The revelation of the legendary GME stock trader Roaring Kitty: If you hold it, you must spare no effort to promote it and make good use of the media influence

Written by:cyclop

Compiled by: Xiaobai Navigation coderworld

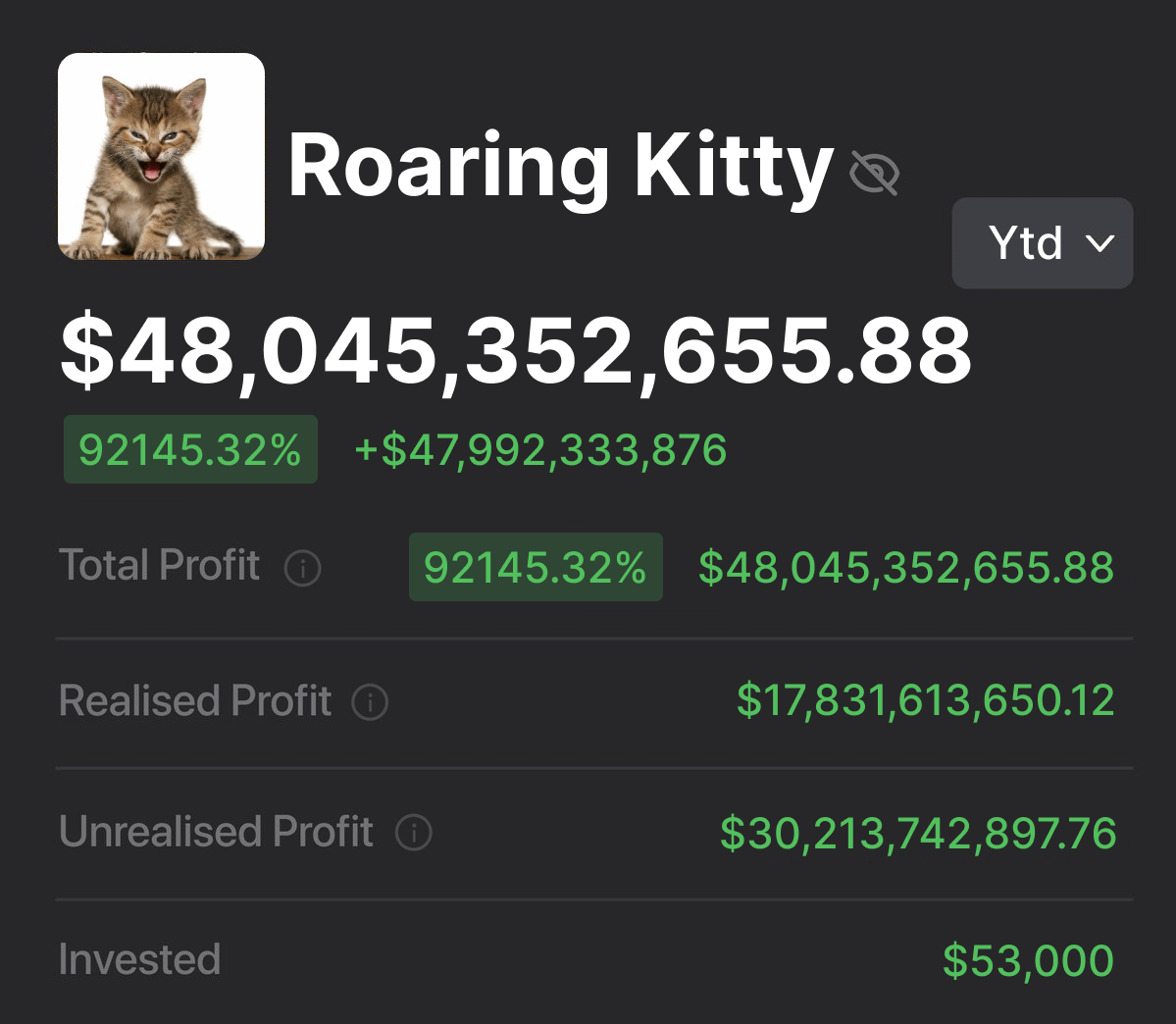

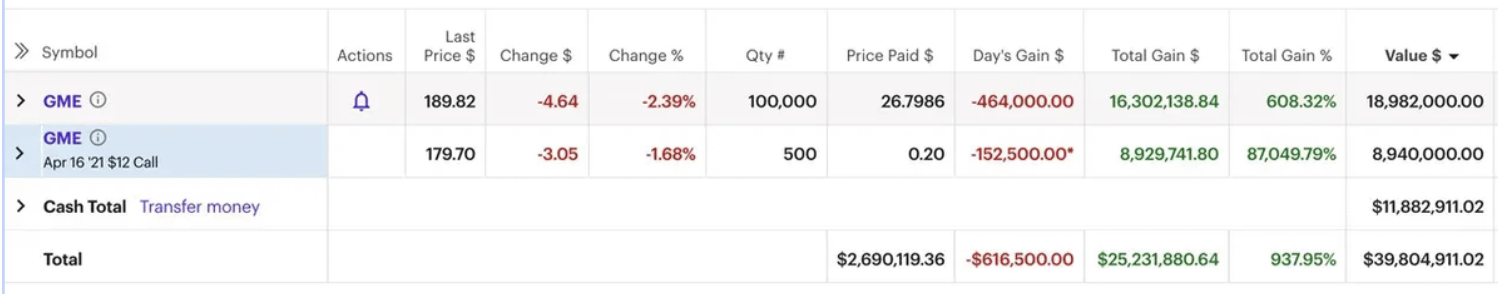

This is Roaring Kitty, one of the best retail traders of all time. $GME He turned $53,000 into $48 million. He was offline for three years and is back today. Here is his full story: The key to trading 10,000x this cycle

Overview

-

Keith Gill, also known as @TheRoaringKitty Shared on his Twitter page that GameStop stock is undervalued

-

He bought it in 2019 for $53,000

-

hiswalletPeaked at $48 million during the GameStop surge

-

Gill hasn’t posted anything in three years, but todayHe is back.

@TheRoaringKitty Who is it?

Keith Gill was born in Brockton, 1986, and was a college track star. After winning All-American honors in college, he began to dabble in stock analysis. In 2019, he bet on $GME , he became an investment icon and a celebrity in the crypto Twitter space, and founded memeszn in 2021. How did he do it?

As early as 2014, he created his own Twitter account with the goal of "finding stocks and seizing investment opportunities". In 2015, he also joined YouTube, regularly broadcasting live to show his transactions and market research. He also joined Reddit in 2019 under the username DFV (DeepFuckingValue).

In 2019, he used all of these social media platforms to purchase @GameStop / $GME He pushed it hard, with a bang on Reddit, YouTube, and Twitter.CommunityMembers also supported his argument, leading to a sharp rise in the share price. $GME It peaked at $483.

In February 2021, Gill testified to Congress, claiming that GameStop was "significantly undervalued." Despite a class-action lawsuit alleging that he caused "huge losses" to small investors and violated securities laws, the lawsuit was dismissed.

Ultimately, Gill made an estimated $48 million, becoming a gigachad, enabling his followers to profit and challenge traditional venture capital firms. His story highlights the mediaXiaobai NavigationInfluence in the market.

Law professor Joshua Mitts highlighted the unique drivers of the meme stock rally, arguing that the meme stock rally was driven by a unique set of factors:

-

New retail traders are entering the market

-

Stimulus measures and historically low interest rates during the pandemic have provided ample liquidity

-

Gill's allegedly large and sustained profits

This applies especially tocryptocurrency, we can learn the following from this story:

-

Powerful KOLs now have the power to influence the market. Look at Ansem, he is $SOL and $WIF incarnation of$SOL and $WIF The contribution of "Pump" is invaluable.

-

跟随许多KOL通常会导致损失,但选择正确的人物是最容易获利的途径。如果他和他的论点很有影响力,那么人群就会追随他,从而形成社区并导致pump。

-

This is why Meme has become so popular. In this space, all players are on equal footing, and VCs won’t sell you at less than 1,000x valuation after each private round unlocks.

Maybe this meme season will go on forever, let's wait and see.

The article comes from the Internet:The revelation of the legendary GME stock trader Roaring Kitty: If you hold it, you must spare no effort to promote it and make good use of the media influence

Related recommendations: I wrote down 6 thoughts on how to get rich in the bull market

Wish you a prosperous life. Written by: Riyue Xiaochu 1 Although the bull market is generally rising, the speculation is still centered on the sector. And if a coin soars, it will drive the speculation of its sector. 2 There are opportunities everywhere in the bull market, but if you are greedy and want to grab them everywhere, it will definitely not be good in the end. On the contrary, if you only need to catch the main rising wave of a sector, it will be enough for you to make a lot of money. If you are lucky, catch…