BTC L2 paradigm and genre: Rollup-like will eventually win

Written by: Zuo Ye

Since May 2023, the popularity of Inscription and its various derivative protocols has made Bitcoin once againBlockchainA new highland for industry entrepreneurship. In this wave, the two major features are the "orthodoxy" established by using Bitcoin UTXO transactions and the "mobility" of Ethereum's series of innovations feeding back to Bitcoin.

In terms of orthodoxy, Ordinal and Runes are protocols created by their author Casey Rodarmor for Bitcoin NFT and FT respectively. However, Runes is still under development, but the wave has arrived, and BTC L2 It's gradually spreading like wildfire.

在迁移性上,比特币资产发行的流通部分几乎都是接入 EVM 生态,因此,借鉴以太坊的 L2 发展思路成为行业共识,进一步的讲,ZK/OP 都被打包纳入其中,但是和以太坊扩容之路类似,陪跑者众,创新者少。

The core of BTC L2 lies in the determination of paradigms and schools. Only by determining the specific technical direction can we bet on high-quality projects. At present, BTC L2 is still in its infancy where concepts outweigh reality.

The purpose of writing this article is to outline the possible development direction of BTC L2, rather than to list current projects, and it will not involve too many technical principles (this article does not contain formulas and codes above the elementary school level, so you can read it with confidence~).

Bitcoin needs to expand, "adding noodles when there is too much water, and adding water when there is too much noodles" is not a good idea

Before BTC L2, the more mainstream expression was "capacity expansion", because Bitcoin's weak TPS could not accommodate slightly larger-scale transactions, such as high-frequency small payments. The expensive Gas Fee and snail-like confirmation speed were unbearable, at least for some people.

Expansion is imperative, especially with the birth of the two major fork projects BCH/BSV in 2017-2018, which in turn forced the SegWit upgrade of the Bitcoin mainnet. For the first time, Bitcoin made a decision that went against its ancestors - the block size was expanded to 4MB, instead of the 1MB designed by Satoshi Nakamoto.

According to Satoshi Nakamoto's design, a Bitcoin block header that does not contain transaction information is about 80 bytes. Based on a 10-minute block time, each block will only generate about 4.2 MB of data per year. After the SegWit expansion, the amount of data will increase to 16.8 MB, but the improvement in TPS is minimal and still hovers in the single digits.

A paradox arises here. The improvement of TPS requires the cooperation of a series of conditions such as hardware and network speed. If it continues at this speed, in order to achieve better transaction speed, Bitcoin will need to continue to expand and eventually become centralized.

People with insight believed that capacity expansion should be stopped and L2 should be sought instead. Thus, the first wave of L2 craze was born, and the idea of Lightning Network also emerged at this time.

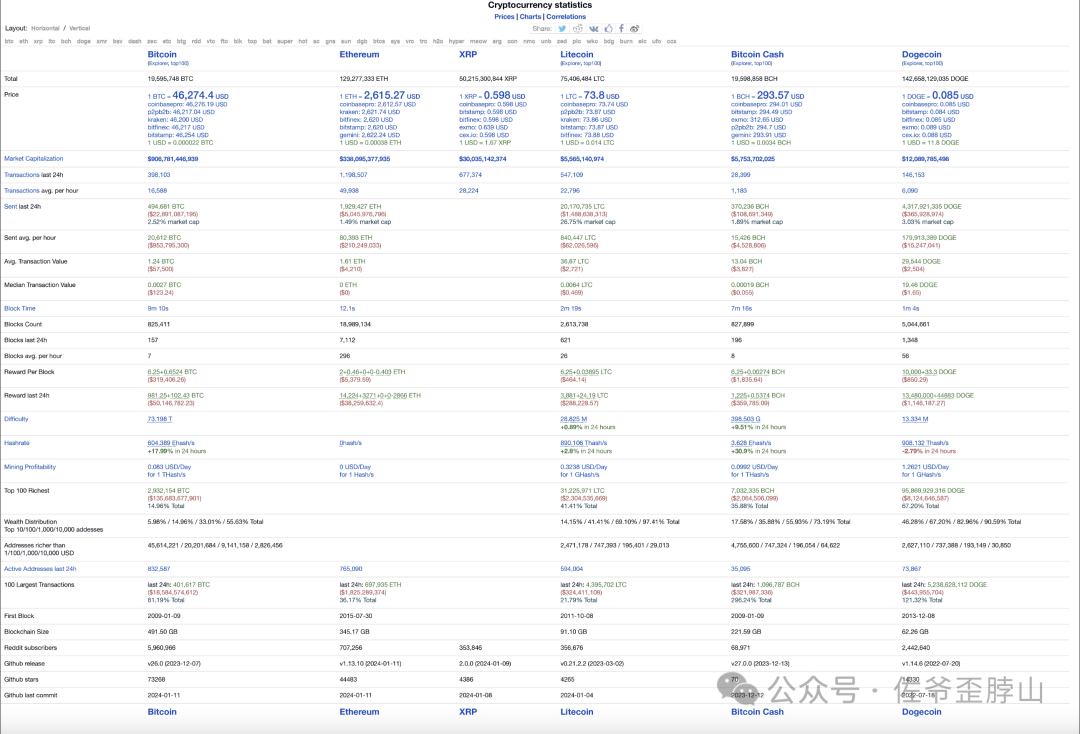

Bitcoin, Ethereum, Dogecoin and Litecoin - Data Comparison

As shown in the above figure, Ethereum is Vitalik's suggestion that Bitcoin supports smartcontractThe products after the rejection, LTC, BCH and Dogecoin are all variants of Bitcoin, with only slight differences of reducing difficulty and increasing speed.

However, the lack of certain key elements has led to many twists and turns in the process of establishing L2 in Bitcoin. The main problems are two:

-

The Bitcoin development language lacks Turing completeness and is difficult to support any complex functions;

-

Due to the hardware limitations in 2008, the Bitcoin mainnet is indeed too slow and needs to be improved;

图灵完备实际上指的是可计算性,通俗理解就是在有限规则内,可以计算复杂问题,比如要设置自动转账,以太坊依靠智能合约,设定一个规则,就可以自动执行,但是比特币就是个公开账本,只能记账,本身无法设置自动转账,这带来了绝对的SafetyIt is very efficient, but it also leads to extreme inefficiency.

The Bitcoin mainnet is very slow and supports very limited functions, so the SegWit upgrade was implemented first to greatly expand the block space, and then the Taproot upgrade was implemented. The Inscription that the inscription relies on is actually similar to code comments, and it also benefits from this.

Based on this, we can first establish a minimalist framework for Bitcoin expansion-L2 development, and then gradually fill in the details:

-

In 2017/2018, L2 launched early attempts: Lightning Network, ChainX, Stacks (established in 2015);

-

After the Taproot upgrade in 2021, some L2 attempts based on it were born, and EVM compatibility became standard, such as Liquid Network (predicted in 2020);

-

After the popularity of Inscription in 2023, many L2 practices of Ethereum, such as ZK/OP Rollup, WASM, multi-signature bridge, and EVM have been fully popularized, such as BitVM, BEVM, and Interlay V2. Overall, it is the stage of Rollup-EVM exploring and feeding back to Bitcoin.

In addition, it should be noted that the division of the three stages is not a replacement relationship, but more of a fusion. For example, the current BTC L2 basically covers EVM, but the implementation ideas are different. This article does not intend to elaborate on the history, but will only select representative solutions for interpretation.

Universal L2: The key is to be able to go up and down

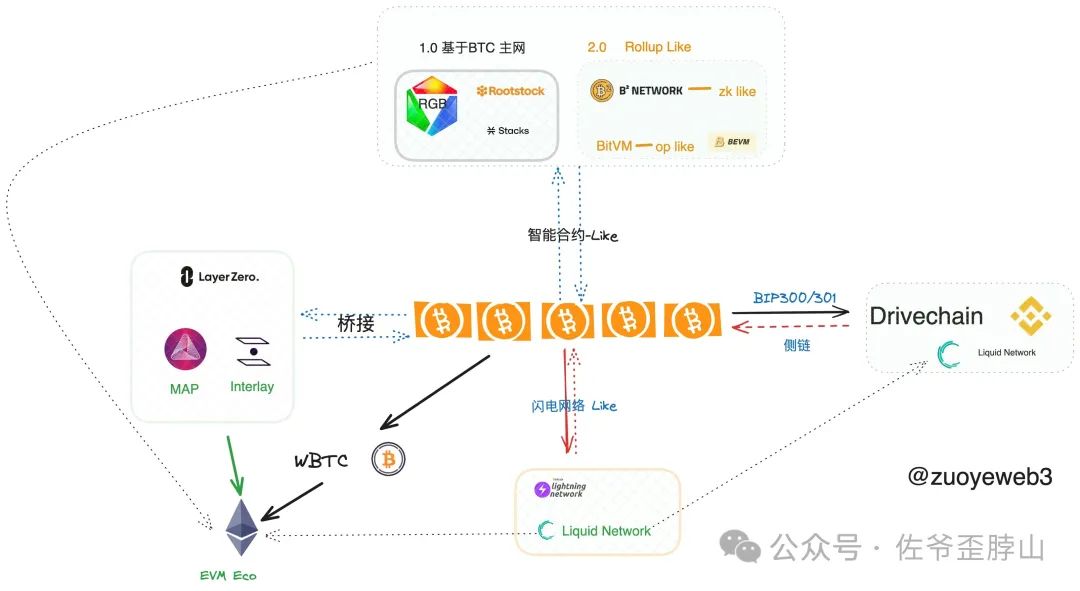

In a nutshell, the current BTC L2 can be divided into four types:There are four categories: Lightning Network, Bridge, Smart Contract (early based on the main network, now similar to Rollup) and Side ChainThis division method has little to do with technology. It mainly examines how it connects to the EVM ecosystem. Unlike Ethereum L2, the primary consideration is how to connect to the main network. BTC L2 needs to link the Bitcoin main network, L2 itself, and the EVM three layers.

BTC L2 paradigm deconstruction

Among them, the Lightning Network cannot connect to the EVM. The Lightning Network is also the BTC L2 that is most similar to Ethereum L2, but now it is an outlier. In addition, the remaining BTC L2s ideas can be included in the above figure. At the same time, not only smart contracts can support EVM. The above division is just for the convenience of explanation to highlight the characteristics of other types.

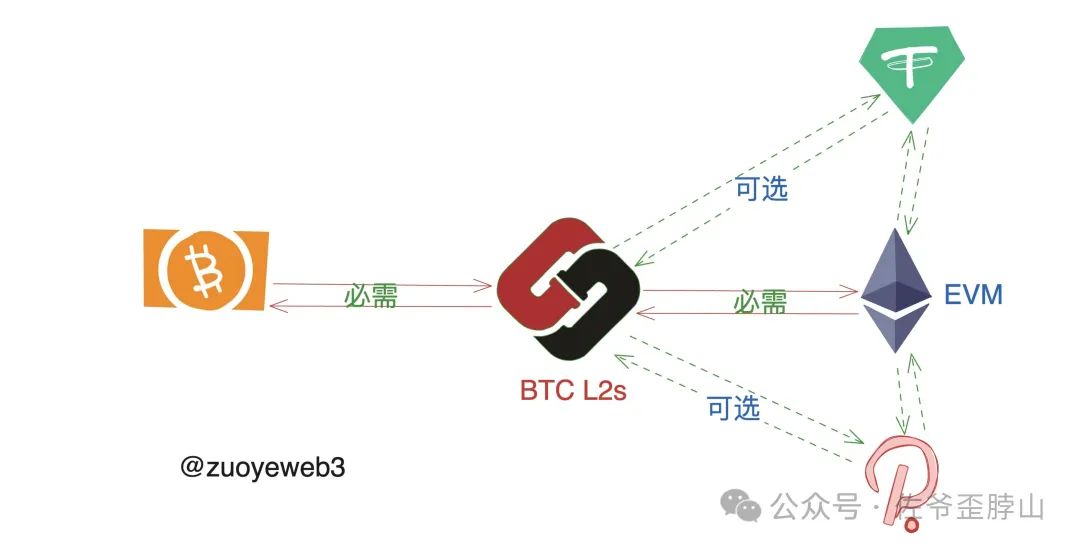

In terms of development ideas, BTC L2 needs to consider the problem of upper and lower channels, that is, how to let BTC settle in its own L2, bear the actual use of BTC flowing into EVM, and how to return the final result to the Bitcoin main network transaction to use the absolute value of Bitcoin.Safetysex.

Here, we will focus on WBTC and the Lightning Network mechanism.In a sense, the subsequent solutions can be regarded as the decentralization of the former and the universalization of the latter.WBTC solves the problem of BTC entering EVM and DeFi, but in a centralized way. The Lightning Network ultimately uses Bitcoin for settlement.SafetyThe performance is exactly the same as the main network.

BTC L2 Function Description

BTC L2 Function Description

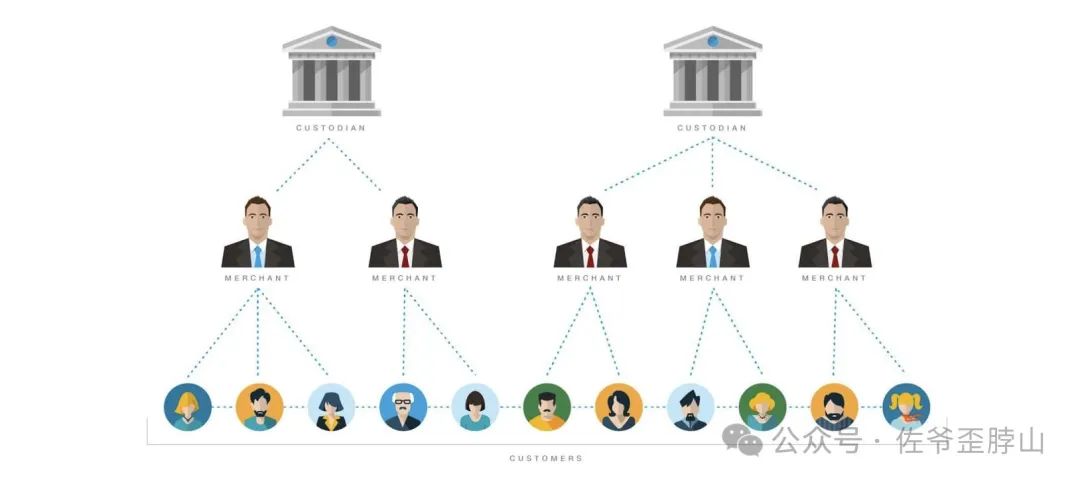

How WBTC works

WBTC stands for Wrapped Bitcoin, which is an ERC-20 token circulated on Ethereum. Token, which is backed by BTC 1:1. In terms of operation, it consists of users, listings, and custodians, and its specific functions can be divided into acceptance, minting, and redemption:

-

To accept WBTC, users need to apply to merchants, who will conduct KYC and AML on users to confirm their identities. Then users will send BTC to merchants, and merchants will send WBTC to users.

-

To mint WBTC, merchants apply to the custodian and send BTC toXiaobai NavigationSend it to the custodian, who will send WBTC to the merchant;

-

To redeem BTC, the merchant applies to the custodian, the custodian returns the BTC to the merchant, the merchant destroys the WBTC, the custodian confirms the merchant's destruction, and the transaction is completed.

It can be seen that WBTC is based on custody and centralized verification. DAO , multi-signature and circulation anonymity, but overall it is similar to USDT, which is the infiltration of traditional financial logic intoBlockchain, it is difficult to serve as the cornerstone of BTC L2.

WBTC Operational Structure

WBTC Operational Structure

The settlement principle of Lightning Network

As mentioned earlier, the Lightning Network ultimately uses the Bitcoin mainnet for settlement. Specifically, the Lightning Network has opened multiple BTC staking nodes and built a PoS-like operating network on top of Bitcoin. It can establish a P2P off-chain transaction channel without real-time confirmation, so it is extremely efficient and has a very low Gas Fee. Only when the two parties finally settle will the off-chain transaction channel be closed. After entering the final on-chain settlement link, the two parties to the transaction need to actually transfer BTC.

Therefore, the Lightning Network takes into account both BitcoinSafetyOf course, since the lightning network is not a real-time settlement system, there are still security risks. Expanding the lightning network into a universal settlement system is another focus of BTC L2.

At this point, the basic ideas of BTC L2 have been sorted out. My original intention is not to provide a technical interpretation, so quite a few implementation details will be omitted. I hope the experts will forgive me and regard this as just a suggestion.

Next, I will use representative projects in each category as examples to illustrate the current development status of BTC L2 for your reference when investing or using it.

Paradigms and schools: various BTC L2 ideas

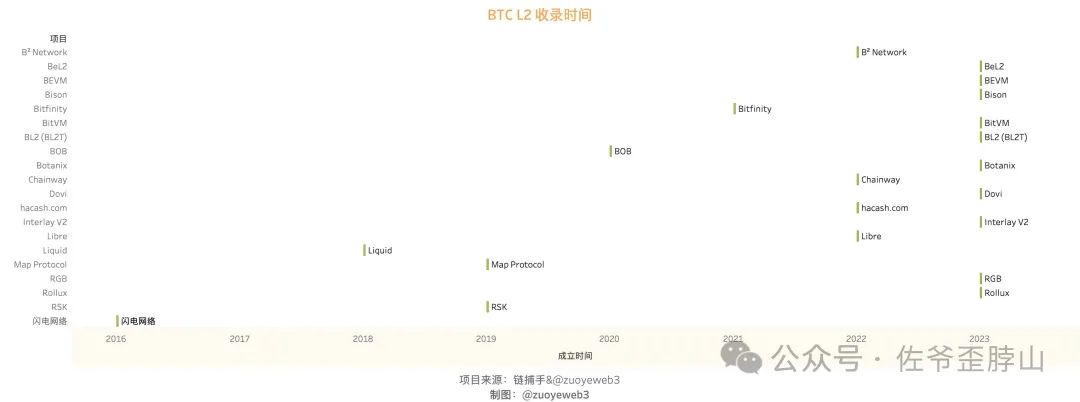

I sorted out the various L2s that have emerged so far, and it is obvious that the blowout period is concentrated in 2023. The popularity of inscriptions has created a focus on funds and technology. At the same time, the accumulation of inscriptions on the main network has also triggeredCommunityFor example, Luke wanted to ban the inscription, but the miners strongly opposed it for economic interests. I have made a detailed analysis of this.The debate over restricting inscriptions: behind the developers' quarrel is a struggle for interests.

What can maintain a balance between miners and developers is the large-scale use of L2, transferring this kind of "creativity" to L2, and the Bitcoin mainnet is only responsible for the final settlement. For example, the Runes protocol is also for this purpose. Referring to the development history of Ethereum, Bitcoin may become "modular" in the future, forming an architecture system of mainnet-Ordinal (BRC-20)-L2-dApp.

BTC L2 establishment time list

BTC L2 establishment time list

The above projects themselves will change. Here they are based on the confirmed establishment time, such as the release of the white paper or the launch of the main network, but this does not affect their classification and description. The key is understanding.

According to the different ways of BTC uplink and transaction results downlink, I further divided L2. The specific parameters can be divided into BTC mapping method, L2 fund management method, data feedback method, supplemented by EVM compatibility, Token issuance, etc., to build a comparison table of existing L2 representative projects of various types.

Representative projects of BTC L2 paradigm

Representative projects of BTC L2 paradigm

From the above table, we can see that there is almost no perfect decentralized L2 solution. All of them more or less require similar transfer to off-chain or use multi-signature to run, and strike a balance between efficiency, decentralization and scalability (EVM compatibility).

以闪电网络为例,这几乎是上个时代唯一存活至今的 L2/ 扩容方案,其完整使用了比特币主网的各个特点,自身也并未发行代币,但是支付通道限制其通用性,非实时结算也导致无法大额转账。

The subsequent Liquid Network can be regarded as a special lightning network with a strong access system. To be more precise, Liquid is a specialized, centralized lightning network variant for B-side institutions. It is more appropriate to call it a side chain. Although it can reissue and circulate BTC, it cannot be opened to all users and the degree of decentralization is too low.

Stacks 开放程度更进一步,并且尝试引入智能合约,其计划可挂钩发行 sBTC,具备一定的无准入特征,尤其是后续会支持 EVM,但是需要矿工质押 BTC 以挖取其代币 STX,而其代币更多作为治理代币而存在,缺乏足够的使用场景,可以理解为铭文之前的 EVM 兼容尝试。

Similar to Stacks are projects such as RGB and Rootstock. Overall, there is not much difference, except that there are increases and decreases in decentralization and the issuance of their own tokens. I don’t think this will be the mainstream in the future.

The mainstream has emerged, that is, the Rollup L2 solution similar to Ethereum will eventually win. Side chains, lightning networks, etc., according to the Ethereum expansion category, do not belong to L2, especially Rollup L2. This article just confuses them for the convenience of discussion. In terms of Bitcoin expansion, I estimate that Ethereum's path will also be referred to.

Specifically for Ethereum-like Rollup L2, BitVM uses hash locks to introduce BTC, and then uses Bitcoin scripts to store optimistic verification results to ensure security. In essence, the calculation is off-chain and the results are on-chain, but there is a time difference in optimistic verification, especially when it comes to BTC. The efficiency of capital utilization and how to deal with fraud may not be completely consistent with the Ethereum OP series solution. Given that the project is still in its early stages, I will continue to pay attention.

Then there is the ZK-based L2 B Network. At present, it seems (not entirely certain) that BTC will be officially bridged to L2, and then the ZK result proof will be written into the Bitcoin script to ensure permanent security. The hidden premise here is that the generated ZK result is completely correct, and Bitcoin is only confirmed as the final DA layer. The white paper shows that BSQ tokens will be issued, and you can also pay attention to its subsequent development ideas.

Another Ethereum-like solution is BEVM, which emphasizes the "synchronicity" of Bitcoin and L2. When BTC is bridged to BEVM, the Bitcoin block header data will be synchronized to maintain data consistency. In the generation of the final result, PoS consensus is used, and the final result is written into the Bitcoin script. However, it is necessary to ensure that there are no problems with the consensus itself during operation. It can only be said that it takes time to verify.

In addition, there is also a bridge + WASM solution. This is one of the few BTC L2s that uses Polkadot as a solution. It still uses the familiar bridge to issue iBTC. The innovation lies in the emphasis on liquidity market making in the vault management solution, which encourages each vault to invest iBTC in DeFi. Secondly, it connects to the Near/EVM/Cosmos ecosystem through a variety of cross-chain bridges. The overlapping of systems is a great test of security, but it has won the Polkadot parachain auction twice. As the main docking solution between Polkadot and Bitcoin, it will also issue INTR tokens, so you can pay attention to it.

Since there is Polkadot, there must be ICP. Both are heterogeneous chains, and both were once Ethereum killers and doomed projects. Bitfinity built the EVM-compatible BTC L2 based on ICP, which has good support for BTC assets. It not only allows BTC to be bridged to L2 through threshold signatures, but also allows BRC20 assets to be bridged to L2. However, it is still uncertain how to handle on-chain funds and data feedback methods. Everyone is welcome to give me some supplements.

We started with the Lightning Network and will eventually return to Bitcoin. The Runes protocol of the founder of Ordinal can also issue tokens. I also classify it as L2. Similar to BRC20, it is completely based on the Bitcoin mainnet and uses UTXO to issue tokens. Although it is not currently in use, it is very likely to be the next Bitcoin mainnet craze. After all, miners earn transaction fees, and they have enough motivation to create FOMO to attract funds.

Back to the beginning of this section, the trick of each project is to issue tokens, even governance tokens. The siphoning effect of BTC is too strong. If the ecosystem is built entirely based on BTC, then the miners will be the only ones who benefit in the end, and L2 may only get a small share of the handling fee. In the business model of Ethereum L2, almost all L2s will eventually issue tokens. I think this rule will also happen on BTC L2. The only problem is that BTC is too strong. It is not easy to convince users to use BTC to pledge or exchange it for their own governance tokens.

At this point, I have basically sorted out the existing BTC L2 paradigms and representative projects. You can feel that I focused on explaining the BTC L2 classification and future development possibilities, and omitted the introduction of each project and the ecosystem. That is not important. What is important is to see the future direction and take the right path.

BTC L2 Vision: Multi-layer Folding, LSD/LRT Explodes Liquidity

BTC has long been used only as digital gold, and together with USDT, it serves as a measure of value and a medium of exchange in the crypto market. Although WBTC is sufficient for daily use, after the inscription, BTC has become an asset issuance platform. Whether it is the BRC20 & Ordinal protocol on the first layer, or the booming BTC L2, it means that BTC itself has surpassed its previous single function. Even as a handling fee, it has created new growth points due to asset minting, issuance, and transfer.

We can also continue to imagine that most BTC is not active and is simply used as a means of storing value. However, after the mining reward is halved, coupled with the approval of the BTC spot ETF, BTC needs to learn how to survive after ETH switches to PoS. For example, the leverage effect of LSD/LRT. The current market value of BTC is around one trillion US dollars. If a large amount of BTC is pledged for L2, its capital efficiency will be reduced. Referring to Blast's idea, interest-bearing L2 can attract retail investors and funds to flow into it. The value of BTC itself is enough to support ten or dozens of times of leverage. It is a pity not to use it as a pegged product for LSD/LRT.

The article comes from the Internet:BTC L2 paradigm and genre: Rollup-like will eventually win

Related recommendation: Arthur Hayes: Bitcoin ETF will create arbitrage opportunities

People finally have a way to escape the global fiat currency devaluation carnival. Author: Arthur Hayes Translated by Joyce, BlockBeats Editor's note: After the Bitcoin ETF was passed, everyone from the crypto community to traditional financial institutions is closely watching the impact of this event on the global financial market. Arthur Hayes analyzes the...