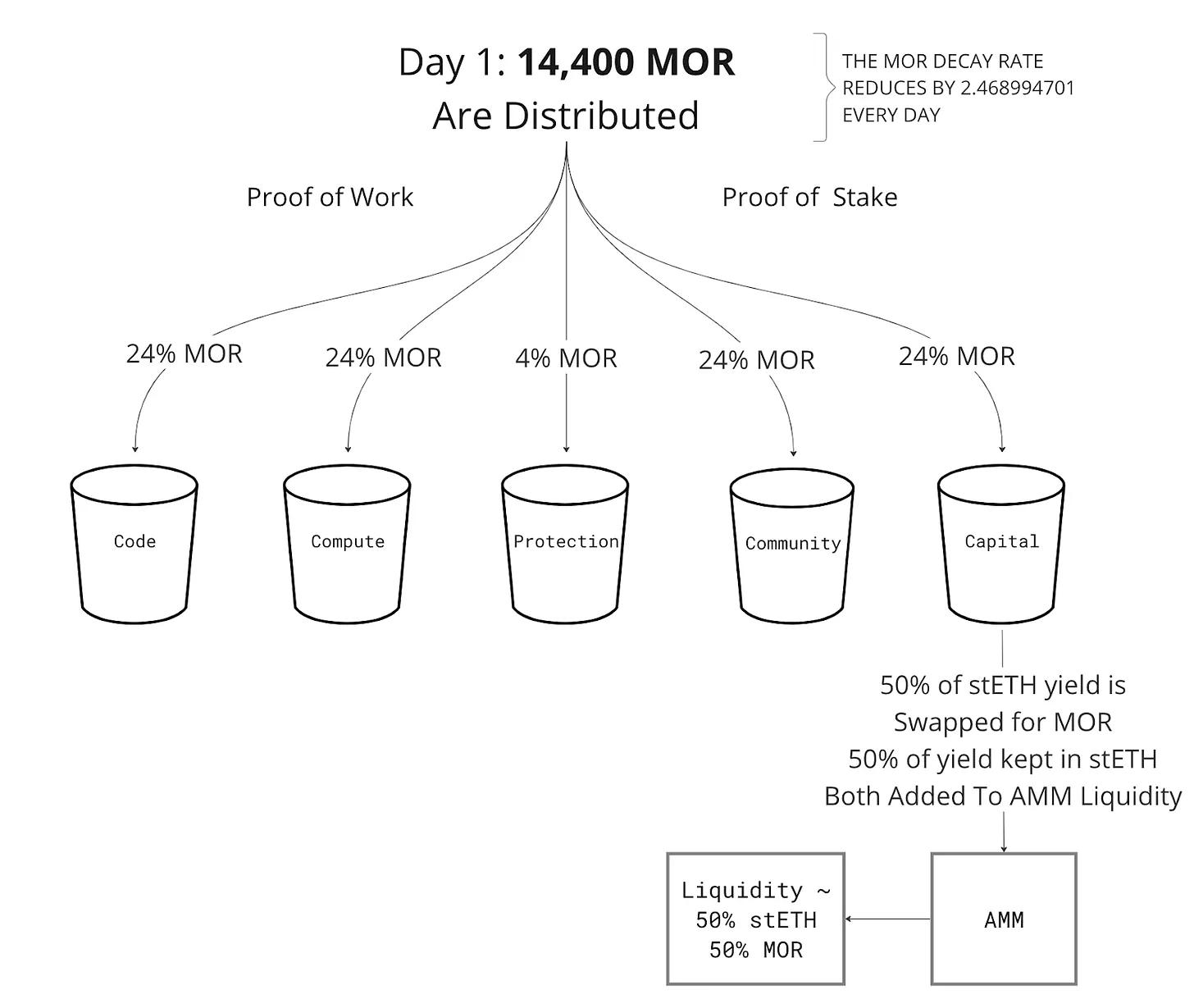

The token inflation structure highlights four main contributors to the protocol:

-

Code – Agent Builder.

-

CommunityBuild front-end applications and tools to attract new users to the ecosystem.

-

Compute - Provides computing power to run the agent.

-

Capital - provides their earnings to fuel Morpheus' economic machine.

Each of these categories receives an equal share of the $MOR inflation reward (a small portion is also saved as an emergency fund), forcing them to:

-

Building the best proxy- Creators get paid when their agents are consistently used. Unlike the OpenAI plugin, which is provided for free, this approach pays builders instantly.

-

Build the best frontend/tools—Creators get paid when their creations are used consistently.

-

Provide stable computing power——Providers get paid when they lend out computing power.

-

Providing liquidity to projects- Earn their share of MOR by maintaining liquidity in the project.

While there are many other AI/intelligent agent projects, Morpheus’s token economic structure is particularly clear and effective in designing incentive mechanisms.

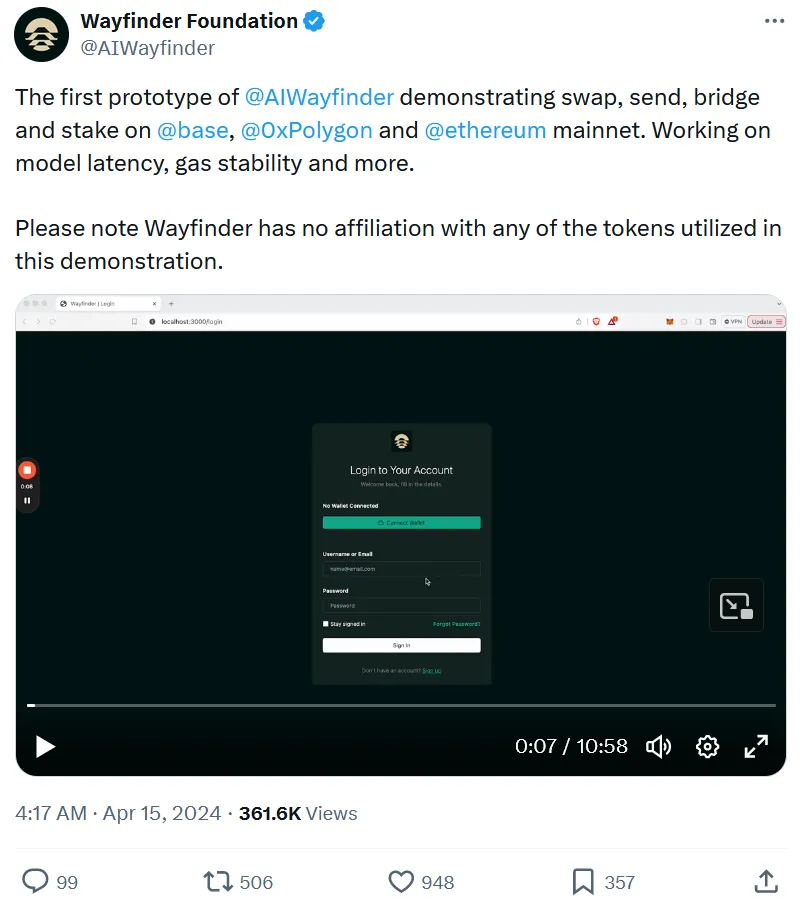

These smart agents are the ultimate example of how AI is truly removing barriers to crypto adoption. dApp UX is notoriously bad (despite many improvements over the past few years), and the rise of LLMs has ignited the passion of every would-be Web2 and Web3 founder. Despite the large number of for-profit projects, great projects like Morpheus and Wayfinder (see demo below) show how easy it will be to conduct on-chain transactions in the future.

Putting it all together, the interactions between these systems might look a bit like the following. Note that this is an extremely simplified view.

How to tell if a project is completely useless

Keep in mind our two broad categories of “Crypto x AI”:

-

Encryption HelpAI

-

AIHelp Encrypt

In this article, we have mainly explored the first category. As we have seen, a well-designed token system can lay the foundation for the success of the entire ecosystem.

Category 1 – Encryption helps AI

DePIN architectures can help jumpstart markets, and creative token incentive structures can coordinate open source projects toward once-elusive goals. Yes, there are several other legal intersections that I didn’t cover due to space limitations:

-

Decentralized Storage

-

Trusted Execution Environment(TEE)

-

Real-time acquisition data (RAG)

-

Zero-knowledge xMachine LearningFor inference/provenance verification

When deciding whether a new project is truly valuable, ask yourself:

-

If it's a spinoff of another established project, is it different enough to be eye-catching?

-

Is it just a wrapped version of open source software?

-

Does the project actually benefit from crypto, or is it shoehorned in?

-

Do we really need 100 crypto projects like HuggingFace?

Category 2 – AI-assisted encryption

I personally see more fake projects in this category, but there are some cool use cases. AI models can remove barriers in the crypto user experience, especially intelligent agents. Here are some interesting categories worth paying attention to in the field of AI-powered crypto applications:

-

Enhanced Intent System — Automated Cross-Chain Operations

-

walletinfrastructure

-

Real-time alerting infrastructure for users and applications

If it's just a "chatbot with a token", it's garbage to me. Please stop promoting these projects for my sanity. Also:

-

Adding AI won’t magically give your failing app/chain/tool product-market fit

-

No one will play a bad game just because it has AI characters

-

Labeling your project “AI” doesn’t make it interesting

Where are we headed?

Despite all the noise, some serious teams are working hard to realize the vision of “decentralized AI” and it’s worth fighting for.

In addition to incentivizing open source model development, decentralized data networks open new doors for emerging AI developers. While most of OpenAI’s competitors can’t compete withReddit, Tumblr, or WordPress Distributed crawling can even out this gap when dealing with large volumes of transactions.

一家公司拥有的计算能力可能永远不会超过世界上其他公司拥有的计算能力的总和,而有了去中心化的 GPU 网络,这意味着其他任何人都有能力与顶级公司相媲美。你所需要的只是一个加密钱包。

Today we are at a crossroads. If we focus on the truly valuable “cryptocurrency AI” project, we have the ability to decentralize the entire AI stack.

The vision of cryptocurrency is to create a secure, untamperedhard currency.Just as this emerging technology was beginning to gain popularity, a more formidable challenger emerged.

In the best-case scenario, centralized AI will not only control your finances, but will also impose biases on every piece of data we encounter in our daily lives. It will enrich a very small number of tech leaders in a self-perpetuating cycle of data collection, fine-tuning, and model injection.

It will know you better than you know yourself. It will know which buttons to push to make you laugh more, get angrier, and spend more. Despite what it may seem, it is not responsible for you.

initial,Encryption technology is seen as adversarial AI A force for centralizationCryptography can coordinate the efforts of dispersed individuals to achieve a common goal. However,Now this ability is facing aCentral BankStronger enemies: Focused AI.This time, time is of the essence and we need to act quickly to resist the centralizing tendencies of AI.

The article comes from the Internet:Crypto AI projects are not all nonsense. How to identify real scenarios and false needs?

OKX Web3 specially built a unique Bitcoin Time Museum on the streets of Taipei during the 2024 BTC Pizza Festival, attracting tens of thousands of people to travel through time and space and look back at the history of Bitcoin development. Brave people enjoy the world first. On May 22, 2010, crypto pioneer Laszlo Hanyecz used 10,000 BTC…