Fed Chairman "throws cold water" on March interest rate cut, Bitcoin falls below $42,500

Written by: Mary Liu, BitpushNews

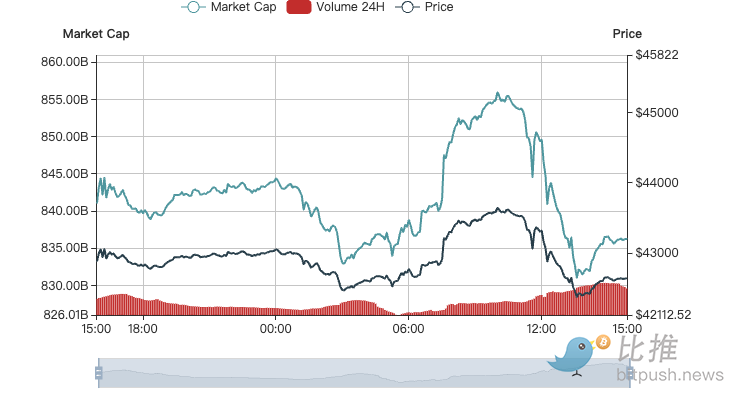

Crypto markets tumbled on Wednesday, with Bitcoin (BTC) falling below $42,500 as hawkish comments from Federal Reserve Chairman Jerome Powell dampened investor expectations for an imminent interest rate cut in March.

Fed: It is not appropriate to cut interest rates until it is "more confident" that it is close to the 2% inflation target

After the first Federal Open Market Committee meeting in 2024, the Federal Reserve kept the benchmark federal funds rate range unchanged at 5.25%-5.5%, in line with market expectations.

Market participants are more concerned with clues about when the Federal Reserve might start cutting interest rates, with many observers expecting a cut as early as its next meeting in March.

However, the Fed pointed out in today's policy statement that it would not be appropriate to cut interest rates until it is "more confident" that inflation is approaching its 2% target.

Powell even poured cold water directly at the press conference: "Based on today's meeting, I want to tell you that I think it is unlikely that the committee will reach the level of confidence to do so at the March meeting. That remains to be seen. March or not The most likely scenario [for a rate cut]”.

When the Fed cuts interest rates is a delicate balance, and several FOMC members have raised the risk of waiting too long to cut rates, arguing that this could harm a strong labor market. On the other hand, there is a risk that too hasty action could reignite inflation.

When asked about the timetable for cutting interest rates, Powell said at the press conference that labor market data and inflation data will continue to be data worthy of attention.

"If we see...particularly unexpected weakness in the labor market, that would certainly impact a quicker rate cut," Powell said. "Certainly, if we see more stickiness or higher inflation, those kinds of things would support later steps." action."

After this statement was published, includingcryptocurrencyRisk assets included immediately fell sharply. BTC fell from the day's high of $43,700 to $42,300, down 2.3% in the past 24 hours.

Other mainstream currencies such as ETH, Cardano's ADA, Avalanche's AVAX and Polkadot's DOT fell by 3%-4%, while Solana's SOL fell by more than 6% on the day, falling below $100.

In traditional financial markets, the S&P 500 index suffered its largest one-day decline since September 21 last year.Xiaobai NavigationThe Nasdaq had its biggest one-day drop since October 25 last year, and the Dow had its biggest one-day drop since December 20 last year.

Interest rate cut delayed until after May?

Alex Krger, macro analyst and co-founder of Asgard Markets, said in an X post: "The market has gotten ahead of itself on interest rates. Rate cuts are starting in May or June, not March."

David Kelly, chief global strategist at JPMorgan Asset Management, said the Federal Reserve has set a timetable for interest rate cuts starting in June.

"It seems to me that they are looking at June, September, December - three rate cuts this year - assuming the economy continues to grow, and there doesn't seem to be any sign that the U.S. economy will soon," he told CNBC after the Fed's statement. collapse and fall into recession. Until they see a sharp rise in the market causing more damage (or potential damage) to the economy, they will simply see the balance of risks tilting more towards sticky inflation rather than the economy heading into recession.”

"The decision of when to start cutting interest rates is arguably a more important and subtle decision than raising interest rates, so the economic data in the next two months will be crucial," said Oliver Rust, product director at economic data aggregator Truflation.

Ruslan Lienkha, head of markets at Web3 fintech platform YouHodler, said, “Any hawkish comments about high interest rates lasting longer than expected could trigger a stock market correction, leading to capital outflows from risk assets such as Bitcoin.”

Bitcoin will be more sensitive to interest rate decisions

However, Swissblock analysts said in a market report on Wednesday that Bitcoin’s downside may be limited as it appears to be consolidating between $44,000 and $42,000 with no clear direction. The report adds that the $42,000 area and sub-$40,000 levels could act as key support levels for the price where buyers may step in.

James Butterfill, director of research at CoinShares, said that as financial institutions increasingly participate in the market through multiple spot Bitcoin ETFs, Bitcoin will become more sensitive to interest rate decisions.

Butterfill said: “Bitcoin prices have realigned with futures market interest rate expectations, suggesting that Bitcoin will be more sensitive to rate-sensitive macro data such as employment and the Consumer Price Index, especially as the excitement surrounding ETFs wanes. Down".

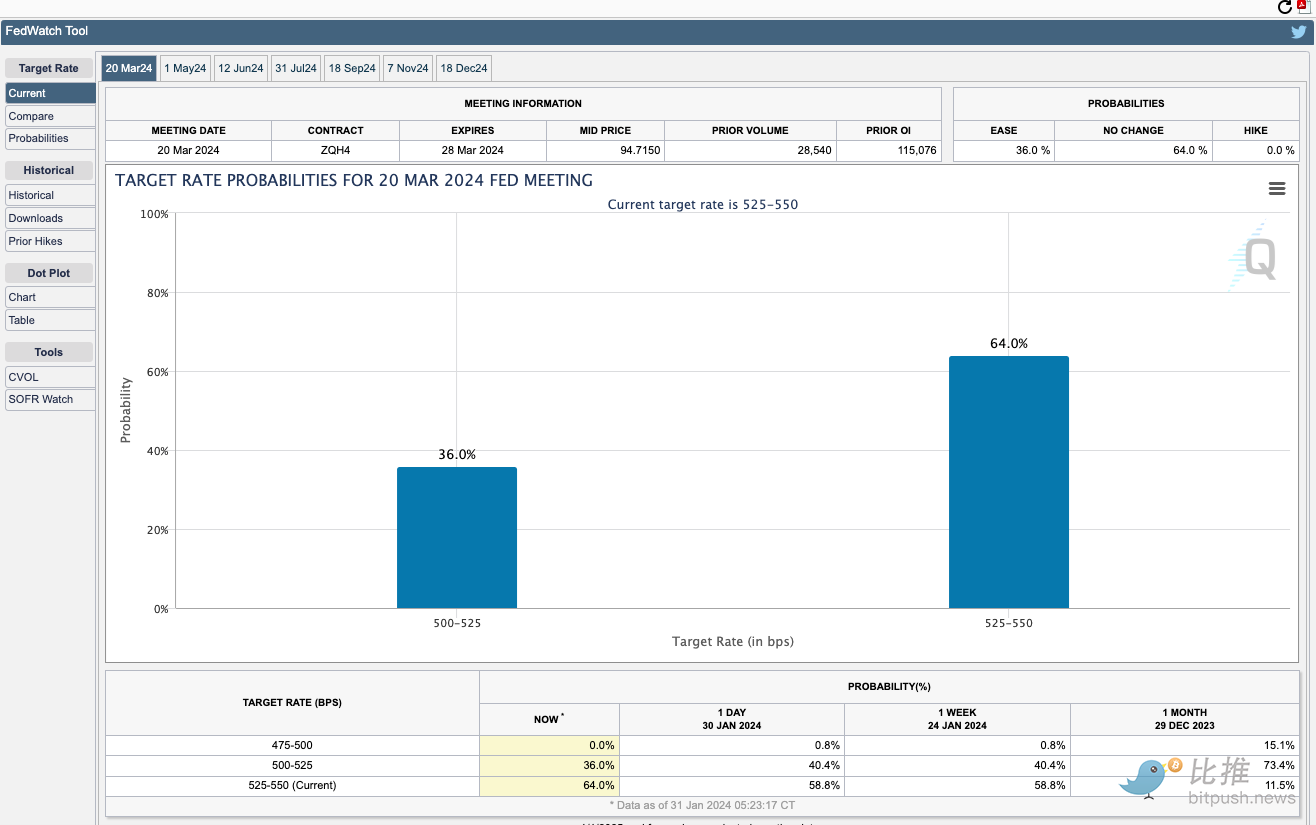

In fact, according to data from the CME Group's FedWatch tool, market bets on an interest rate cut in March have dropped from about 65% before the Fed's decision to the current 34.5%.

Upcoming data may allow policymakers to make more accurate decisions, with a key U.S. manufacturing index updated on Thursday, a January jobs report on Friday and two inflation reports ahead of the Fed's March meeting.

The article comes from the Internet:Fed Chairman "throws cold water" on March interest rate cut, Bitcoin falls below $42,500

Related recommendations: Tribute to Degens, a pioneer driving early adoption in the crypto industry

Without Degens, we would have no idea how big our infrastructure isSafety和可扩展。 撰文: Qiao Wang 编译: 小白导航 coderworld 几个月前,我意识到:在加密货币风险投资界,“投机”是最经常被反对的想法,但在加密用户中却是最普遍的共识。 我当然不是在…