Hong Kong's first batch of 6 virtual asset ETFs approved, physical subscription and redemption is expected to open a compliant "withdrawal" channel for cryptocurrencies

Written by: Weilin

The regulatory approval for Hong Kong’s Bitcoin and Ethereum spot ETFs has officially come into effect.

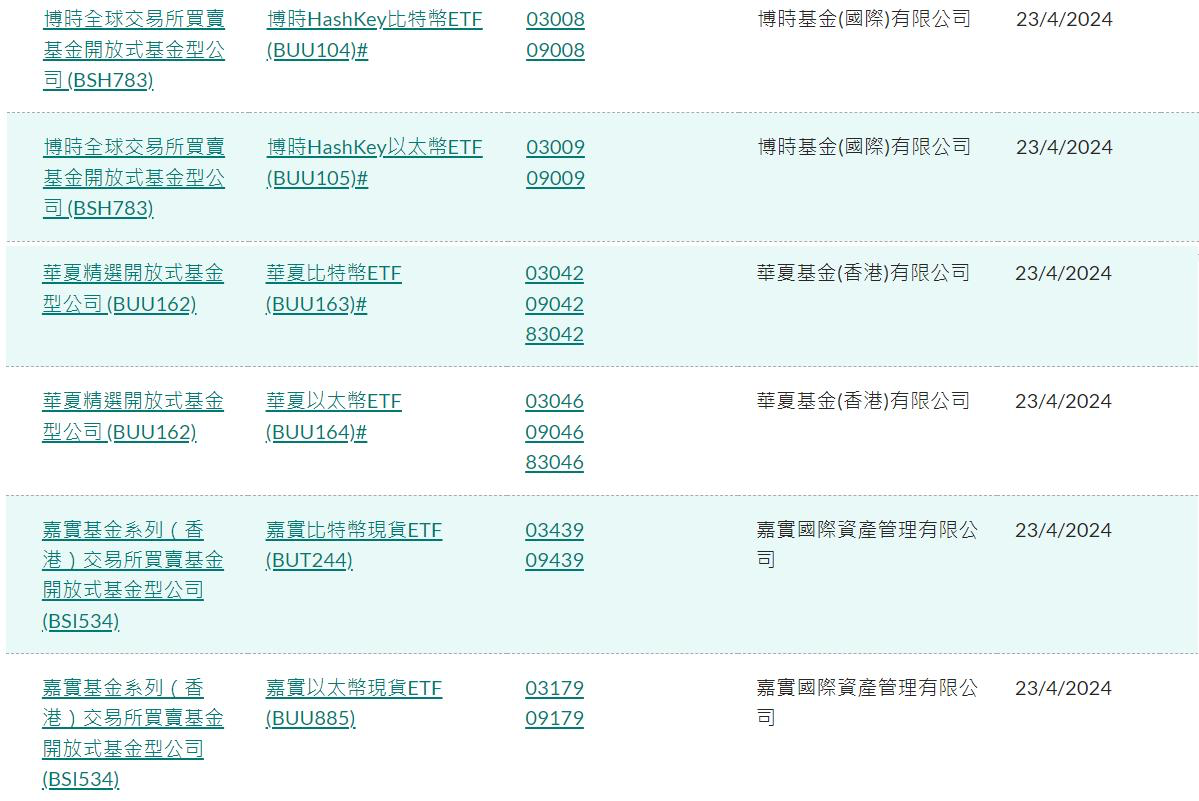

On the evening of April 24, the official website of the Hong Kong Securities and Futures Commission (SFC) listed the Bitcoin and Ethereum spot ETFs of three fund companies, China Asset Management (Hong Kong), Bosera International and Harvest International, with the approval date of April 23, 2024. At the same time, the three institutions also officially announced that they had officially obtained the approval of the SFC and were expected to be officially launched on April 30.exchangeGo public.

This is the first time such products have been launched in the Asian market, and they are designed to provide investment returns that closely follow the spot prices of Bitcoin and Ethereum. Virtual asset spot ETFs lower the investment threshold and risk. Professional fund management has strict investment processes and risk management mechanisms. ETF products can be traded on mainstream securities.exchangeIn addition, ETF products also provide a physical subscription and redemption mechanism. Investors can indirectly hold Bitcoin by holding ETF shares without worrying about the storage andSafetyquestion.

Currently, these ETF products can be subscribed in cash or currency, but relevant accounts need to be opened in Hong Kong to operate. According to Caixin, according to the joint circular issued by the Hong Kong Securities and Futures Commission and the Hong Kong Monetary Authority in December 2023, both the virtual asset futures ETFs currently available in the Hong Kong market and the virtual asset spot ETFs to be issued in the future cannot be sold to retail investors in mainland China and other places where the sale of virtual asset-related products is prohibited. However, mainlanders holding Hong Kong identity cards, even if they are not permanent residents of Hong Kong, can participate in the transactions of the above-mentioned ETFs under compliance.

6 ETFs with fierce competition in management fees

Harvest Global is the first fund to submit a Bitcoin spot ETF in Hong Kong. According to Tencent Finance's "First Line", the Hong Kong Securities Regulatory Commission urgently updated the list of virtual asset management funds in the early morning of April 10. It was originally planned to approve a total of 4 Bitcoin spot ETFs in the first batch, including Harvest Global, China Asset Management, Bosera Fund, and Value Partners. However, from the list currently published, Value Partners did not appear.

The application process of several fund companies was a bit hasty. Some Bitcoin spot ETF applicants, including China Asset Management, temporarily set up a team about a month ago and submitted their applications in the second week of March. Two weeks later, China Asset Management obtained approval from the Hong Kong Securities Regulatory Commission. The solutions required to submit a Bitcoin spot ETF in Hong Kong this time involve at least 20 partner institutions, including Bitcoin custodians and market makers, institutions holding comprehensive accounts for virtual asset transactions, etc.

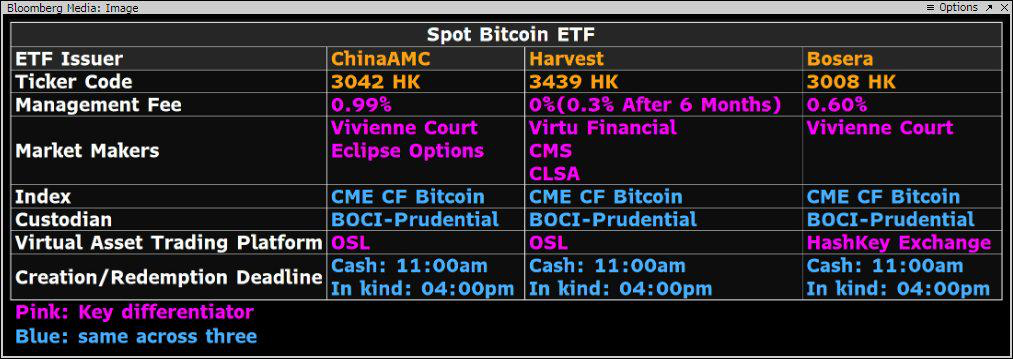

In terms of supported currencies, the above-mentioned ETFs issued by Bosera International and Harvest Global have dual counters for Hong Kong dollars and US dollars respectively, while the two ETFs issued by China Asset Management (Hong Kong) have not only Hong Kong dollar and US dollar counters, but also an RMB counter, making three currency counters issued simultaneously.

Just like the price war when the US Bitcoin spot ETF was launched, the competition among the three fund companies in Hong Kong on management fees is also very fierce. Harvest International's products are exempted from management fees within 6 months of holding, and Bosera International's products are exempted from management fees within 4 months after issuance. According to Bloomberg analyst Eric Balchunas, the management fees of the three funds are 30 basis points (Harvest International), 60 basis points (Bosera International) and 99 basis points (Huaxia Fund), which are lower than expected on average. Previously, it was expected that the fees of these ETFs could be between 1-2%. ETF analyst James Seyffart said that Hong Kong may have a potential fee war due to these Bitcoin and Ethereum ETFs.

Currently, the fees of the 11 approved Bitcoin ETFs in the United States range from 0.19% to 1.5%. Fidelity's Fidelity Wise Origin Bitcoin Trust (FBTC) has a fee of 0.25%, and the fee reduction will last until July 31, 2024. BlackRock's iShares Bitcoin Trust also has a fee of 0.25%, and 0.12% in the first 12 months (or until assets reach $5 billion). ARK 21Shares Bitcoin ETF (ARKB) has a fee of 0.21%, and 0.% in the first six months (or until assets reach $1 billion). Grayscale's Grayscale Bitcoin Trust (GBTC) has the highest fee, at 1.5%.

The approval of the Hong Kong Bitcoin spot ETF comes about three months after the U.S. Securities and Exchange Commission approved the first batch of U.S. Bitcoin spot ETFs on January 11. According to Bloomberg data, U.S. Bitcoin ETFs have accumulated $56 billion in assets so far.

Physical ETF subscription and redemption will open a compliant "withdrawal" channel

在香港,发行虚拟资产现货 ETF 可以采用现金(Cash Model)或实物(In-Kind Moder)两种模式进行交易。其中,针对现金申赎,基金必须在香港持牌交易所上获得虚拟资产,可以是场内交易或是场外交易;而针对实物申赎,虚拟资产需通过券商转入或转出基金的托管账户。

Unlike the SEC’s model, the SEC only allows cash redemption of spot Bitcoin ETFs to reduce the number of intermediaries and increase controllability. Physical subscription and physical redemption are allowed, which means that customers can use relevantcryptocurrencyBuy or sell shares of an ETF instead of using U.S. dollars.

Analysts point out that physical ETF redemption will open up a compliant “withdrawal” channel for Bitcoin and Ethereum. Especially for institutions and high-net-worth investors, converting Bitcoin into an ETF with a nearly fixed ratio can effectively avoid potential card freezing problems when “withdrawing” through exchanges; it can also reducewallet, private key managementSafetyRisks, further protect your assetsSafety.

Previously, the scale of funds attracted by Hong Kong Bitcoin and Ethereum spot ETFs had caused heated discussions. On April 15, Eric Balchunas, senior ETF analyst at Bloomberg, said on the X platform: "We think that if they (ETF issuers) can attract $500 million in funds, they will be very lucky. The reasons are as follows: 1. The Hong Kong ETF market is very small, only $50 billion, and mainland Chinese residents cannot buy these ETFs at least from official channels. 2. The three issuers that have been approved (Boshi Fund, China Asset Management, and Harvest Fund) are all small. There are no large institutions like BlackRock participating yet. 3. Hong Kong's underlying ecosystem is illiquid and inefficient, so these ETFs may see large spreads and premium discounts. 4. The fees for these ETFs may be between 1-2%. This is a far cry from the extremely low fees in the United States."

Still, the approval of a Bitcoin ETF in Hong Kong could be a significant market opportunity, Bloomberg ETF analyst Eric Balchunas said in a separate research note, “which could significantly increase assets under management (AUM) and trading volume of Bitcoin ETFs in the region.”

加密货币交易所 Websea 首席运营官 Herbert Sim 此前也对外界表示,香港首个现货比特币 ETF 的批准会增加贝莱德等大型美国 ETF 发行人的需求和资金流入,他预计这种情况将持续下去。他表示:「随着比特币减半的供应减少,价格肯定会飙升。」

And according to an April 12 post by cryptocurrency commentator Bitcoin Munger, large investors or whales holding at least 10,000 BTC are accumulating Bitcoin at current price levels in anticipation of the approval of the Hong Kong virtual asset ETF before approval.Xiaobai Navigation“The group that is net accumulating BTC is the largest whales (>10k). This is a positive counter-trend sign if I need to guess.”

The article comes from the Internet:Hong Kong's first batch of 6 virtual asset ETFs approved, physical subscription and redemption is expected to open a compliant "withdrawal" channel for cryptocurrencies

ERC-404 能够为资产带来高度的流动性,但需要结合其他赛道方的真正购买力。 撰文:南枳,Odaily 星球日报 2 月初,由 Pandora 开创的 ERC-404 标准掀起了一轮对 FT 和 NFT 结合模式的探索浪潮,PANDORA 代币市值一度突破 …