Bitget Research Institute: BTC breaks through $70,000 to test the upper resistance level, and the Base chain Meme wealth effect is significant

Written by: Bitget Research Institute

Summary

BTC spot ETF has seen net inflows for four consecutive days, and BTC has returned to the resistance level above $70,000. The strong wealth-creating effect of Base ecosystem meme coins over the weekend has pushed Base ecosystem TVL and DEX trading volume to break through historical highs.

-

The sectors with strong wealth-creating effects are: Base Ecosystem (DEGEN, MFER), Solana Ecosystem (JTO, JUP, WIF), and RWA Sector;

-

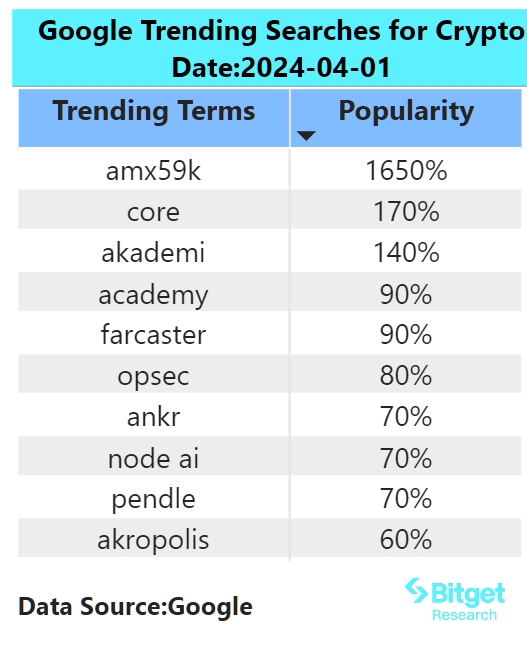

User Hot SearchToken& Topics: PENDLE, DEGEN, Farcaster;

-

Potential airdrop opportunities include: Zircuit, PublicAI;

Data statistics time: April 1, 2024 4:00 (UTC+0)

1. Market environment

The market expects that the Federal Reserve will keep interest rates unchanged in May, and the probability of a 25 basis point rate cut in June is more than 60%. Amid the prospect of rate cuts and tensions between Russia, Ukraine and the Middle East, gold prices hit a new high, breaking through the $2,250/ounce mark.

BTC once again broke through $70,000, repeatedly testing the upper resistance level. After experiencing 5 consecutive days of net outflow, BTC Spot ETF saw 4 consecutive days of net inflow last week. The market focused on the inflow/outflow of BTC Spot ETF this Monday. The market focused on the Base chain over the weekend: Base chain TVL exceeded $1.17 billion, and the outbreak of popular meme coins on the chain led to a single-day DEX transaction volume on Base exceeding $1.2 billion, setting a record high.

2. Wealth-making sector

1) Sector changes: Base ecology (DEGEN, MFER)

main reason:

(1) The TVL of the Base ecosystem exceeded 3.2 billion US dollars, and the 24-hour trading volume of dex exceeded 1.2 billion US dollars, both breaking historical highs. The capital inflow and capital activity within the ecosystem have increased significantly throughout March.

(2) This weekend, the founders of popular blue-chip NFT mfers and Doodles in the last bull market successively issued tokens on the Base chain. The huge wealth effect caused by MFER stimulated the rise of meme coins in the entire Base ecosystem and a surge in trading volume.

(3)DEGEN:除了代币的大涨和社媒的广泛讨论,Degen Chain 上的 DSWAP、DINO 也表现不俗。同时,Degen 重塑了 Farcaster 生态,允许 Casters 使用 DEGEN 打赏优质内容创作者,随着 Farcaster 公布了 Paradigm 的投资和 10 亿美元估值,被市场持续看好。

Rising situation:

DEGEN rose by more than +300% in a week and more than +4000% in a month; MFER's price was only 0.008u in the first hour after opening, and its ATH reached 0.32u, with the highest increase reaching +3900%.

Factors affecting the market outlook:

The continuous inflow of funds into the Base ecosystem may directly affect the overall trend of meme coins on the Base chain. The development of the Degen Chain ecosystem, the development of the SocialFi track, and the progress of Farcaster's coin issuance will all affect the performance of the DEGEN coin price. Traders can pay close attention to changes in data such as the ecosystem TVL and DEX trading volume. With the continued improvement of fundamentals, the mentioned assets are expected to break new highs. At the same time, historically, the ceiling of meme coins on the Base chain is limited, so beware of the risk of chasing high prices.

2) Sector changes: Solana ecosystem (JTO, JUP, WIF)

main reason:

(1) The price of SOL broke through $200 again. SOL was relatively resilient during the market correction, and the TVL of the Solana ecosystem did not decline significantly during the market correction. It continued to rise rapidly during the rebound.

(2) WIF's continuous record highs and the wealth-creating effect of Solana's mid- and long-tail meme coins have continued to benefit Solana's ecological applications. On March 30, Solana's on-chain DEX transaction volume was US$1.313 billion, second only to Ethereum's US$1.5 billion. In April, the market expects that Solana's well-known ecological projects Marginfi and Parcl will issue coins, injecting new vitality into the ecosystem.

Rising situation:

JTO rose by +30% in the past 24 hours and broke the historical high again; JUP rose by +20% in the past 24 hours and broke the historical high again; WIF rose by +60% in the past week and +390% in the past month.

Factors affecting the market outlook:

(1) The continued influx of funds into the Solana ecosystem and the upcoming TGEs and airdrops of several well-known projects this year (Kamino, Parcl, Marginfi, DFlow, Backpack, MagicEden, Tensor, etc.) will bring continued development and popularity to the Solana ecosystem, and support the price of SOL.

(2) The development of each of the leading projects in the ecosystem directly affects the price of its own currency. For example, the development of the derivatives trading market on Jupiter and the yield of JLP will play a crucial role in the price trend of JUP.

3) The sector that needs to be focused on in the future: RWA track

main reason:

BlackRock announced the launch of its firstBlockchainThe entry of the giants has brought a second spring to the RWA track. RWA may still be one of the most important narratives in this bull market. After Bitget launched Goldfinch (GFI), the token has risen for three consecutive days, and the price of ONDO has doubled in a single month. Bitget Research also mentioned in its Western European market research report that ONDO is the Google Search in Western Europe in early 2024. cryptocurrencyRanked 5th in the related word search rankings. (https://www.bitget.com/zh-CN/research/articles/12560603807344)

Specific currency list:

-

MKR: MakerDAO It was the most important target of market attention when RWA first entered the mainstream field of vision, and a project that cannot be avoided when discussing RWA.

-

ONDO: The current flagship token in the RWA track, backed by TradFi giants: BlackRock, Goldman Sachs and Bridgewater.

-

GFI: Goldfinch has strong financing endorsement from a16z and Coinbase, and provides global lending services to borrowers in a decentralized manner.

-

PROPS: Rumors that "Aptos is preparing to release an important RWA announcement in April" have caused a recent surge in PROPS, a real estate RWA project within the ecosystem.

-

Parcl, which has not yet issued tokens: a real estate derivatives trading platform on Solana. The market expects the project to issue tokens in April.

3. User Hot Searches

1) Popular Dapps

Pendle Finance:

Pendle Finance is a yield trading protocol where users can split interest-bearing assets into yield assets YT and principal assets PT. The separation of interest-bearing assets and principal assets allows market players to formulate different trading strategies for different scenarios. With the upgrade of Shanghai, Ethereum became an interest-bearing asset after staking. The subsequent launch of EigenLayer allowed LST to be re-pledged. Coupled with the launch of more and more interest-bearing RWAs based on treasury bonds or similar, Pendle has gradually become the largest yield trading protocol in the crypto world.

At present, Pendle's TVL has climbed to 3.54 billion US dollars. Pendle's protocol token PENDLE has also gradually set a record high. The crypto market has recently ushered in a RWA boom, which is a huge benefit for the Pendle protocol. Investors are advised to continue to pay attention to the trend of Pendle protocol introducing RWA assets, and the market size has huge potential.

2) Twitter

DEGEN:

Degen Chain is built on Arbitrum Orbit. The Base network is only used as a settlement layer, and the DA layer uses AnyTrust. It first became popular on Farcaster channels, distributing tokens between builders, content creators, and users. DEGEN reshapes the Farcaster ecosystem, allowing Casters to use DEGEN to reward high-quality content creators. Yesterday, Farcaster announced Paradigm's lead investment, with a valuation of $1 billion. Among them, degen, as the first project with an ecosystem, is highly expected by the market.

In terms of tokens, DEGEN has carried out a relatively large-scale airdrop. As of now, DEGEN has 53,000 holders, the number of transactions has exceeded 553,000, and it is still growing rapidly. The token price has also increased 45 times in the past month. Whether DEGEN can continue to be strong in the future requires continued attention to the ecological construction and whether SocialFi can produce a positive flywheel effect.

3) Google Search & Region

From a global perspective:

Farcaster is a completely decentralized protocol that makes it easy for developers to build decentralized social networking applications. Farcaster recently announced the completion of a financing round led by Paradigm with a valuation of $1 billion. The ecosystem derived from Farcaster has recently become popular on the Base chain, including Degen, Higher, etc. Degen has even launched its Layer3 DegenChain, using the DEGEN token as its native token, directly pushing the price of the DEGEN token to new highs.

Web3 SocialFi has always been a hot topic and track in the industry, but both Lens and Friend.tech were short-lived. The emergence of Farcaster this time has provided a more complete ecological structure design and complete products, which is more friendly to both users and developers. With the support of major institutions, it will reignite the hype enthusiasm in the social field.

From the hot searches in each region:

(1) There are no significant hotspots in Africa and Latin America:

The regional popularity in Africa and Latin America showed a relatively scattered performance, among which MEME,AI, RWA, and some of the recently launched cryptocurrencies have appeared on the hot searches. This situation shows that the overall market has seen differentiation in themes. When the market is relatively stable, the rotation speculation of sector themes has begun.

(2) Southeast Asia, CIS, and Europe as a whole continue to maintain their enthusiasm for RWA:

BlackRock recently launched the first tokenized asset fund BUIDL on the Ethereum network. At the same time, Coinbase has been selected as a key infrastructure provider. Since the release of the news, the RWA field has been dominating the crypto market, and the ecosystem has shown a booming trend, with asset projects of various types emerging. So far, BlackRock's on-chain fund BUIDL has attracted $245 million in deposits, with strong demand.

Potential Airdrop Opportunities

Zircuit

Zircuit is a parallel and AI-integrated Layer2 public chain project based on zkRollup. It is invested by Pantera and Dragonfly. The current TVL of the project has exceeded 1.1 billion US dollars. Zircuit's current ecosystem is gradually improving, and it already includes functions such as staking, cross-chain bridges, and browsers. Users can also participate in the construction of the ecosystem andCommunityInteract to obtain airdrop qualifications.

Specific ways to participate: 1) Enter the staking page (https://stake.zircuit.com/) to participate in staking to win points; 2) Participate in node deployment to win points (https://build.zircuit.com/build).

PublicAI

PublicAI is a distributed AI network that simplifies the process of outsourcing a variety of tasks, from data annotation to many data annotations related to artificial intelligence. The platform enables other organizations to enhance data analysis, data annotation, and accelerate the development of machine learning models through a large, structured pool of participants.

The project has not yet announced its financing situation, but according to its official website, the project has received support from the Solana Foundation, Nvidia and first-tier VCs.

How to participate: 1) Go to the page (https://beta.publicai.io/participant) to register and log in; 2) Repost and comment on PublicAI with the corresponding topic tags; 3) Become a Data Dock node.

The article comes from the Internet:Bitget Research Institute: BTC breaks through $70,000 to test the upper resistance level, and the Base chain Meme wealth effect is significant

Bitcoin halving is coming, will SIDE take off? Blockchain技术的未来似乎不可避免地是模块化的。以太坊Dencun升级后,以太坊将采用EIP-4844来提高以太坊的数据可用性,展示了世界最大智能合约平台的技术堆栈向模块化转变的持续趋势。 比特币作为最大的加密资产,其生态最近开…