dYdX Chain: From dApp to application chain ecology, the old DeFi wants to create products that are more competitive than CEX

Author: Xiaobai Navigation coderworld

introduction

October 2023DXofGenesis BlockCreated by the validator, marking the official launch of the dYdX chain.

Just two months ago, dYdX’s total trading volume exceeded $1 trillion, despite being the largest decentralized perpetualcontract交易所,但dYdX的野心是做出Products that are more competitive than centralized exchanges.If an independent application chain can provide the performance required to implement the product and achieve true decentralization, then migration is an inevitable choice.

In this issue, we will take a deep look at the development of dYdX Chain after its launch and analyze DX 如何打造最佳的合约交易所。

Why does dYdX want to create its own application chain?

dYdX was also one of the "first batch of people to try it out": the adoption of StarkEx in 2021 reduced dYdX's gas to 1/50 of the original, the number of supported trading pairs increased 10 times, and the trading volume also grew rapidly.Migrate toL2Make dYdX the most commendableDeFiThis is not all dYdX wants, as its order book and matching engine are still centralized.

As the business develops further, dYdX needs infrastructure to make more adaptations to its products, which is something StarkEx cannot do at its iteration speed.

IOSG once made a vivid metaphor:

“Ethereum Rollup is like an old building in the city center. Its advantage is that it is located in a prosperous business district (composability), but its disadvantage is that the decoration is shabby (infrastructure iteration is slow), and the owner is not allowed to renovate (it does not support application-customized nodes).dYdX is a big tenant of this building, and usually does not socialize (not relying on composability). Therefore, it decided to move to the suburbs and build a small villa.At this time, I happened to meet a good decoration team (Cosmos SDK), so we hit it off and put Rollup aside.

From tenant to landlord of self-built housing,DXNot only does it save a lot of rent (sharing profit redistribution with StarkEx), but it also has room for independent development. On June 22, 2022, dydx officially announced the development of an independent application chain to achieve complete decentralization and provide the best trading experience.

dYdX v4: High performance and decentralizationOn-chain contract exchange

The key to the dYdX v4 upgrade is to use the Cosmos SDK to build your own application chain and optimize the performance of the application layer with the underlying control.

Cosmos SDK is an open source toolkit that allows developers to build an independentBlockchainThe Tendermint consensus algorithm ensuresSafetyThe network and minimal latency enable Cosmos to process thousands of transactions per second. More importantly, developers can modify and optimize theirBlockchain:For example, dYdX requires an independent verification system that allows verification nodes to maintain order books off-chain. Independent application chains allow them to use their ownToken(instead of ETH) to pay transaction fees and eliminate Gas fees.

Such an application chain can obviously support dYdX to further improve product experience, and the improvement of v4 compared to v3 is also obvious.

Figure 1: Performance comparison between v3 and v4

-

Version upgrade, enhanced user experience

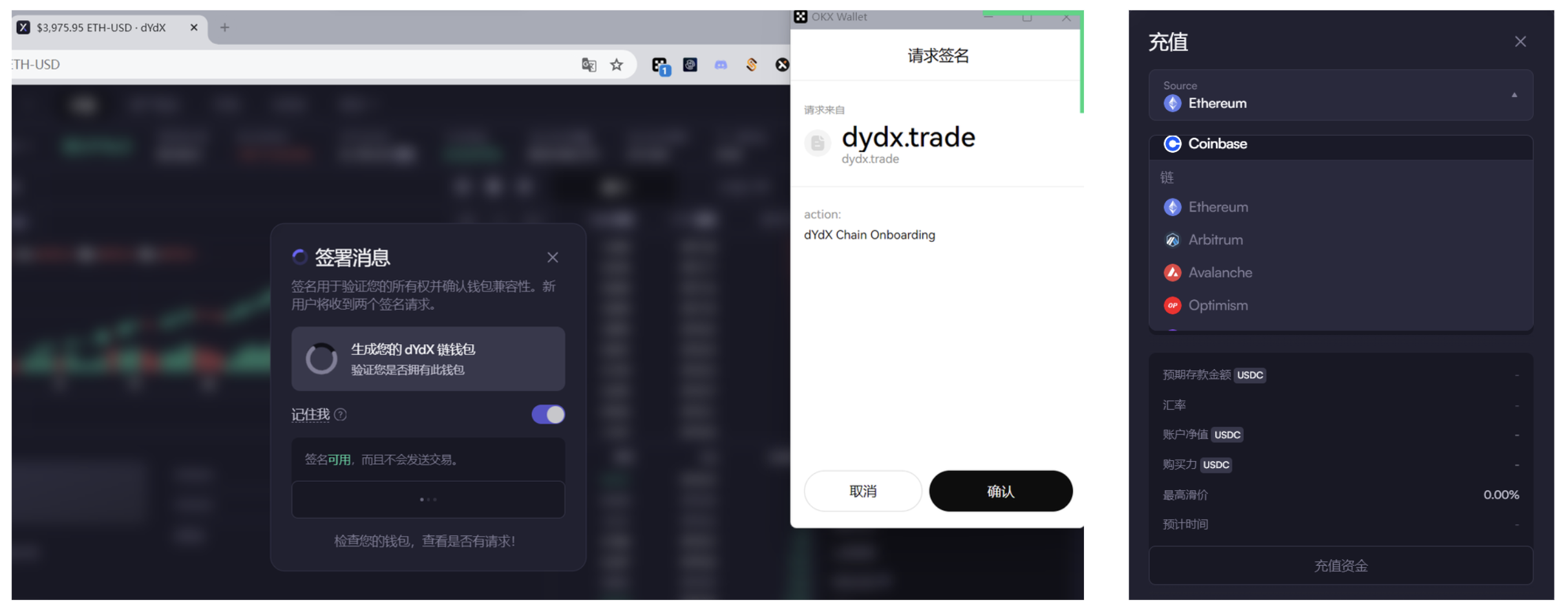

When dYdX announced that it would be an independent application chain, it was also questioned by some people: for example, whether leaving the huge user base and ecosystem of Ethereum would lead to user loss. The author found through actual testing that in terms of product experience, users still use Metamask, OKX Web3 and other mainstreamwallet登入v4版本;且相比v3入金只支持ETH网络,v4版本还支持从Coinbase和L2跨链入金到dYdX。

While migrating to Cosmos to take advantage of its high performance and flexibility, dYdX pays great attention to the consistency of user experience. The familiar deposit link and transaction are continued, so that users can switch to the new v4 version without paying attention to which chain the assets come from.

-

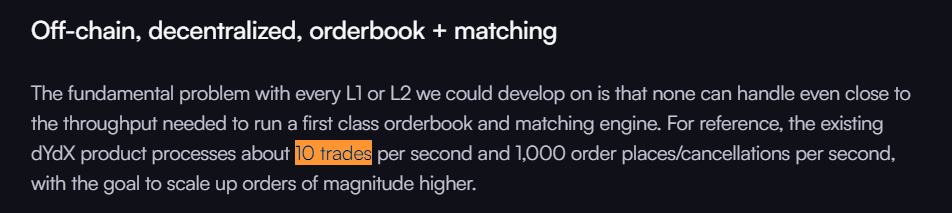

Better performance

Cosmos’ customized application chain allows dYdX to exclusively enjoy the performance of the entire chain, better meeting the needs of dYdX’s high-throughput trading and hedging systems. Before the migration, dYdX could only process about 10 transactions and 1,000 order/cancellation requests per second.After the migration, dYdX can process up to 2,000 transactions per second.

-

Lower gas

In high-frequency trading, there are many pending and canceling orders. The feature of paying gas when placing an order on the chain obviously cannot attract professional traders to abandon CEX. However, in the v4 version of dYdX, the fee is only charged after the order is successfully matched and the transaction result is uploaded to the chain.Transaction fees are charged as a percentage, and the experience is closer to that of centralized exchanges.

-

More decentralized

dYdX v3 is a hybrid decentralized exchange: most of the contracts and code are open source and on-chain, but the order book and matching engine are still run centrally.

andThe v4 version allows dYdX to have a fully decentralized off-chain order book and matching engine.:60 active validators around the world are responsible for performing network verification and block creation. Each validator maintains an off-chain order book. When orders are matched in real time, new blocks will be created, and consensus is reached when 2/3 of the validators vote in favor. Data is updated and returned to the front end through the indexer.

-

更好的代币赋能

在v3版本,dYdX代币主要用途是获得手续费折扣;而v4实现去中心化的另一好处是给予代币更大的赋能空间。

From a governance perspective,dYdX token holders will be able to define token functionality, add or remove markets, and modify parameters of dYdX v4.

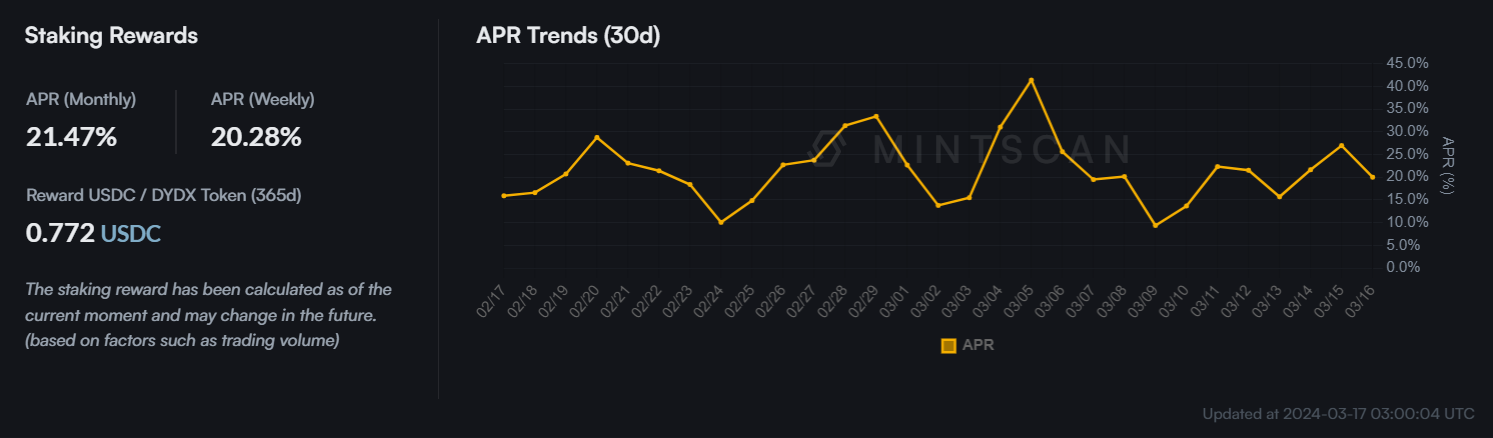

frompledgeangle,The dYdX chain requires validators to stake dYdX tokens to run and protect the chain. The revenue of dYdX is distributed to stakers: the current APY for stakers is as high as 20%, and is paid in USDC.

-

More Markets

More importantly, v4 has achieved permissionless listing of coins, and supports more coin contracts than v3. Currently, it supports contracts for more than 60 coins, and in March, it newly supported GRT, MANA, ALGO, HBAR, IMX, RNDR, AGIX and other token transactions.The founder stated on Twitter that he plans to support transactions of 500+ currencies by the end of 24 years.

Stabilize the application chain foundation and accelerate market expansion

Advanced technology is the foundation, but to make users feel the convenience brought by technology, it is necessary to implement specific products, educate through market promotion and operate systematic projects to let users experience the user experience.

In addition to providing a better trading experience and more currencies, v4 also provides a series of incentive activities to help smooth the import of users from v3. The author summarizes three types of user participation from high to low risk preferences.DXSeveral ways for the ecosystem to gain incentives:

-

Incentives for increasing trading volume and being a maker

At the end of November, Chaos Labs launched a six-month, $20 million dYdX chain early adopter incentive program. 80% is used to reward trading activities. After each successful transaction, traders will receive dYdX rewards.

-

Hedging consumes funding rate

If you do not want to bear the risk of long or short in the transaction, you can choose the long-short hedging method to earn funding rates: that is, open a short order on dYdX and hold spot on CEX for hedging to earn dYdX funding rates.

-

pledgedYdX, received 20%APR

You can also earn up to 20% APR by simply staking dYdX, which is distributed in the form of USDC. Currently, dYdX has distributed more than 8.2 million USDC to 15,000 stakers - all of which are real income distributions from transaction fees.

-

dYdX vs. other on-chain futures exchanges

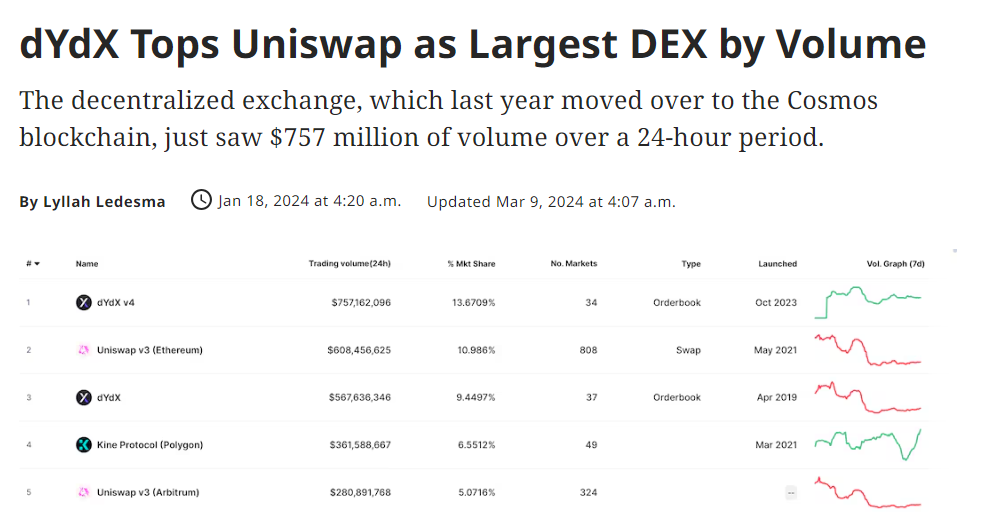

dYdX’s incentive activities have effectively attracted users and transactions: three months after its launch, the total transaction volume of dYdX v4 has reached nearly 80 billion US dollars.On January 18, the dYdX chain even surpassed Uniswap to become the DEX with the largest trading volume.

On-chain derivatives trading has a larger market space than spot trading, so there is fierce competition, and various protocols have shown their unique capabilities. We have listed several competitive protocols in this field.

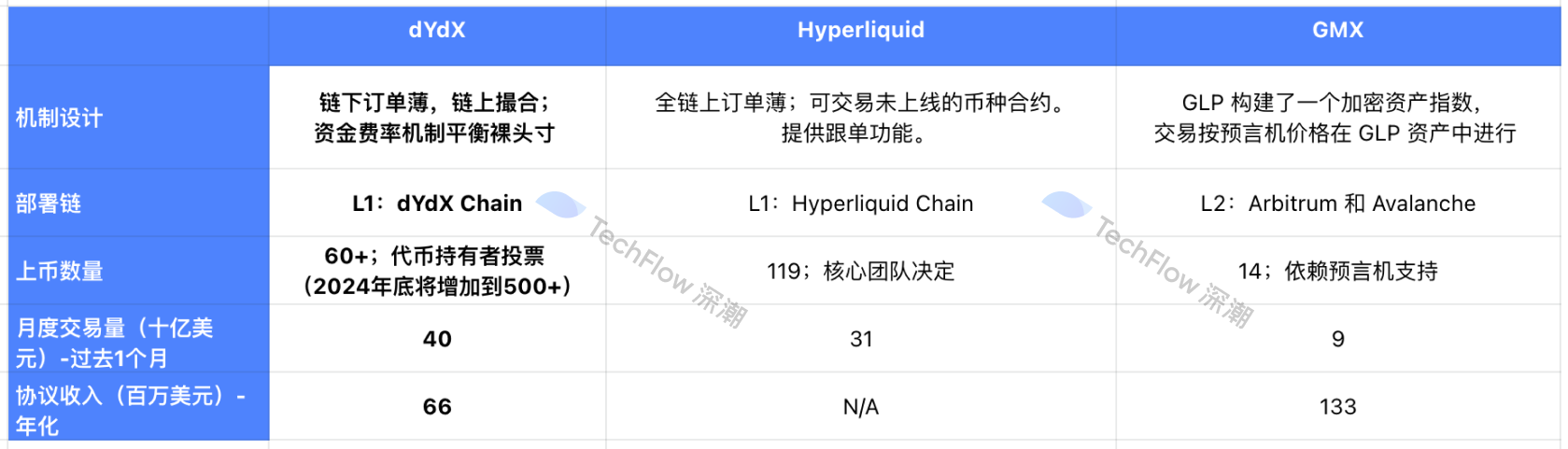

Figure 2: dYdX vs. other decentralized perpetual swap exchanges

GMXIt is popular because it provides 30X high leverage and large transactions without slippage. However, the V1 mechanism has the possibility of small currencies being manipulated, resulting in GLP losses. In V2, this situation is avoided by introducing a separate liquidity pool and limiting the opening amount, but there are still restrictions on providing more trading currencies. In addition, the GMX transaction fee is higher than the previous two.

HyperliquidIt has attracted much attention for launching the popular Friend.Tech futures trading and copy trading functions, and has similar mechanisms to dYdX. However, the current listing of coins and core values are completely determined by the team: for example, the Friend.Tech futures calculation formula was modified to avoid price manipulation, and the decentralization and product maturity are not as good as dYdX.

Hyperliquid is a rising star, and it has captured traffic through novel gameplay and rapid coin listing; but from the perspective of product experience and decentralization, dYdX is better, and therefore more popular among professional traders. Although the decentralized perpetual contract exchange track is still undecided, dYdX is still ahead of other competitors in terms of trading volume.

Cosmos interoperability helps dYdX’s liquidity staking ecosystem grow rapidly

Most L1s follow the path of building infrastructure first and then attracting developers, while dYdX first creates successful applications and then customizes the application chain for further development. The application chain not only allows dYdX to break through performance bottlenecks,It also brings more room for development for dYdX: StarkEx’s interaction with other ETH ecosystems is relatively complex, while Cosmos allows dYdX to interact with other ecosystems that supportIBCCosmosBlockchainInteroperability.

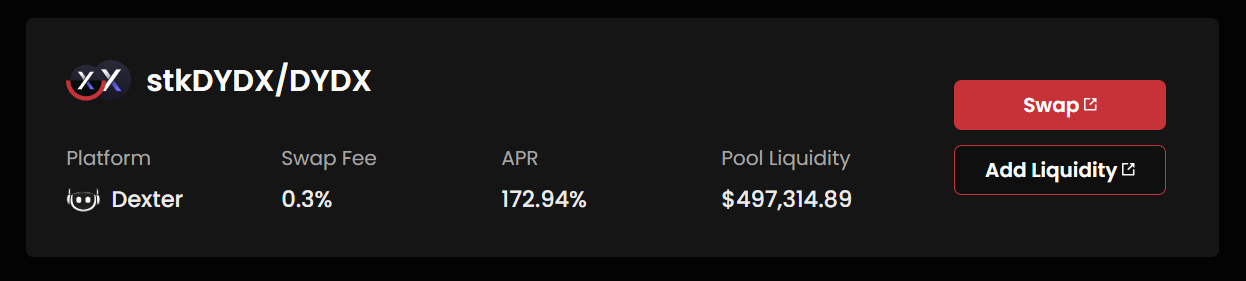

LiquiditypledgeFor example, due toDXThe fee income distributed to stakers is very considerable, and has attracted more than 106M dYdX to participate in staking.However, after staking, liquidity is locked and redemption will take 30 days. The huge potential demand has attracted three LSD protocols to compete to provide dYdX liquidity staking.

Taking pStake as an example, users who stake dYdX in pStake will not only have their staking income automatically reinvested, but can also add liquidity pools in Dexter to earn supply.Up to 173% APR (including PSTAKE token rewards).

Another example is the integration with Squid, the cross-chain infrastructure solution of the Axelar Interoperability Network, which enables users to access the Cosmos application chain from Ethereum L1, L2 Rollup, and centralized exchanges.Xiaobai NavigationThe reason why dX can access cross-chain bridges and liquidity staking functions so quickly is precisely due to the unparalleled interoperability of Cosmos. In the future, we can expect dYdX to combine with other protocols in the Cosmos ecosystem to bring more possibilities.

Summarize

From v3 to v4, dYdX has undergone a complete transformation from a dApp to a customized application chain.

The performance and flexibility of customized application chains enable them to provide users with lower transaction costs and faster transaction speeds; on the other hand, allowing token holders to participate in verification and chain protection, governance voting, and income distribution is a big step towards true decentralization.

at last,DXAfter becoming an application chain, it is possible to develop an ecosystem. DX From the key data released for the first quarter, we can see that great breakthroughs have been made in terms of trading volume, supported currencies and pledged volume.

Thanks to Cosmos' unparalleled cross-chain interoperability, each Cosmos chain can interact seamlessly. Because dYdX's tokens distribute real returns and can participate in governance, they have been combined with other Cosmos protocols into liquidity staking and DeFi protocols.

dYdX may no longer be a dApp as we originally knew it, but an application chain with more ecological possibilities. When DeFi returns to the public's attention this year, we look forward to more development of dYdX Chain.

For more details, please refer to:dYdX official website |dYdX Chinese official Twitter

The article comes from the Internet:dYdX Chain: From dApp to application chain ecology, the old DeFi wants to create products that are more competitive than CEX

Related recommendations: OORT: Storage + computing power + model training, creating a one-stop DeAI solution

走进 OORT,通过探究其赛道背景、项目运作逻辑等方面,一窥项目前景及 AI+DePIN 赛道 2024 年的发展机遇与挑战。 作者:小白导航 coderworld 2023 年末,加密研究机构 Messari 在其《Crypto Theses for 202…