Decoding the Korean crypto market: Upbit has the second largest trading volume in the world, and young people are more enthusiastic about crypto than stocks

Written by: DeSpread

1. Introduction

1.1. 社区的重要性

cryptocurrencyThe community of a project is not just a collection of users and investors, but one of the key factors that determine the success or failure of a project. The importance of the community cannot be overemphasized becauseBlockchainThe technology and the projects based on it all revolve around decentralized governance.

Decentralized governance involves the team and the community jointly deciding the future of the project.TokenDecisions on economy, roadmap, development priorities, etc. If a team ignores the community and operates a project opaquely, it will cause suspicion and uncertainty in the community, thus spreading FUD (Fear, Uncertainty, Doubt) and shaking the value foundation of the entire project.

Luna founder Do Kwon often ignores many questions raised by the Luna community about the LUNA-UST mechanism, and even stated on Twitter that he does not debate with beggars. Not only that, he continued to ignore the question of "How to prepare the equivalent of $300 million in Anchor Protocol interest?", indicating that it was a "question without answer value", but instead caused the community to fear that Luna would go bankrupt. Looking back, ignoring community feedback is very costly.

Community participation and feedback play an important role in the development of projects and meeting market needs and expectations. Therefore, when project teams actively participate in community communication, they can effectively improve the transparency and credibility of the project. Community members are also the most effective propagandists who can help spread the value and promise of the project and make great contributions to the growth of the project's user base. The reason why all new projects recently use community airdrops as rewards is also based on understanding the importance of community participation and in order to quickly attract community participation.

1.2. Focus on the Korean market

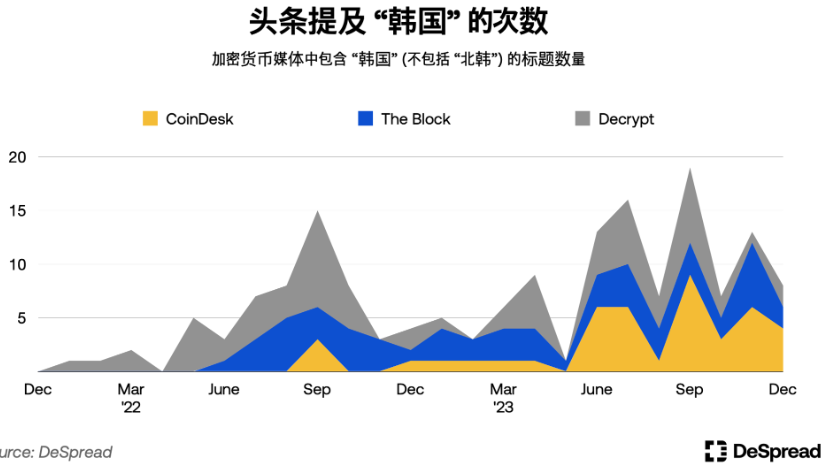

随着时间的推移,韩国在加密货币行业中的地位和关注度不断提高。对主要国际媒体头条新闻中提及 “韩国” (不包括朝鲜) 的分析证实,全球对韩国加密货币市场的兴趣与日俱增。图表中 2017 年下半年的峰值主要是关于 Luna 和 Do Kwon 的文章,但从 2023 年下半年开始,我们看到更多关于政府监管或韩国市场的文章,表明韩国市场的趋势和政策正在成为全球关注的焦点之一。

In addition, as we have mentioned in our previous report (DI-01: South Korea Centralized Exchange)exchangeIts trading volume ranks high globally. As shown in the figure above, Upbit ranked the second largest spot market in the world in 2023, second only to Binance.

韩国交易所倾向于交易非主流 (如比特币和以太坊) 的山寨币,而对于市值相对较大的山寨币,韩国交易所的影响力也很大,例如,比特币 L2 项目 Stacks (STX) 在 2023 年 8 月 5 日的韩国交易量占了全球交易量的 90%,以太坊最大的 NFT 市场项目代币 BLUR 在 2023 年 1 月 4 日的韩国交易量占了全球交易量的 60%。这些数据表明了韩国市场的重要性及其对全球市场的影响力。

Identifying community trends in a particular market is essential to understanding the characteristics of that market. This report aims to provide an in-depth analysis of the Korean cryptocurrency community from this perspective. This report mainly focuses on understanding the communities in the Korean cryptocurrency market in 2023, the topics in its communities, and the correlation between community interests and market trends.

2. Korean Cryptocurrency Community Platform

2.1. Telegram

Telegram is an international messaging service with about 800 million monthly active users (MAU) worldwide. It is also the most active community platform in South Korea that uses on-chain products. Telegram offers a variety of features, including large group chats, notification messages, and robots, so many communities operate on Telegram beyond just sending messages between individuals.

There are channels on Telegram for various topics, including airdrop information, exchange announcements, DeFi news, trading signals, research, etc. According to our statistics, there are currently at least 500 cryptocurrency-related channels in South Korea.

The project usually has its own official Telegram channel and chat room, through which users can quickly receive the latest information about the project and interact with other community members. Telegram also supports multiple languages, so it is easy to communicate with the global community, and information forwarding and quoting between channels is also quite convenient, which is an effective way to exchange information.

2.2. KakaoTalk Open Chat Room

KakaoTalk is the most widely used messaging app in South Korea, with 48 million MAUs by the end of 2023, making it the top app in South Korea. With a population of 51.32 million, it can be said that all Koreans use KakaoTalk. Since KakaoTalk is suitable for users of all ages, the cryptocurrency community also uses KakaoTalk's open chat rooms for communication. Open chat rooms are one of KakaoTalk's services, and users with similar interests can create chat rooms.

Cryptocurrency-related open chatrooms are mainly composed of general cryptocurrency investors and holders, most of whom invest in coins listed on Korean centralized exchanges. Generally speaking, cryptocurrency chatrooms on Kakao tend to focus on price trends and market analysis. Compared with Telegram, these cryptocurrency communities have higher accessibility and more diverse participants, but the difference is that these participants are less adept at using on-chain services.

In addition, KakaoTalk’s open chatrooms can only accommodate up to 1,500 people, and have limited features such as message forwarding, making it difficult to share information between chatrooms. Not only that, Kakao’s bots have limited functionality, and it is not possible to create sub-channels within a chatroom. In addition, KakaoTalk has few international users and is a fairly localized community platform.

Due to the above reasons, KakaoTalk still has many shortcomings in terms of community management. In terms of these technical limitations and user characteristics, the overall impression given by the cryptocurrency community on KakaoTalk in terms of information quality and professionalism is slightly insufficient.

2.3. Coinpan

Coinpan is one of the largest cryptocurrency community websites in South Korea, with an MAU of 5.3 million by the end of 2023, according to Simillerweb. This figure exceeds the MAU of Bithumb, the second largest exchange in South Korea by trading volume (Bithumb's MAU was approximately 4.7 million as of December 23). On March 27, 2023, the number of posts in the Coinpan Free Forum reached 8,636 per day, making it one of the most active communities in South Korea.

The main types of posts on Coinpan include profit and loss, news, and investment arguments. Most discussions focus on currencies listed on centralized exchanges such as Upbit and Bithumb, and promote investment in specific currencies. In the profit and loss forum, many users will share screenshots of exchanges to verify the profitability of their investments, and some will share screenshots of overseas exchanges.contractProfit claim.

On Coinpan, users can check cryptocurrency prices on various exchanges, including Bithumb, Upbit, Coinone, Coinbit, Korbit, and Binance, and find information about Korean premiums and trading volumes. However, some message boards and specific features require logging in or reaching a certain level of community participation to unlock, creating a barrier for general user participation.

2.4. DCInside

DCInside is one of the most popular online community websites in South Korea. It is often called the Korean Reddit and is loved by everyone for its anonymity and free discussion culture. DCInside organizes message boards called "Gallery" according to various topics. Users can choose to hang out in the appropriate Gallery according to their interests.

There are several cryptocurrency-related galleries on DCInside, including Bitcoin Gallery, Altcoin Gallery, NFT Gallery, and Cryptocurrency Gallery. These galleries focus on information sharing and investment discussions on currencies listed on centralized exchanges such as Upbit and Bithumb, but not on on-chain activities.

These communities are often highly speculative, based on subjective opinions and short-term profit-seeking investments, and most of the information is non-objective. There is relatively little discussion about the long-term value of on-chain technology or projects, and all the focus is on the short-term gains brought by the rise and fall of specific currencies.

Due to these characteristics, although the Cryptocurrency Gallery on DCInside is slightly lacking in professionalism and information quality, if you want to understand the interests and investment behaviors of Korean cryptocurrency investors, the platform can be a useful window.

2.5. X (Twitter)

X (formerly Twitter) has become one of the most used platforms in the global cryptocurrency community. The main communication channel for all relevant people in the industry is to exchange and share information through Twitter.

However, the Korean cryptocurrency community is slightly less active on Twitter than the global level. The data also shows (as shown in the lower part of this article) that the number of cryptocurrency-related Twitter users and tweets in Korea is significantly lower than that in Japan (possibly because Twitter as a platform is not popular in Korea).

Despite the low numbers, Korean crypto Twitter has a wide range of interests, including experts on specific projects, technical analysts, veteran investors, speculators, memecoin enthusiasts, and DeFi and NFT experts, etc. In particular, fundamental and research-based investors are the most active on the platform.

In South Korea, Twitter also lags behind Telegram in terms of timeliness. In the Korean cryptocurrency community, news on Telegram spreads the fastest and is the most heatedly discussed. In comparison, Twitter's information spreads more slowly. However, compared with other communities, Twitter is characterized by having more active on-chain users.

2.6. Discord

Discord was originally a communication platform for gamers, but has recently been widely used by the cryptocurrency community. The main feature of Discord is the server-based community organization. Each project or organization can create its own server, and users can join the server they are interested in to communicate with the community.

In the cryptocurrency space, Discord is primarily used to build communities around specific projects. Many projects run their own Discord servers to share project updates, development progress, airdrops, governance voting, and other information, and to facilitate communication and discussion among community members.

However, because Discord is very focused on a single project, there is relatively little discussion of general investment information or market trends. On the other hand, because Discord is structured so that each server runs independently, it is difficult to share information between different servers.

Discord offers a variety of features such as voice chat, screen sharing, role assignment, and bot integration, making it a tool for community management, especially among developers, who receive notifications of code updates and discuss technical issues through integration with GitHub.

Compared to the global level, Discord's usage rate in South Korea is low because Discord is still an unfamiliar platform for Korean users, and the language barrier raises the threshold for general users to participate in the global community. In addition, as mentioned earlier, the widespread use of Telegram and KakaoTalk in South Korea is also one of the reasons for the low usage rate of Discord.

2.7. Naver Cafe

Naver is the largest website in South Korea, which provides a community service called Naver Cafe. Naver Cafe is one of the most popular and longest-running community platforms in South Korea, and the cryptocurrency community also uses the platform. The cryptocurrency community on Naver Cafe tends to focus on price chart analysis and investment information sharing, especially for currencies listed on Korean centralized exchanges, especially altcoins, reflecting that Korean investors tend to pursue short-term profits and are interested in highly volatile altcoins rather than the basics of cryptocurrencies.

While Naver Cafe has the advantage of being an easily accessible and most familiar platform to users, it is slightly lacking in expertise and information reliability. Although we can find many successful investment stories and recommendations on Naver Cafe, most of them are still speculative in nature and lack objective evidence. In addition, Naver Cafe has many limitations due to its lack of connection with the global community. Most conversations in Naver Cafe are conducted in Korean, and there are relatively few discussions about overseas projects or global trends. However, in recent years, due to the growing interest of users in DeFi, NFT, and on-chain activities such as airdrops and liquidity monitoring, the number of related Naver Cafe activities has also increased.

So far, we have introduced the main characteristics of the Korean cryptocurrency community formed on various platforms, each of which has its own unique characteristics in terms of user numbers, interests, and discussion culture. In the second half, we will use this as a backdrop and dig deeper into the data to see what the hot topics in the Korean cryptocurrency community are in 2023 and what impact they have on the market.

3. 2023 Korean Community Trends

Google Trend

Google Trend is a search engine provided by Google, the world's largest search engine.Serve, which provides a specific search term at a specific time and placeXiaobai NavigationThe search frequency in the region. The search volume of Google Trends is expressed in relative interest, with 100 representing the highest search volume during the period. By using Google Trends for keyword analysis, we can observe which topics Korean investors and users are interested in and compare them with other countries.

3.1.1. Comparison of stocks and cryptocurrencies

-

South Korea loves cryptocurrencies

-

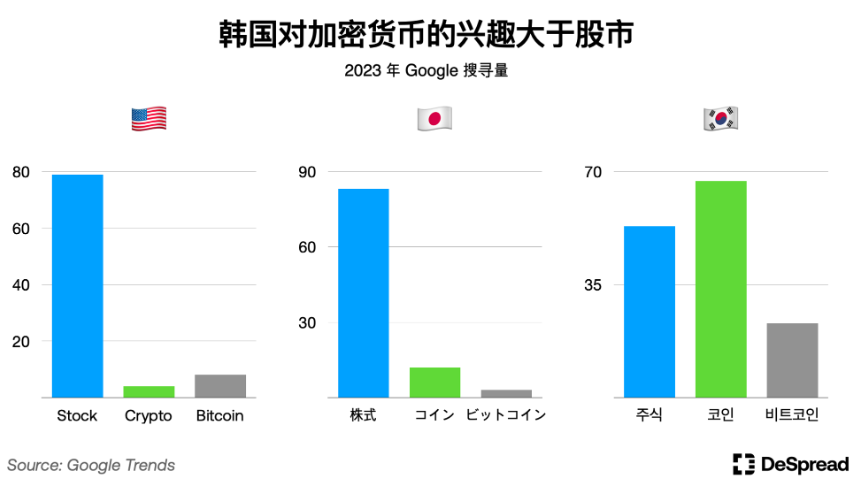

Stocks and cryptocurrencies are the two most common investment methods in the United States, Japan, and South Korea. When comparing the search volume of stock and cryptocurrency keywords, it can be found that South Korea has a higher interest in cryptocurrency than other countries. In the United States, the search volume for stocks is about 20 times that of cryptocurrencies, and in Japan, the search volume for stocks is about 7 times that of cryptocurrencies. Only in South Korea, the search volume for cryptocurrency is about 25% more than that for stocks.

-

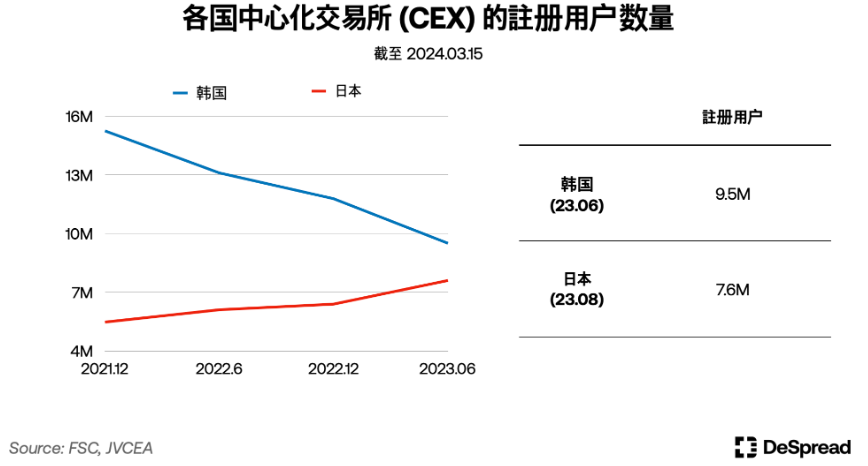

This difference can also be observed in the actual number of investors. As of 2022, the number of stock investors who held at least one share in South Korea was approximately 14.41 million (28% of the total population), while the number of cryptocurrency investors with exchange accounts in the same year was approximately 6.27 million (12% of the total population), showing a significantly higher proportion. In contrast, the number of registered accounts on centralized exchanges recorded in Japan in December 2022 was approximately 6.3 million, which is only 5% of the Japanese population.

-

-

Comparison between South Korea and Japan

-

Japan’s interest in cryptocurrencies is lower than that in stocks, which can also be observed from trading volumes. Comparing the trading volumes of the top five Japanese exchanges and the Korean exchange Upbit in May last year, a huge difference can be found between the two.Top five exchanges in JapanThe combined trading volume of the two exchanges was $4 billion, while Upbit alone had a trading volume of over $27 billion.

-

According to Coingecko, the trading volume of Japanese exchanges is mainly concentrated in Bitcoin and Ethereum, which is very different from the situation in South Korea, which focuses on altcoins. However, as shown in the above figure, according to the Japan Cryptocurrency Exchange Association (JVCEA), the number of registered accounts on cryptocurrency exchanges continues to grow, indicating the growth potential of the market.

-

3.1.2. Comparison of interest in representative exchanges across countries

-

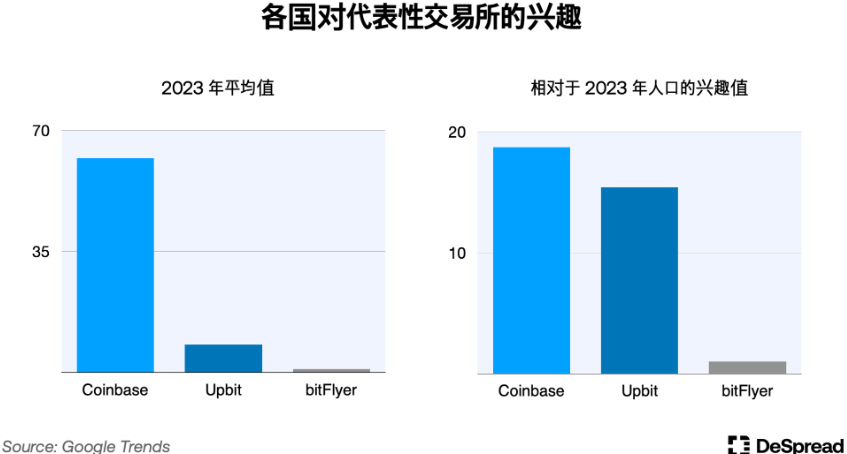

Definition of Representative Exchange:Centralized exchanges areBlockchainand an indispensable part of the cryptocurrency industry, as it is the easiest threshold for investing in cryptocurrency and a window for converting on-chain users. Coinbase, Upbit, and bitFlyer are the leading exchanges in the United States, South Korea, and Japan, respectively. We analyzed their keywords to understand the level of interest in cryptocurrency and centralized exchanges in each country.

-

South Korea has a high interest rate relative to its population:The chart shows that in terms of absolute search volume, Coinbase is the exchange with the highest average, but if we look at it in terms of population ratio, Upbit and Coinbase are very close, indicating that the usage rate of cryptocurrency exchanges in South Korea is quite high. In contrast, Japan's bitFlyer is relatively low in both absolute search volume and relative population, indicating that the usage rate of cryptocurrency exchanges in Japan is still relatively low.

-

The nature of the cryptocurrency environment in various countries:The United States has an active cryptocurrency trading environment centered on Coinbase. Coinbase provides services to users around the world. As of the end of 2022, the number of users who have passed the KYC review has reached 100 million, which exceeds the population of South Korea. In South Korea, as of the first half of 2023, there were 9.5 million registered accounts on centralized exchanges and about 6 million active users; while in Japan, as of August 23, there were 7.6 million registered accounts on centralized exchanges, which is relatively small compared to the population of Japan.

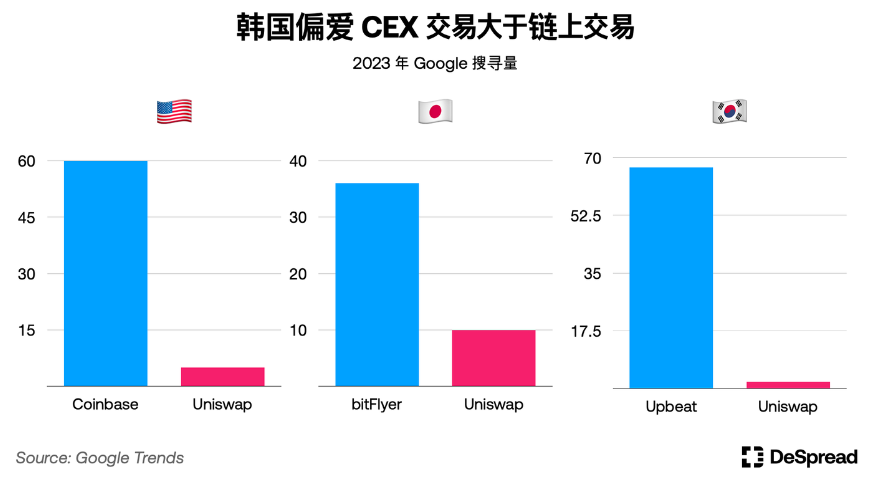

3.1.3. Comparison of keywords between centralized exchanges and on-chain

-

Measuring on-chain transaction interest: Compared with centralized exchanges, the threshold for on-chain trading activities is very high. We analyzed keywords related to on-chain trading and keywords related to centralized exchanges separately to indirectly understand the interest of various countries in on-chain trading.

-

Interest in on-chain transactions:As an indirect indicator of interest in on-chain transactions, we selected the leading decentralized exchange (DEX) Uniswap and conducted a comparative analysis with representative exchanges in various countries. In comparison, the United States is more interested in on-chain transactions than Japan, and Japan is higher than South Korea. Although South Korea's cryptocurrency investment activities are active, its interest in on-chain transactions is low, and although Japan's interest in Uniswap seems high, this is an illusion caused by Japan's low interest in bitFlyer.

-

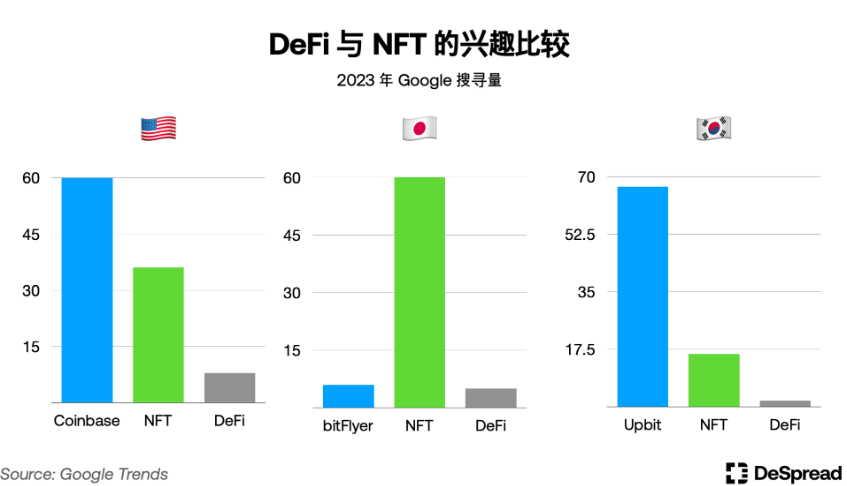

NFT and DeFi:NFT and DeFi are the two keywords that best represent on-chain activities. The United States and South Korea are more interested in NFT than DeFi. It can be speculated that this is because NFT is easier to understand for ordinary users, and there are many short-selling activities, which makes it easier for users to obtain. Japan's interest in NFT is significantly higher than that of centralized exchanges, indicating that Japan's NFT market is relatively active.

-

Developer Ratio and On-Chain Interest:According to Electric Capital data, the regional distribution of global cryptocurrency developers shows that North America accounts for 28% of the total, while East Asia and the Pacific, including South Korea, accounts for 11%. Although there is no exact data for a single region in South Korea, the proportion of protocol developers in South Korea seems to be very small compared to the trading volume, which also shows that South Korea is more keen on trading through centralized exchanges rather than developing on-chain technology.

Overall, South Korea has a high interest in cryptocurrency investment and trading, but relatively low interest in on-chain activities such as NFT and DeFi. On the other hand, the United States has a high interest in on-chain activities, while Japan has a relatively active NFT market.

3.2. Telegram cryptocurrency community

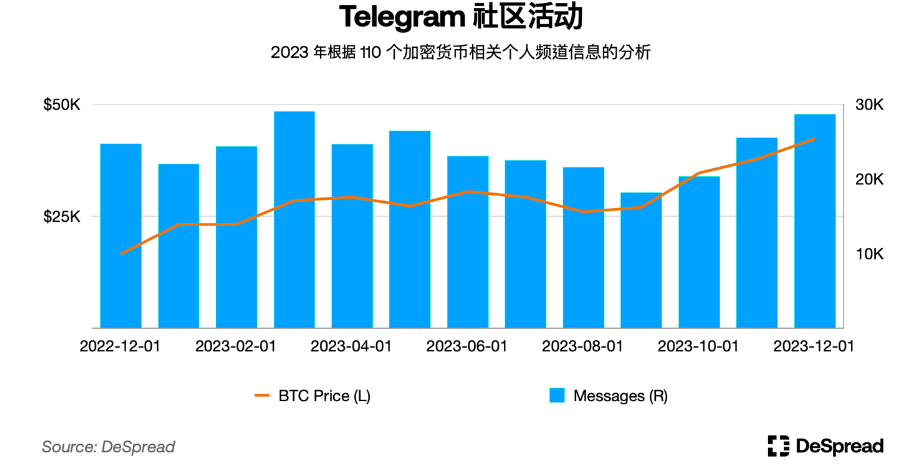

Based on 110 Korean cryptocurrency announcement channels running on Telegram, we analyzed the information sent by these channels in 2023. In order to remove purposeful posts and announcements not from community interest, our analysis excluded corporate channels and channels that simply share news headlines. Through these analyses, we will understand the Telegram channels that Korean cryptocurrency investors are most familiar with, the topics that users are interested in, and the sentiment trends over the past year.

3.2.1. Activity analysis

The above chart compares the 2023 Bitcoin price to the monthly message count of 110 Korean cryptocurrency community channels.

-

Bitcoin Price and Community Activity: In general, channel activity tends to increase during periods of rising Bitcoin prices. In particular, the number of messages in the channel increased significantly during the Bitcoin price surge from October to December 2023, indicating that price fluctuations have stimulated investor interest, leading to an increase in information sharing and discussion.

-

Channel activity in a bear market: In August and September 2023, when the BTC price fell, the number of messages in the channel decreased. In a bear market, investor participation tends to be lower and community activity tends to be flat.

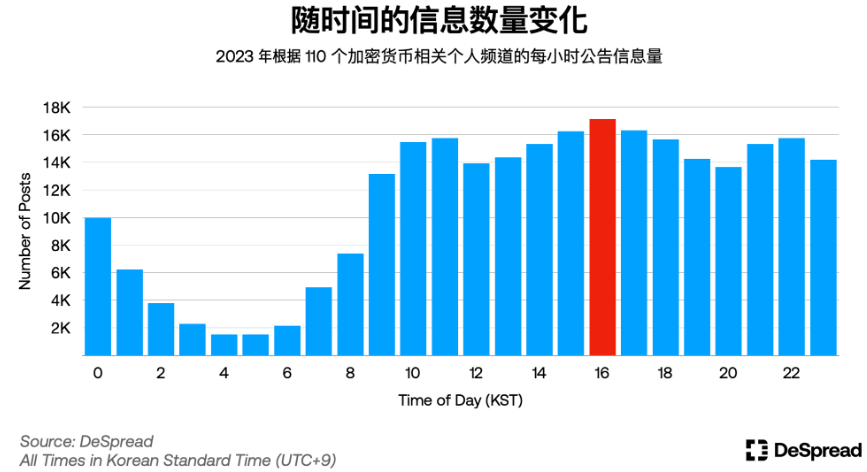

- peak hours: By analyzing the number of announcement messages on individual Telegram channels by time period, we found that the peak of activity occurs between 4pm and 5pm Korea time. The number of messages starts to increase from around 9am and continues until 11pm, with the highest activity between 2pm and 6pm, and the peak of the number of messages at 4pm. In contrast, community activity is the lowest between 2am and 6am. Overall, we can see that this is similar to the daily life pattern in Korea. What is more interesting is that the community activity continues even after 3:30pm after the stock market closes or after 6pm after get off work, reflecting the 24-hour global nature of the cryptocurrency market.

3.2.2. Keyword trend analysis in 2023

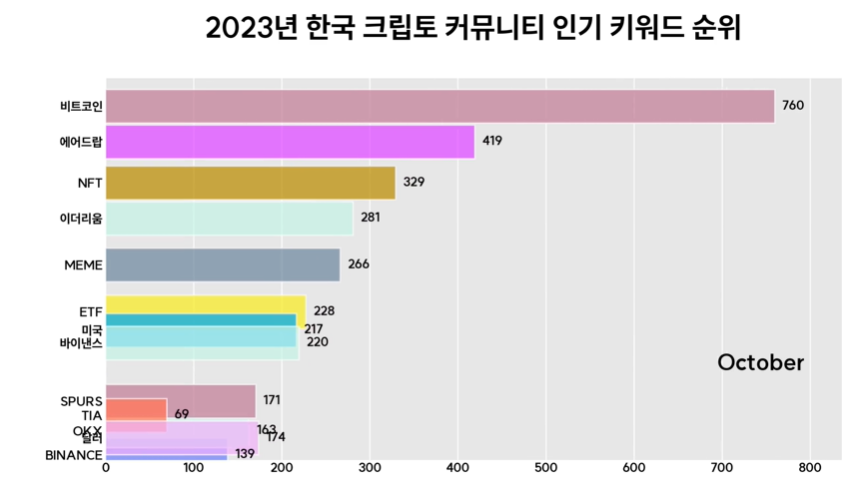

We analyzed the most mentioned keywords in 110 Korean cryptocurrency Telegram personal channels in 2023 and found that the most mentioned keywords are "Bitcoin", "NFT", "Airdrop" and "Ethereum". Interestingly, although Google Trend shows that South Korea's interest in NFTs is lower than other countries such as the United States and Japan, NFTs still rank high in the Telegram community. We speculate that this is because many projects continue to use free airdrops of NFTs as a marketing tool.

Overall, it can be seen that investors are more interested in things that are free, and Telegram's relatively large on-chain user base also has some influence. Next, we will look at the hot keywords in the Korean community each month.

January: Focus on macroeconomic uncertainty

In January, macroeconomic keywords such as "CPI", "FOMC" and "interest rate" and New Year-related keywords such as "year-end settlement" topped the list. This shows the impact of macroeconomic uncertainty and recession concerns on the cryptocurrency market.

February,March: Airdrops and USDC decoupling

2 月,Silvergate 和 SVB 的破产以及 3 月份 USDC 的脱钩导致市场情绪大幅下滑,但 2 月份 NFT 市场 Blur 的代币空投和三月份以太坊 L2 The Arbitrum project's airdrop successfully attracted the community's attention, thus revitalizing the market. The airdrop successfully helped Blur pose a threat to OpenSea, and Arbitrum's airdrop successfully guided users to use the ecosystem's dApps, increasing Arbitrum's on-chain activities. As shown in the figure above, the keyword "ZK Sync" also rose to the top in February and March, showing users' expectations for future airdrops.

April: Memecoin craze and Sui

In April, "PEPE" representedMemecoinThe hype has been set off again. The price of the frog-themed PEPE token soared more than 80 times in just three days, quickly becoming the focus of attention. The next generation of Layer 1 based on Meta BlockchainThe launch of the platform’s “SUI” mainnet also attracted the attention of the cryptocurrency community. It was also the first time that the five major exchanges in South Korea listed the same cryptocurrency at the same time.

May: BRC-20 Token Standard and Political Regulatory Issues

In May, the token standard "BRC-20" used on the Bitcoin network attracted widespread attention in the cryptocurrency community. BRC-20 works by using the Ordinals protocol to record information on the Bitcoin network. It is similar to NFT and somewhat different from ERC-20. BRC-20 has many inconveniences, such as users needing to issue new inscriptions or track tokens if they want to transfer tokens.walletBalance, it is necessary to build an offline indexer, etc. Nevertheless, BRC-20 is seen as a new attempt to demonstrate the expansion possibilities of the Bitcoin ecosystem.

In addition, the political regulation issues raised by the Kim Nam-kook case have also made the cryptocurrency community boil. South Korean lawmaker Kim Nam-kook was accused of holding and trading billions of won worth of cryptocurrencies, sparking controversy surrounding senior public officials investing in cryptocurrencies. The problem occurred during a standing committee meeting, where Kim Nam-kook was discovered trading cryptocurrencies during the meeting during a live broadcast, and Kim Nam-kook's previous involvement in a bill to postpone taxation of cryptocurrencies raised questions about conflicts of interest. In response, an amendment to the Public Officials Ethics Act was proposed and passed, requiring all legislators and senior public officials to declare the type and amount of cryptocurrencies they hold after December 14, 2023.

June: CeFi platforms went bankrupt one after another

In June, two major Korean CeFi platforms, Haru Invest and Delio, went bankrupt one after another, shocking the cryptocurrency industry. The platform had been recruiting investors at high interest rates, but suddenly stopped user withdrawals overnight due to opaque fund management and improper partner selection. Investigations showed that Haru Invest suffered heavy losses in the FTX disaster, which triggered a chain reaction and led to the bankruptcy of Delio. According to reports, the losses are estimated to be as high as 130 billion won, and the company is in bankruptcy management procedures.

This incident highlights the opacity and weak risk management of CeFi platforms, especially considering that Delio is licensed by the Financial Services Commission, which shows that the journey of cryptocurrency to gain trust through institutionalization still needs to overcome many challenges. In the Korean community, this incident highlights the pros and cons of CeFi and DeFi, and DeFi is sought after as an alternative because of its transparency of funds on the chain.

July: Ripple wins partial SEC lawsuit/ Worldcoin launches/ Eyes on Japan

In July, Ripple partially won its lawsuit against the U.S. Securities and Exchange Commission (SEC). The U.S. District Court in New York ruled that the sale of XRP to retail investors did not violate securities laws, and many communities believe that this ruling has the potential to change the future debate on cryptocurrency securitization. After the news came out, the price of XRP soared, and because there are many XRP holders in the Korean community, it also attracted great attention from the community.

In addition, Open, which is famous for ChatGPT AI The cryptocurrency Worldcoin, backed by CEO Sam Altman, is listed on major exchanges around the world. Worldcoin's unique structure uses irises to identify individuals and allocates cryptocurrency based on that. The Korean community is concerned about the project's privacy issues and its potential as a solution to distinguish between humans and artificial intelligence. In South Korea, Bithumb, Korbit and Coinone have listed Worldcoin.

关键词 “日本” 也被频繁提及。7 月,日本最大的区块链会议 WebX Tokyo 召开,韩国社区主要提及到了日本政府的加密货币政策。

August: Curve hack/ Sei mainnet launch/ Bitcoin ETF approval expectations

In August, the CRV hack shocked the cryptocurrency community. A vulnerability was found in the decentralized exchange Curve Finance, which led to an outflow of more than $50 million. Especially considering that the head of Curve had taken out loans with CRV collateral in multiple DeFi protocols, it raised concerns among users about possible liquidations if the price of CRV fell. Fortunately, the price of CRV recovered after the incident, avoiding the worst-case scenario. However, a decline in community trust is inevitable.

Sei’s listing is also the focus of the community. At the same time as the mainnet was launched, Sei successfully

Listing on internationally renowned exchanges such as Coinbase and Binance, followed by the five largest exchanges in South Korea, is highly anticipated. Sei's investor-friendly token economics, such as airdropping 25% tokens to the community, is also considered to be its strength.

Meanwhile, the Korean community began to see expectations for the approval of a Bitcoin spot ETF in August, with a series of applications from financial institutions including BlackRock and Fidelity, giving users hope for institutional interest and participation. However, the SEC postponed the application again in September, subsequently causing concern among community users.

September: KBW and Friend Tech

The Korea Blockchain Week (KBW) 2023 held in September is the largest blockchain event in South Korea. The event was held in Seoul from September 4 to 9 and attracted many industry leaders including Ethereum co-founder Vitalik Buterin, Circle CEO Jeremy Allair and Maelstrom Fund CIO Arthur Hayes to discuss blockchain in depth. Korean blockchain projects also participated in the event to share their vision and achievements.

Another hot topic in September was “Friend.tech.” Since its launch on August 10, Friend.tech has seen its TVL (total value locked) grow nearly 10 times from $5 million to $50 million in just one month. Many KOLs in South Korea are using the service and are looking forward to future airdrops, making it a hot topic of the month.

October: $MEME Token and $SPURS

In October, the $MEME token launched by Memeland became a hot topic in the cryptocurrency community. Memeland is an NFT project created by the popular community "9GAG" and has attracted much attention by issuing NFTs such as Captain and Potato. At that time, Memeland launched a farming campaign and announced plans to launch its own token $MEME. Because non-NFT holders can also earn points through simple social tasks, the community's expectations for future airdrops have increased, making this event a focus of the Korean community in October. In addition, the Tottenham fan token $SPURS, which features Son Heung-min, was also listed on the Korean exchange, attracting widespread attention.

November: Celestia Mainnet Release and Airdrop

In November, the mainnet launch of the modular blockchain Celestia (TIA) attracted the attention of the overall cryptocurrency community, and its token $TIA was listed on major global exchanges, including Bithumb, Coinone and Korbit in South Korea. Before the mainnet launch, it conducted a large-scale airdrop for Cosmos users who met certain conditions, attracting the attention of investors. Frequent users of the network received an average of more than 300 TIAs, and the initial token was traded at around 3,000 won (2.2 US dollars).

December: Fusionist Binance Launch Pool / Wemix re-listed

In December, Fusionist became the 40th project on Binance Launch Pool, and the price of this Web3 game has risen to over $10 since its listing, bringing rich returns to investors.

In addition, Wemix, which was delisted a year ago due to circulation issues, was relisted in South Korea's KRW trading pair. A year ago, Wemix was delisted by DAXA due to a large discrepancy between the circulation plan information submitted to DAXA members and the actual circulation. In December, a year later, Wemix was relisted on Bithumb, and Coinone, Gopax and Korbit followed suit, and are currently traded on four exchanges in addition to Upbit. Although Wemix's circulation problem seems to have been resolved to a certain extent, Korean investors remain cautious about the transparency of circulation.

3.2.3. Main sources of information

In order to analyze the information access channels and influence of the Korean cryptocurrency community, we collected message data from 110 cryptocurrency personal Telegram channels in 2023. Based on this data, we summarized the information sources cited by each channel and selected the top ten platforms, and the results are shown in the figure below.

The “Coverage” in the chart refers to the percentage of channels that cited a particular platform at least once in 2023. For example, if all channels cited a particular platform as a source of information during the year, the coverage of that source would be 100%.

-

X's influence: After analyzing 110 Korean cryptocurrency Telegram personal channels, we found that X (formerly Twitter) is the most cited source of information. After all, almost all Web3 projects have an official X account, and the platform is also the platform with the most cryptocurrency users in the world, so all communities often use X as a source of information. In terms of coverage, X also received a high score of 100%, which shows that X is very influential in the Korean cryptocurrency community.

-

Korean media: Among Korean platforms, CoinNess, Naver, and BlockMedia are the most cited sources of information on Telegram, with CoinNess topping the list with 5,162 citations and 92% coverage. CoinNess is a newsletter service that allows users to quickly understand the latest trends and issues through real-time translation of overseas messages, which is why they are frequently shared on Telegram. Naver is the largest website in South Korea, whose services include news and blogs. With 3,194 citations and 99% coverage, the website is also an important source of information for the Korean cryptocurrency community. Blockmedia is a blockchain-specific media in South Korea, with 1,080 citations and 68% coverage, and is one of the most commonly used sources of information for the Korean cryptocurrency community. Blockmedia's articles mainly cover traditional financial markets and cryptocurrency market trends, major project updates, company news, and regulatory news at home and abroad. Compared to CoinNess, its reports are less timely and cover more traditional financial markets, so it lags behind in terms of citation and coverage in the cryptocurrency community.

3.2.4. Channel forwarding ranking

The above figure shows the top 10 most forwarded channels among 110 Telegram channels. Retweets are similar to reposts in X, that is, information posted on one channel is forwarded by another channel. It is an indicator that can measure the influence and popularity of the channel.

被转发最多的频道是 “코인같이투자 (WeCryptoTogether)”,有 168,765 次转发,比第二名 “취미생활방 (EnjoyMyHobby)”的 125,919 次转发数高于约 34%。“WeCryptoTogether ”是韩国最大的加密货币频道之一,有约 33,000 名订阅者,该频道提供各种项目的信息和分析。前 10 个频道中有一半是订阅者超过 10,000 人的大型频道,这表明订阅者越多的频道转发量越大。

3.2.5. Average forwarding ranking of channels

Earlier we analyzed the ranking of the channels with the most reposts. Next, we will analyze the ranking of the average number of reposts per message, which is another indicator of the quality and influence of a channel’s information.

In terms of average number of reposts, "유트로의크립토서바이벌(jutrobedzielepsze)" ranked first with an average of 57.5 reposts, which is about 57% higher than the second-ranked "ICOROOTS_Definalist" with 36.6 reposts. It is worth noting that the number of subscribers of "유트로의크립토서바이벌(jutrobedzielepsze)" ranks 8th among all channels, indicating that the quality of information has a greater impact than the number of subscribers.

3.2.6. Information Views Ranking

Looking at the most viewed information in the Korean cryptocurrency community throughout 2023, three themes stand out.

First, Korean users have a strong interest in legal and regulatory issues in the cryptocurrency industry. Content related to negative issues in the industry (such as privacy leaks, money laundering, and financial crimes) tops the list of views, which shows that users are concerned about the uncertainty and risks of the industry.

Secondly, users are very interested in new investment opportunities, especially token sales. Information about Sui token sales ranked fourth and attracted the most views. It can be seen that Korean investors are very sensitive to new projects and profit opportunities.

Finally, in third place is content related to macroeconomic indicators (such as CPI), which has also received steady attention from the community, reflecting investors' tendency to judge the direction of the cryptocurrency market by paying attention to macroeconomic trends.

In addition, although the number of reposts is relatively low, questions related to specific personal events or specific projects also receive higher views.

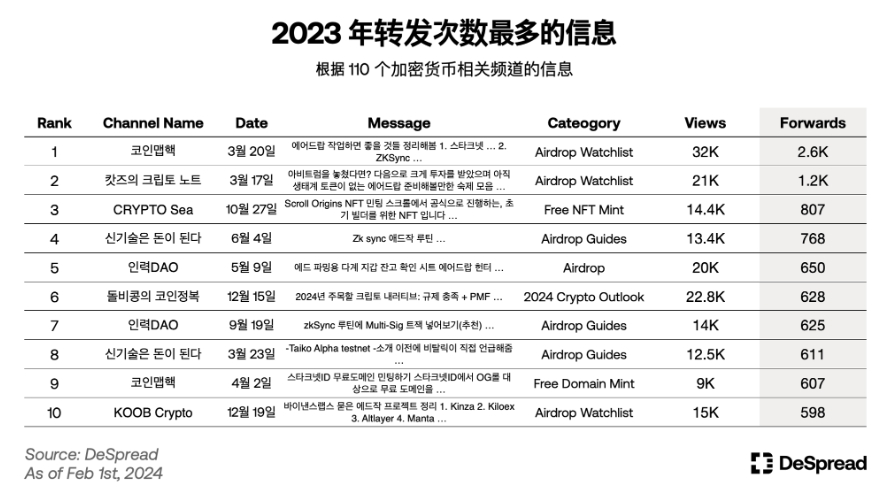

3.2.7. Information forwarding ranking

Looking at the most forwarded messages in the Korean cryptocurrency community in 2023, we find that airdrop-related messages dominate. The most forwarded message was the "Summary of Airdrop Workflow" posted on the "Coinmap Hack" channel on March 20, which was forwarded more than 2,600 times and ranked first. This message detailed how to participate in airdrops of promising projects such as Starknet, zkSync and LayerZero, and was widely shared among Korean users.

Most of the messages ranked from 2nd to 10th are also about information about free benefits, such as airdrops and free NFTs, among which airdrops from emerging projects such as zkSync, Starknet and Scroll occupy the top few. Interestingly, although the information "Ambush Binance Labs Airdrop Project Edzac, etc." released by "KOOB Crypto" on December 19 was relatively recent, it still managed to rank in the top 10, indicating that information about projects that are expected to receive investment from large exchanges is still influential in the community.

Overall, the most active information in the Korean cryptocurrency community in 2023 is airdrop-related content, and it is particularly sensitive to news about new and promising cryptocurrencies.

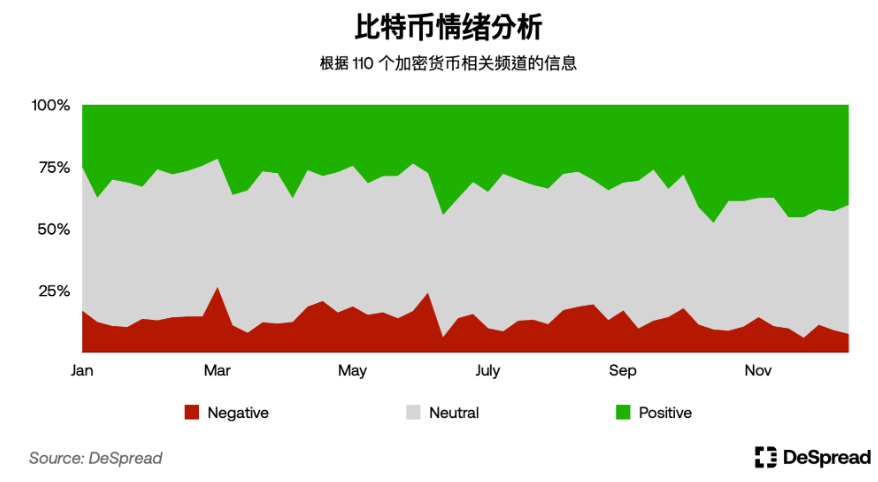

3.2.8. Bitcoin sentiment analysis

使用 Open AI 的 GPT-4 模型,我们对 2023 年韩国加密货币社区中包含关键词 “比特币” 和 “BTC” 的消息进行了情感分析。分析中使用的提示信息旨在确定消息的正面性、负面性和中性,以及与比特币的相关性和消息的类别。在分析过程中,我们排除了被归类为营销和促销相关的消息,结果共得到了 22,878 条消息。

Based on this information, we notice that the proportion of positive messages has increased significantly in June, while when comparing sentiment trends with the Bitcoin price chart, we find that positive sentiment generally increases when prices rise, while negative sentiment increases when prices fall.

However, sentiment lags behind price and does not lead price reactions, indicating that investor sentiment changes with price fluctuations, and the proportion of positive sentiment increased in the second half of the year, indicating that users are quite optimistic about the approval of the Bitcoin ETF at the end of the year.

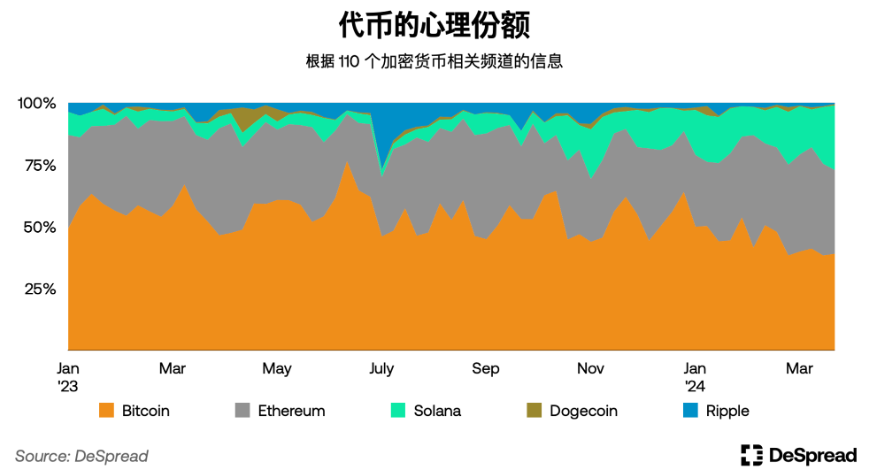

3.2.9. Token’s mindshare

We continued to analyze the number of times each token was mentioned in the community and defined it as the “mind share of the token”, which refers to the proportion of a specific token in the total conversation. A high mind share data represents a high interest in the Korean community in the token.

Through analysis, we found that Bitcoin (BTC) and Ethereum (ETH) have high mindshare in the Korean cryptocurrency community, proving that they continue to attract investors’ attention as the main assets in the cryptocurrency market.

On the other hand, Solana (SOL) has had a clear upward trend since July 2023, especially in the spring of 2024, almost on par with Ethereum. This may be due to the recent rapid development of the Solana ecosystem, the increased expectations of various projects releasing airdrops, and the growing popularity of Solana's meme coins.

3.2.10. The most positive channel for Bitcoin

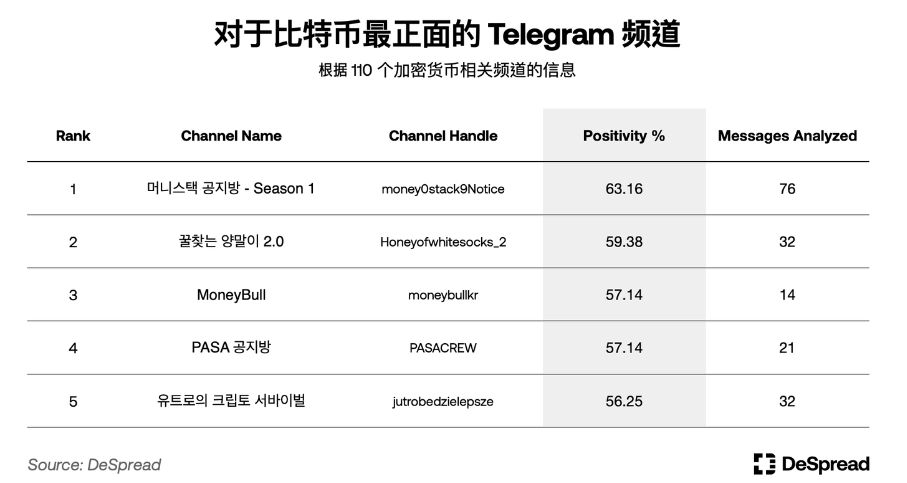

By analyzing 110 personal channels using the GPT-4 model, we identified the channels that were most positive about Bitcoin in 2023.

The top-ranked channel is "MoneyStack", with 63% of Bitcoin-related information being positive. This channel is also the channel that shares the most Bitcoin information or opinions, with a total of 76 Bitcoin-related information. "MoneyStack" is a professional channel that provides information about Bitcoin and the Stacks ecosystem (Bitcoin L2). It not only actively reports new information related to Bitcoin, but also maintains an objective and balanced perspective. The channel has more than 3,700 subscribers.

It is worth noting that although the channel has a high proportion of positive information, it does not represent any recommendation to buy. In addition to objective information, it also contains information on the technical aspects of the Bitcoin ecosystem.

3.3. X (Twitter)

In the global cryptocurrency community, Twitter has become one of the most important communication channels. Many projects and influencers use Twitter to share the latest information and participate in lively discussions. However, the usage of Twitter in South Korea is significantly lower than in other countries, and the cryptocurrency community is no exception.

Although the actual number of Twitter users is not public, a report from DataReportal shows that as of April 2023, South Korea has 9.8 million Twitter users, while the United States and Japan have 95.4 million and 67.5 million, respectively.

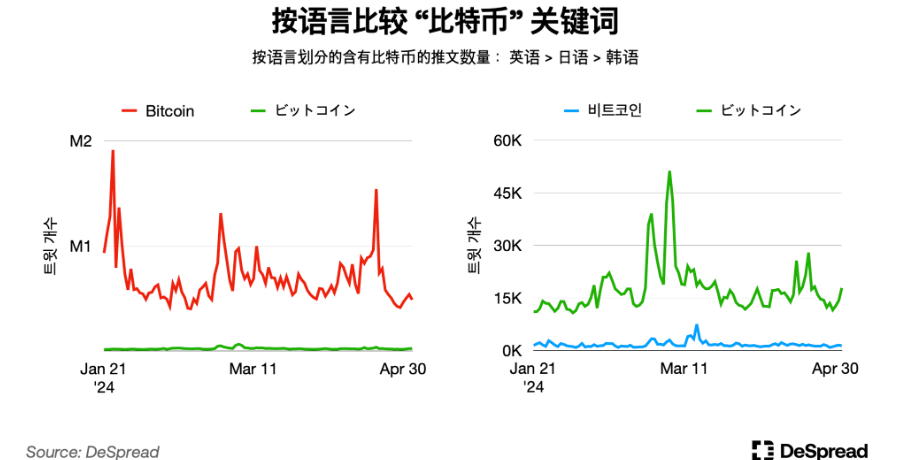

This difference is also evident when analyzing the number of tweets containing Bitcoin keywords in different languages. As shown in the figure above, comparing the number of Bitcoin-related tweets in Japan and South Korea, Japan generated an average of more than 17,000 tweets during this period, while South Korea only averaged 1,700. Even taking into account the number of Twitter users, South Korea's per capita Bitcoin tweets are relatively low.

3.4. DCInside

DCInside is a leading online community platform in South Korea, with "Gallery" as the main message board for various topics. We analyzed the posts published in the most popular cryptocurrency-related gallery "Bitcoin Gallery" on DCInside in 2023.

3.4.1. Activity Trends

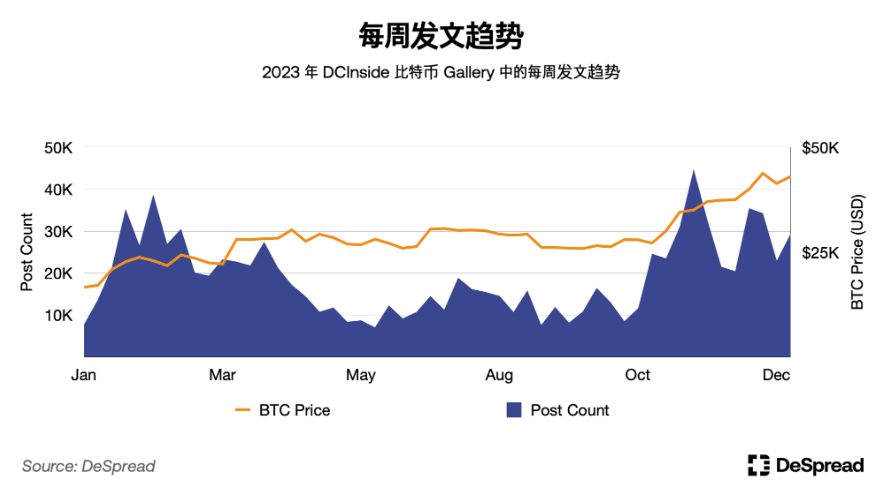

Analysis of the number of weekly posts on DCInside Bitcoin Gallery in 2023 shows that, similar to the activity trend of Telegram, it increases when Bitcoin prices generally rise, especially in late October and early November when Bitcoin prices soared, with the number of posts reaching a weekly peak of about 45,000 per day. It can be seen that investors in DCInside's Bitcoin Gallery are very sensitive to price movements and will actively share information and participate in discussions. On the other hand, during periods of sideways fluctuations in Bitcoin prices, activity is relatively low, proving that low market sentiment affects investors' participation in the community.

3.4.2. Bitcoin Gallery keyword ranking

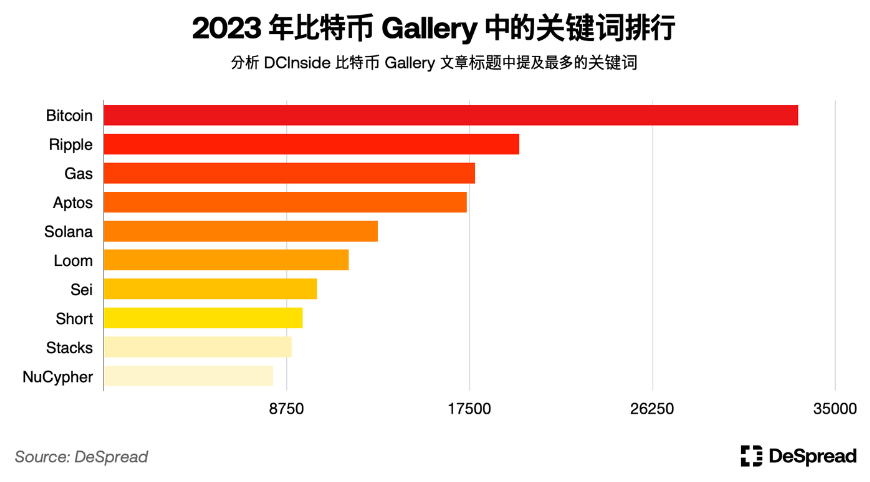

By analyzing the titles of articles published by DCInside Bitcoin Gallery in 2023, we found that "Bitcoin" topped the list with an overwhelming advantage, which means that Bitcoin is still the core currency in the cryptocurrency market and the focus of investors. Most of the altcoins ranked second to tenth are listed on Korean exchanges, including Ripple (XRP), which is particularly popular among Korean investors and ranks second. Interestingly, GAS ranks third, and we speculate that this may be due to the fact that GAS soared more than 10 times for no reason in a month, which attracted huge attention and repercussions. Subsequently, GAS fluctuated sharply, falling 75% in three days.

The only non-token name in the top ten has the keyword “Short”, which means short selling, reflecting the high interest of DCInside investors in short selling. It can be said that this name is a highly speculative group seeking short-term profits.

Overall, in 2023, DCInside's Bitcoin Gallery shows the community's stable interest in Bitcoin, and keywords such as "short selling" also show the speculative nature of the community.

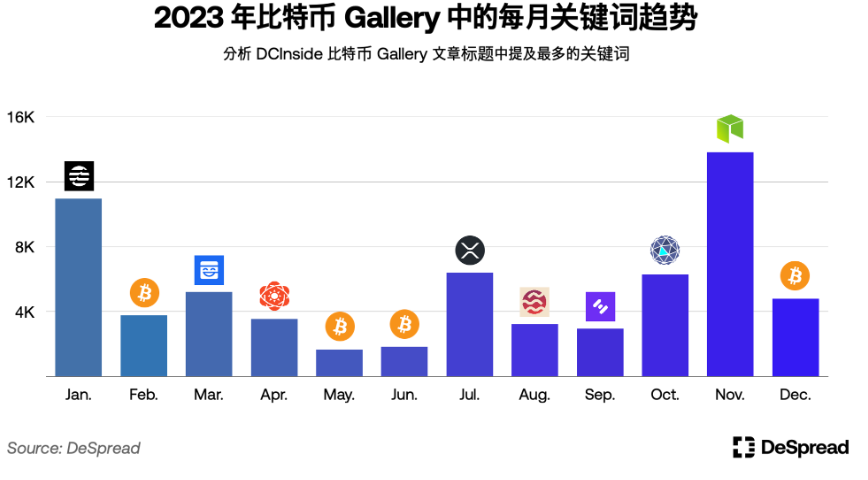

3.4.3. Most mentioned keywords in each month of 2023

We also looked at the most mentioned keywords in Bitcoin Gallery article titles on a monthly basis. In January, "APTOS" was the most mentioned keyword as its price surged more than five times. In July, "XRP" was the most mentioned keyword as expectations for XRP's price increase increased after the company won its lawsuit against the SEC. In November, "GAS" was the most mentioned keyword as it surged more than 10 times for no apparent reason. However, GAS subsequently fell 75% in just three days, which can be said to be a typical pump-and-dump behavior.

Through the changes in keywords on DCInside every month, it can be seen that Korean investors are very sensitive to short-term market fluctuations and have a high degree of attention to tokens listed on Korean exchanges. However, since these trends tend to favor short-term profits, the platform is less suitable for communicating the long-term value and technological innovation of specific projects.

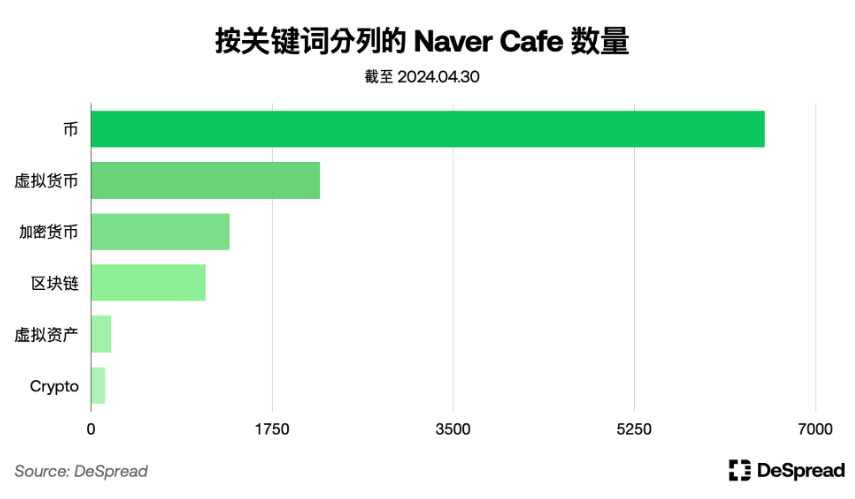

3.5. Naver Cafe

The above chart shows the number of Naver Cafes based on keywords. The ranking is based on the words used alternately with "cryptocurrency". It can be seen that the most commonly used terms in the community are "Coin (币)" and "Cryptocurrency (虚拟货币)".

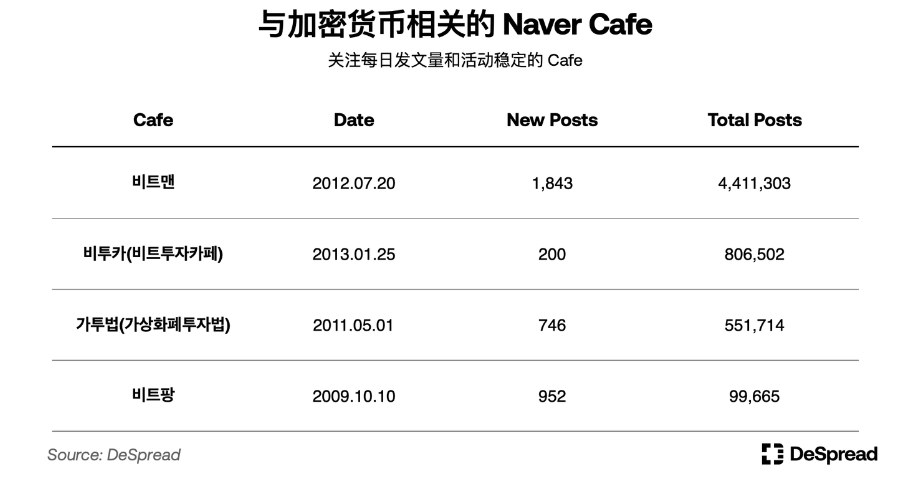

In order to understand the characteristics of the Naver Cafe community, we selected representative Naver Cafes related to cryptocurrency. The selection method was to search for cryptocurrency-related words from February to April 2024 and collect Cafes that appeared at the top of the search results and had a relatively stable number of daily posts.

The search results show that most Cafes focus on price discussions, especially compared to Bitcoin, users are more interested in altcoins. Because Cafes focus on price, the number of posts in Cafes is proportional to price, showing a correlation with price.

4 Conclusion

In this article, we deeply analyze the characteristics of the Korean cryptocurrency community on various platforms and the main trends of concern in 2023. The analysis shows that South Korea occupies a very important position in the global cryptocurrency market. For example, Upbit, the largest exchange in South Korea, has the second largest spot trading volume in the world, and Korean users are more interested in cryptocurrencies than stocks, which are indicators that prove the characteristics of this market.

Given the importance and potential of the Korean market, it seems natural for many global Web3 projects to consider entering the Korean market. However, successful market entry requires a deep understanding of the characteristics and needs of the local community.

As we can see, the Korean cryptocurrency community has its own unique characteristics. Telegram, KakaoTalk, and other messaging-based communities are very active, highly speculative, and very sensitive to short-term price movements. On the other hand, Twitter usage is low, and interest in on-chain activities such as NFTs and DeFi is lower than in other countries.

Based on these characteristics, if foreign projects want to gain a foothold in the Korean market, they must have marketing strategies and community management knowledge that meet the expectations of local investors, which means that instead of adopting global standards, they need to adopt strategies that can meet the needs of the local market.

Especially in the initial process of building the community, it is crucial to win the trust of local investors, and how to use professional managers who speak Korean to effectively achieve results will be the key to success. In the long run, it is necessary to get rid of the speculative community that wants short-term profits through the dissemination of information about technology and vision. Having a way to raise the intrinsic value and growth potential of the project to the local community will be an important factor in success or failure.

We hope that this report will help readers further understand the Korean cryptocurrency community and provide meaningful insights for Web3’s Korean market strategy. Looking ahead, it is necessary for us to continue to closely monitor the ever-changing trends in the cryptocurrency market through timely data analysis and in-depth research, and pay close attention to trends unique to the Korean community.

The article comes from the Internet:Decoding the Korean crypto market: Upbit has the second largest trading volume in the world, and young people are more enthusiastic about crypto than stocks

“The Elixir Network has become an influential force in the order book trading space.” Written by: Elixir Translated by: Xiaobai Navigation Coderworld The purpose of this post is to provide relevant data since the launch of the Elixir Network Trusted Mainnet, including key statistics such as users, TVL, order book liquidity based on real-time native integration…