Wall Street is frantically buying Bitcoin

Written by: Qin Jin

Whether it’s skyrocketing or plummeting, Wall Street has never stopped buying Bitcoin.

On January 10, the U.S. Securities and Exchange Commission approved 11 Bitcoin ETFs, including BlackRock. Before the approval, in the past six months when the approval signal was released, Bitcoin rose from a low of nearly $27,000 to a high of nearly $490 million, a total increase of nearly 1,62%, leading the list of rising crypto assets.

After the approval, Bitcoin plummeted twice in a row. One time was on January 13, when Bitcoin fell below $42,000, with a daily drop of more than 7%. Another time was in the early morning of January 23, when Bitcoin fell below $40,000, with a daily drop of more than 3%.

The surge and plunge of Bitcoin itself seems to have never stopped Wall Street financial giants from frantically buying Bitcoin.

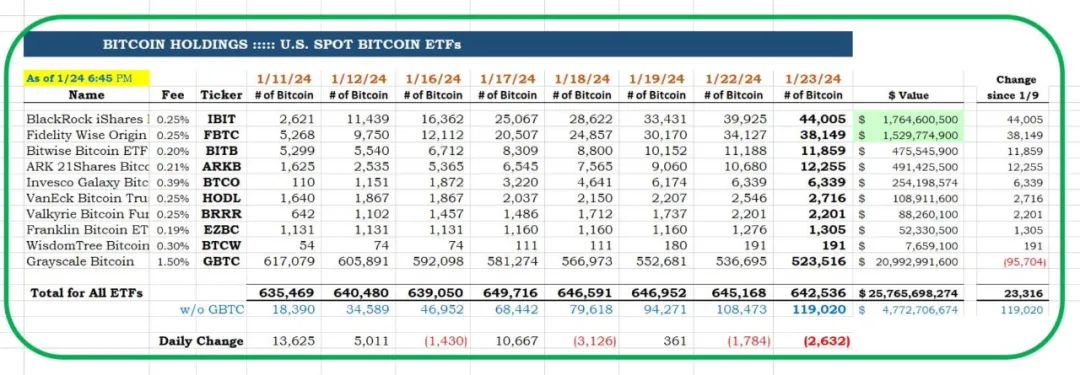

According to the latest statistics from CC15Capital, from January 9, within 8 trading days after the launch of Bitcoin ETF, 10 Bitcoin spot ETF institutions including BlackRock have bought a total of 119,020 Bitcoins, worth about $4.7 billion. This does not include the 523,516 Bitcoins currently held by Grayscale GBTC, worth about $20 billion. Since January 10, when the U.S. Securities and Exchange Commission approved Bitcoin spot ETFs including BlackRock, Grayscale GBTC has been in redemption status.

According to Eric Balchunas, senior ETF analyst at Bloomberg, who has been tracking the Bitcoin ETF from start to finish, as of January 24, GBTC outflows were "only" $425 million, the lowest level since the first day of the ETF launch, and it seems to be trending downward. Nevertheless, this is still a considerable number.

The key to the problem is to find the key problem.Wall Street financial giants including BlackRock snapped up 119,020 bitcoins in just 8 days. It should be noted that MicroStrategy, another software listed company on Wall Street, took 300 days to snap up 100,000 bitcoins. Wall Street financial giants including BlackRock snapped up the same amount of bitcoins as MicroStrategy in 1/38 of the time it took MicroStrategy, or even more than MicroStrategy.

It seems to have become an indisputable fact that the future of Bitcoin belongs to Wall Street.After all, as long as the Bitcoin ETF is traded on the Nasdaq and NYSE for one day, financial giants including BlackRock will never stop rushing to buy Bitcoin.

Among the 119,020 bitcoins, BlackRock undoubtedly bore the brunt, with a reserve of 44,005 bitcoins, worth about 1.765 billion. When Carbon Chain Value wrote the article "BlackRock's Big Explosion" on January 17, BlackRock held 11,500 bitcoins. Seven days later, the number of bitcoins held increased to 44,005.

-

Next is Fidelity Investments, which has 38,149 bitcoins in reserve, worth approximately $1.53 billion.

-

Bitwise reserves 11,859 bitcoins, worth approximately $475 million.

-

Ark Capital ARK reserves 12,255 bitcoins, worth approximately $490 million.

-

Invesco Galaxy reserves 6,339 bitcoins, worth approximately $254 million.

-

VanEck reserves 2,716 bitcoins, worth about $100 million.

-

Valkyrie reserves 2201 bitcoins,Xiaobai NavigationWorth approximately US$86.26 million.

-

Franklin reserves 1,305 bitcoins, worth approximately $52.33 million.

-

WisdomTree reserves 191 bitcoins, worth about $7.66 million

-

Finally, Grayscale reserves 523,516 bitcoins, worth about $21 billion. Compared with the original 581,274 bitcoins, nearly 60,000 BTC have been sold.

Why did Grayscale sell off GBTC? CarbonChain Value has previously written about Grayscale GBTC, which was founded in 2013. When the U.S. Securities and Exchange Commission approved its conversion to an ETF, it had accumulated nearly $30 billion in assets. These assets come from large institutions and qualified individual investors. When Grayscale GBTC charges a high fee rate (1.5%) relative to the other 10 Bitcoin ETF institutions, some individual investors will consider redeeming cash and choose other investment institutions with lower fees for investment. The result is that Grayscale can only sell BTC.

Secondly, the existence of large institutions like FTX that directly redeemed and liquidated led to Grayscale selling BTC. According to Coindesk, FTX has sold about $1 billion of Grayscale Bitcoin ETF, which explains most of the capital outflow.

The article comes from the Internet:Wall Street is frantically buying Bitcoin

相关推荐: 起底 MakerDAO RWA,看 DeFi 捕获链下资产的治理体系与交易架构

This article will cover the more mature RWA projects in MakerDAO. Written by Will Awang Real-world assets exist off-chain, and asset owners can obtain expected returns from them. The relevant rights and benefits are regulated by the legal system and rooted in our social contract. For the on-chain DeFi of "Code is Law", how to adapt to it?