Can the Bitcoin-driven public chain Core become the optimal solution for BTCFi?

Written by angelilu, Foresight News

Bitcoin just celebrated its 15th birthday this year, and the fourth halving of its life cycle is imminent, with 21 million coins to be halved.Token92% of the total supply have been mined. At this historic moment, "applications" such as inscriptions and Bitcoin NFTs have exploded the market in the past six months. Bitcoin smartcontractThe enthusiasm for the ecosystem has also been rekindled. For the current Bitcoin, DeFi is a relatively lacking link but has the greatest room for imagination.

People are still looking for a way to fully inherit BitcoinSafetyThis article will introduce the BTCFi solution provided by the public chain Core.

What is the Core Chain?

Core chain is EVM-compatible Layer 1 powered by Bitcoin Blockchain, "Bitcoin Driven" is the Core chain that can inherit the Bitcoin networkSafetyThis is the key to the stability of the network, and this is reflected in the consensus mechanism of the Core chain.

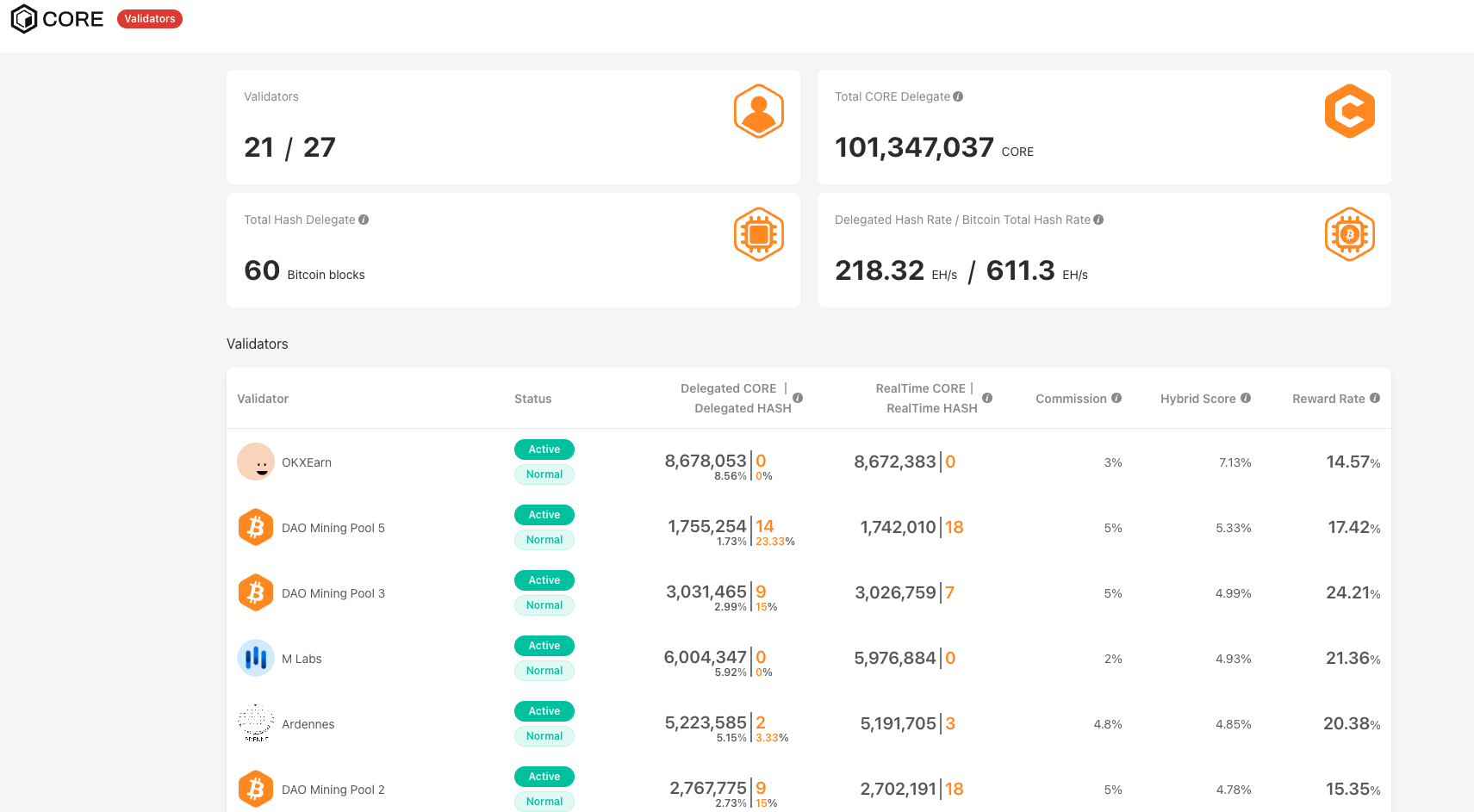

Core 链的共识机制结合了比特币 PoW,具体而言,Core 的 21 个验证节点通过一套混合评分体系选出,其评分标准包括质押在验证节点上的比特币算力大小和 Core 链原生代币 CORE 的质押数量,未来还计划将比特币质押作为节点评分的标准之一。

Can it become the optimal solution for BTCFi?

作为 BTCFi 领域的新秀,Core 链是否能够成为最优解尚待市场验证,但其采用的比特币 PoW 共识机制以及将推出的比特币质押无疑为其安全性和去中心化特性提供了强有力的支撑。

The consensus mechanism of the Core chain is based on Bitcoin PoW

Core 链和目前其他比特币生态项目最大的不同在于 Core 链的共识机制直接使用了比特币的 PoW,比特币的 PoW 共识是当前经过时间验证的最安全和去中心化的去中心化记账机制。那么 Core 链让比特币的 PoW 机制成为共识的一部分,也是为 Core 链增加了一个安全的「保护壳」,让 PoW 在保障比特BinanceWhile being complete and decentralized, it also ensures the security of the Core chain.

For Bitcoin miners, the Core chain's consensus mechanism also provides an option to earn profits without incurring additional energy and time costs, providing miners with the possibility of diversified income as Bitcoin rewards continue to decrease.

According to the Core chainOfficial websiteThe data shows that the computing power of the verification nodes currently entrusted to the Core chain is 218.32 EH/S, accounting for 35% of the total Bitcoin computing power of 611.3 EH/s. This number was onceReached 40%Huobi, OKX, Bitget and other largeexchangeIt has joined the Core chain as a verification node to jointly ensure its safe operation.

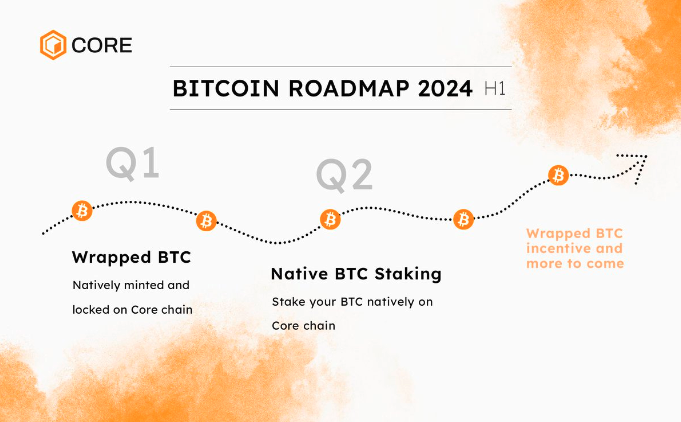

Bitcoin staking will start in Q2 2024

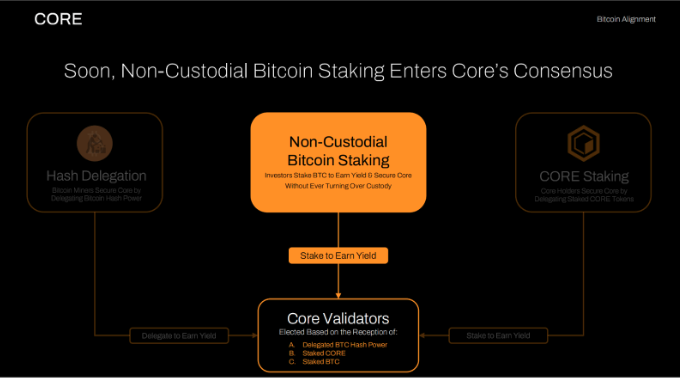

Based on the combination of Bitcoin PoW, the Core chain will introduce Bitcoin staking in the consensus mechanism in Q2 this year. That is to say, the Core chain's verification node score in the future will include three weight factors, namely Bitcoin computing power, staked CORE tokens, and staked Bitcoin.

Bitcoin is currently the crypto asset with the highest market value and the strongest consensus. The Core chain introduces the Bitcoin staking function, combined with the underlying use of Bitcoin PoW to maintain the decentralization and security of the public chain. The Core chain has great potential to fully open up the prosperity of BTCFi.

For Bitcoin holders/investors, the new Bitcoin staking feature of the Core chain will also be a new and competitive investment option, because the Bitcoin staking process of the Core chain is non-custodial and safer than some centralized custodians. The participation of Bitcoin pledgers will fully open up a BTC 2.0 era, allowing Bitcoin pledgers, Bitcoin computing power pledgers, and CORE pledgers to continue to gain income, forming an economic cycle of mutual positive incentives.

至此,对 Core 共识机制的介绍才完整结束,Core 是一个既 EVM 兼容又能完全继承比特币安全性的公链,具备发展比特币 DeFi 的条件,也能为现有 DeFi 项目向 Core 迁移共同并构建比特币 DeFi 生态提供基础设施。

Introducing stCORE and laying out BTC DeFi

Liquidity staking is the sector with the highest TVL in the current DeFi field. It is simpler than more complex DeFi activities and can also improve the utility of tokens. Therefore, Core's initial exploration of Bitcoin DeFi focuses on liquidity staking strategies. Core recently announced the launch of the liquidity staking token stCORE to solve the problem that tokens cannot be traded after staking CORE. After staking CORE, users will receive an equal amount of liquidity staking tokens stCORE. stCORE can be traded, sold or used in other DeFi protocols while CORE has been staked, enhancing user liquidity.

In addition, the Core chain's 2024 Bitcoin staking roadmap shows that it will also launch Wrapped BTC minted and locked on Core, staking of Core chain native Bitcoin, and Wrapped BTC incentive mechanisms to enhance the utility of Bitcoin on the Core chain.

Core Team and Background

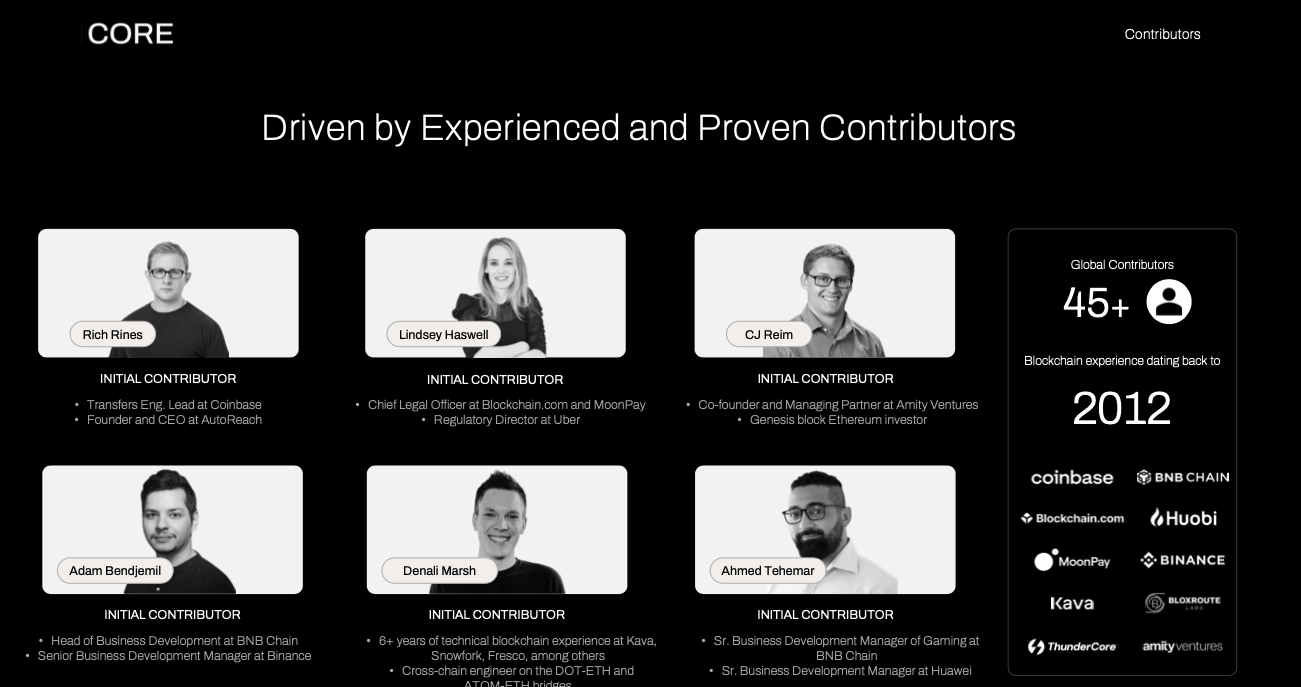

After gaining an in-depth understanding of the consensus mechanism of the Core chain and its vision of building a Bitcoin DeFi ecosystem, understanding the team and organization behind it can also help us further understand Core. DAO The organization is responsible for operations and currently has more than 45 members worldwide. Among them, core contributor Rich Rines has three years of experience working at Coinbase and is the chief engineer responsible for fund flows. Other members of the team also come from well-known large institutions in the industry and hold senior positions, including Blockchain.com, MoonPay, BNB Chain, etc.

Core DAO 贡献者团队背景强大,他们的运营成效也通过社交媒体的数据得到了体现,X(原 Twitter)平台上,Core DAO 的关注者数量已经突破了 210 万,Discord 的CommunityThe number of members exceeds 250,000, indicating that it has a largeCommunityBase.

Core Token CORE

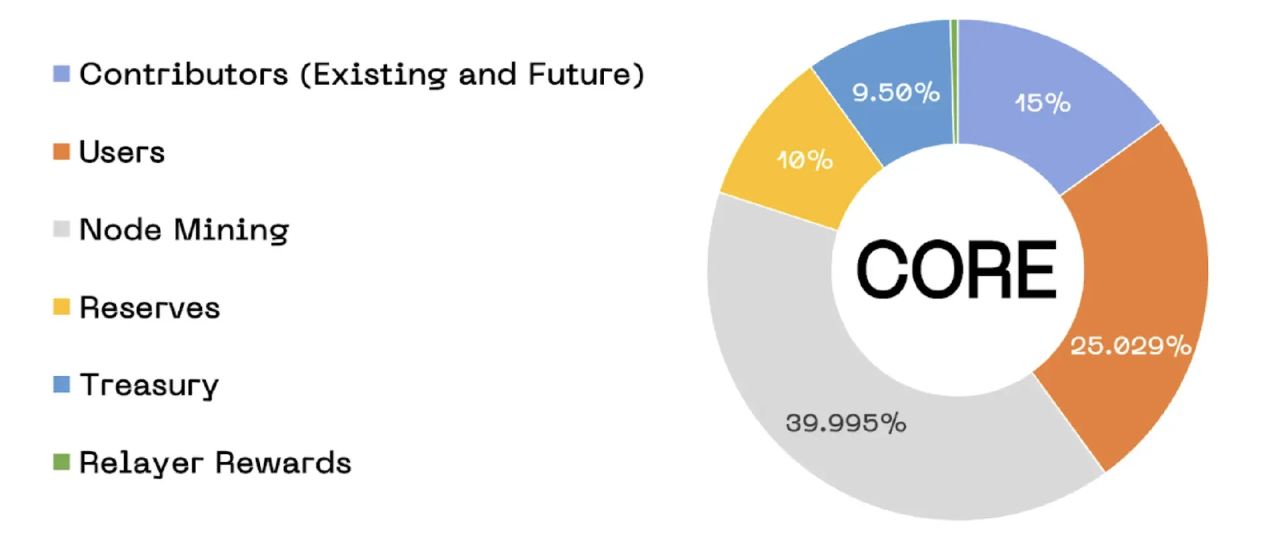

The token CORE is the utility and governance token of the Core chain. It can be used to pay gas fees for transactions, stake on the Core network, and participate in network governance. It will be launched in February 2023 with a total supply of 2.1 billion. The total supply in its token economic model is:

-

39.995% (about 840 million pieces) for node mining rewards;

-

25.029% (about 525 million pieces) for user rewards;

-

15% (about 315 million pieces) are distributed to project contributors;

-

10% (about 210 million pieces) are used as reserves;Xiaobai Navigation

-

9.5% (about 200 million) are allocated to the treasury to support the development of the Core chain ecosystem;

-

0.476% (about 10 million pieces) is used for relay node rewards.

From the above distribution model, it can be seen that CORE tokens are mostly allocated to node mining. The node reward of 39.995% will be distributed in about 81 years, and the block reward will decrease by 3.6% each year.

summary

The various features of the Core chain are built around the creation of the BTCFi ecosystem, including its innovative consensus mechanism that combines PoW, a large user base, and compatibility with EVM. In 2024, Core will use these features to supplement and improve the Bitcoin DeFi ecosystem. At the same time, Bitcoin's powerful network and high security will in turn support the stable and secure operation of the Core chain, which can be said to be mutually reinforcing and evolving together.

The article comes from the Internet:Can the Bitcoin-driven public chain Core become the optimal solution for BTCFi?

Without relying on platform coins or investors, the earliest participants have completed the project's investment, distribution, marketing and evangelism. Author: Xinwei, Ian TL;DR In the past few years,BlockchainThe industry has undergone tremendous changes, especially in the way tokens are issued. From the initial simple ICO to the complex DeFi structure, and then to today’s…