CoinGecko report: More than 50% of Crypto assets have "died" since 2014

Source: bitcoinist

Compile:Blockchainknight

CoinGecko recently conducted a comprehensive analysis of the Crypto asset market, and its report revealed a troubling fate for digital currencies.

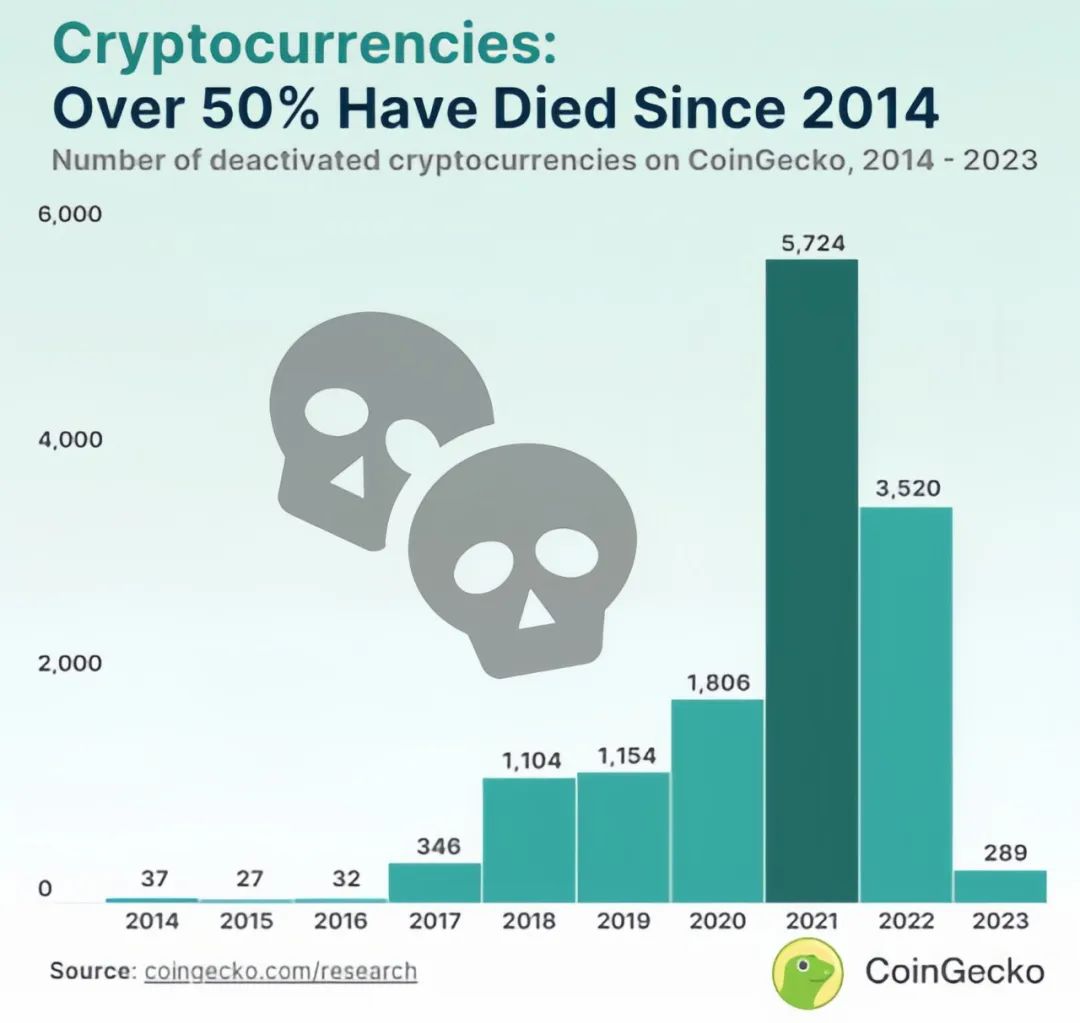

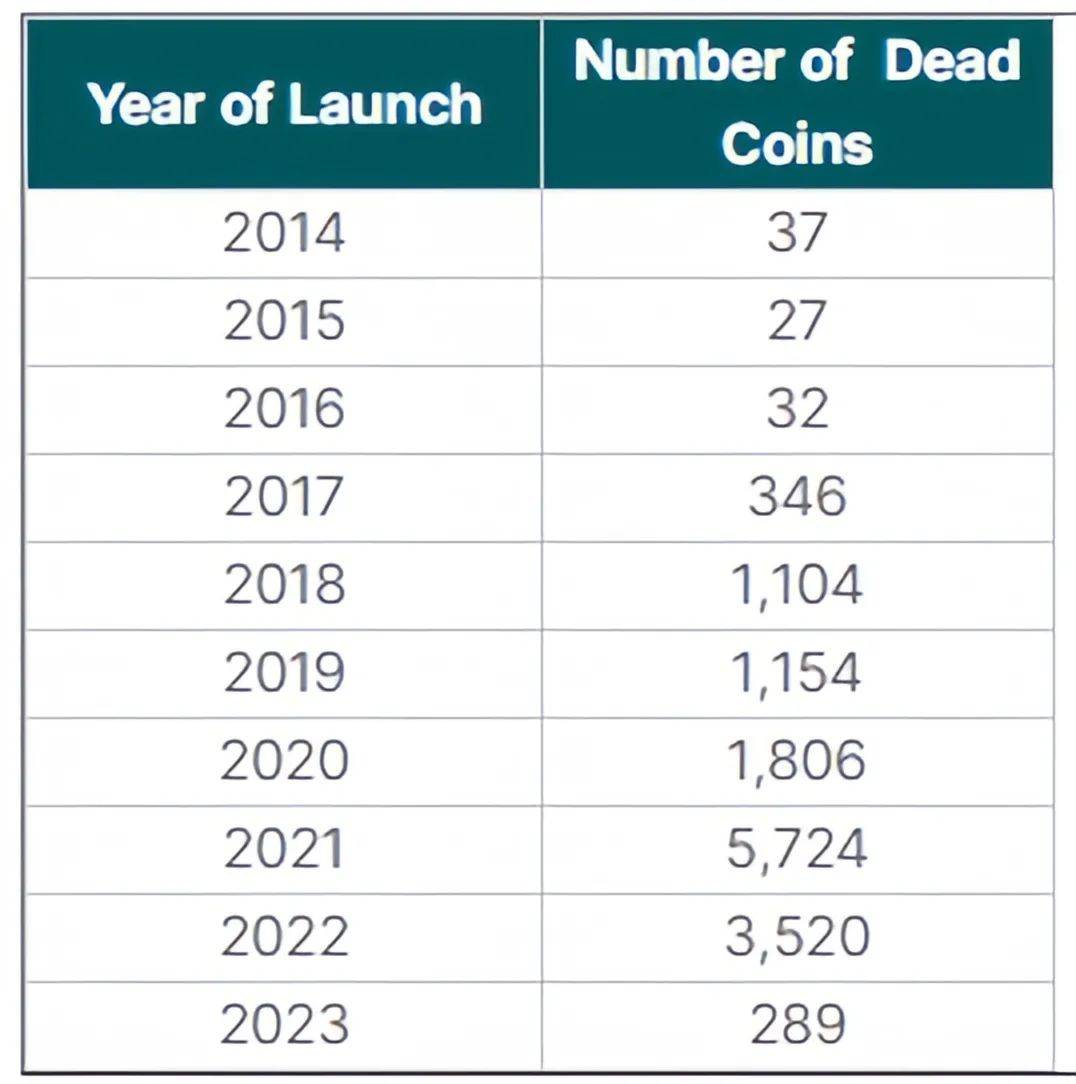

The report shows that since 2014, more than 50% of the 24,000 digital currencies listed on the platform have disappeared..

A whopping 14,039 crypto assets have been labeled “dead” or “failed” due to either long-term inactivity or an inherent lack of viability as an effective medium of exchange.

The report paints a vivid picture of a market fraught with challenges and uncertainty, with a clear correlation between bull runs and project failures.

The massive surge in prices and speculative enthusiasm during the 2020-2021 boom resulted in the most casualties, with a total of 7,530 crypto assets falling in the subsequent correction, accounting for 53.6% of all collapsed currencies.

This period also saw a proliferation of meme coins, characterized by a lack of strong technological foundations and clear use cases, which led to their rapid rise and subsequent fall.

As of January 2024, a total of 5,724 Crypto assets have closed down, among which Crypto assets launched in 2021 performed the worst.

2021 was the worst year for Coingecko since its launch, with more than 70% of the Crypto assets listed on the platform now closed down.

Next are the Crypto assets listed in 2022, of which 3520 have gone bankrupt, accounting for about 60%.

In 2023, 289 of the assets listed by Coingecko went out of business. More than 4,000 cryptocurrencies went out of business that year.Xiaobai Navigationo The failure rate of asset listings is less than 10%, a significant decrease compared to previous years.

Amid this sobering assessment, there is a glimmer of hope in the 2023 data.

The failure rate of Crypto assets issued this year has been greatly reducedSo far, only 289 out of more than 4,000 Crypto assets have disappeared, with a probability of less than 10%.

This positive trend can be attributed to a variety of factors, including a possible shift towards better-structured projects with stronger value propositions, as well as a maturing investor base that conducts deeper research and due diligence.

The report points out the main reasons for the closure of several crypto assets on the CoinGecko platform.

Prolonged periods of inactivity, more than 30 days, topped the list, followed by media coverage or credible evidence revealing a scam or fraudulent activity.

In addition, the dissolution of the project team, rebranding, or unavailability of Crypto assets are also considered necessary factors leading to deactivation.

In the final analysis,CoinGecko report offers cautionary tale for investors navigating volatile crypto asset markets.

With failure rates this high, the need for comprehensive research and critical evaluation of individual projects becomes apparent.

The article comes from the Internet:CoinGecko report: More than 50% of Crypto assets have "died" since 2014

Related recommendation: Founder's personal account: Everything you want to know about Mint Cash

本文详细阐述了 Terra 底层机制缺陷、Mint Cash 运行机制及独特架构、相关代币空投规划等信息。 撰文:Shin Hyojin,Mint Cash 创始人 编译:Frank,Foresight News 事实上,Terra 及其稳定币生态发生的事情,…