Hayes Fund: The Oracle Wars, Why Flare is Undervalued?

Written by:Maelstrom(Arthur Hayes Family Office)

Compiled by: Felix, PANews

The oracle protocol acts as an intermediary between the decentralized network and external data sources toSafetyConnect on-chain and off-chain data in a scalable and extensible way. Including Web APIs, databases, sensors connected to devices, real-time data feeds, and even otherBlockchainNetwork.BlockchainAs applications become more complex, this off-chain data becomes increasingly important for the development of new use cases (such as the recently popular "machine learning").

This article will take a deep dive into three key oracle protocols, Chainlink, Pyth, and Flare. Although Chainlink is currently the market leader, it has limitations in latency and high throughput; while Pyth focuses on financial institutions and lacks in universality. It is worth noting that the "dark horse" oracle protocol Flare, which combines features comparable to Chainlink and Pyth with a fully sovereign L1, is a unique (and possibly underestimated) protocol. The following is a deep dive into each protocol and the views on the so-called "oracle war".

LINK

Chainlink is synonymous with oracles and is the undisputed market leader. Its powerful decentralized node network makes Chainlink the first choice for many dApps, DEXs, and DeFi platforms. Chainlink's reliability and growing number of partners make it the first choice for institutions and emerging projects. Chainlink's decentralized oracle network operates through a unique consensus mechanism that utilizes multiple nodes to obtain and verify real-world data. This multi-party approach ensures transparency and minimizes the risk of manipulation. However, while the oracle network itself is decentralized, analysts point out that Chainlink's multi-signature maintains a high degree of control over protocol price feeds. In order to ensure the accuracy and tamper-proofness of the data, Chainlink uses economic incentives to align the interests of node operators and users.

As of May 2024, Chainlink has integrated with more than 500 DEXs and more than 800 DeFi platforms. Its oracles provide price information for more than 5,000 trading pairs, with update times ranging from minutes to hours depending on the chain and asset. Chainlink heartbeats are refreshed periodically or when the price deviates beyond a specified range (e.g. 1%).

Chainlink oracles currently capture over $20 billion in value across different data sources and services. LINK Token用于 Chainlink 网络内的质押和声誉,市值超过 70 亿美元。据 Coingecko 数据,Chainlink 代币占所有预言机市值的 70% 以上。总体而言,对 Chainlink 预言机服务的需求让代币持有者实现增值,因为 LINK 需要向节点运营商支付服务费用。

(The total guaranteed value TVS of the oracle is often used to summarize the overall economic impact and adoption of the oracle network. Source: DefiLlama)

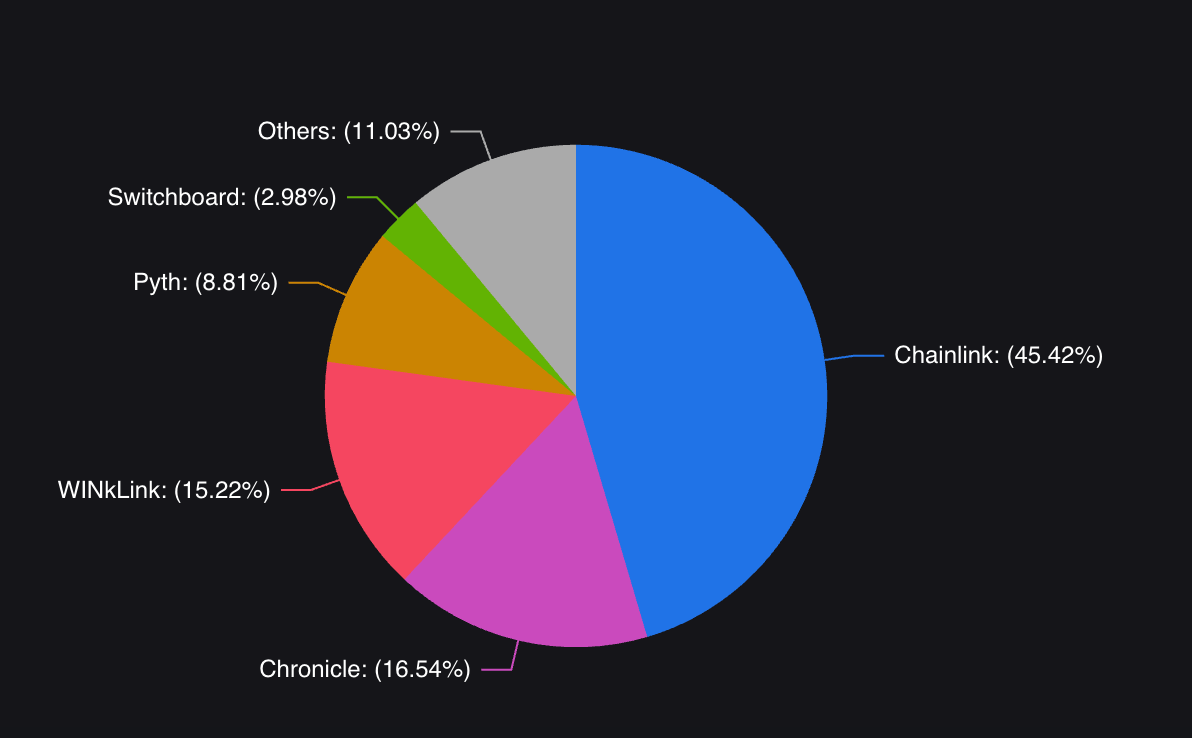

It is worth noting that the structure of the oracle market is not static, and competitors are constantly grabbing a piece of the pie.

PYTH

Pyth is a new oracle protocol focused on financial use cases, using over 90 TradFi and crypto financial institutions as data providers (think price data for stocks, commodities, and currencies directly from the source). Pyth’s innovation is three-fold:

-

Quantifying uncertainty: Introducing confidence intervals in its reported prices, a feature that allows users to measure not only the price, but also the degree of uncertainty about the price, which is extremely valuable in volatile markets.

-

Multi-chain: Pyth’s data sources can be used for applications on nearly any chain. Initially launched on Solana and its own Pythnet (a fork of the Solana codebase), Pyth Network provides solutions for non-Solana chains through integrations such as Wormhole.

-

Efficient Price Updates: Another innovation introduced by Pyth Network is the Pull Oracle architecture, which, unlike the inefficient Push Oracle common in traditional systems, enables efficient, on-demand price updates required by data users.

Pyth's price refresh rate is typically between 300 and 500 milliseconds, which is orders of magnitude faster than some competing services or better suited to the needs of modern finance (e.g., dex). This speed is due to Pyth's trust model, which relies directly on a few large data providers rather than decentralized nodes to provide price information. Pyth's trust model isn't the only module with a low degree of decentralization. Pyth's reliance on centralized entities like Wormhole has made it vulnerable to outages in the past. Pyth is also working to implement collateral requirements for data providers to incentivize accurate price feed services.

Nonetheless, driven by lending protocols, Pyth’s TVS has surged from $500 million to over $4 billion in the past 6 months. Pyth’s partnership with Solana has been very successful, combining fast data processing with Solana’s high-throughput infrastructure. Following a successful airdrop last November, Pyth plans to offer a new round of $100 million worth of Pyth tokens to its more than 160 integrated dapp partners.

While Pyth has been successful in its specific market, it has not yet proven scalable to broader use cases outside of finance.

FLR

Flare is an emerging competitor in the oracle space that takes a different approach than Chainlink, Pyth, and other competitors. That is, Flare is not just an oracle network, it also has computing power - that is, EVM intelligencecontract。Flare 将智能合约平台与预言机系统相结合,负责网络共识和生成区块的验证者也负责向网络传输数据。也就是说,验证者需要成功地向网络提供准确的数据才能获得验证奖励。谷歌云(Google Cloud)最近与 Figment 和 Ankr 等公司一起,作为验证者和贡献者加入了 Flare。

Data connectors and the Flare Time Series Oracle (FTSO) are at the heart of the Flare system:

-

Data connector: Connect data from otherBlockchain和 web 服务的状态数据引入 Flare Blockchain上,例如交易信息。

-

FTSO: Streams time series data from multiple chains to Flare. (Ongoing upgrades will eventually enable up to 1000 data feeds, with 1-2 block updates every 90 seconds)

This unique combination sets Flare apart, as data feeds and attestations are free for dapps running directly on Flare (Flare charges for data elsewhere).

All in all, Flare is probably underrated.

Chainlink has a considerable first-mover advantage, with countless projects already integrated with it. However, as Flare gains more and more traction, it has the potential to quickly catch up with Chainlink. To better illustrate FLR’s potential, here is the FDV as of May 1, 2024:

-

FLR: $2.9 billion

-

PYTH: $5 billion

-

LINK: $12.7 billion

The above comparison may look quite different if we consider the following background:

-

Flare's project integration number is less than Chainlink's 10%, and it is just getting started

-

FLR’s token economics incentivizes active participation by stakeholders and holders

-

Flare provides both data and computation services, making it very different from existing oracle protocols - in addition to being able to generate fees from data services, it can also build its own native ecosystem

It’s still early days for Flare, but assuming it can achieve its roadmap — here’s the upside potential for FLR in different scenarios:

-

On par with PYTH: about 1.7 times

-

Half of LINK: about 2.27 times

-

The median value between PYTH and LINK: about 3.17 times

-

LINK's 75%: about 3.3 times

The oracle war will be won by projects that not only meet current market needs but also meet next-generation challenges. While Chainlink is the market leader, latency and applicability for high-throughput use cases leave a lot to be desired. On the other hand, Pyth's focus on financial institutions brings a unique dimension to the oracle space, but leaves a lot of gaps in terms of universality across use cases. Flare combines the above characteristics with the characteristics of L1, and its unique market positioning deserves attention. The winner of this war will be the protocol that can provide reliable up-to-date data, create strong network effects, and adapt to the changing needs of the DeFi ecosystem (including emerging ecosystems such as artificial intelligence, which involves processing large and diverse data sets). Although it is too early to draw conclusions, FLR seems to be undervalued compared to tokens in the same track.

The article comes from the Internet:Hayes Fund: The Oracle Wars, Why Flare is Undervalued?

Related recommendations: Interview with Fyde, a crypto asset management platform: How to use AI Building an on-chain vault to increase returns, reduce risk, and optimize liquidity?

AI 和机器学习非常适合监测,因此在预防性威胁监测或网络分析方面,使用它很有意义。 专访:1912212.eth,Foresight News 经历过上个周期的一系列暴雷事件,部分用户已意识到诸多所谓的资产管理公司或协议,并没有真正为用户的资金SafetyDo your best. Move...