Is the re-pledge market about to start a new era? An inventory of potential projects in the re-pledge track

Written by: Uncle Jian

1. What is the reason for the resurgence of popularity of EigenLayer?

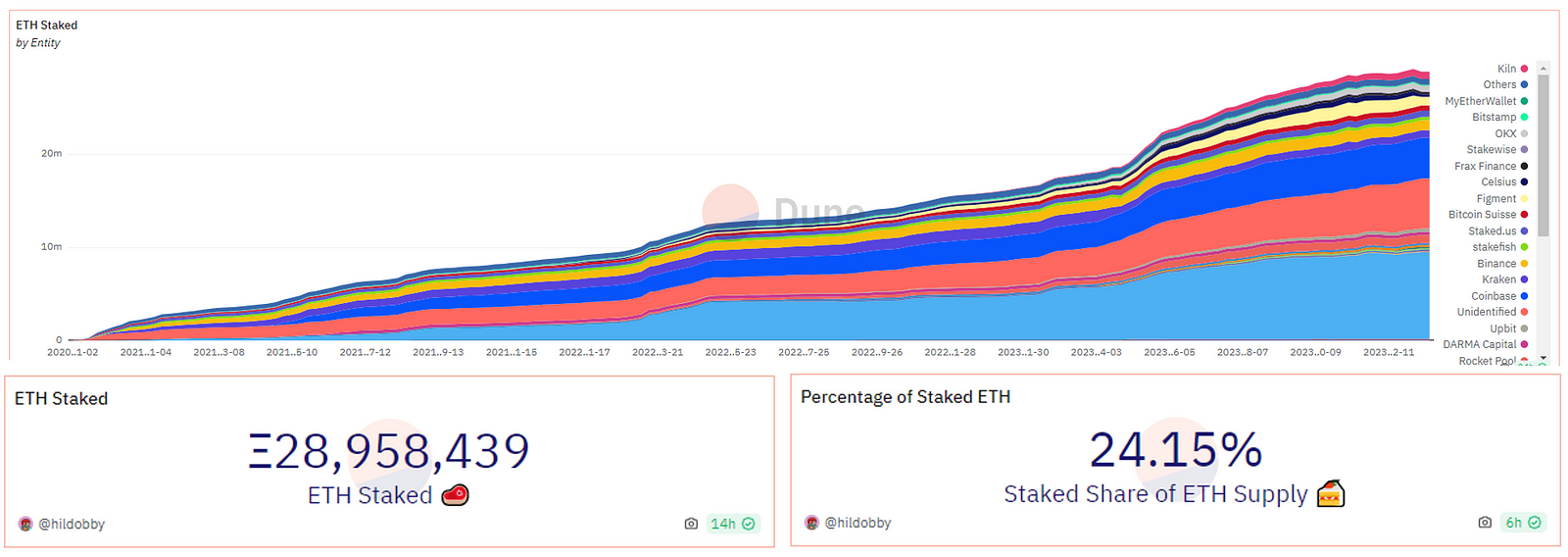

With the approval of Bitcoin spot ETF, positive news for Ethereum emerges: the expectation of the approval of Ethereum spot EFT and the upgrade of Cancun have given the long-sluggish Ethereum new vitality.

The amount of Ethereum pledged continues to increase, and the need for re-staking is becoming increasingly prominent. EigenLayer allows users to re-stake ETH, lsdETH (liquidity pledged ETH) and LP Tokens on other side chains, oracles, middleware, etc., as nodes and receive verification rewards, so that third-party projects can enjoy the benefits of the ETH mainnet.SafetyIn addition, ETH stakers can also get more benefits, achieving a win-win situation.

数据来源:https://dune.com/hildobby/eth2-staking

数据来源:https://dune.com/hildobby/eth2-staking

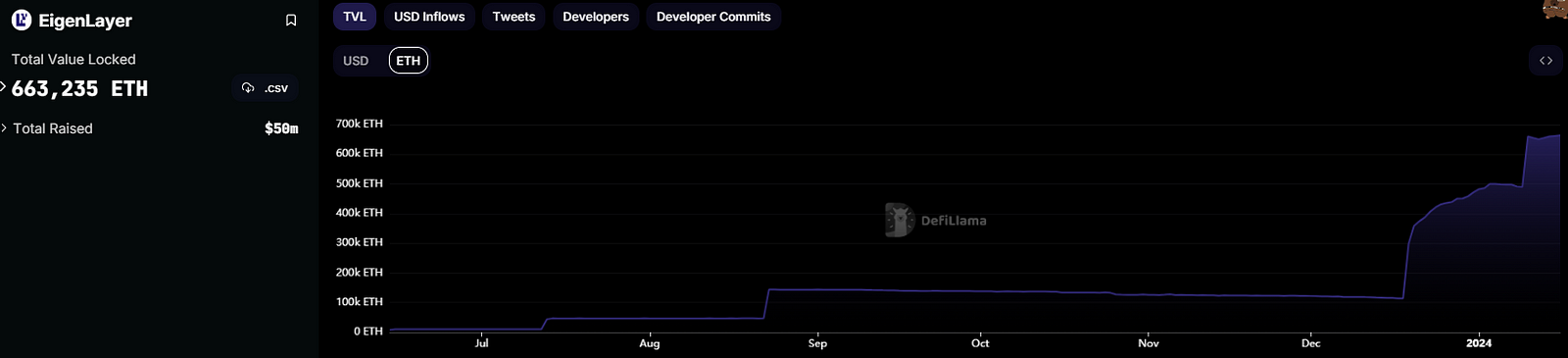

The re-staking trend has become the focus of the Ethereum ecosystem after EigenLayer increased the LST pledge limit. In just one month, EigenLayer absorbed more than 500,000 Ethereums, with a TVL of over 1.6 billion US dollars, becoming the 12th top protocol on the Ethereum chain.

数据来源:https://defillama.com/protocol/EigenLayer?denomination=ETH

数据来源:https://defillama.com/protocol/EigenLayer?denomination=ETH

Recently, EigenLayer announced that it will provide re-staking services for Cosmos sub-chains, which is of great significance to both Ethereum and Cosmos. EigenLayer provides re-staking services for Cosmos sub-chains, enabling Cosmos to obtain Ethereum’sSafetyIt also opens up a new world of incremental returns for Ethereum stakers.

The picture shows EigenLayer Universe, source: https://x.com/eli5_defi/status/1746550169183846503?s=20

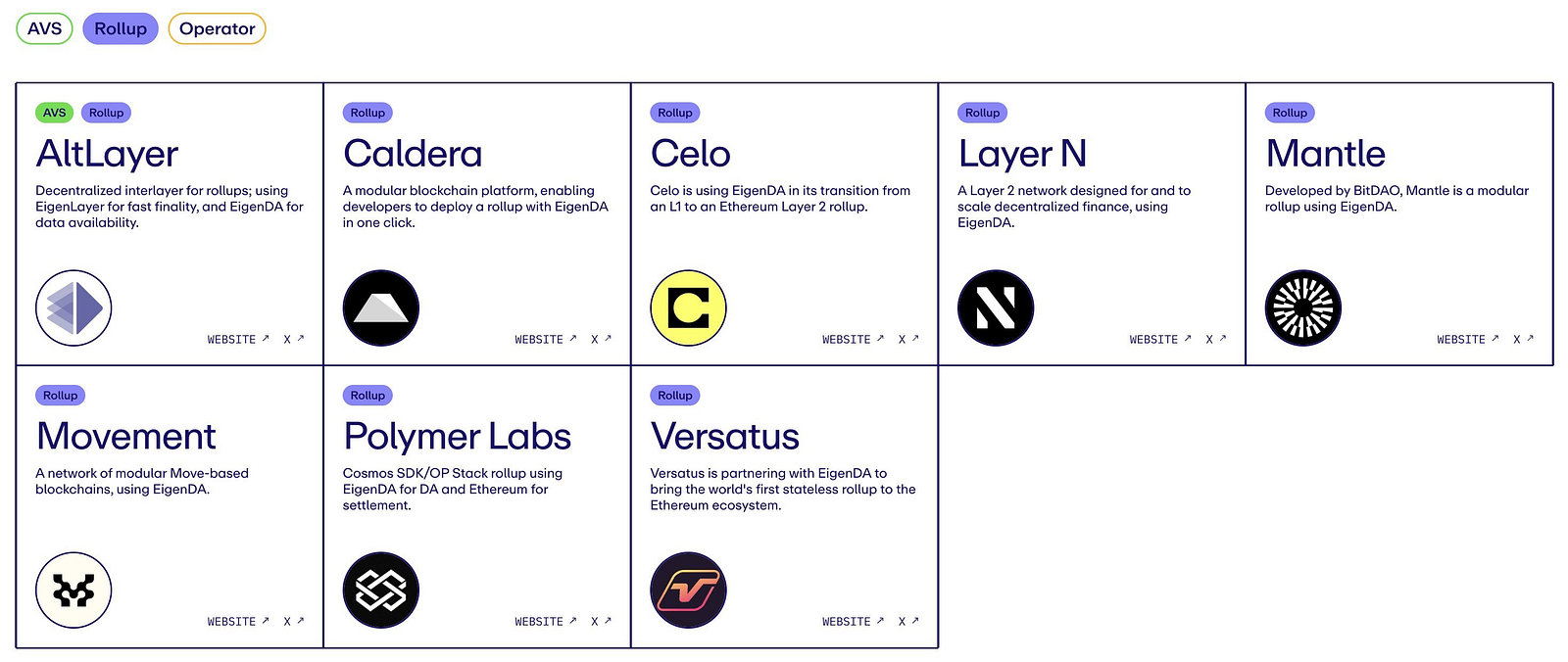

The first AVS using EigenLayer verification service, EigenDA, is also about to be launched, and the narrative of its DA service follows Celestia’sToken TIA surged and became a hot topic in the market.

The picture shows EigenDA’s partners. Source: https://x.com/eigen_da/status/1731674794347860449?s=20

The picture shows EigenDA’s partners. Source: https://x.com/eigen_da/status/1731674794347860449?s=20

For more information about EigenLayer, please refer to this issue:Research Report | EigenLayer: Strengthening Ethereum Security and Inspiring a New Era of Staking》

2. What are the potential projects in the re-pledge track?

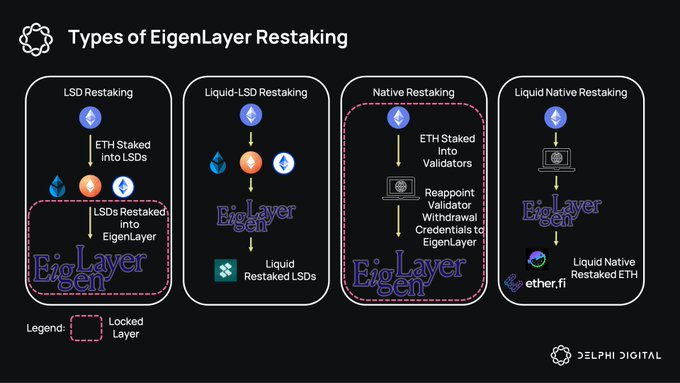

EigenLayer is not the only project in the restaking space. There are also many opportunities for derivative projects under the Restaking narrative. Here are four types of Restaking:

LSD Restaking: Deposit the LST (stETH, cbETH, etc.) you get after depositing into the LSD protocol into EigenLayer and then stake it.

Liquid-LSD Restaking: Through LRD protocols such as Kelp DAO etc., entrust LST to the LRD protocol, which will deposit it into EigenLayer and then pledge it, and the user will get the pledge certificateToken Liquid Restaking Token (LRT).

Native Restaking: Native liquid staking refers to validators using EigenPod smartcontractRedirect validator withdrawal credentials to EigenLayer.

Liquid Native Restaking: Native liquid restaking refers to projects such as etherf.fi or Puffer Finance that provide small ETH node services, providing the ETH in the node to EigenLayer for restaking.

Image from: Delphi Digital, source: https://x.com/Delphi_Digital/status/1740463277099151482?s=20

Below is a list of five un-issued re-staking projects for your reference. These five projects can obtain EigenLayer points while obtaining points for their respective projects.

Kelp DAO

Kelp DAO 是由支持多链的 LSD 项目 Stader Lab 做的 Restaking 项目,属于上文所说的 Liquid-LSD Restaking 类型,目前开放存入 Lido 的 stETH 以及 Stader 的 ETHx 这两个 LST 代币,不过由于目前 EigenLayer LST 的额度已满,因此目前是暂停存款的。

Although Stader Lab has already issued tokens, Kelp DAO has already launched a points system. As its sub-project, Kelp DAO should still launch its own tokens. And we can expect the linkage effect between SD (Stader Lab's token) and Kelp DAO.

Swell

Swell is an old LSD protocol. Not long ago, it announced that it would enter the field of Liquid Restaking. It is a Liquid Native Restaking product. After adding the re-staking function, users can deposit ETH and exchange it for rswETH, so Swell will no longer be subject to the EigenLayer LST quota limit.

Since Swell has not yet issued a token with an airdrop expectation, its LST token swETH has attracted the attention of airdrop hunters and is currently the second most pledged asset in EigenLayer. Previously, LSD could earn points, and participating in re-staking can also earn points.

ether.fi

ether.fi is a Liquid Native Restaking product. It has received a $5.3 million seed round of financing from Arthur Hayes, the founder of BitMEX. Unlike Lido, ether.fi uses a decentralized, non-custodial approach to staking ETH, and announced that it will provide re-staking services. Since it is native ETH re-staking, it is not affected by the EigenLayer LST limit and can still be deposited. Its collateral certificate token eETH (wrapped token weETH) is also one of the few liquid LRT collateral certificate tokens.

Renzo

Renzo is also a Liquid Native Restaking product and is not subject to the EigenLayer LST deposit limit. Deposits are still accepted. However, it should be noted that ETH deposited in Renzo is not currently open for redemption, and the collateral certificate ezETH cannot be transferred, so it is locked in the short term.

On January 16, Renzo announced the completion of a $3 million seed round of financing.SafetyThe security is guaranteed, and compared with similar protocols, the locked amount is smaller, which makes it more cost-effective at present.

It should be noted that due to the form of earning points for attracting new customers and the undisclosed team background, coupled with the fact that redemption is not open, it has been questioned and distrusted by some users.

Puffer Finance

Puffer Finance is aXiaobai NavigationThe anti-confiscation liquidity pledge agreement is similar to ether.fi, and is also a product of the Liquid Native Restaking type. Staking is not yet open. Puffer Finance has received seed round financing led by Jump Crypto, with a total of US$6.15 million in financing, and the valuation has not been disclosed.

EigenLayer imposes a 32 ETH threshold requirement on general Ethereum re-staking nodes, which must be met to run AVS.

Puffer’s re-staking function is to lower this threshold to below 2 ETH in an attempt to attract small nodes.

3. Taking a different approach, how to use Pendle to participate in re-staking?

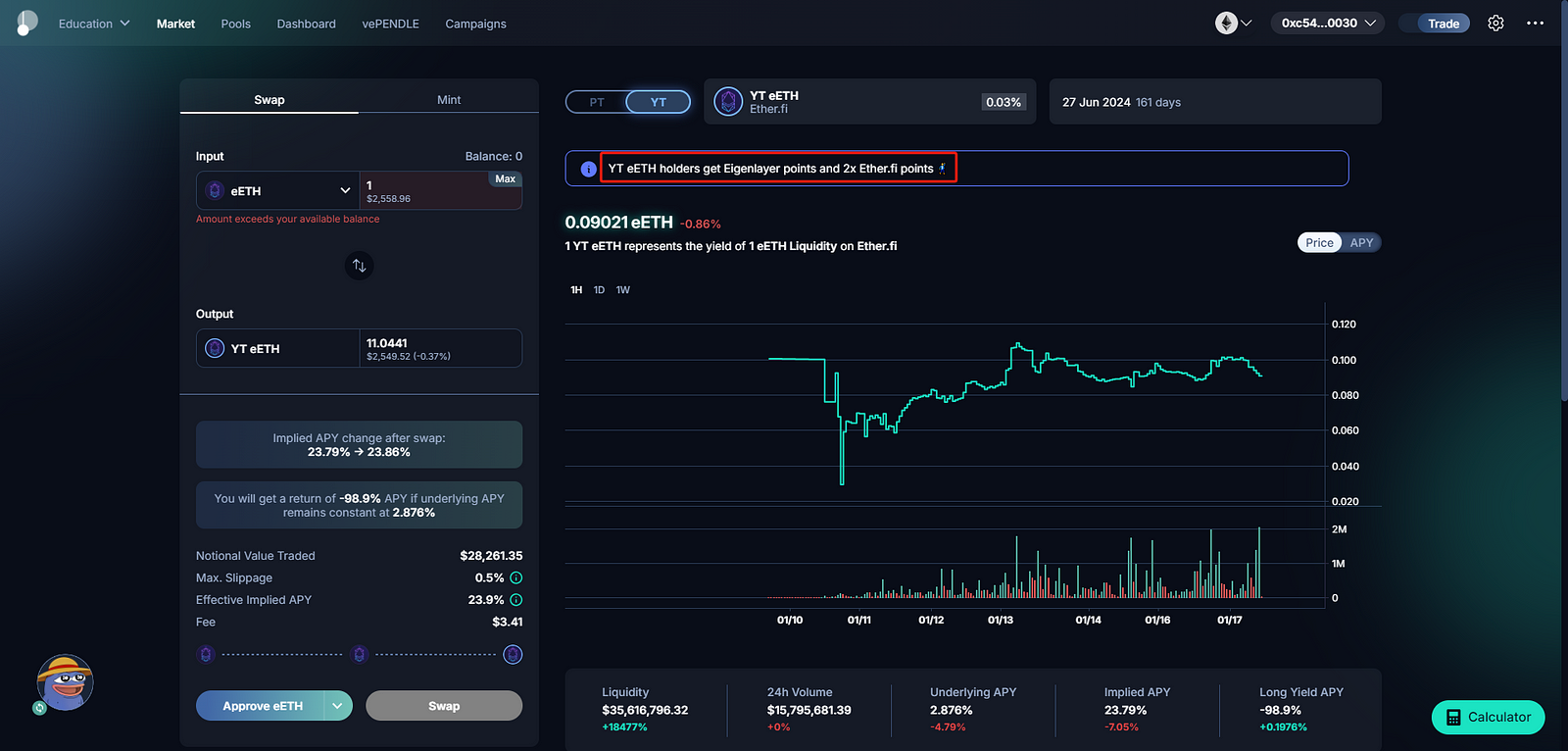

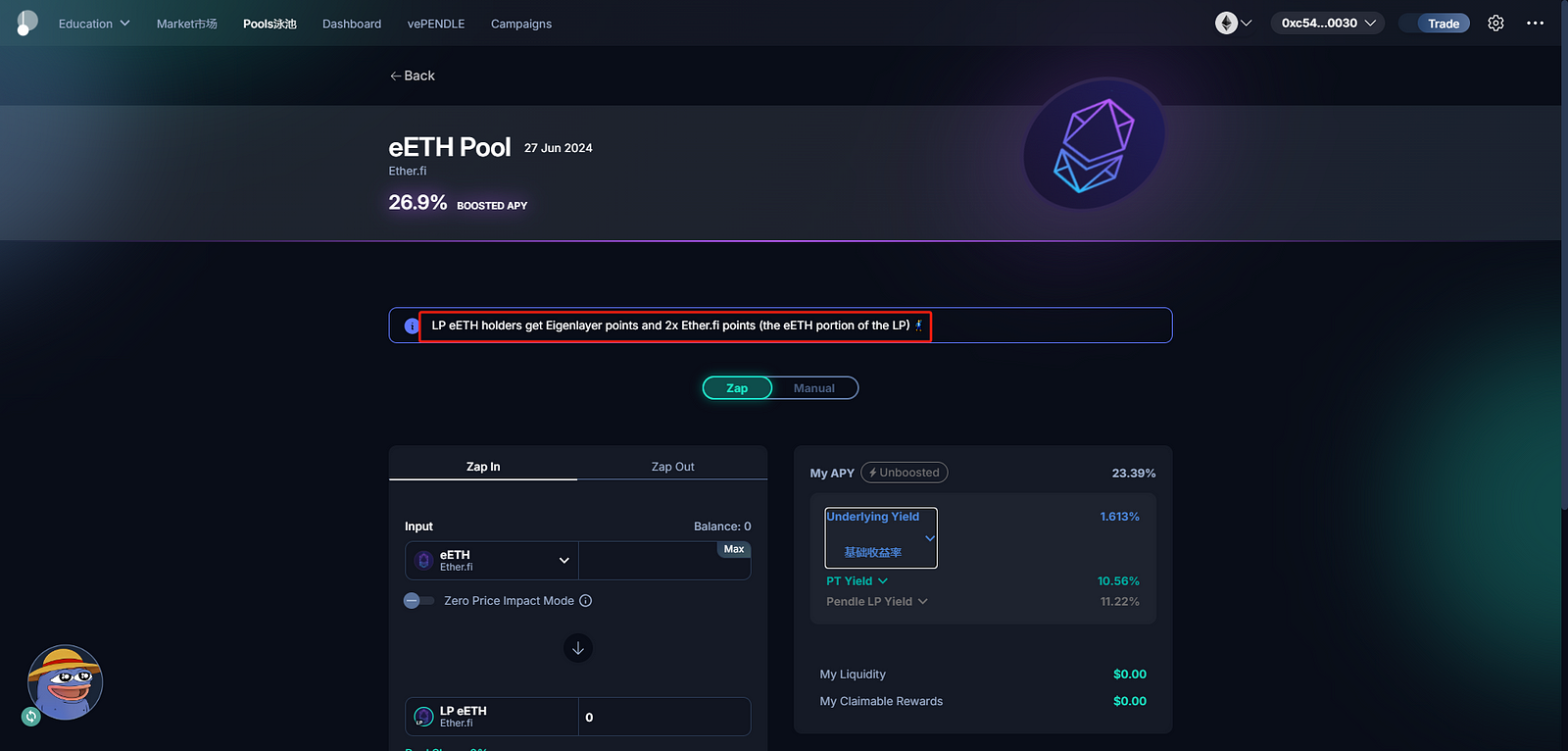

Pendle is a decentralized interest rate trading market that provides transactions for PT (Principal Token) and YT (Yield Token). We can use YT transactions in Pendle to accelerate the acquisition of ether.fi and EigenLayer points.

Enter Pendle's YT-eETH trading, and then buy YT-eETH. Holding YT-eETH, you can get staking income, double ether.fi points, EigenLayer points, and Pendle's trading rewards. Currently, 1 eETH can buy about 11 YT-eETH, which is equivalent to 11 times leverage.

It looks like the returns are very tempting, right? But after understanding the price mechanism of YT, you will know that the price of YT is gradually reduced as the expiration date approaches. This is essentially exchanging time for staking returns and points.

Of course, you can also obtain the above rewards in a lower-risk form by forming LP, but this also has disadvantages, such as being susceptible to impermanent loss and having relatively low efficiency in obtaining points.

Tip: If you are not familiar with Pendle, please learn relevant knowledge before operating it. Due to space constraints, this article cannot provide too detailed an explanation.

4. Risks that cannot be ignored in re-pledge

Restaking, as an emerging concept in the crypto space, is emerging, providing more opportunities for stakers to join different networks and increase their returns. EigenLayer calls itself "Airbnb for decentralized trust", highlighting the appeal of this opportunity. However, restaking is not without risks, and it introduces a series of potential issues that deserve careful consideration.

1. Penalty risk: Increased risk of losing staked ETH due to malicious activity.

2. Centralization risk: If too many stakers move to EigenLayer or other protocols, it may pose a systemic risk to Ethereum.

3.contract风险:各协议的智能合约可能存在风险。

4. Multi-level risk superposition: This is the key issue of re-pledge. It combines the existing pledge risk with additional risks to form multi-level risks.

V. Conclusion

The ETH/BTC exchange rate rebounded strongly after the Bitcoin spot ETF was approved. With the support of the Cancun upgrade and the Ethereum spot ETF, the Ethereum ecosystem will also rebound. The main theme of the Ethereum ecosystem in the future is the direct benefits of the Cancun upgrade. L2 The other is the EigenLayer re-staking ecosystem.

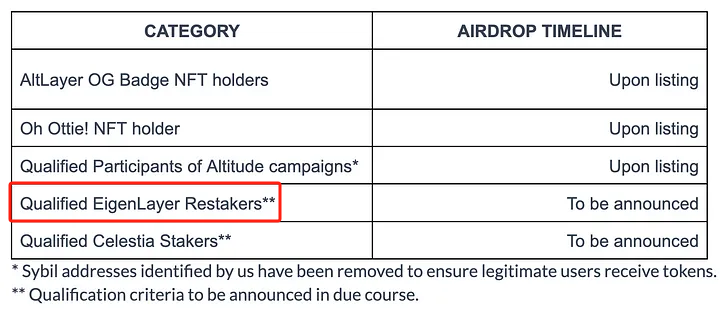

Using the projects mentioned today to participate in re-staking is undoubtedly the most cost-effective option. As long as you participate in staking, you can kill two or three birds with one stone. It should be noted that the recent Altlayer airdrop rules mentioned that airdrops will be given to EigenLayer pledgers, but whether they can be identified as EigenLayer pledgers by staking in protocols such as Kelp DAO and Renzo is still unknown.

Image source: https://blog.altlayer.io/altlayers-alt-token-launch-f49bf8ac2556

Of course, we must also realize that the continuous re-staking is essentially a speculative leverage created for liquidity. While bringing higher returns, it also amplifies risks. No matter which layer of the agreement has a contract problem, the user's assets will be damaged.

The article comes from the Internet:Is the re-pledge market about to start a new era? An inventory of potential projects in the re-pledge track

Focus on on-chain data and review the weekly news. In the past week (1.15-1.19), many new hot currencies and topics have appeared in the market. 1. Market Trends The most popular topics in the market this week (01.15-01.19) are: GBTC total outflow reached 2.2 billion US dollars, Ethereum Sepolia test network will be launched in January...