Why can’t this bull market replicate the alt season of 2021?

Written by Distilled

Compiled by: Xiaobai Navigation coderworld

introduce

Over the past two years, I have been following the altcoin market with all my heart. However, there has always been a question in the market: the long-awaited "alt season" similar to 2021 has not yet appeared.

Here, I’ll explain why and offer suggestions for optimizing your altcoin strategy.

Let’s first define “Alt Season”. Definition: When altcoins outperform Bitcoin ($BTC) and prices soar across the board.

This is a period of great altcoin boom and euphoria is building in the market. Think of it like a rising tide lifting all boats.

That’s what a strong altcoin season can do, boosting almost every sector. What’s the driving force? The massive amount of liquidity that’s flooding into the market.

Tracking liquidity flows

Historically, there have been two main sources of this liquidity:

-

New inflows from retail investors, through centralizedexchangeInflow

-

从中心化交易所(CEX)上的比特币流出到山寨币上的流动性

Liquidity then slides down the market cap ladder and further along the risk curve. OGs are so familiar with this dynamic that they often refer to it as “the road to alt season.”

The Lalapalooza Effect

The path to the 2021 altcoin season was clearly visible, but now it is gone. I think the reasons are multifaceted and are the result of a combination of several factors.

Individually, each variable is not enough to make a big difference, however, when combined and pointing in the same direction, the effect is huge.Famed investor Charlie Munger describes this effect as the Lalapalooza effect.

So what is the cause of the combined effect here? I see several and will try to explain them.

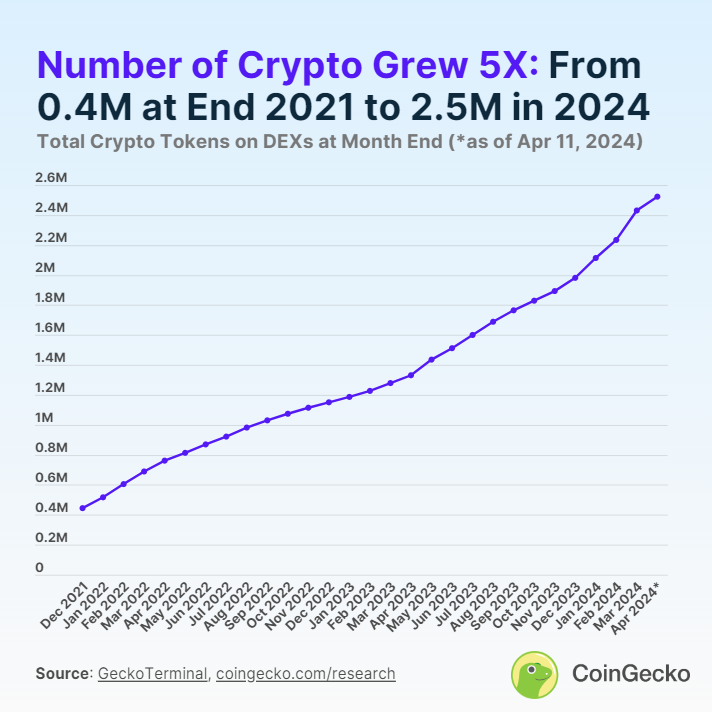

1. Too many projects

The market is full of liquidity, but it is overwhelmed by the extreme saturation of projects. Imagine there are more ships in the ocean than waves.

Only artificial intelligence (AI) or SOL ecosystem have truly felt the wave of “copycat season”.

What was once a rising tide that lifted all boats has become a selective, rotating game that's akin to the PvP nature of "The Hunger Games."

2.TokenALLOW: Hidden Handbrake

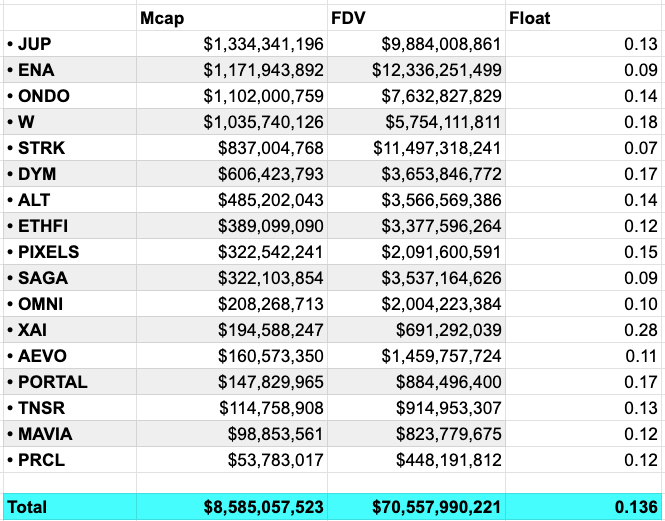

代币稀释,特别是来自代币解锁的稀释,使得2021年式的山寨币季受阻。

This often overlooked factor absorbs a large amount of organic capital inflows. No matter how good the technology is, if supply exceeds demand, it will be difficult for prices to rise.

An investor recently sampled the releases of major projects so far in 2024. The average circulation of these projects is about 14%, and the funds waiting to be unlocked have reached 70 billion US dollars.

What happens when a market combines oversaturation with excess supply? The answer: conditions for the cottage season become difficult.

3. The Double-Edged Sword of Adoption

The increase in TradFi adoption has been a mixed blessing. On the one hand, it has increasedcryptocurrencyOn the other hand, it brings more talent to the crypto space.

更多的人才可能看起来是有益的,但实际上却提高了市场效率。如果更多聪明的人转向加密货币,那么要找到优势就更难了。

4. Bitcoin ETF: A new dynamic

比特币ETF的批准改变了山寨币的游戏规则。在ETF之前,比特币的主要获取渠道是通过中心化交易所。

This is good news for altcoins, as investors can easily switch from Bitcoin to try altcoins.

This time, the people buying Bitcoin are different.

Those who buy Bitcoin through an ETF face a more complicated path to enter the altcoin market.

5. The perfect storm: the Covid-19 effect

Why is 2021 such a remarkable year for altcoins? A lot of it has to do with the unique circumstances.

With the lockdown in place, the flow of money and the time people spend interacting online are both particularly high.

This creates the perfect conditions for cryptocurrencies to attract retail investors, and given the rarity of such conditions, it is reasonable to view 2021 as an outlier.

Everyone is still “drunk” on the 2021 highs; but the alt season of this bull run seems out of reach.

in conclusion

Review this article

-

The altcoin market has gone from a general upsurge to a rotation game.

-

With more smart people in the market, it takes more effort to find an edge.

-

Project saturation, and a massive oversupply of tokens, is draining liquidity.

-

The traditional path for altcoin season has been broken, largely due to Bitcoin ETFs.

Practical advice

That’s a lot to cover in this post, so let’s make it actionable:

-

Focus on fully diluted valuation (FDV) and saturation rate.

-

Keep an eye on ETF developments and sectors with heavy institutional participation, such as RWA. These may have different and potentially more favorable opportunities over the next few years.

-

With the market flooded with altcoins, don’t just look at the USD value. Compare altcoin valuations to Bitcoin ($BTC). There is no point in holding an asset with higher risk and lower returns. Assessing altcoin performance relative to Bitcoin can provide a clearer indicator of strength.

-

Work hard on your strengths. It’s not just about growing assets, it’s also about enhancing your knowledge, skills, and network.

There are many opportunities in the cryptocurrency market, but they require more effort and new perspectives. The market changes rapidly and success will favor those who can adapt quickly.

The article comes from the Internet:Why can’t this bull market replicate the alt season of 2021?

In the past 24 hours, many new popular currencies and topics have appeared in the market, and they may be the next opportunity to make money. Written by: Bitget Research Institute Summary BTC spot ETF has a net inflow for 4 consecutive days, and BTC has returned to the resistance level above 70,000 US dollars. The Base ecosystem meme coins have a strong wealth-making effect over the weekend…