Sui and Aptos Ecological Hidden Dark Horse: Navi and Amnis Early Layout Guide

Written by: dt

The rotation of public chains created many wealth opportunities in the last bull market cycle, especially the successive rise of EVM L1 public chains, starting from Ethereum and then to BSC, then Fantom and Polygon, and finally Avalanche, which took over. Not only are public chain tokens The growth rate itself is astonishing, and it has also led to the rise of various protocols in the ecosystem; and in this cycle, EVM L1 is no longer the mainstream narrative, and various L2 Rollup public chains are springing up like mushrooms after a rain, and emerging high-performance Move VM public chains that are favored by capital, such as Sui and Aptos, are the current market potential public chains.

前几期的 CryptoSnap Dr.DODO 已向大家介绍许多 L2 Rollup 相关的赛道,本周将介绍 Move VM 系的 Sui 和 Aptos 尚未发币的两个潜力生态项目,提早帮你布局埋伏!

Navi Protocol

The first one to introduce is Navi Protocol, which currently ranks first in the Sui ecosystem with a TVL of nearly 100M. After acquiring Volo, another top LST protocol in the Sui ecosystem, it currently provides lending and liquidity staking (LST) services.

Navi lending is based on capital efficiency,Safetyis good at security and user experience, and its innovative “Leverage Vault”Xiaobai NavigationIncrease profits through automated leverage, reduce new asset risks through "isolation mode" and monitor accounts in real time 24 hours a day. Navi continuously optimizes the process and adds new reward management, transaction recording and other functions to provide seamless lending services.

Volo is the protocol with the highest proportion of the liquidity staking market in the Sui ecosystem, occupying 30% of the market. Volo is also the first place in the Sui Foundation Liquid Stake Hackathon. After Navi acquires Volo, it will provide one-stop lending and LST services, and more to meet user needs.

In addition, Navi is currently conducting points activities. The points mechanism includes using native tokens to pledge to obtain income, fee discounts and participation in protocol governance. It also draws on Curve's Ve economic model and introduces the veNavi concept.

Amnis Finance

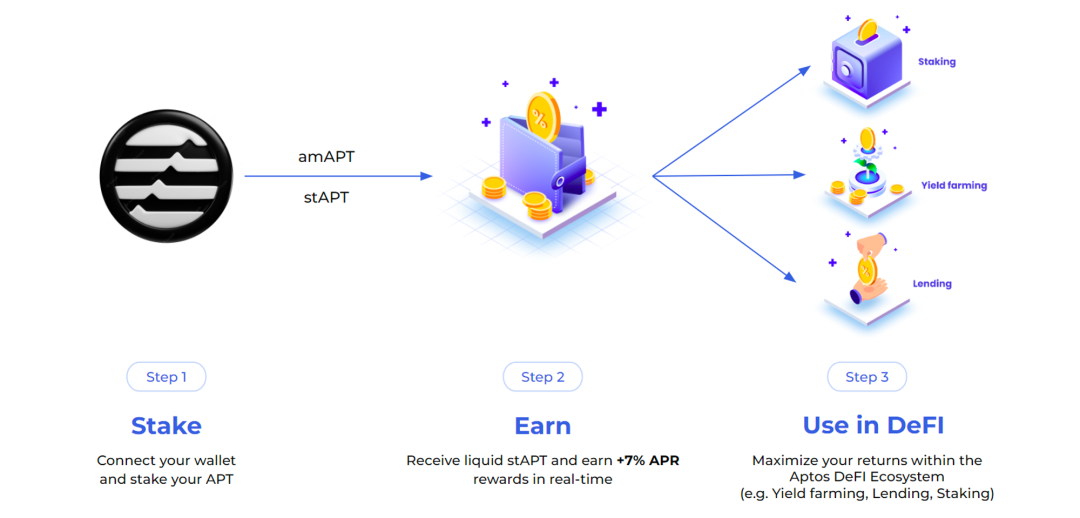

The second project introduced is Amnis Finance, a liquidity staking protocol on Aptos. Currently, TVL ranks second on Aptos at 38M. Amnis provides users with aSafety, easy-to-use and innovative liquidity staking solutions that allow them to easily maximize their APT token returns and unlock liquidity.

Amnis has launched two APT derivative tokens, amAPT and stAPT. amAPT is a stable currency corresponding to APT at a 1:1 ratio and can be used for transactions, adding liquidity, etc.; stAPT is an asset with income, representing the APT pledged by users to Amnis. Someone can earn staking income.

What is different from other LST protocols is that the Amnis protocol has built-in income tokenization products. Amnis packages income-bearing assets into standardized income tokens SY and splits them into principal tokens PT and income tokens YT to realize the return. Maximum control, this innovation provides users with greater asset control and revenue management flexibility.

Author's opinion

At the time of writing this article, the currency price of $Sui continues to hit new highs, and the current on-chain ecology is still in a very early pioneering stage. In addition to Thala, another Move-based public chain Aptos, which occupies the leading position in the ecology, the development of other ecological projects is still considerable. Early days.

Both protocols introduced in this article have LST products. For the author, from the perspective of asset allocation, allocating Sui & Aptos tokens and depositing them into the LST protocol to earn APR while ambush the airdrop of protocol tokens is a way to eat more than one fish. good idea.

The article comes from the Internet:Sui and Aptos Ecological Hidden Dark Horse: Navi and Amnis Early Layout Guide

Bitcoin "fundamentals" remain at the center of market action, and the market is tougher than expected, with significant uncertainty present. Original source: eGirl Capital Original compilation: 0x26, BlockBeats Editor's note: eGirl Capital is a magical crypto capital. The goal of investing in only 2 protocols every year makes them rarely appear...