A comprehensive review of the Restaking track. How much do you know about the projects that should not be missed in the "Staking Year"?

Written by: Peng SUN, Foresight News

2024 is still a big market away from the prediction of “Pledge Year”.

From Cosmos, Solana ecosystem to Ethereum, staking is already a recognized wealth password in the industry. As Ethereum's demand for liquidity staking and capital efficiency increases, EigenLayer's expected currency issuance, AltLayer's airdrop and Renzo's financing news directly triggered the Restaking war. Restaking was first proposed by Eigenlayer founder Sreeram Kannan, allowing ETH that has been pledged on Ethereum to be pledged again on other consensus protocols, allowing it to be shared into the Ethereum economy.Safetysex, to ensure one’s ownSafetyGet up and running.

Currently, Renzo, ether.fi, Kelp DAOThe airdrop point plans of Ethereum LRT projects such as , Eigenpie, Swell, and Puffer Finance have driven the market's FOMO sentiment. Outside of these mainstream projects, are there other opportunities in the Restaking track? To this end, the author made a brief inventory of the Restaking track and sorted out a total of 47 projects, including 20 Ethereum Restaking protocols and 7 full-chain LRT protocols. In addition to EigenLayer and Ethereum-related protocols, LRTFi, and infrastructure, the author has also compiled some Cosmos, NEAR, Solana, Bitcoin, BNB Chain, Polygon, Berachain and other public chain restaking projects for the benefit of readers.

Restaking protocol

EigenLayer

-

Whether to issue coins: No coins have been issued yet

-

Supported pledge currencies: ankrETH, cbETH, wBETH, oETH, swETH, stETH, ETHx, osETH, etc.

-

Whether to accumulate multiple points: EigenLayer points

EigenLayerIt is the Ethereum re-staking protocol and the leader in the re-staking track. It supports LST such as ankrETH, cbETH, wBETH, oETH, swETH, stETH, ETHx, osETH and so on. Token, Ethereum verification nodes can also use native ETH to re-pledge. According to DefiLlama data, EigenLayer TVL has exceeded US$2 billion, increasing more than 7 times since December 18.

Recently, EigenLayer launched the second phase testnet of EigenLayer and EigenDA, and the mainnet will be launched in the first half of 2024. The third phase will introduce AVS (Active Verification Service) outside of EigenDA, and it is expected that the third phase will enter the test network and main network in 2024. At the same time, EigenLayer also plans to DApps provides "sharedSafety” mode, which will allow protocols to join the network by leveraging the public Ethereum staking pool. In addition, the Ethereum re-pledge amount on EigenLayer (currently over $1.7 billion) can be simultaneously provided to all services developed on the network to achieve a common security mechanism.

In February 2023, EigenLabs, the team behind EigenLayer, completed a $50 million Series A financing, led by Blockchain Capital, with participation from Coinbase Ventures, Polychain Capital, Hack VC, Electric Capital, IOSG Ventures, etc. The valuation terms were not disclosed.

EigenLayer has not issued coins yet, but has launched “re-pledge points”, which are issued based on the user’s re-pledge time and amount. Currently, EigenLayer has extended the re-staking opening window to February 6th to February 10th and removed the cap for all LST.

Kelp DAO

-

Whether to issue coins: No coins have been issued yet

-

Supported pledge currencies: ETHx, sfrxETH, stETH

-

Whether to accumulate multiple points: Yes

Kelp DAO是一个多链流动性质押平台,其创始人此前创立了流动性质押协议 Stader Labs,Stader 在 Polygon 与 BNB Chain 上均是第二大 LSD 协议。据 DefiLlama 数据显示,Kelp DAO TVL 现为 2.55 亿美元。

Kelp DAO 目前正在 EigenLayer 上构建 LRT 解决方案,其再质押代币为 rsETH,目前支持的 LST 包括 ETHx(Stader)、sfrxETH(Frax)与 stETH(Lido)。用户可将上述资产再质押换取 rsETH,reETH 价格目前是各种奖励与已质押 LST 的基础价格。rsETH 可用于其他 DeFi 协议。

Currently, Kelp DAO has launched Kelp Miles incentives. Kelp Miles are used to track users’ contributions to Kelp and are used to determine future reward distribution proportions. Kelp Miles depends on the user's LST re-staking amount and the number of days of staking. Users who previously staked LST from December 12, 2023 to January 1, 2024 can receive 1.25x Kelp Miles in the next 3 months. Users who stake LST after January 1st will receive Kelp Miles rewards as usual.

In addition, all users who re-stake on Kelp before the EigenLayer deposit limit is closed are eligible to receive EigenLayer Points, which will be distributed according to the amount of LST deposited by the user.

ether.fi

-

Whether to issue coins: No coins have been issued yet

-

Supported pledge currency: ETH

-

Whether to accumulate multiple points: Yes

ether.fi是一个流动性质押平台,已于 2023 年 11 月 15 日推出其流动性再质押代币 eETH,允许用户抵押其 ETH 以获得抵押奖励,并自动在 EigenLayer 中再质押其 ETH,无需用户手动完成再质押。eETH 可用于 Pendle、Curve、Balancer、Maverick、Gravita、Term Finance、Smmelier 等 DeFi 协议。用户可将 eETH 封装成 weETH,weETH 未来也可在 Balancer、Gravita、Pendle、Aura、Maverick 等 DApp 中使用。此外,ether.fi 还将推出 Staders,可用于质押 eETH。据 DefiLlama 数据显示,ether.fi TVL 现为 5.07 亿美元。

ether.fi has launched loyalty points. eETH or weETH holders can obtain loyalty points and EigenLayer points at 100%. Loyalty points may be used for decentralized governance and cannot be transferred. Loyalty points = staked ETH * 1000 * number of days staked.

Eigenpie

-

Whether to issue coins: No coins have been issued yet

-

Supported pledge currencies: swETH, wBETH, mETH, sfrxETH, rETH, stETH, etc.

-

Whether to accumulate multiple points: EigenLayer points will be launched soon

EigenpieIt is a SubDAO organization under the multi-chain income protocol Magpie that provides liquidity re-pledge services. Users can re-pledge their swETH, wBETH, mETH, sfrxETH, rETH, stETH and other LST assets to Eigenpie. Since the opening of the LST pre-deposit window on January 28, TVL has exceeded US$100 million and is now US$116 million. Pre-deposits are open until 03:00 on February 10, Beijing time.

Previously on January 23, Eigenpie announced the economics of EGP tokens, with a total supply of 10 million, and the allocation included IDO (40%),CommunityIncentive (35%), Magpie Treasury (15%), and Early Backer Airdrop (10%). Eigenpie promises to introduce EGP tokens through a fair launch, without the participation of VC or pre-sale activities, ensuring equal opportunities for all participants. The team gave up the token allocation and allocated 15% EGP tokens to Magpie Treasury.

Eigenpie has now launched a points reward system. For every 1 ETH of LST deposited, users can obtain 1 Eigenpie point per hour. Depositors can earn 2x points 15 days before pre-deposit. The points can be used to obtain airdrops and participate in IDO.

Renzo

-

Whether to issue coins: No coins have been issued yet

-

Supported pledge currency: ETH

-

Whether to accumulate multiple points: Yes

RenzoIt is an Ethereum staking protocol based on EigenLayer. The mainnet was launched on December 18 last year and launched the native ETH re-pledge function. Users can earn ETH re-pledge income and 100% EigenLayer points. Every time a user deposits an LST or ETH, an equivalent amount of ezETH will be minted. Renzo runs a distributed Ethereum validator infrastructure powered by Figment and P2P.org, with unlimited participation in EigenLayer. When users deposit native ETH, they must reach the minimum limit of 32 ETH before staking through the Ethereum beacon chain verification node. Renzo will also launch a Trade feature. According to DefiLlama data, Renzo TVL is approximately $155 million.

On January 16, 2024, Renzo completed a US$3.2 million seed round of financing, led by Maven11, with participation from OKX Ventures, IOSG Ventures, Figment Capital, SevenX Ventures, and others, with a valuation of US$25 million.

Renzo has now launched the points program ezPoints. Users holding ezETH can receive 1 ezPoints every hour, and early users will also receive rewards. Users who provide liquidity to the ezETH/WETH capital pool will receive 2x ezPoints rewards, and can also invite new users to earn exPoints.

Puffer Finance

-

Whether to issue coins: No coins have been issued yet

-

Supported pledge currencies: stETH, wstETH

-

Whether to accumulate multiple points: Yes

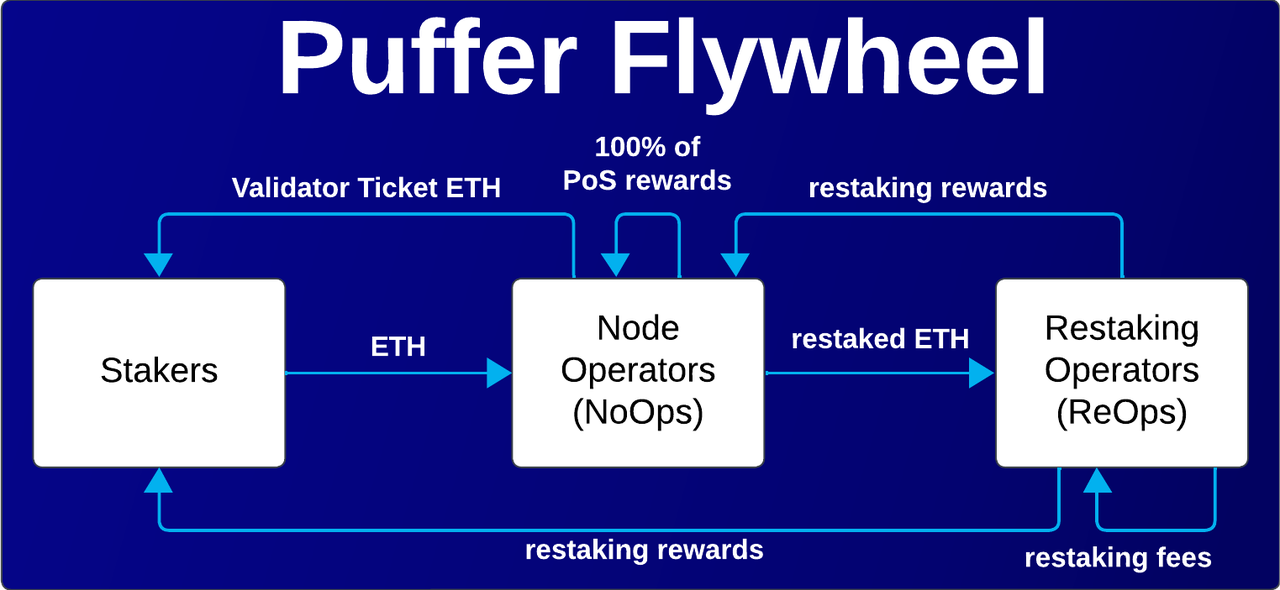

Puffer FinanceIt is a native liquidity re-pledge protocol built on Eigenlayer. The protocol is composed of pledgers and node operators (NoOps). Users holding 1 ETH can run the validator and retain 100% PoS rewards (including execution rewards and consensus rewards ). NoOps can delegate the ETH in its validators to re-staking operators (ReOps) in exchange for re-staking rewards, and node operators (NoOps) can also choose their MEV strategy independently. Stakeholders can deposit any amount of ETH to obtain the native liquidity staking token (nLRT) pufETH. pufETH also uses Compound's cToken mechanism, which is not only fully compatible with DeFi protocols, but the value of pufETH will increase as the protocol mints validator tickets (tickets) and PoS re-staking rewards.

The difference between Puffer's nLRT and other LRTs is that nLRT can obtain traditional PoS rewards and re-staking rewards, while other re-staking protocols only provide point rewards related to their native tokens.

Image Source:Puffer Docs

On September 1, 2023, several Ethereum liquidity staking providers, including Rocket Pool, StakeWise, Stader Labs, Diva Stake, Puffer Finance, and Swell Network, committed (or are committing) to limit their holdings to no more than the total pledged amount 22%, designed to deal with the increasing concentration of the Ethereum staking market.

In August 2023, Puffer Finance completed a $5.5 million seed round, led by Lemniscap and Lightspeed Faction, and led by Brevan Howard Digital, Bankless Ventures, Animoca Ventures, KuCoin Ventures, DACM, LBank Labs, SNZ, Canonical Crypto, 33DAO, WAGMI33, Concave And angel investor Lightspeed partner Anand Iyer, Eigen Layer founder Sreeram Kannan, Coinbase staking business director Frederick Allen, F2pool and Cobo joint venture Shenyu, Curve core contributor Mr. Block, North AmericaBlockchainAssociation President Ramble, Eigen Layer Chief Strategy Officer Calvin Liu, Obol Chief Commercial Officer Richard Malone, PledgeCommunityLeader Ladislaus von Daniels participated in the vote.

On January 30, 2024, Binance Labs announced its investment in LSD protocol Puffer Finance. The specific investment amount was not disclosed.

Puffer Finance will soon open staking for ETH, stETH, USDT and USDC, and users will be rewarded with Puffer and EigenLayer points at the same time. In addition, Puffer Finance has launched the Crunchy Carrot event on January 30. Users can link their Twitter accounts andwallet, select "Family" and retweet event tweets to earn points and allow you to view the points ranking list. At present, Puffer Finance has ended the first phase of staking ahead of schedule, the second phase of staking has started, and TVL has exceeded US$150 million.

Swell Network

-

Whether to issue coins: No coins have been issued yet

-

Supported pledge currency: ETH

-

Whether to accumulate multiple points: Yes

Swell NetworkIt is an Ethereum staking protocol that launched the re-staking token rswETH (Restaked Swell Ether) on January 30 this year, providing unlimited access to EigenLayer Restaking points, which can be used in DeFi while continuing to accumulate Restaking rewards. Currently, rewETH version 1.0 allows users to deposit ETH to earn rswETH and accumulate restaking rewards in the form of Pearls and EigenLayer Restaked points. According to DefiLlama data, Swell TVL is US$457 million and Swell Liquid Restaking TVL is US$4.43 million.

On March 14, 2022, Swell Network completed US$3.75 million in financing, led by Framework Ventures.

Swell Network’s native token SWELL has not yet been launched, and token economics have not been announced.

Stakestone

-

Whether to issue coins: No coins have been issued yet

-

Supported pledge currency: ETH

-

Whether to accumulate multiple points: None yet

StakestoneIt is a one-stop full-chain LST staking protocol, benchmarked against Lido, which can bring native staking income and liquidity to Layer 2. It not only supports the head staking pool, but is also compatible with re-staking and will integrate EigenLayer. StakeStone supports ETH beacon chain re-pledge and LST re-pledge, aiming to become the leading protocol on the re-pledge track.

According to DefiLlama data, in just 3 weeks from December 15, 2023 to January 3, 2024, StakeStone TVL surged from US$4.17 million to US$542 million, and the current TVL is US$669 million. StakeStone is also deeply involved in Manta's incentive activities. Among Manta New Paradigm's $900 million TVL, StakeStone provided $720 million in liquidity.

StakeStone's native LST is STONE, which has been officially upgraded to full-chain LRT. STONE is an OFT based on LayerZero, which can be seamlessly used in multi-chain liquidity markets through STONE-Fi, such as DEX, AMM, lending, stablecoins, derivatives, GameFi, SocialFi, etc. STONE does not use a rebase mechanism, but is similar to Lido's wstETH in generating revenue. In other words, the number of STONE will not change with the changes in the income generated by ETH staking, but its value will increase with the increase in ETH staking income. This is similar to the effectiveness of Puffer's cToken model.

StakeStone has not issued coins yet, and the team is expected to launch airdrop-related activities. Currently, users can stake ETH in StakeStone and earn income from the STONE-Fi ecological protocol.

ClayStack

-

Whether to issue coins: No coins have been issued yet

-

Supported pledge currencies: ETH, rETH, stETH

-

Whether to accumulate multiple points: Yes

ClayStackIt is a liquidity staking platform that entered the Ethereum re-staking field through EigenLayer on January 24. ClayStack has changed its Ethereum liquidity staking token called csETH to a re-staking token and will use the Ethereum re-staking protocol EigenLayer to provide the new service. Currently, ClayStack supports ETH, rETH, and stETH to be pledged into the protocol. According to DefiLlama data, ClayStack TVL is now $3.96 million.

CLAY is the native token of ClayStack. The issuance plan will be announced in February and will provide users with reward points at a 1:1 ratio before the token is released. The total supply of CLAY is 100 million, and 5% tokens will be distributed to the community through the IGD (Initial Governance Diversification) program.

Users can stake ETH or LST to earn CLAY points and EigenLayer points without upper limit. During IGD, users can receive more CLAY rewards. As weekly ETH deposits increase, so will csETH demand, and CLAY point allocations will also increase.

Inception

-

Whether to issue coins: No coins have been issued yet

-

Supported pledge currencies: stETH, rETH, ankrETH, cbETH, wBETH, oETH, osETH, swETH, ETHx, sfrxETH, mETH, etc.

-

Whether to accumulate multiple points: No

InceptionIt is an isolated liquidity re-pledge protocol that supports the re-pledge of stETH, rETH, ankrETH, cbETH, wBETH, oETH, osETH, swETH, ETHx, sfrxETH, mETH and other LSTs, and issues isolated liquidity re-pledge. Tokens (iLRTs). iLRT can be used in DeFi protocols and remains isolated from the underlying LST.

Inception has been launched on the Ethereum mainnet, and its current TVL is $65,000. Inception will also expand to other Layer 2 networks and integrate multiple DeFi protocols.

According to the roadmap, Inception will launch a private placement round of financing in the first quarter of 2024, launch the mainnet, launch TGE in the second quarter, and develop full-chain LRT. InceptionLRT will launch the native token ING. The current token allocation rules are: 2.5% tokens are allocated in the Pre-Seed round, 9% is allocated to the seed round, 10% is allocated to the private placement round, 6% is allocated to the treasury, 6% is allocated to consultants, and 3% is used for Marketing, 15% allocated to team members, 48.5% used for liquidity incentives.

Sommelier Finance

-

Whether to issue coins: Yes

-

Supported pledge currencies: eETH, stETH, swETH

-

Whether to accumulate multiple points: Yes

Sommelier FinanceIt is a decentralized asset management protocol built on the Cosmos SDK. It has now launched re-pledge vaults Turbo eETH, Turbo stETH, and Turbo swETH. Users can also earn ether.fi loyalty points by depositing in the eETH vault.

According to DefiLlama data, Sommelier TVL is now $60.23 million.

The total supply of Sommelier's native token SOMM is 500 million and has been distributed to all investors in August 2023.

Astrid

-

Whether to issue coins: No coins have been issued yet

-

Supported pledge currencies: stETH, rETH or cbETH

-

Whether to accumulate multiple points: None yet

AstridIt is an Ethereum liquidity re-pledge protocol powered by EigenLayer. Users deposit LST (stETH, rETH or cbETH) into the re-pledge pool and obtain Astrid liquidity re-pledge tokens (LRT), including rstETH, rrETH or rcbETH. LST will be staked on EigenLayer and voted by Astrid DAO to be delegated to multiple operators. The rewards earned by users are calculated with compound interest, then pledged back to EigenLayer, and distributed through balance reset. Users holding LRT will see their balances automatically adjusted.

Currently, Astrid has launched the test network and has launched re-staking points. Astrid points will be determined based on the user's re-staking ETH and the staking duration. The total points are the sum of stETH points and rETH points.

GenesisLRT

-

Whether to issue coins: No coins have been issued yet

-

Supported pledge currency: ETH

-

Whether to accumulate multiple points: None yet

GenesisLRTIt is a re-staking platform that allows ETH to be pledged to multiple networks in exchange for the re-staking token genETH. Currently, GenesisLRT has been launched on the test network, and the main network has not yet been launched. According to the official website, the TVL of ETH pledged on the Genesis test network is US$147 million.

According to the roadmap, GenesisLRT will complete a seed round of financing and a US$3 million private placement round in the first quarter, and deploy the Genesis governance token GEN. It will launch TGE and GEN token airdrops in the second quarter, and develop full-chain LRT and modularization in the second half of the year. LRT.

Restaking Cloud – K2

Restaking Cloud – K2It is an Ethereum liquidity re-pledge protocol, which is now online on the test network. It currently supports kETH, stETH, rETH, dETH and ETH re-pledge in exchange for K2, but the TVL is 0.

Rest Finance

-

Whether to issue coins: No coins have been issued yet

-

Supported pledge currencies: ETH, stETH, rETH, cbETH, etc.

-

Whether to accumulate multiple points: Yes

Rest FinanceIt is an ACM (algorithmic collateral management) enhanced liquidity staking solution. Users can pledge LST such as ETH, stETH, rETH, cbETH and obtain Rest liquidity re-pledge token restETH. Holding restETH will receive LST rewards and EigenLayer in real time AVS Reward. ACM can provide deep liquidity for the protocol, increase yields, and strengthen anchoring stability.

Rest Finance was launched on January 29, but according to the official website, Rest Finance TVL is now 0.

Rest Finance's native token is REST, which has not yet been issued. The total supply is 100 million and the FDV is US$20 million. 10% of the total REST supply will be allocated to the Investor Reserve, 20% to contributors, 5% to the DAO treasury, 5% for initial liquidity, and 60% for token release. The REST token call option is oREST, and the holder can purchase REST at a discount to the market price. Exercising oREST will result in a premium being paid directly to the protocol.

Restake Finance DAO (RestakeFi)

-

Whether to issue coins: No coins have been issued yet

-

Supported pledge currency: LST

-

Whether to accumulate multiple points: Yes

RestakeFiIt is a modular liquidity re-pledge platform powered by EigenLayer. Users can deposit their LST into RestakeFi to obtain their re-pledge token rstETH. rstETH holders can receive EigenLayer native rewards and Ethereum staking rewards. At the same time, rstETH can also be traded in DEX and will be integrated into DeFi protocols. According to its official documentation, RestakeFi will first integrate stETH into its protocol and then support other LST.

Currently, Restake has been launched on the test network, and the main network has not yet been released.

In September 2023, RestakeFi completed a $500,000 seed round of financing, with participation from AlfaDAO, DCD, Yields and More, Moni, etc.

StakeEase

-

Whether to issue coins: No coins have been issued yet

-

Supported pledge currency: LST

-

Whether to accumulate multiple points: No

StakeEaseIt is a cross-chain re-staking aggregator, powered by Router’s Cross-Chain Intent Framework (CCIF), which can complete the multi-step re-staking process with one click. On January 18, StakeEase launched the Ethereum Goerli test network, and now supports using Stader to pledge ETH and using Kelp to pledge again.

StakeEase will soon launch a points system and launch the mainnet to integrate more protocols and LST.

YieldNest

YieldNestIt is a liquidity re-pledge protocol supported by EigenLayer and has not yet been launched as a product.

Euclid Finance

-

Whether to issue coins: No coins have been issued yet

-

Supported pledge currencies: ETH, LST

-

Whether to accumulate multiple points: Yes

Euclid FinanceIt is a full-chain liquidity re-pledge protocol based on EigenLayer. Users can re-pledge their ETH and LST into the protocol and obtain LRT elETH. elETH can automatically compound interest. Holding elETH can obtain re-pledge rewards, EigenLayer points and Euclid governance. Token ECL rewards. In addition, if users independently pledge ECL and then pledge ETH or LST, they can join the operating node network.

The product has not yet been launched, and the token status has not been announced.

Rio Network

Rio NetworkIt is a liquidity re-pledge network. Its first liquidity re-pledge token is reETH, and the Restake product has not yet been launched. Chorus One, Figment, HashKey Cloud, Kiln and Unit 410 are Rio's first node operators and will operate ETH validators and maintain AVS.

According to official documents, Rio Network has completed a seed round of financing, with Polygon Capital, Blockchain Capital and Breyer Capital co-leading the investment.

Layerless

LayerlessIt is a full-chain liquidity re-pledge protocol supported by EigenLayer and LayerZero. It was launched on January 4. It does not have an official website yet and will be launched on the testnet in the first week of February. Layerless is creating full-chain re-pledge tokens (ORT). Users can deposit LST tokens supported by EigenLayer into EigenLayer through Layerless. The ORT received is liquid and can be used in DeFi protocols.

LRTFi

Agilely

AgilelyIt is a liquidity re-pledge derivatives protocol that has introduced a decentralized lending protocol on Arbitrum and launched a full-chain interest-bearing stablecoin USDA (Agilely USD) supported by LayerZero. USDA is backed by collateral such as ETH, wstETH, rETH, cbETH, sfrxETH, wBTC, ARB, GLP, GMX and LRT. At present, its products have supported ETH, wstETH, rETH, wBTC, sfrxETH, cbETH to mint USDA, but have not yet supported assets such as LRT. Users can mortgage the above assets, create Vaults and borrow USDA.

Agilely currently supports three networks: Arbitrum, BNB Chain, and Polygon. Agilely token AGL has not yet been launched, and a public sale and points program will be launched.

Entangle

EntangleIt is a cross-chain DeFi protocol whose products include Liquid Vaults, oracles, and Photon communication protocol. Entangle is trying to enter the re-pledge track. Users can deposit their LP tokens or pledge tokens into Liquid Vaults to obtain 1:1 supported LSD, which can be used for re-pledge or exchange. Entangle now supports 11 itemsBlockchainnetwork. Currently, Entangle has launched the testnet and launched the testnet incentive plan.

In January 2024, Entangle completed US$4 million in seed and private placement rounds, with participation from Big Brain Holdings, Launch Code Capital, LBank Labs, Skynet EGLD Capital, Cogient Ventures, Owl Ventures, Faculty Group, Seier Capital and other institutions.

Entangle’s native token is NGL, which has not yet been launched.

Ion Protocol

Ion ProtocolIt is a liquidity release protocol for pledgers and a loan platform for pledging and re-pledged assets. Users can transfer assets supported by any validator (including LST, LST LP positions, re-pledge positions, liquidity re-pledge positions, and pledged LST LP positions). , LST index products, etc.) into the collateral vault and mint all ETH from their deposits.

Currently, Ion Protocol has launched testnet V2.

In July 2023, Ion Protocol completed a $2 million Pre-Seed round of financing, which was jointly led by Portal Ventures and SevenX Ventures. Participating investors include Foresight X, Bankless Ventures, Maelstrom Fund, Alexander, The Daily Gwei founder Anthony Sassano (sassal .eth) and Synracy Capital co-founder Ryan Watkins, among others.

In addition, Ion Protocol was selected as one of the first batch of Foresight X Accelerator Program projects in March 2023.

Pendle

-

Whether to issue coins: Yes

-

Supported pledge currencies: eETH, reETH, ezETH

-

Whether to accumulate multiple points: Yes

PendleIt is a DeFi yield protocol. The Pendle LRT pool has recently been launched. It currently supports Ether.fi’s eETH, Kelp DAO’s reETH and Renzo Finance’s ezETH. Users who purchase Pendle YT tokens can obtain points (2-3) corresponding to the LRT protocol. times) and EigenLayer integral (1 times).

Equilibria

EquilibriaIt is a revenue booster on Pendle, using the veToken/ revenue-increasing model adopted by Pendle, providing higher returns to LP through the tokenized version of vePendle, ePENDLE, and providing additional rewards to PENDLE holders. LPs on Pendle can deposit into Pendle through Equilibria to increase returns without holding any vePENDLE positions. PENDLE holders can use their PENDLE to mint ePENDLE, and ePENDLE can be re-pledged to earn additional income.

Maverick Protocol

Maverick Protocolis a DeFi infrastructure that allows liquidity providers to achieve high capital efficiency through their required liquidity provision (LP) strategies. Now supports rsETH, rswETH, weETH and other LRT and related assets.

In June 2023, Maverick Protocol completed a strategic round of financing of US$9 million, led by Founders Fund, with participating investors including Pantera Capital, Binance Labs, Coinbase Ventures and Apollo Crypto. This round of financing will be used to expand the scale of the protocol, deploy to new chains and support developers to build on the infrastructure. At the same time, Maverick Protocol is stillBinance Project 34 on Launchpool.

Davos

DavosIt is an over-collateralized stablecoin project that has integrated LST and LRT as its Collateralized Debt Position (CDP) collateral. After depositing the collateral, users can mint and borrow its full-chain stablecoin DUSD. For LST, the Davos LTV ratio is set to 66%, ensuring that the borrowed DUSD is over-collateralized by 150%. Davos already supports Ethereum mainnet, Polygon mainnet, Arbitrum, Optimism, Polygon zkEVM, BNB Smart Chain, Linea mainnet and Avalanche.

According to DefiLlama data, Davos TVL is approximately $486,000.

In January 2023, Davos received a $500,000 Pre-Seed round of financing from Polygon Ventures and Polygon co-founder Sandeep Nailwal. In March of the same year, Davos received investment from MH Ventures and LD Capital. In addition, Davos Protocol participated in OKX Web3 in September 2023 wallet The seventh event of Cryptopedia.

Ender Protocol

Ender Protocolis a liquidity staking protocol that allows users to mint centralized yield tokens and liquidity staking power tokens END, which are fully collateralized by the liquidity staking rewards of Ender Bond bond deposits. Ender will launch endETH and build a restaking solution on the EigenLayer stack. Its tweet on January 31 stated that Ender Protocol is an all-in-one liquidity staking, re-staking, revenue separation, revenue provision, LST-bond, deformation revenue compression, metaverse bond, driven by liquidity staking. Metaverse,L2-EVOS, superfluid re-pledge and liquidity supply derivatives protocol, aiming to become a yield-based liquidity staking income trading protocol similar to Pendle.

Ender Protocol can mint Ender WL NFT#2 to obtain early participation qualifications and receive ENDR airdrops. There is no participation in VC and private placement rounds, and tokens will not be distributed to insiders. Users can also participate in the Bond Liquidity Provision (BLP) event to receive airdrops.

Restaking public chain

Supermeta

SupermetaIt is a zkLayer2 specifically used for liquidity re-pledge. Users can deposit supported LSD into their Layer2 bridge and receive LST, while receiving ETH and EigenLayer automatic compound interest rewards. Supermeta's LRT can be used as collateral or to increase Supermeta's native DEX liquidity.

Currently, Supermeta products are not yet online.

Tenet

TenetIt is a re-staking public chain that introduces the DiPoS consensus mechanism, allowing LSD from other networks to be re-staking to Tenet to protect the network and participate in governance. Tenet's native token is TENET, which can be used as Gas to pay transaction fees. TENET can also be pledged to validators in exchange for LSD tokens tTENET. User pledges otherBlockchainThe LSD of the network can be exchanged for tLSD. At the same time, Tenet adopts the ve token economic model, and TENET can be locked to generate veTENET.

Tenet also has a native stablecoin protocol to support the minting of all tLSD on Tenet. Its US dollar stablecoin is LSDC (Liquid Stake Dollar), which can be used to pay loans on the Tenet stablecoin protocol and can be minted by re-pledged LSD to the Tenet valdiator network during the creation period. Users can borrow LSDC interest-free and earn interest through underlying collateral returns.

Currently, Tenet has launched the mainnet beta version.

Karak

KarakIt is a modular Layer2 with native risk management, re-pledge and AI infrastructure. Currently, users can earn XP rewards on Subsea.

On December 13, 2023, Karak developer Andalusia Labs completed a $48 million Series A round of financing, led by Lightspeed Venture Partners, with a valuation of more than $1 billion. Participating investors include Mubadala Capital as well as Pantera Capital, Framework Ventures, Bain Capital Ventures and Digital Money Group.

Omni Network

Omni Networkis a re-pledgeBlockchain, allowing developers to access their applications across all Rollups, Omni validators need to stake their ETH to participate in network consensus. Omni introduces a unified global state layer to ensure security through EigenLayer's re-pledge, which can be used for cross-chain communication, lending, etc. between different Rollups.

In April 2023, Omni Network completed US$18 million in financing, with participation from Pantera Capital, Two Sigma Ventures, Jump Crypto, Hashed, The Spartan Group and others.

Restaking infrastructure

Among the Restaking infrastructure projects, this article briefly lists individual projects. EigenLayer ecological AVS, Rollup, node operators, etc. will be further reviewed later.

AltLayer

AltLayerIt is a Rollup as a Service protocol. In December 2023, EigenLayer collaborated with AltLayer to launch Restaked Rollups. AltLayer expects Restaked Rollups to be available as a single bundle so that Rollup users can benefit from a single point of integration. Restaked Rollups can integrate decentralized sorting, fast determinism, composability and other functions into a single Rollup.

AltLayer is also one of the first eight partners to use EigenDA for data availability.

Exocore

-

Whether to issue coins: No coins have been issued yet

-

Supported pledge currency: LST, the product is not yet online

-

Whether to accumulate multiple points: No

Exocore是一个全链再质押协议,采用模块化架构设计,结合基于 Tendermint 的拜占庭容错(BFT)共识机制、零知识(ZK)轻客户端桥接和完全兼容 EVM 的执行环境。Exocore 允许将所有支持链上的任何代币进行再质押,包括原生 L1、L2 协议代币、LST、DeFi LP 代币、稳定币与其他代币化资产,为链下服务提供加密经济安全。Exocore 通过无需信任跨链桥机制与外部 L1、L2 区块链无缝对接,无需引入额外的信任假设。同时,Exocore 引入「联盟再质押」概念,链下服务可形成一个联盟,以相互扩展其加密经济安全。

Exocore has not launched a product yet. Users can join the ecosystem on its website and apply for membership as stakers, verification nodes, developers, etc.

SSV Network

SSV NetworkIt is a decentralized open source ETH staking network based on distributed validator technology (DVT). A tweet on January 4 showed that SSV will cooperate with EigenLayer to complement and re-stake, claiming that a "mainnet" EigenLayer validator is running on SSV. At the same time, both EigenLayer and the stakers can choose to transfer the responsibilities of the validator to SSV and maintain the re-staking status of ETH on EigenLayer to obtain additional income from the SSV incentive main network.

Hyperlane

HyperlaneIt is a universal and permissionless interoperability layer built for modular blockchain stacks. Anyone can deploy Hyperlane to any blockchain environment, and blockchains where Hyperlane is deployed can communicate seamlessly. Hyperlane has partnered with EigenLayer last year, and the two parties will launch AVS integration in early 2024.

In September 2022, Hyperlane completed US$18.5 million in financing, led by Crypto Investor Variant, with participation from Galaxy Digital, CoinFund, Circle, Figment, Blockdaemon, Kraken Ventures and NFX.

Currently, Hyperlane has not announced any token information.

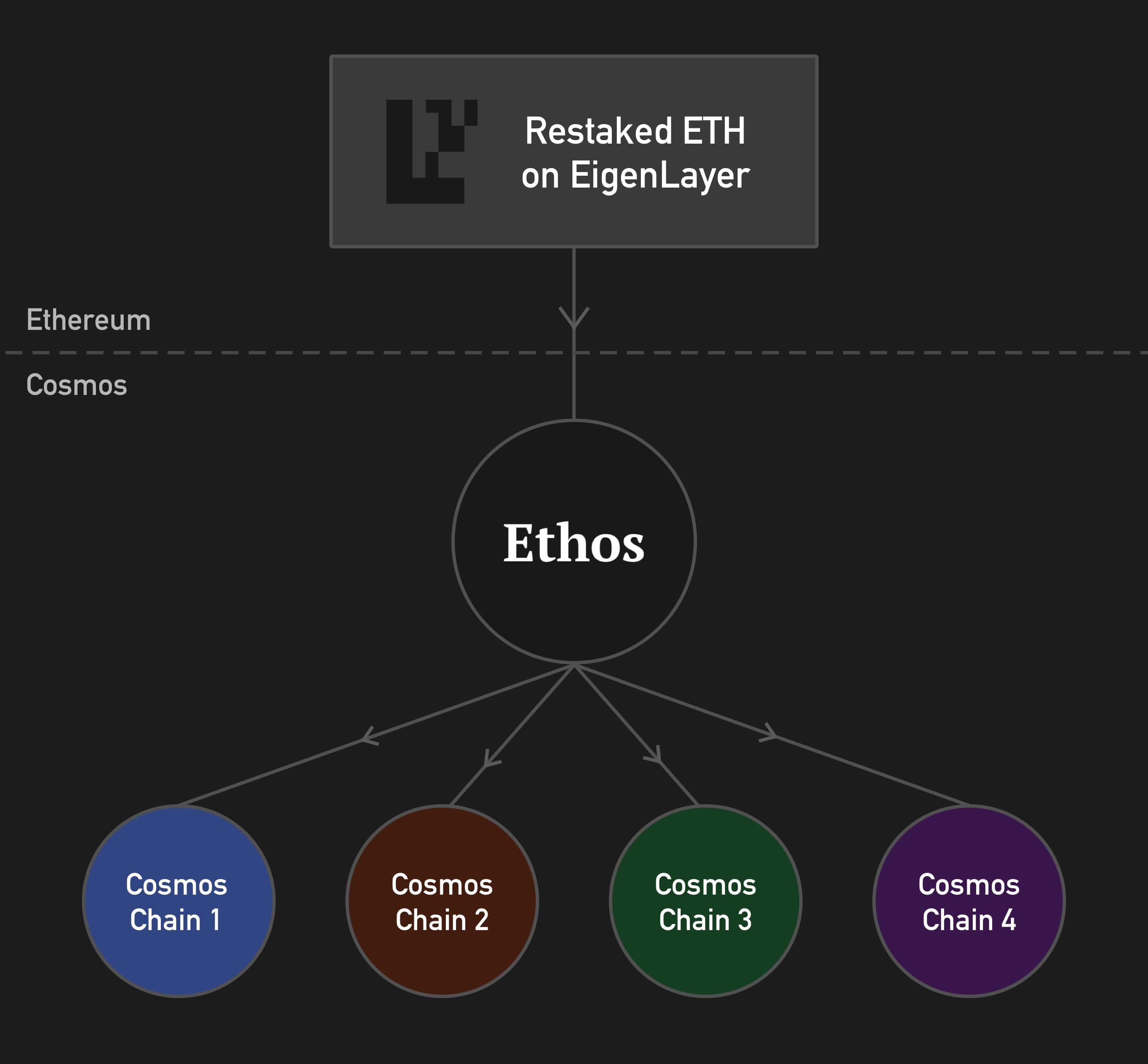

Ethos

EthosDesigned to re-stake Ethereum to Cosmos, application chains can benefit from the economic security of Ethereum. Ethos adopts Mesh Security shared security solution, deploys AVS to utilize EigenLayer infrastructure, and relies on IBC and Ethos application chain to coordinate user rights between consumer chains. EigenLayer re-stakeholders deposit ETH into AVS on Ethereum Layer1 and select a node operator for delegation. Execution layer node operators have a preset validator on each Cosmos consumer chain to delegate their virtual stake. The Ethos application chain then coordinates the updated status to the respective consumption chain via IBC and handles subsequent reward and/or slashing updates. These will be reflected to the AVS of Ethereum L1 through the off-chain relay mechanism. contractsuperior.

Image Source:Introduction to Ethos

Ethos is currently in a private testnet phase. On January 20, Ethos announced that Sommelier Finance, a decentralized asset management protocol, was its first launch partner.

Polygon Ecology

Polygon 2.0

-

Whether to issue coins: Yes

-

Supported pledge currency: POL

In June 2023, Polygon launched Polygon 2.0, aiming to become a unified network composed of L2 chains powered by ZK technology to establish the "value layer" of the Internet. Polygon co-founder Sandeep Nailwal worked on Said on Twitter in August 2023, in Polygon 2.0, its new token POL is pledged in the staking hub, and users can pledge the same POL on different chains at the same time. This staking method is called "enshrined restaking".

Polygon 2.0 aims to eliminate staking’s reliance on third parties to enhance ecosystem security and reduce centralization risks.

NEAR Ecology

LiNEAR Protocol

-

Whether to issue coins: Yes

-

Supported pledge currencies: bLiNEAR, LiETH

-

Whether to accumulate multiple points: Yes

LiNEAR ProtocolIt is a NEAR ecological full-chain liquidity staking and re-pledge agreement that allows users to pledge or re-pledge ETH, NEAR and other assets to earn income, and receive LiNEAR, bLiNEAR and LiETH. LiNEAR is LST, bLiNEAR and LiETH are LRT. LRT assets can not only obtain re-pledge income, but also obtain PoS staking rewards.

According to DefiLlama data, LiNEAR Protocol TVL is now $61.63 million.

On January 17, LiNEAR Protocol launched the governance token LNR and distributed it to active community members through Genesis Airdrop. The snapshot time is from April 5 to December 31, 2023. Users can connect to the NEAR wallet before April 15, 2024 to claim LNR rewards. LNR will give holders governance rights, including participation in decisions such as staking and re-staking strategies, multi-chain deployment, etc. The total supply of LNR in the Genesis airdrop is 1 billion, of which: 10% will be distributed to LiNEAR stakers through airdrop; 9% will be used for team incentives for a period of one year and will be distributed linearly in the next three years; 11% tokens are reserved for use airdropped in the future; 8% will be used for protocol development; 12% will be used for marketing and operations; 27% will be used for community planning; 23% will be stored in the DAO vault.

Octopus Network

-

Whether to issue coins: Yes

-

Supported pledge currency: NEAR

Octopus NetworkIt is a NEAR ecological multi-chain network. Its version 2.0 already supports NEAR re-pledge and adaptive IBC. Among them, re-pledge includes two roles: validator (Validator) and delegator (Delegator). NEAR holders can participate in re-staking. Users who re-stake at least 10,000 NEAR can run Appchain nodes, and delegators must entrust at least 100 NEAR. The 70% awarded by Appchain will be used for re-staking rewards, and the 30% will be used to repurchase OCT. Appchain rewards are distributed according to the amount of NEAR re-staking by the node. The higher the re-staking amount, the greater the reward.

The re-staking reward distribution cycle is one day. NEAR staking rewards will be automatically re-staking, but users need to receive the re-staking rewards independently.

The total supply of Octopus Network token OCT is 100 million, the circulating supply is 78.7 million, the market value is approximately US$24.49 million, and the current price is 0.3143 USDT.

Solana Ecology

Picasso

PicassoThe Kusama parachain, originally the Polkadot ecological DeFi protocol Composable Finance, has launched Mantis Games on January 28, introduced re-staking on Solana, and initially accepted SOL, jitoSOL, mSOL and bSOL. The vault will be launched starting from 50,000 SOL. It will then increase to 150,000 and 500,000 SOL. Users who hold MANTIS Games NFT can form a team. The first round of Mantis ended on January 30, with a total of 50,000 SOL deposited, a total reward of 17.5 million PICA, and a Vault APY of up to 67.04%. The second round of the Mantis Games is about to begin.

On January 31, Picasso cooperated with Solend to integrate cTokens (including cUSDC, cSOL, cUSDT, cSLND) and planned to use them in Solana's re-pledge layer. Users can re-pledge cToken in the Picasso re-pledge layer (Solana IBC) on Solana to utilize its liquidity, and users can obtain compound returns.

Picasso's native token is PICA, with a total supply of 10 billion, a circulating supply of approximately 450,000, and a market value of approximately US$73.32 million. The current price is 0.016 USDT.

Bitcoin Ecology

Babylon

BabylonIt is a Bitcoin pledge protocol that allows Bitcoin holders to pledge BTC to the PoS blockchain without third-party custody/cross-chain/encapsulation to obtain PoS network verification rights and earn income. In a tweet on October 11, 2023, Babylon said that its protocol can realize the re-hypothecation of Bitcoin. Currently, Babylon’s Bitcoin staking testnet has not yet been launched.

On December 7, the Bitcoin staking protocol Babylon completed US$18 million in financing, led by Polychain Capital and Hack VC, with participation from Framework Ventures, Polygon Ventures, OKX Ventures, and IOSG Ventures.

BNB Chain Ecology

Yield 24

-

Whether to issue coins: Yes

-

Supported pledge currencies: ETH, BNB, BTC, stablecoin or LRT

-

Whether to accumulate multiple points: Yes

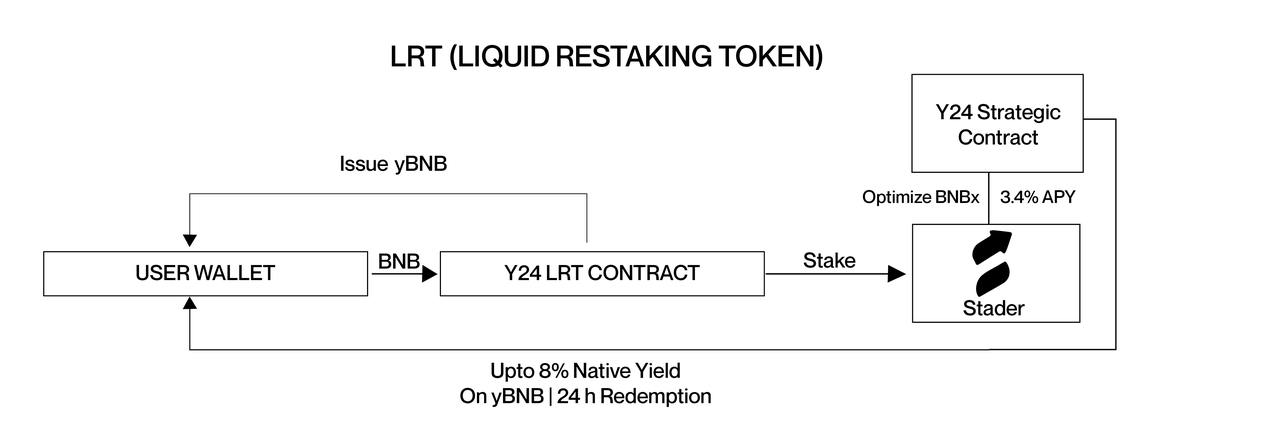

Yield 24It is a liquidity re-pledge protocol that runs on EVM-compatible chains such as BNB Chain, Ethereum and Polygon. Users can re-pledge their ETH, BNB, BTC, stablecoins or LRT in this protocol. Currently, Yield 24 has integrated Stader and Ankr Liquidi Staking, two liquidity staking platforms and validators, on BNB Chain. Users can stake BNB to obtain yBNB and earn Yield 24 native token Y24 token rewards.

Berachain Ecology

Beradrome

BeradromeIt is a re-pledge and liquidity market on Berachain, with ve(3,3) token economics, built-in bribery, voting and other mechanisms. The Beradrome NFT series is "Tour de Berance". Regarding re-staking, Beradrome has not yet made significant progress.

The total supply of Beradrome tokens is 100,000. Holding the "Tour de Berance" NFT can receive token airdrops.

other

Origin DeFi

Origin DeFiIt is a DeFi project that launched the ETH-based revenue aggregator Origin Ether (OETH) on the Ethereum mainnet in May last year. Currently, users can pledge oETH in protocols such as EigenLayer. OETH uses ETH and LST (stETH, rETH and sfrxETH) as supporting collateral to ensure that 1 OETH = 1 ETH. OETH earns revenue using Curve, Convex, Curve AMO, Balancer & Aura.

The total supply of Origin DeFi governance token OGV is 4,449,673,706 pieces, the circulating supply is 645,405,079 pieces, and the market value is approximately US$5.2 million.

Redacted Cartel (Dinero)

Redacted CartelIt is an old DeFi project that has turned to the LSD track. In April 2023, Redacted Cartel released the white paper of DINERO, an over-collateralized stablecoin based on Ethereum, but it has not yet been launched.

Redacted adopts a dual-token LST mechanism. Users can deposit ETH into the Pirex platform of Redacted DAO to mint pxETH, and deposit pxETH into Dinero in exchange for apxETH to obtain an automatic compound interest reward vault. Unpledged pxETH will not receive staking rewards.

On February 1st, Restaking Cloud – Blockswap DAO community, a core contributor to K2, voted to pass the proposal of “Integrating Redacted’s Pirex ETH into kETH and Restake Cloud”, intending to use apxETH as collateral for its re-pledge agreement and provide higher Pledge income.

The article comes from the Internet:A comprehensive review of the Restaking track. How much do you know about the projects that should not be missed in the "Staking Year"?

Related recommendations: Is flatcoin supported by Coinbase founder a good idea?

Flatcoin has practitioners, but it may not be suitable as a medium of exchange. Written by: JP Koning Compiled by: Luffy, Foresight News To get straight to the point, I don’t think flatcoins are a good idea. The idea of flatcoin has been around for a while, but it wasn’t until earlier this year that Coi…