The traffic of crypto websites such as CEX is lower than the previous peak, and the climax of retail investors’ influx has not yet arrived?

Written by Tiger Research

Compiled by: Xiaobai Navigation coderworld

Abstract

-

BlockchainMarket Network Traffic Analysis:BlockchainNetwork traffic is an overlooked factor in market analysis. When looking at the market through network traffic, there has not been an explosive growth in traffic during the current period compared to past booms, raising questions about the vitality of the market.

-

cryptocurrency价格和网络流量:尽管中心化交易和 DeFi 的网络流量都保持平稳,但整体cryptocurrency价格显著上涨。与过去由零售投资者推动的市场不同,这很可能是因为 ETF 等外部机构的涌入而上涨的。

-

Differences in DeFi analytics tools and DeFi network traffic: While traffic to analytics tools like DEX Screener has grown steadily, network traffic to traditional DeFi services is relatively low. This suggests that investors are more selective in making actual trading or investment decisions, rather than frequently accessing analytics tools to get market information.

text

The recent rise in cryptocurrency prices has led many to believe that the market has re-entered a bull cycle. However, rising cryptocurrency prices do not equate to increased market activity. To accurately determine market activity, many other factors must be considered.

其中包括常见的市场指标,如 DAU 和 MAU,以及区块链特定的指标,如加密货币交易量、活跃walletVolume and TVL. Many market analyses utilize these factors. The Solana network TVL exceeding $4 billion, reaching a two-year high, is one example.

“网络流量”很少被用作分析因素。由于区块链服务的性质,真实用户活动非常重要,因此包括访客在内的网络流量被用作项目的内部参考指标,但不作为分析因素。

However, network traffic analysis can help analyze the market in depth as it can reveal public interest in services and their detailed regional information. In this report, we will use network traffic analysis to analyze the blockchain market status in 2024, providing a different perspective from other reports on an industry-by-industry basis and helping you understand the market from a realistic perspective.

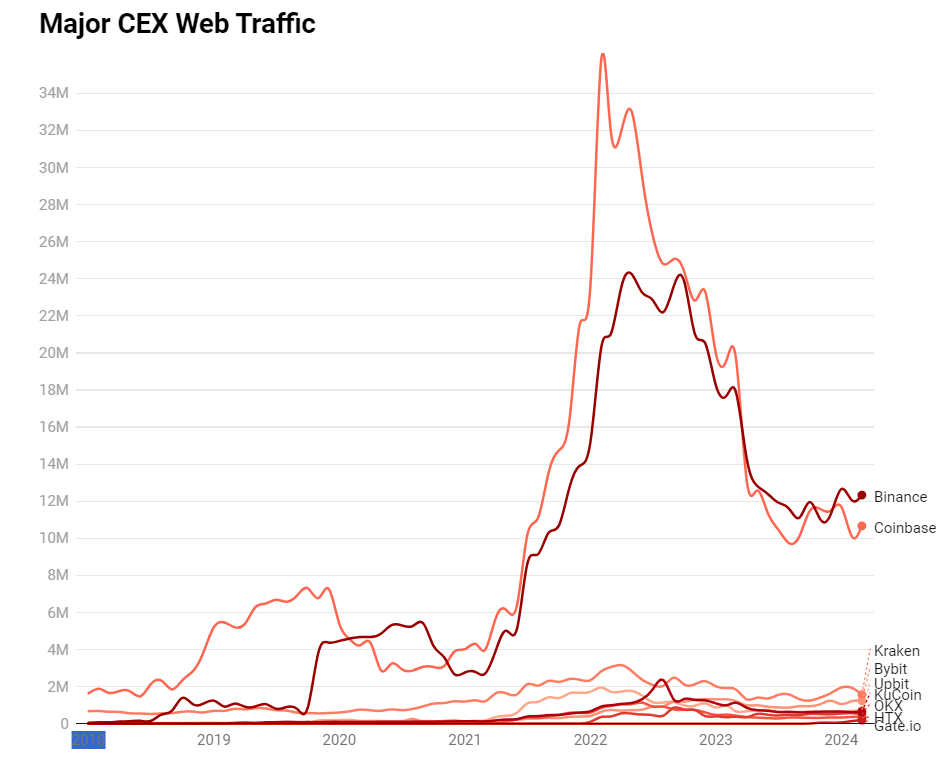

1.CEX

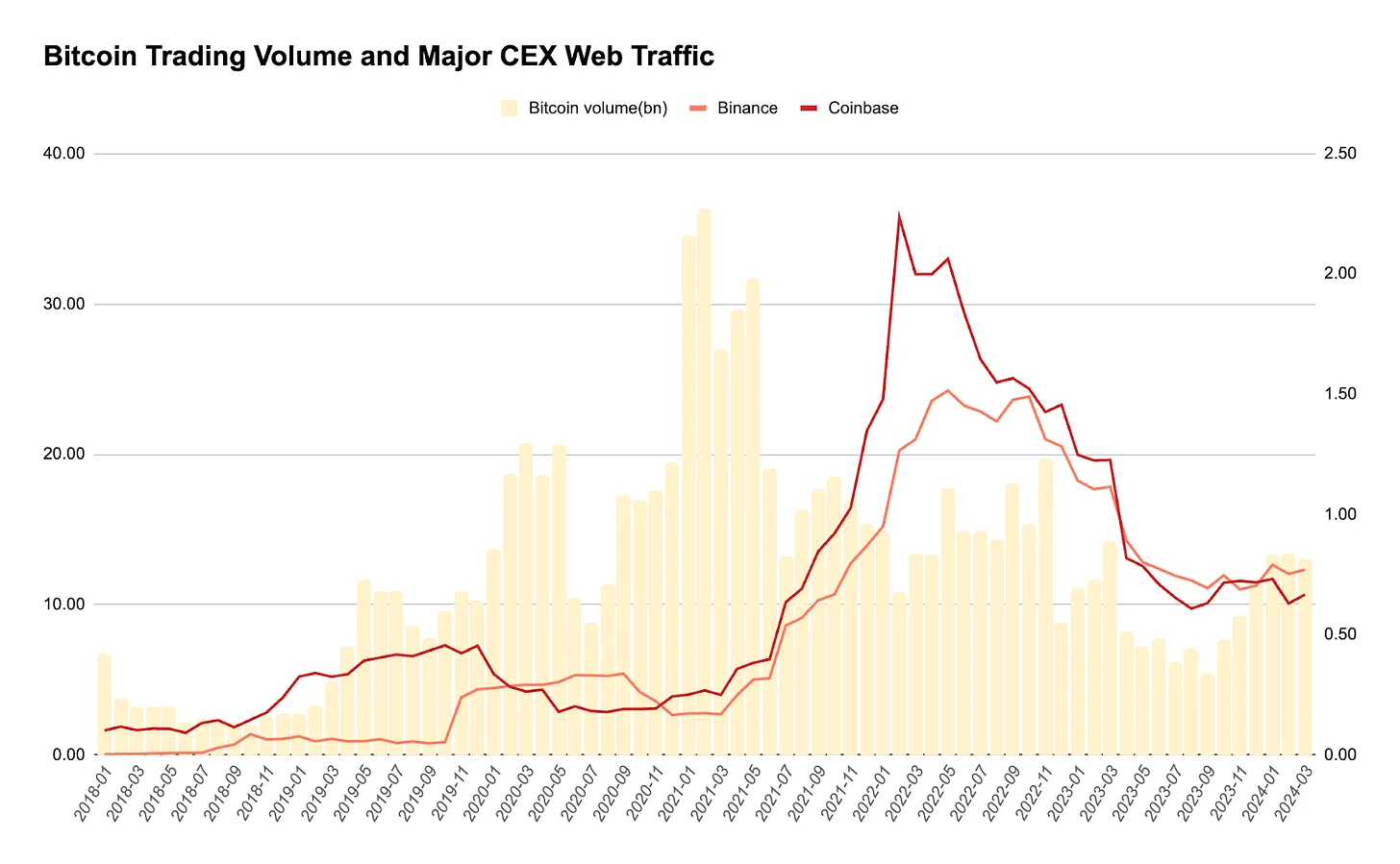

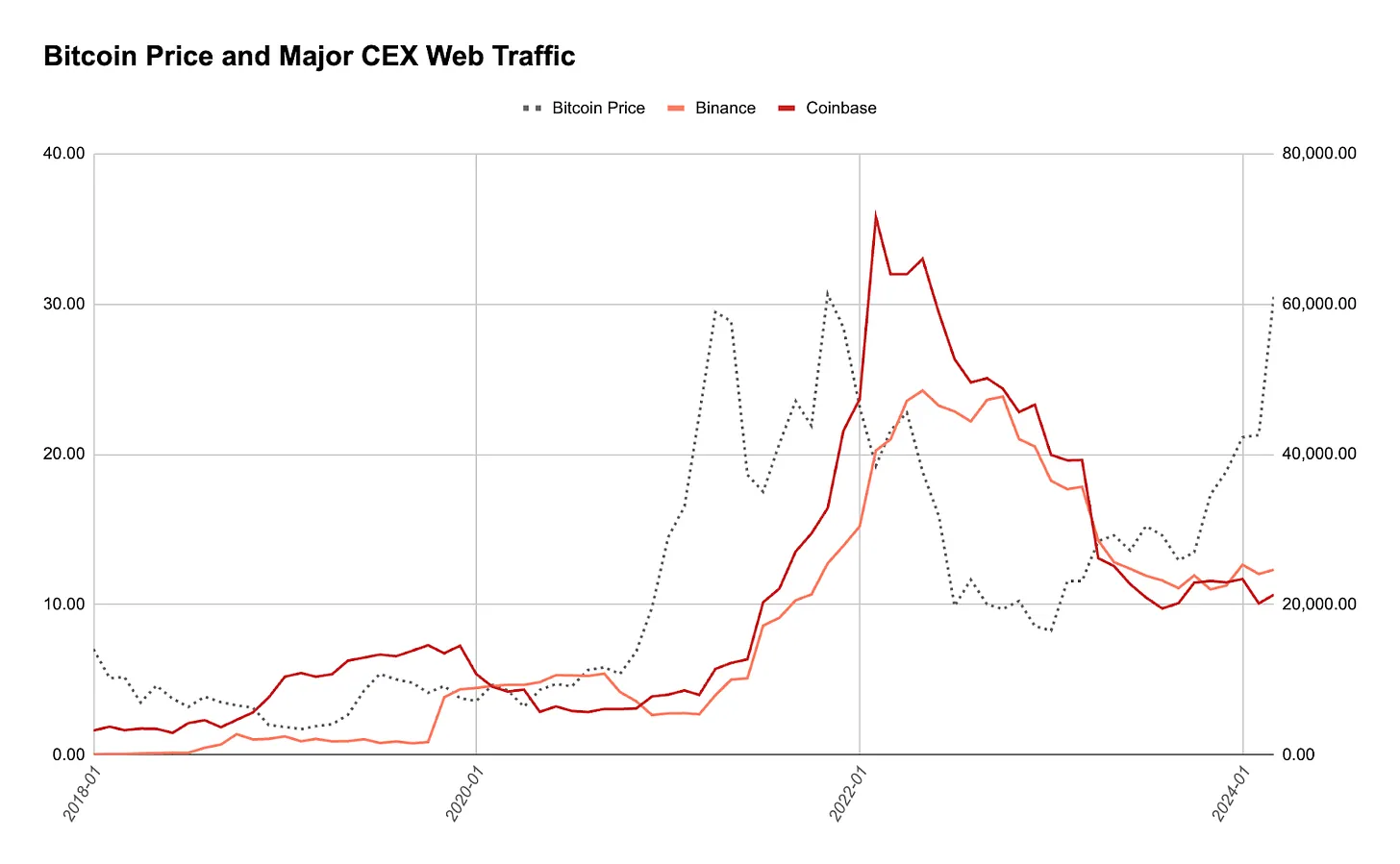

With the recent surge in cryptocurrency prices, the most popular area is undoubtedly cryptocurrencyexchangeBy analyzingBinanceSuch major cryptocurrenciesexchangeFrom the network traffic, we can see that the current market prosperity is not as hot as in previous periods.

Comparing Bitcoin prices and trading volumes with each exchange’s web traffic further illustrates the difference from past booms.Bitcoin prices have risen sharply while trading volume and exchange network traffic have remained low, suggesting that trading outside of cryptocurrency exchanges, such as ETFs, may be driving the price increase.

If this trend accelerates, we believeRetail investors will play a smaller role during this period than in the past, ETFs and other traditionally traded financial products may play a larger role.

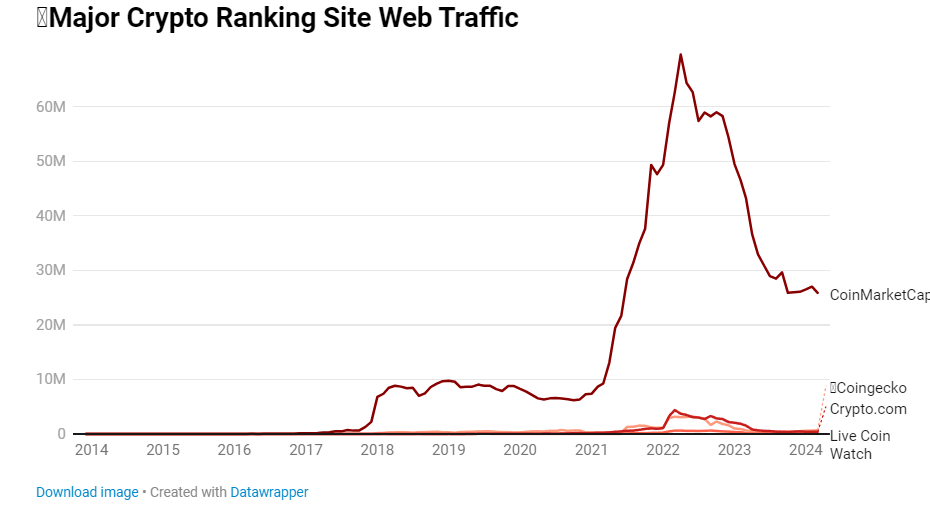

2.Cryptocurrency Ranking Sites

CoinMarketCap dominates the web traffic ranking of cryptocurrency ranking portals, followed by Coingecko. The difference in web activity between CoinMarketCap and Coingecko is huge.

Web traffic to all cryptocurrency ranking sites remained stable rather than rising, which is also different from previous market booms.

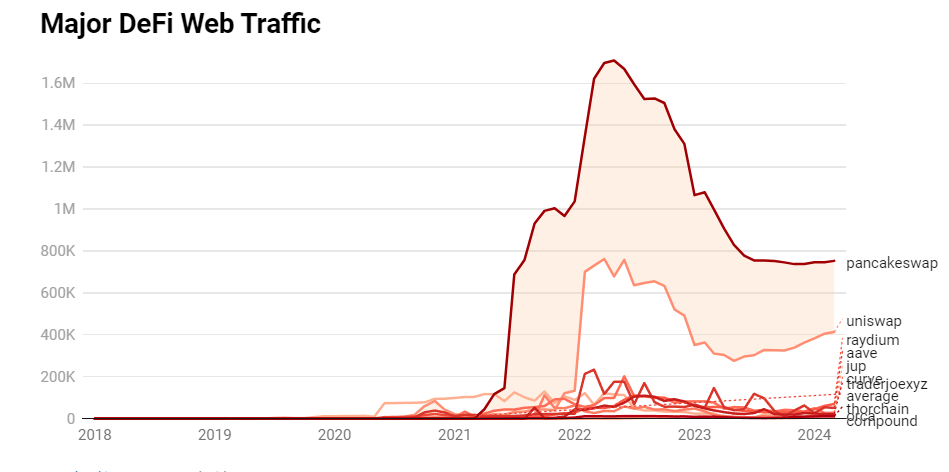

3. DeFi

When looking at the network traffic of major DeFi projects, PancakeSwap is in a dominant position, followed by Uniswap, Raydium, etc. PancakeSwap's high traffic is likely due to various features, including games and NFTs. These are not core features, but they are factors that attract users, which is difficult to find in other DeFi platforms.

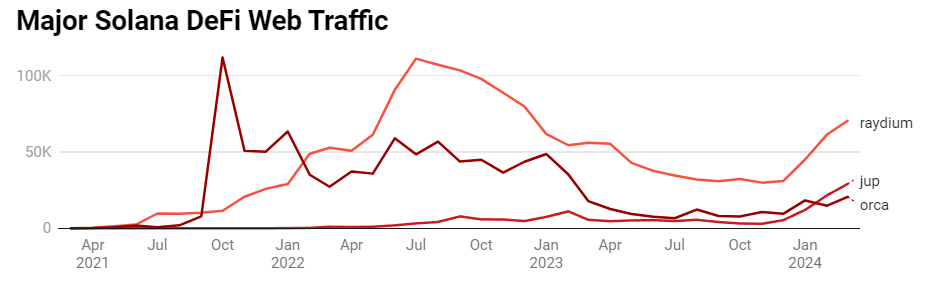

Among the recently popular Solana DeFi, Raydium leads, followed by Jup and Orca. After the FTX bankruptcy, we can see that the trading volume first dropped and then rebounded, which is in line with the trend of actual trading volume.

4. DeFi Screening Tools

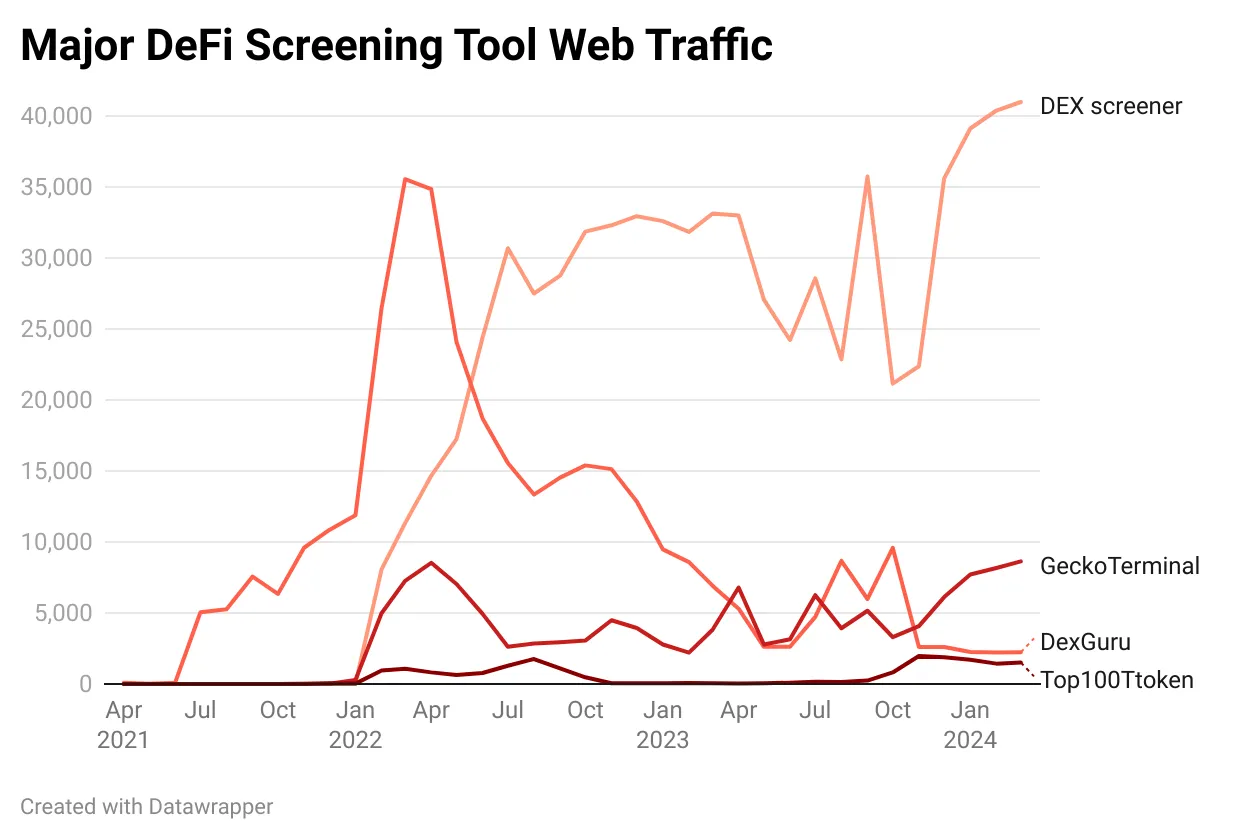

Because there are manyTokenWith the emergence of blockchain technology, it is crucial to have a tool that can view and analyze them at a glance. Currently, DEX screener dominates the network traffic, while DexGuru has been trending downward since its peak in early 2022.

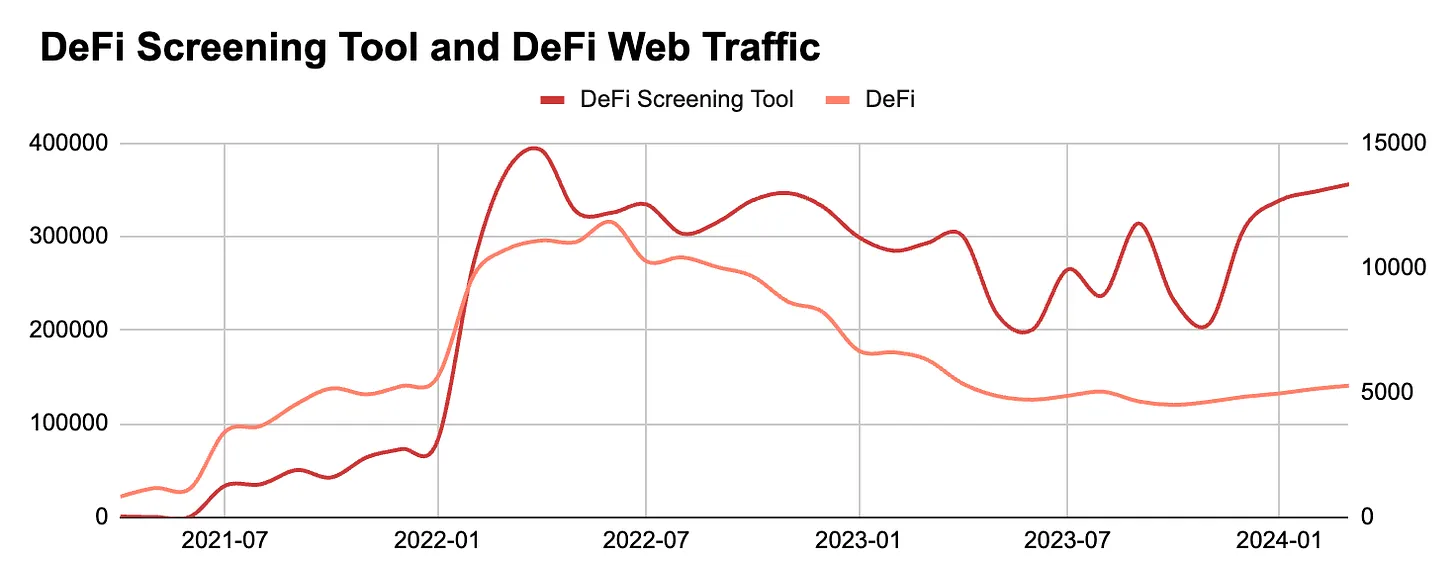

When comparing the average network traffic of DeFi screening tools and the network traffic of each major DeFi project, the gap is driven by differences in usage processes. Typical DeFi investors use analytical tools to track their crypto assets and access these tools frequently. General DeFi tools lack additional features, so traffic may only be concentrated when making investment decisions. In addition, some DeFi analytical tools also support transactions such as swaps, which also adds more reasons for users to stay.

in conclusion

In this article, we look at the blockchain market using the often overlooked web traffic, which is one of the various factors used when analyzing the blockchain market. The most impressive finding is that, unlike in the past, the market is not currently experiencing an explosion in traffic. Even taking into account the evolution of services and the fact that many services have been released as applications, the volume is still low, so it is difficult to conclude that the cryptocurrency market has reached boom times based on this metric alone.

We hope that this analysis will allow many market participants to gain a more comprehensive understanding of the blockchain market through the lens of network traffic activity.

The article comes from the Internet:The traffic of encrypted websites such as CEX is not as high as the previous peak, and retail investors are pouring in.Xiaobai NavigationThe climax of entry has not yet arrived?

Related recommendations: Delphi Digital Co-creation: Cryptocurrency and AI The combination is inevitable

Cryptocurrency and AI are a perfect combination, with the cornerstones of the most powerful technology being auditability, community ownership, and community direction. Written by: Tommy, Co-founder of Delphi Digital Translated by: Xiaobai Navigation Coderworld Introduction This article explores in depth the inevitable combination of cryptocurrency and artificial intelligence, and analyzes the impact of this combination on the future…