As the bull market is replenishing its "ammunition", the two major stablecoins have issued an additional $10 billion in 30 days

Written by: Mary Liu, BitpushNews

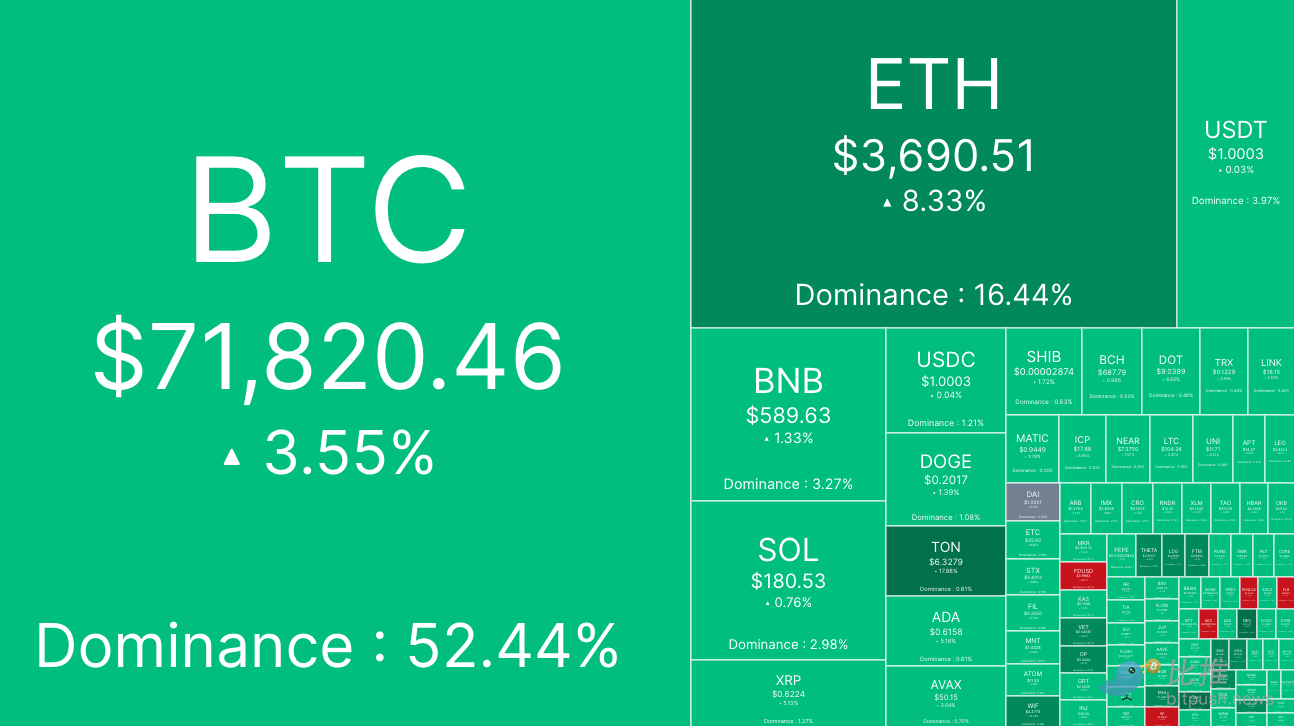

As the halving approaches, Bitcoin has had a strong start to the week, surging above $72,000 in early trading on Monday, less than 3% away from its all-time high of $73,750. Market data shows that after trading near $69,400 over the weekend, Bitcoin bulls began to move higher in the early hours of Monday morning, breaking through the $71,000 resistance level and hitting a high of $72,780 shortly after 8 a.m. EST. At press time, Bitcoin was trading at $71,845, up 3.5% in the 24 hours.

Other stocks that rose on MondayTokenIncluding Ethereum (up 8%), meme coin Dogwifhat (up 18%) and Pepe (up 10%).

Data released by Coinshares on Monday showed that digital asset investment products recorded $646 million in inflows last week. Bitcoin-related investment products remained in the spotlight, with inflows totaling $663 million, while investment products that short Bitcoin saw outflows totaling $9.5 million for the third consecutive week, indicating a slight capitulation among bearish investors.

“Year-to-date inflows are at an all-time high of $13.8 billion and are now well ahead of 2021’s total of $10.6 billion,” said James Butterfill, head of research at Coinshares.

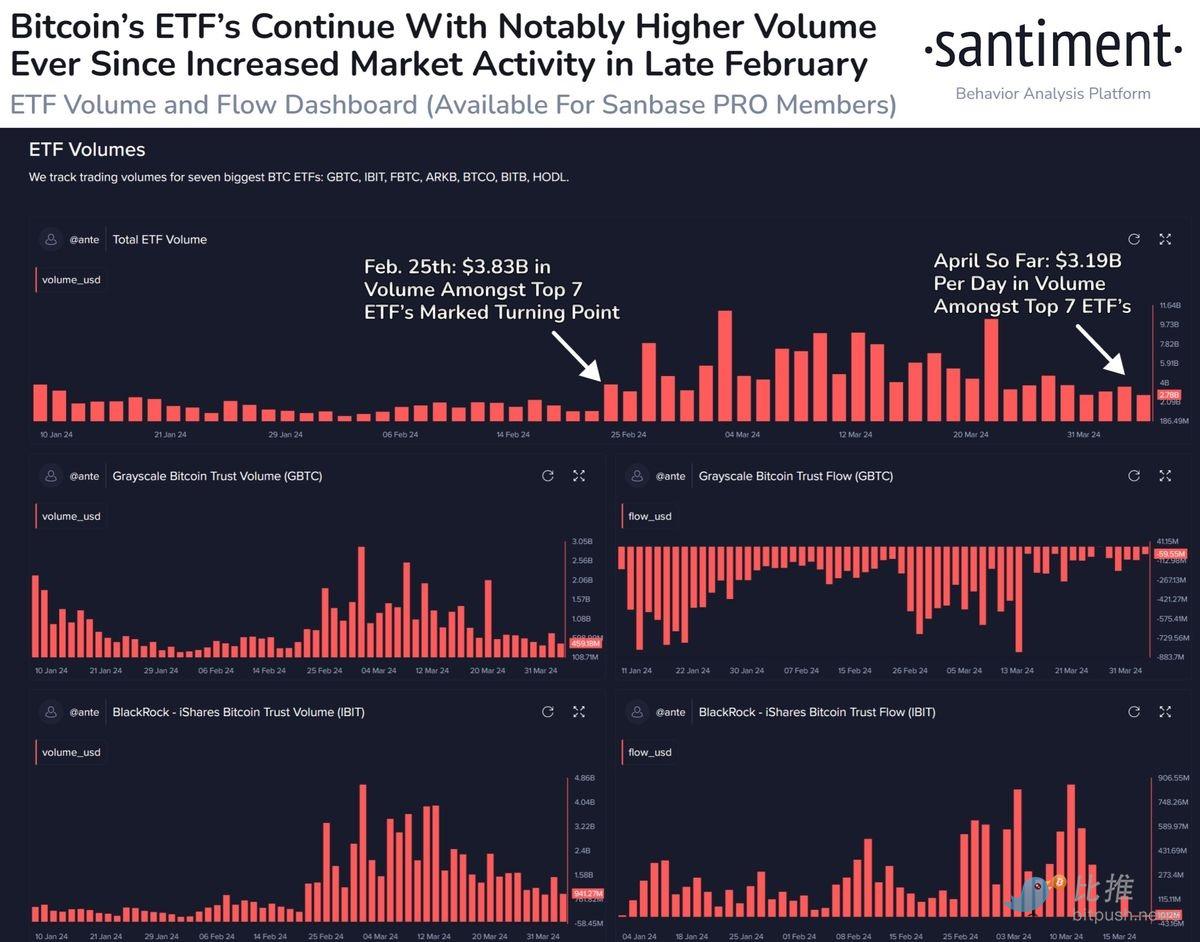

On-chain analysis company Santiment believes that ETF trading activity remains at a relatively active level. Analysts at the company said: "Bitcoin ETF trading volume has not slowed down four weeks after BTC broke through a new high. In GBTC, IBIT, FBTC, ARKB, BTCO, BITB and HODL, trader activity is still significantly higher than the turning point that began after retail trading began to pour in at the end of February."

They added: “High activity should continue until the halving on April 19, but it will be interesting to see whether ETF volume and on-chain volume decline directly after the halving.”

Stablecoin activity suggests bulls are preparing for a rally

Markus Thielen, head of research at 10x Research, said that while the price of Bitcoin has been moving sideways and consolidating since early March, it may soon resume its climb.

"After a sharp bullish run since January 25, we turned cautious a month ago (March 8) as forward returns seemed unpredictable based on the technical setup of the market and the trade (cryptocurrency) is about risk reward and knowing when to bet big/small, and the past thirty days have really been a time for small bets. But that will soon change.”

Thielen noted: “Bitcoin was trading in a symmetrical triangle pattern last month, and according to some historical analysis, 75% of triangle patterns will see a continuation pattern (of a bull run) and higher prices.”

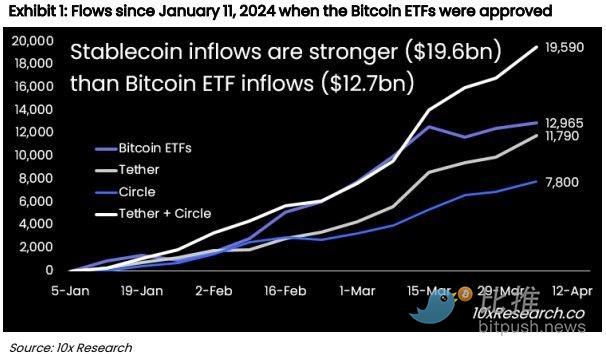

Thielen said stablecoin trading volumes could be a better predictor of future conditions than just looking at ETF flows or futures data.

他说:「在过去 30 天里,我们看到 ETF 录得约 50 亿美元的净流入,而更值得关注的是, Tether 净流入了 69 亿美元,Circle 铸造了约 30 亿美元,总共有 100 亿美元的新资金通过稳定币进入。虽然比特币 ETF 的流量引起了媒体的关注,但与 ETF 相反,稳定币的铸造量是其两倍,而且可能只做多头。我们建议减少对比特币 ETF 流动的关注,稳定币发行商是需观察的对象,将推动这个市场走高。」

Thielen concluded: “While we have expressed concerns about weak ETF flows, the baton has been passed to stablecoins. Tether recorded $2.4 billion in 7-day minting signals, one of the highest records since the start of this bull run, and fiat currencies are accelerating intocryptocurrencyIn the area, we would like to turn bullish as a symmetrical triangle breakout is imminent.”

Thielen’s analysis shows that based on the current formation, the triangle pattern “met” on April 18, and if it is a bullish breakout, Bitcoin could climb above $80,000 in the coming weeks, and buying at 69,280 and setting a stop loss at 65,000 seems “appropriate.”

许多加密货币Xiaobai NavigationTraders expect the Bitcoin halving event to be a pivotal moment in 2024, with a significant impact on the cryptocurrency market. However, analysts at Steno Research expect it to be a "buy the rumor, sell the news" event. Steno Research expects the value of BTC to surge ahead of the halving event. However, within the first 90 days after the halving, its value could "fall below the price at the time of the halving."

According to data provided by Alternative, with only 11 days left until the Bitcoin halving, the sentiment in the crypto ecosystem is still in the "extreme greed" realm. The current overall market value of cryptocurrencies is $2.69 trillion, and Bitcoin's dominance rate is 52.4%.

The article comes from the Internet:As the bull market is replenishing its "ammunition", the two major stablecoins have issued an additional $10 billion in 30 days

Merkle Trade aims to turn trading into an enjoyable and social activity for everyone. Written by: Merkle Trade Translated by: Xiaobai Navigation Coderworld Merkle Trade is the first gamified, full-chain sustainable DEX powered by LayerZero and Pyth Network, …