Pantera Capital Investment Methodology: How to evaluate the crypto market through fundamentals and macro environment?

Written by: Cosmo Jiang, Erik Lowe

Compiled by: Xiaobai Navigation Coderworld

In the past few months, the United StatescryptocurrencyThere have been some positive developments in the regulatory environment. We all know about the U.S. District Court for the Southern District of New York’s ruling in the three-year lawsuit between the Securities and Exchange Commission (SEC) and Ripple Labs, which ruled that XRP is not a security. We call it a “positive” black swan event that few people expected.

cryptocurrencyAnother unexpected victory recently. On August 29, the US Court of Appeals ruled in favor of Grayscale in its lawsuit against the SEC regarding its spot Bitcoin ETF application that was rejected last year. We believe this greatly increases the chances of spot Bitcoin ETF applications from companies like BlackRock, Fidelity, and others being approved.

While the United States appears to lag behind much of the world in its acceptance of digital assets, with many countries taking equal or even harsher measures against cryptocurrencies, the United States’ saving grace is that it has a court system that is committed to procedural due process, ensuring that there is a path to redress when boundaries are crossed.

“The rejection of Grayscale’s proposal is arbitrary and capricious because the Commission fails to explain its disparate treatment of similar products. We therefore support Grayscale’s petition and vacate the order.”

— Opinion of the Court submitted by the RAO Circuit Judge

We have always stressed the need for trustless systems. In our industry, this means that users can rely onBlockchainWe can rely on the U.S. court system to do the same, helping to shape a promising regulatory environment for cryptocurrencies in the future and facilitating more innovation to happen onshore.

We have long discussed the potential for a spot Bitcoin ETF, and now we see a glimmer of hope.

The crypto industry is maturing at a similar level to stocks

The maturity of the digital asset space may be similar to an inflection point in the development of the stock market.

TokenNew forms of capital are emerging that could replace equity in an entire generation of businesses. This means that many companies may never list on the New York Stock Exchange.exchangeListed, but only hasToken。这是企业与管理团队、员工、Token持有者以及数字资产独有的潜在其他利益相关者(如客户)之间的利益对齐方式。

There are currently around 300 publicly traded liquid tokens with market caps exceeding $100 million. This investable universe is expected to grow as the industry expands. More and more protocols have product use cases, revenue models, and strong fundamentals. Applications like Lido or GMX didn’t exist two or three years ago. In our view, sifting through this large universe of ideas can be a significant source of outsized returns because just like in the stock market, not all stocks are created equal, and the same is true for tokens.

Pantera is focused on finding protocols with product-market fit, strong management teams, and a path to attractive and defensible unit economics, and believes this is a widely overlooked strategy. We believe we are at an inflection point in this asset class where traditional and more fundamental frameworks will be applied to digital asset investing.

In many ways, digital asset investing is similar to the major inflection points that the stock market has developed over time. For example, fundamental value investing is taken for granted today, but it didn’t become popular until the 60s when Warren Buffett launched his first hedge fund. He was an early pioneer in applying the lessons of Benjamin Graham to practice, which led to the development of the long-short equity hedge fund industry as we know it today.

Cryptocurrency investing is also similar to emerging market investing in the 2000s. It faces similar criticisms to the Chinese stock market at the time, namely that many companies are small companies in an irrational stock market driven by retail investors. You don’t know if the management team is misleading investors or misappropriating funds. While there is some truth to this, there are also many quality companies with strong long-term growth prospects that are great investment opportunities. If you are a discerning, fundamentals-focused investor who is willing to take the risk and put in the effort to find these good ideas, you can find incredible investment success.

Our main point is that the prices of digital assets will increasingly trade based on fundamentals. We believe the same rules that apply in traditional finance will apply here as well. There are many protocols now with real revenue and product-market fit that have attracted loyal customers. There are now more and more investors using a fundamental lens to apply traditional valuation frameworks to pricing these assets.

Even data service providers are beginning to resemble those in the traditional financial sector. But instead of Bloomberg and M-Science, they are Etherscan, Dune, Token Terminal, and Artemis. Their purpose is virtually the same: tracking a company’s key performance indicators, profit and loss statements, actions and changes in management teams, etc.

In our view, as the industry matures, the next trillion dollars entering this space will come from institutional asset allocators trained in these fundamental valuation techniques. By investing using these frameworks today, we believe we are at the forefront of this long-term trend.

Fundamentals-Based Investment Process

The fundamentals-based investment process for digital assets is similar to that of traditional stock-based assets. This may be a pleasant surprise to investors in traditional asset classes, but also a key misunderstanding.

The first step is to conduct fundamental due diligence, answering the same questions you would when analyzing a public stock. Is there product market fit? What is the total addressable market (TAM)? How is the market structured? Who are the competitors and what are their differentiators?

Next is the quality of the business. Does this business have competitive barriers? Does it have pricing power? Who are their customers? Are they loyal, or do they leave quickly?

Unit economics and value capture are also very important. While we are long-term investors, ultimately cash is critical and we want to invest in sustainable businesses that can ultimately return capital to their token holders. This requires sustainable profitable unit economics and value capture.

The next layer of our due diligence process is to research the management team. We care about the management team’s background, track record, incentive alignment, and their strategy and product roadmap. What is their go-to-market plan? Who are their strategic partners? And what is their distribution strategy?

Compiling all of this fundamental due diligence information is the first step in every investable opportunity. This ultimately leads to building financial models and investment memoranda on our core holdings.

The second step is to translate this information into asset selection and portfolio construction. For many of our holdings, we have multi-year three-table models with capital structure and forecasts. The models we create and the memos we write are at the core of our process-oriented investment framework, which enables us to have the knowledge and foresight to select investment opportunities and adjust position sizes based on event path catalysts, risk/reward and valuation.

After making an investment decision, the third step is to continuously monitor our investments. We have a systematic data collection and analysis process to track key performance indicators. For example, for the decentralizedexchange Uniswap, we actively collect on-chain data in our data warehouse to monitor the trading volume of Uniswap and its competitors.

In addition to monitoring these key performance indicators, we strive to maintain a dialogue with the management teams of these agreements. We believe it is very important to conduct on-the-ground research calls with management teams, their customers and different competitors. As a sophisticated investor in this space, we are also able to leverage Pantera’sCommunityWe see ourselves as partners and are committed to contributing to the growth of these protocols by helping management teams with reporting, capital allocation or management best practices.

Fundamentals-based investing practice: Arbitrum

One of the main criticisms of Ethereum is that during periods of increased activity, transactions on the base layer can become slow and expensive. While the roadmap to creating a scalable platform has been controversial, second-layer solutions such as Arbitrum are emerging as viable solutions.

Arbitrum’s main value proposition is simple: faster, cheaper transactions. It can transact 40 times faster and 20 times cheaper than transacting on Ethereum, while being able to deploy the same applications and have the sameSafetyAs a result, Arbitrum has found product-market fit and is seeing strong growth both on an absolute basis and relative to its peers.

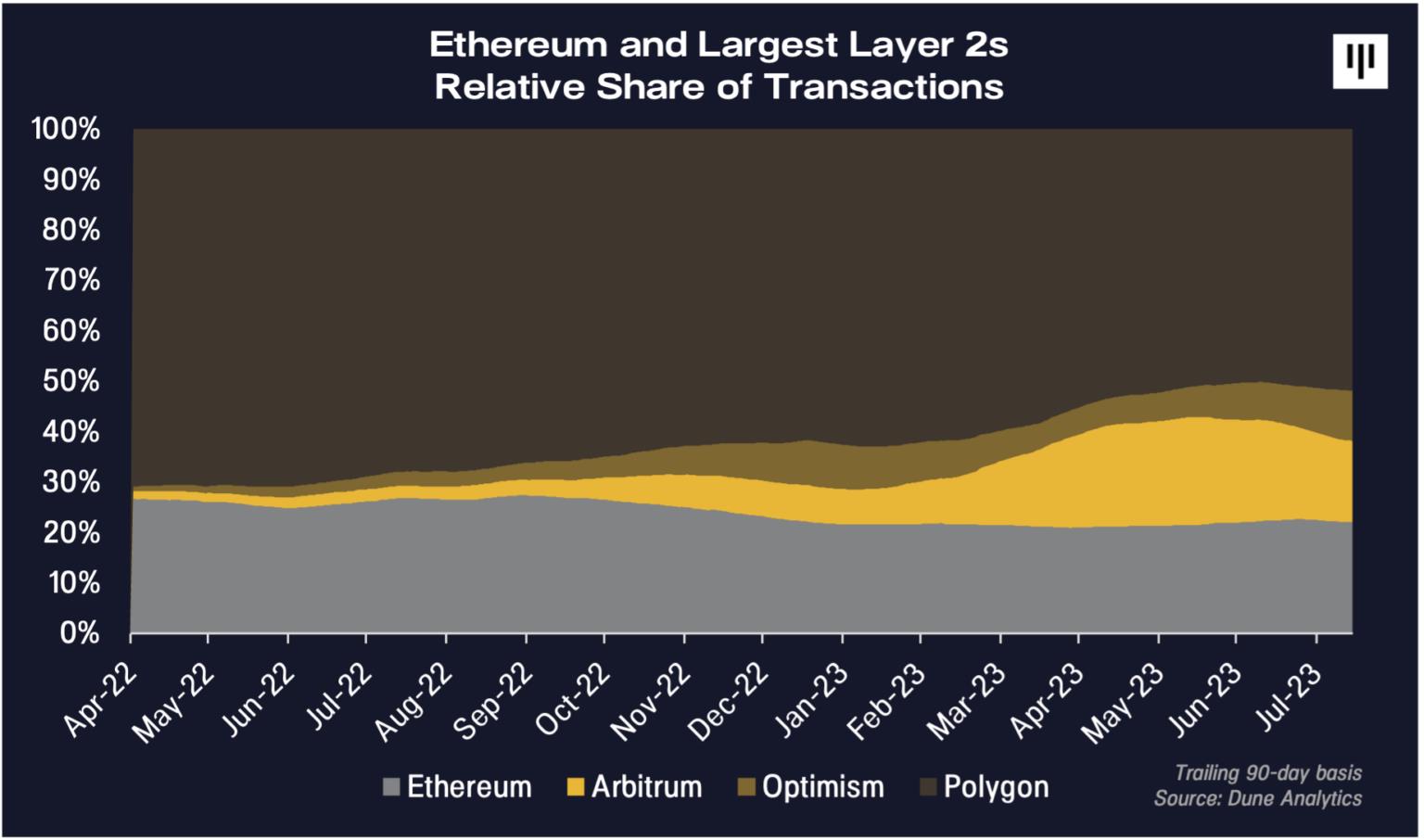

For fundamental investors looking for evidence of growth with fundamental traction, Arbitrum would rank high on this list. It is one of the fastest growing second layer solutions on Ethereum and has captured a significant share of the transaction market over the past year.

To dig a little deeper into that last point, Arbitrum is one of the few chains that has shown growth in transaction volume throughout the bear market, while overall usage has been relatively weak. In fact, if you break the data down, you’ll see that between Ethereum and all of its other second-layer solutions, Arbitrum has actually contributed 1,00% of the growth in the Ethereum ecosystem this year. Arbitrum has a huge share of the growth within the Ethereum ecosystem, while Ethereum itself has a huge share of the overall cryptocurrency space.

Arbitrum’s network is in a virtuous cycle. Based on our field research, developers are attracted to the growing usage and user base on Arbitrum. This is a positive network virtuous cycle: more users means more developers interested in creating new applications on Arbitrum, which in turn attracts more users. But as fundamental value investors, we have to ask ourselves if all of this matters unless there is a way to monetize this activity, right?

Answering this question is why we believe this is a good fundamental investment opportunity - Arbitrum is a profitable protocol with multiple upcoming potential catalysts.

In this space, many average investors may not be aware that there are actually protocols that can generate profits. Arbitrum generates revenue by collecting transaction fees on its network, batching these transactions, and then paying the Ethereum base layer to publish these large transactions. When a user spends 20 cents on a transaction, Arbitrum collects this fee. They then bundle these transactions into large batches and publish these transactions to Ethereum layer 1, paying a fee of about 10 cents per transaction. This simple math means that Arbitrum can make a gross profit of about 10 cents per transaction.

We have found a protocol that has found product-market fit and has reasonable unit economics, which ultimately gives us confidence that its valuation is credible.

Arbitrum's growth in key operating metrics

Here are some charts that illustrate some of the fundamentals.

Since launch, the number of active users has grown continuously, with nearly 90 million transactions per quarter. Revenue for the second quarter was $23 million, and gross profit reached nearly $5 million in the second quarter, an annualized $20 million. These are the things we can do every day onBlockchainWe use key performance indicators that are tracked and validated on a daily basis to monitor whether Arbitrum is meeting our investment thesis and financial forecasts.

Currently, with an average of about 2.5 million monthly users, each making an average of 11 transactions per month, that’s about 350 million transactions per year. Based on these numbers, Arbitrum is almost a $100 million per year business, generating about $50 million in normalized gross profit. Suddenly, this becomes a very interesting business.

As for catalysts and what makes this a timely investment, a key part of our research process is tracking the entire Ethereum technology roadmap. The next big step is an upgrade called EIP-4844, which will effectively reduce transaction costs for roll-ups like Arbitrum. Arbitrum's main cost, which is 10 cents per transaction, could be reduced by 90% to 1 cent per transaction. At that point, Arbitrum will have two options. They can pass these cost savings directly to the Ethereum blockchain.Xiaobai NavigationThey can pass these savings on to users, further accelerating adoption, or they can keep these savings as profit, or both. Either way, we foresee this being a significant catalyst for increasing Arbitrum usage and profitability.

Valuation is an important part of fundamental investing. Arbitrum currently has a market cap of $5 billion based on outstanding shares. This is quite attractive in our view relative to some of the other first and second layer protocols with similar market caps but a fraction of the usage, revenue, and profits.

To put this valuation in the context of growth, we believe Arbitrum could grow to over 1 billion trades per year over the next year, with a profit of 10 cents per trade. This implies roughly $100 million in earnings, which translates to a valuation of about 50x forward earnings at a $5 billion market cap. This looks expensive in absolute terms, but in our opinion reasonable for an asset that is still growing at triple digits. Compare this to real world business valuations, if you look at popular software companies like Shopify, ServiceNow, or CrowdStrike, which are growing revenues in the double digits, trade at an average multiple of about 50x, and they are growing much slower than Arbitrum.

Arbitrum is a protocol with product-market fit, growing very fast (both absolutely and relative to the industry), clearly profitable, and trading at a reasonable valuation relative to its own growth, other assets in crypto, and other assets in traditional finance. We continue to track these fundamentals closely and hope that our thesis will be validated.

Background Catalyst

There are several big background catalysts coming up that could have important impacts on the digital asset market.

While institutional investment interest has retreated over the past year, we are watching for upcoming events that could generate renewed interest among investors. The most important is a potential spot Bitcoin ETF approval. In particular, BlackRock’s application is an important event for two reasons. First, as the world’s largest asset manager, BlackRock is subject to intense scrutiny and only makes decisions after careful consideration. Even amid regulatory fog and the current market environment, BlackRock has chosen to continue to increase its investment in the digital asset industry. We believe this sends a signal to investors that cryptocurrency is a legitimate asset class with a lasting future. Second, we believe ETFs will increase exposure to and demand for this asset class sooner than most expect. Recent news is that the U.S. Court of Appeals sided with Grayscale in its lawsuit against the SEC’s rejection of its spot Bitcoin ETF application last year. We believe this significantly increases the chances that spot Bitcoin ETF applications from companies like BlackRock, Fidelity, and others will be approved, possibly as early as mid-October.

While the regulatory landscape is starting to become clearer, it is still likely to be the biggest factor holding the market back, especially for the price of longer-tail tokens. In part, it seems like a pushback against the SEC as the courts are beginning to fight back against their “enforcement regulation” actions. In addition to the Grayscale spot Bitcoin ETF news, the court’s ruling in favor of Ripple in its case against the SEC was positive about digital assets not being considered securities. This is an important event because it shows that regulation of digital assets can and should be more nuanced. Regulatory clarity is important both for consumer protection and for entrepreneurs who need the proper framework and guidance to have the confidence to create new applications and unleash innovation.

Finally, crypto is at what we call a “dial-up to broadband” moment. We have written before in previous letters that crypto is at a similar stage to the internet 20 years ago. Ethereum scaling solutions like Arbitrum or Optimism are making huge progress and we are seeing increased transaction speeds, reduced costs, and the increased capacity that comes with that. Similar to how we couldn’t imagine how many new internet businesses would be created after the internet went from dial-up to broadband speeds, we think the same will happen with crypto. In our opinion, we have yet to see this massive uptick.BlockchainBroad adoption of new use cases enabled by infrastructure and speed improvements.

The article comes from the Internet:Pantera Capital Investment Methodology: How to evaluate the crypto market through fundamentals and macro environment?

The "City Party Map Shanghai Station" co-organized by Weirdo Ghost Gang and CutUp, a fashion brand under its parent company ManesLAB, will be officially launched on September 10. On September 8, the well-known Chinese NFT project Weirdo Ghost Gang (WGG) officially announced that it and its parent company ManesLAB will jointly host the "City Party Map Shanghai Station" on September 10.