Technology synergy and market upgrade: Strategic value analysis of the cooperation between Aevo and Celestia

Written by Deriva Research

On January 24, 2024, the decentralized Layer 2 derivatives trading protocol Aevo announced on X (formerly Twitter) that it has L2 The solution was migrated to the Celestia platform, bringing new exploration to the field of decentralized finance (DeFi). One of the important results of this cooperation is that it has brought huge economic benefits to Aevo by significantly reducing the cost of data availability, and successfully converted these profits into user value. This strategic adjustment not only improves Aevo'sexchangeand sorter profitability, and lays a solid foundation for further expanding its DeFi protocol and application ecosystem in the future.

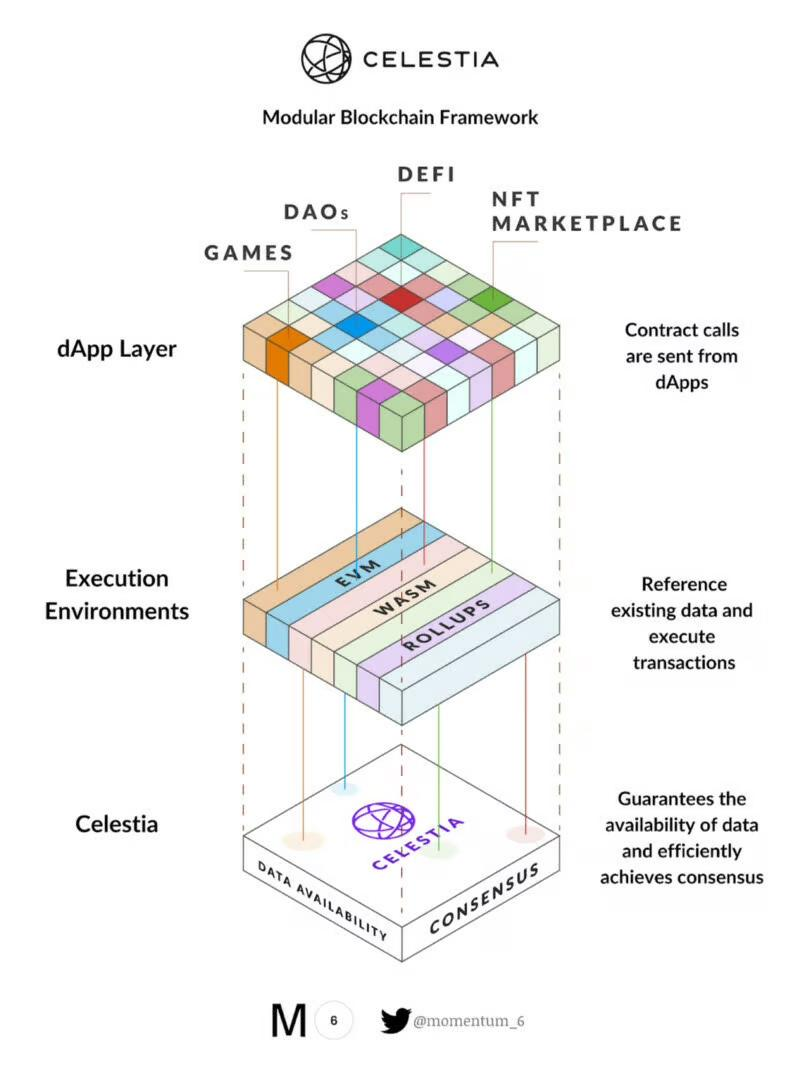

1. Modularity of CelestiaBlockchainArchitecture

As a leader in modular data availability, Celestia offers a unique and innovativeBlockchainIts modular architecture allows for more flexible data processing and storage, significantly improvingBlockchainApplication performance and scalability. Celestia’s core advantage lies in its high throughput and low-cost data availability layer, which not only improves data processing efficiency but also provides higherSafety性和可靠性。这些特点使得 Celestia 成为 Aevo L2 解决方案理想的基础设施选择。

2. Aevo’s Background and Products

Since its inception, Aevo has been one of the major players in the DeFi field, focusing on providing decentralized derivatives trading services. Aevo innovatively combines off-chain matching and on-chain settlement to provide users with efficient andSafety的交易体验。作为最早采用 OP Stack L2 技术的平台之一,Aevo的目标是构建一个性能强大、用户友好的去中心化交易平台。其产品和服务不断扩展,以应对快速变化的市场需求。

3. What can the cooperation between Celestia and Aevo bring?

Aevo 宣布其L2解决方案成功迁移到使用 Celestia 作为基础设施,这是一个重要的发展里程碑。这一合作标志着Aevo在成为更广泛、开放的DeFi协议和应用程序生态系统之前迈出的关键一步。通过将数据可用性(DA)成本降低100倍,Aevo L2 能够显著提升其交易所和排序器的盈利能力,同时大规模扩展用户引进,并加速增长,将成本节省回馈给用户。这一变革对于 Aevo 至关重要,因为此前所有的 Rollup 数据都发布到以太坊主网,每月成本高达 50-100 ETH。借助 Celestia 的高吞吐量数据可用性层,Aevo 能够提高其链本身的可扩展性,增加区块大小并减少区块时间,从而改善链本身的用户体验。

4. Synergy between Aevo and Celestia

The collaboration between Aevo and Celestia is not just a combination of technologies, but also a major evolution of DeFi services. By fully leveraging Celestia's data availability layer, Aevo is able to significantly reduce its operating costs, which is particularly critical in the DeFi field. In addition, this collaboration will increase the profitability of Aevo's exchange and sorter by more than 90%, significantly improving the economic benefits of the entire platform. This is not only beneficial to Aevo, but also provides Celestia with a platform to demonstrate its technical strength and jointly promote the development of DeFi services. This synergy is not only reflected in the economic benefits of both parties, but also in the cooperative force that drives the entire DeFi industry forward.

5. Impact on Scalability and Transaction Throughput

The addition of Celestia makes Aevo's chain itself more scalable, which is essential for processing a large number of transactions. By increasing the block size and reducing the block time, Aevo is able to process transactions more efficiently, thereby improving the user experience. This means that Aevo can support more users and larger-scale transactions while maintaining low latency and high throughput, which is essential for maintaining market competitiveness and attracting new users. Celestia's technical advantages provide Aevo with a sustainable development foundation and provide solid support for its future business expansion and innovation.

VI. Innovation and market flexibility

This collaboration brings unprecedented opportunities for innovation to Aevo. With Celestia's support, Aevo can launch new products and services more quickly and respond flexibly to market changes. This innovation is not limited to improving existing products, but may also include developing new DeFi tools to further expand its market influence. This flexibility is critical to staying competitive in the ever-changing DeFi market. The collaboration will be a booster for Aevo to accelerate innovation and expand its product line, providing users with more diversified choices, and is also expected to promote the overall development of DeFi.

VII. Cost-effectiveness and user impact

By using Celestia, Aevo has achieved a significant reduction in data availability costs, which not only improves its profitability, but also enables Aevo to convert cost savings into user benefits. Lower transaction fees and more efficient transaction processing capabilities will directly improve the user experience and attract more users to participate. This improvement in cost-effectiveness also means that Aevo can be more attractive in the highly competitive DeFi market. By passing these economic advantages to users, Aevo is expected to establish stronger brand awareness and user loyalty among users, further consolidating its leading position in the DeFi field.

8. Future Prospects and Ecosystem Growth

The collaboration between Aevo and Celestia is more than just a technology upgrade; it is also a catalyst for the development of both ecosystems. As Aevo evolves into a broader DeFi ecosystem, Celestia’s technology will facilitate the deployment of new protocols and the expansion of the ecosystem. This collaboration opens the door to future innovation and development, and is expected to lead to the birth of a range of new DeFi products and services. The collaborative efforts of both parties are expected to drive the entire industry forward, provide users with more choices, and also inject new vitality into the healthy growth of the DeFi ecosystem. This collaboration is not only strategically important to Aevo and Celestia, but will also bring a more prosperous future prospect to the entire DeFi ecosystem.

IX. Conclusion

Overall, Aevo's decision to choose Celestia as its infrastructure marks an important turning point in the DeFi space. This collaboration not only improves Aevo's transaction efficiency and economic benefits, but also brings new innovation and development opportunities to the DeFi market. As Aevo and Celestia make progress together, it can be foreseen that the DeFi space will usher in more innovation and growth in the future. This collaboration not only promotes the development of both parties at the technical level, but also injects new vitality into the entire DeFi ecosystem, providing users with a more advanced and efficient trading experience. This strategic decision is expected to have a far-reaching impact in the industry, prompting more projects to seek similar cooperation opportunities and promote the DeFi space to develop in a more open and innovative direction.

About Celestia

Celestia is a modular Data Availability (DA) network thatSafetyScalable with the number of users, allowing anyone to easily start their ownBlockchain. Rollups and L2 use Celestia as a network for publishing and providing transaction data, which can be downloaded by anyone. For them, Celestia provides high-throughput DA that can be easily verified by light nodes. By modularizing the blockchain stack, anyone can start their own blockchain without the need for a validator set.

For more information, visit Celestia'sOfficial website.

About Aevo

Aevo is the first company to focus on options and perpetualscontractAevo Exchange is a highly robust options and perpetual swap platform built on the Aevo L2 rollup and Optimism stack.contractCLOB (Central Hub Matching Engine) decentralized exchange, on which Aevo Strategies (Automated Strategies) are built. This architecture achieves low gas fees and low latency while significantly improving liquidity and capital efficiency.

For more information, visit Aevo'sOfficial website.

ArticlesXiaobai NavigationFrom the Internet:Technology synergy and market upgrade: Strategic value analysis of the cooperation between Aevo and Celestia

相关推荐: 「以太坊杀手」又回来了,一文梳理社区 Solana「喊单话术」

Looking back at Solana's development this year, its vision of "Nasdaq on the chain" is moving forward step by step, and the familiar name of "Ethereum killer" has once again been given to Solana. Written by: Kaori Solana's ecology continues to heat up, with meme coins, inscriptions, and NFTs all working together to make the crypto market aware of this "Ethereum killer" that was once considered the most likely...