Arthur Hayes: Bitcoin ETF will create arbitrage opportunities

By Arthur Hayes

Compiled by Joyce, BlockBeats

Editor’s Note:After the Bitcoin ETF was approved, everyone from the crypto community to traditional financial institutions was closely watching the impact of this event on the global financial market. In this article, Arthur Hayes analyzed the reasons for the approval of the Bitcoin ETF - Bitcoin's anti-inflation characteristics make it an ideal asset in the current global inflation environment. The Bitcoin ETF provides an opportunity for funds that want to avoid the impact of inflation but cannot leave the traditional government control. Then, Arthur Hayes conducted an in-depth analysis of the market impact that the Bitcoin spot ETF may bring, and explained in detail the creation and redemption process of the ETF, as well as the possible arbitrage opportunities in the operation of the Bitcoin ETF.

BlockBeats compiled the original text as follows:

(Any of the following opinions are the author's personal opinions and should not be used as a basis for investment decisions, nor should they be considered as recommendations or suggestions for engaging in investment transactions. Image from X user@CryptoTubeYT)

Why now?

The last moments of life are the most expensive from a medical point of view. We are willing to spend unlimited amounts of money on treatments that can delay the inevitable. Likewise, the elites of the US hegemony and its client states, who are responsible for maintaining the current world order, are willing to protect this order at all costs because they benefit most from it. But the US hegemony has been on its deathbed since 2008, when shady mortgages on penniless Americans triggered a global economic crisis as severe as the Great Depression of the 1930s. And what prescription do the mid-century New Keynesian barbers who blindly follow Ben Bernanke prescribe? The same prescription that a dying empire always prescribes... "The printing presses are humming."

The United States, Europe, and a number of its vassal states, rivals, and allies elsewhere have all resorted to printing money to address different symptoms of the same problem: a deeply unbalanced global economic and political system. The United States, led by the Federal Reserve (Fed), prints money and buys U.S. government bonds and mortgages. Europe, led by the European Central Bank (ECB), prints money and buys government bonds of euro member countries to keep the flawed monetary (but not fiscal) union alive. Japan, led by the Bank of Japan (BOJ), continues to print money in its pursuit of the phantom inflation that vanished after the 1989 real estate crash.

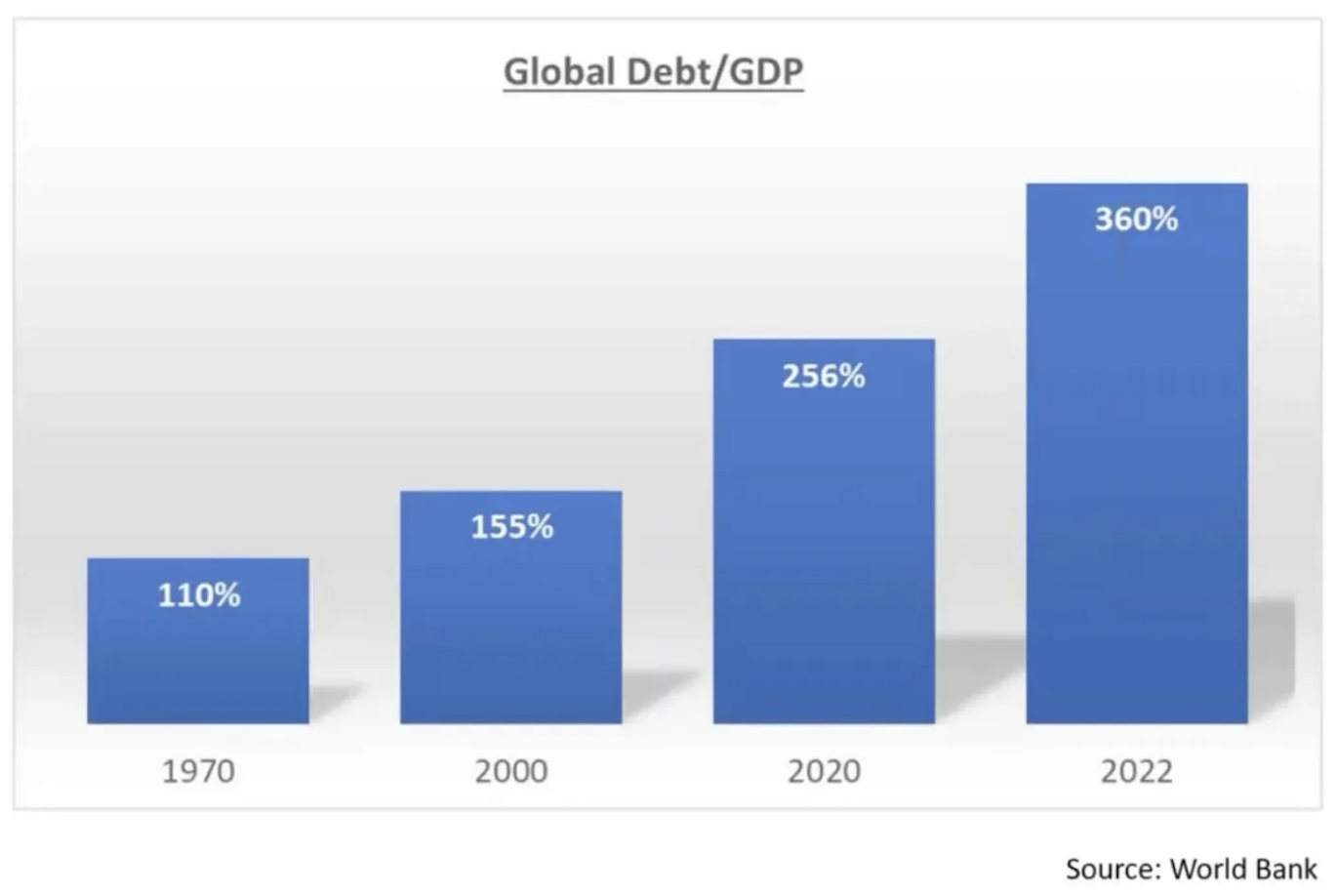

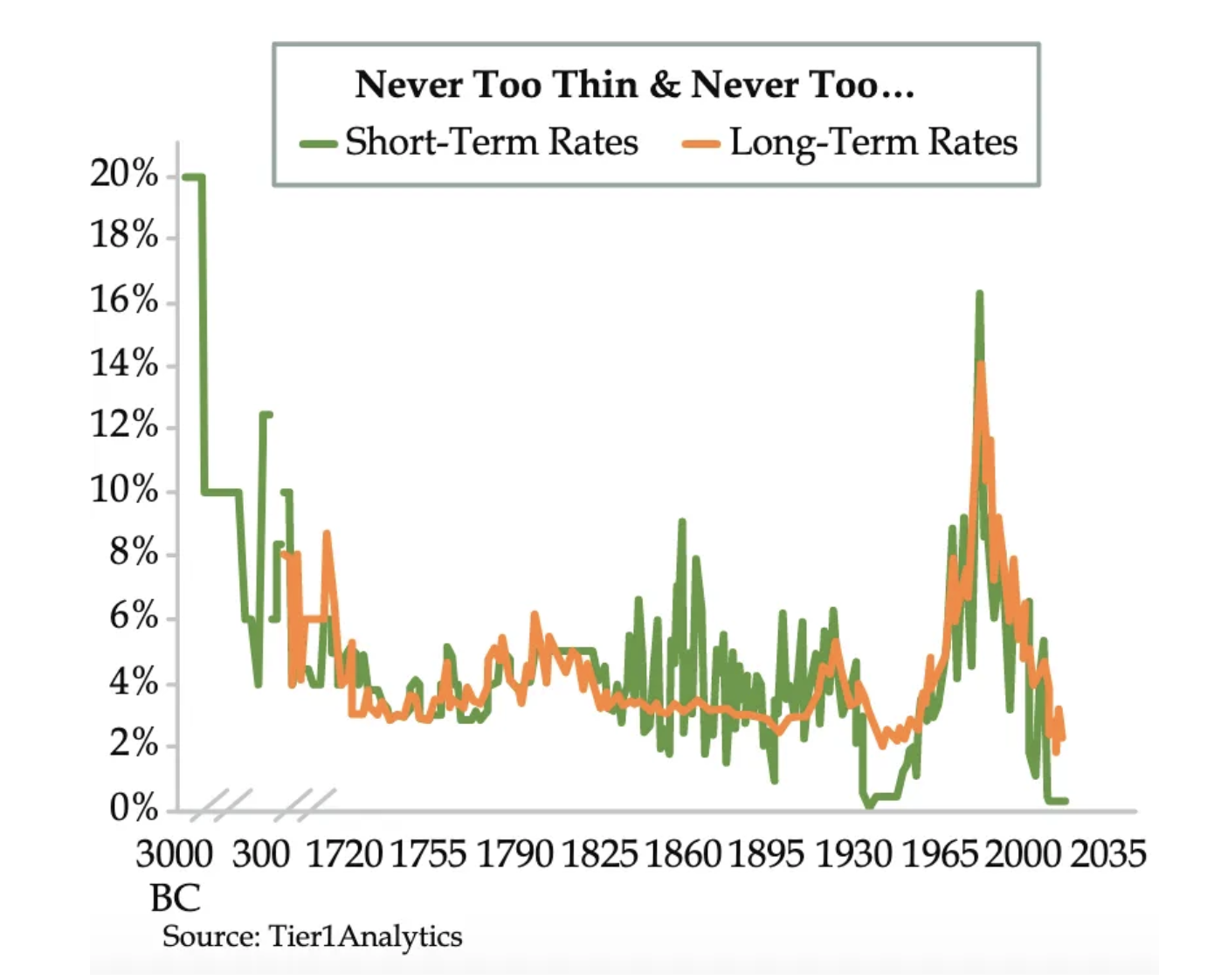

The result of this wanton money printing was an accelerating rise in the global debt-to-GDP ratio. Global interest rates hit 5,000-year lows. At their peak, almost $20 trillion of corporate and government bonds had negative yields. Since interest is compensation for the time value of money, if interest is negative, are we suggesting that time is no longer valuable?

grateful Quill IntelligenceDanielle DiMartino Booth of provided this chart.

As you can see, in response to the 2008 Global Financial Crisis (GFC), interest rates were pushed to 5,000-year lows.

This is a Bloomberg index of the total amount of negative-yielding debt in the world. From nothing before the 2008 global financial crisis toXiaobai NavigationIt reached a high of $17.76 trillion in 2000. This was the result of central banks around the world lowering interest rates to $0% and below.

The majority of the world’s population does not own enough financial assets to benefit from this global fiat currency debasement. Inflation has sprung up on all kinds of commodities around the world. Remember the Arab Spring in 2011? Remember when avocado toast was less than $20 in every major global financial center? Remember when a family with a median income could afford the median price of a house without having to turn to the “Bank of Mom and Dad”?

The only marginally viable way out is to own some gold. But gold is impractical to actually own. It's heavy and hard to hide in large quantities, and it's hard to hide from greedy government regulators. So ordinary people just have to suffer in silence while the elites continue to party in Davos as if it's 2007.

Yet, like a lotus flower blooming in a cesspool, Satoshi Nakamoto released the Bitcoin whitepaper in the midst of a morally, politically, and economically bankrupt empire. The whitepaper outlined a system where, through internet-connected machines and cryptographic proofs, people could, for the first time in human history, separate money from state in a globally scalable way. I say “globally scalable” because Bitcoin is weightless. Whether you hold 1 Satoshi or 1 million Bitcoins, they weigh the same 0. Furthermore, you can unlock your Bitcoins simply by rememberingwalletMnemonics, use your mind to protect your Bitcoin. Bitcoin provides everyone with a complete financial system that is no longer subject to the ancient system and only requires a device connected to the Internet.

People finally have a way to escape the global fiat currency debasement orgy. However, Bitcoin is not mature enough to provide a credible escape hatch for believers after the great financial crisis of 2008. Bitcoin, and the entire crypto market, must grow in the number of users and prove that they can withstand a serious crisis.

We, the faithful believers, had a severe test in 2022. The Federal Reserve, followed by most central banks around the world, set about tightening financial conditions at the fastest pace since the 1980s. The hegemonic US banking system and bond markets could not withstand the Fed’s onslaught. In March 2023, three US banks (Silvergate, Silicon Valley Bank, and Signature Bank) collapsed within just two weeks of each other. The US banking system was bankrupt if accounted for at market value, and it remains so today, especially given their holdings of US Treasuries and mortgage-backed securities. So US Treasury Secretary bad girl Yellen created the Bank Term Funding Program (BTFP) as a secret way to save the entire US banking system.

cryptocurrencyNor have they been immune to disruptions caused by high interest rates. Centralized lending platforms like BlockFi, Celsius, and Genesis have all gone bankrupt due to loans they made to over-leveraged trading firms like Three Arrows Capital. Terra Luna, a stablecoin pegged to the U.S. dollar, has also been hit by a governance row.Token Luna went bankrupt due to price drops, and theTokenThe event wiped out more than $40 billion in virtual value in two days.exchangeFTX, run by the “right” type of white American hegemon, Sam Bankman-Fried, is the biggest. stealHe took more than $10 billion in client funds, and his scam was exposed as crypto asset prices plummeted.

What happened to Bitcoin, Ethereum, and DeFi projects like Uniswap, Compound, Aave, GMX, dYdX? Did they fail? Did they call the central crypto banks and get bailed out? Absolutely not. Overleveraged positions were liquidated, prices dropped, people lost a ton of money, centralized companies ceased to exist, but Bitcoin blocks are still being produced on average every 10 minutes. DeFi platforms did not go bankrupt on their own. In short, there was no bailout because crypto can’t get bailed out. We got hurt, but we persevered.

在 2023 年的余烬中,很明显美国霸权及其附庸国不能继续实施紧缩的货币政策。这样做将使整个体系破产,因为杠杆和债务堆积得太高。一个耐人寻味的事情发生了,随着美国长期国债收益率开始逐步上升,比特币和加密货币却出现了反弹,而债券价格在下跌。

Bitcoin (white) and the U.S. 10-year Treasury yield (yellow)

As you can see in the chart above, when interest rates rise, Bitcoin, like all other long-term assets, falls.

After the Bank Term Funding Program (BTFP), this relationship reversed. Bitcoin rose in tandem with yields. Especially as the bear market accelerated steeply, rising yields indicated that investors had no faith in the “system.” In response, they sold off the most valuable assets of the U.S. empire.SafetyThis money has mainly flowed into the "Glorious Seven" artificial intelligence technology stocks (Apple, Google's parent company Alphabet, Microsoft, Amazon, Meta, Tesla, Nvidia), and to a certain extent, cryptocurrencies. After nearly 15 years, Bitcoin has finally shown its true colors and become "the people's currency" rather than just a derivative of the empire's risk assets. This poses a very thorny problem for traditional finance.

Capital must stay in the system to inflate away the massive amounts of unproductive debt. Bitcoin is outside the system and now exhibits zero to slightly negative correlation with bonds (remember, when yields rise, bond prices fall). If bond vigilantes expressed their displeasure with government bonds by selling them and buying Bitcoin and other cryptocurrencies, the global financial system would collapse. It collapses because the inherent losses incurred within the system are finally realized, and large financial firms and governments will have to shrink dramatically. Bitcoin is outside the system and now exhibits zero to slightly negative correlation with bonds (remember, when yields rise, bond prices fall).

To avoid this liquidation, the elite must create a highly liquidexchangeThey are trying to financialize Bitcoin by creating exchange-traded funds (ETFs). This is the same trick they played on the gold market when the SEC approved ETFs like SPDR GLD in 2004 that allegedly held gold bars in vaults around the world. If all the capital that wanted to escape the collapse of the global government bond market bought a Bitcoin ETF managed by a large traditional financial company like BlackRock, then the capital would still beSafetyStay within the system.

As it became apparent that the Fed and all other major central banks would have to turn to money printing again in order to protect global bond markets, BlackRock formally applied for a Bitcoin ETF in June 2023. Spot Bitcoin ETFs are approved in the United States. However, in 2023, the US SEC appears to have finally accepted such an application. I present the following to highlight the strangeness of current events surrounding the ETF approval process. The Winklevoss brothers applied for a spot Bitcoin ETF in 2013, but the SEC rejected their application for more than a decade. BlackRock applied and was approved within six months. It makes one sigh: "Hmm..."

As I mentioned in my previous article,ExpressionAs written in the 2016 Bitcoin ETF, a spot Bitcoin ETF is a trading product. You buy it with fiat currency to earn more fiat currency. It is not Bitcoin. It is not a path to financial freedom. It is not an escape from the traditional financial system. If you want to escape, you have to buy Bitcoin, withdraw it from the exchange, and keep it yourself.

I wrote this lengthy preface to explain “why now?” Why, at this critical moment for the Empire and its financial system, has a spot Bitcoin ETF finally been approved? I hope you can appreciate the significance of this development. The global bond market is estimated at $133 trillion; imagine the influx of money into Bitcoin ETFs if bond prices continue to fall, even as the Fed may begin cutting rates in March. If inflation bottoms out and resumes rising, bond prices may continue to fall. Remember, war causes inflation, and there is certainly war going on in the Empire’s periphery.

Market Impact of Spot Bitcoin ETF

The rest of this post will discuss the market impact of a spot Bitcoin ETF. I will focus only on BlackRock’s ETF because BlackRock is the largest asset manager in the world. They have the best ETF distribution platform in the world. They can sell to family offices, retail financial advisors, retirement and pension plans, sovereign wealth funds, and even central banks. All the other companies will do their best, but the BlackRock ETF will be the clear winner in terms of assets under management. Whether this prediction is correct or not, the following strategy will work for any issuer with a lot of ETF trading volume.

This article will discuss the following and how the inner workings of ETFs will create amazing trading opportunities for those who can trade in traditional finance and crypto markets: the ETF creation and redemption process, spot trading arbitrage and time series analysis of transactions, ETF derivatives such as listed options, the impact of ETF financing transactions.

With all that out of the way, let’s make some money!

Cash rules everything around me

Problem solved. Funding (creation) and withdrawal (redemption) can only be done with cash. The most concerning aspect of this ETF is that it allows regular people to purchase the ETF with fiat currency and choose to redeem the ETF in Bitcoin. The purpose of this product is to store fiat currency, not to provide a way to easily purchase Bitcoin with a retirement account.

create

To create ETF shares, an Authorized Participant (AP) must send the dollar value of the creation basket (i.e., a certain number of ETF shares) to the fund by a certain time each day.

APs are large traditional financial trading companies. Some important institutions in traditional finance have registered as APs for different ETFs. Some companies that have called on the government to ban cryptocurrencies, such as the company where JP Morgan CEO Jamie Dimon works, will also participate. This surprises me ;)

example:

Each ETF share is valued at 0.001 BTC. The creation basket contains 10,000 shares, which are worth $1,000,000 at 4 pm EST. The Authorized Participant (AP) must wire this amount to the Fund. The Fund will then instruct its counterparty to purchase 10 Bitcoins. Once the Bitcoin purchase is complete, the Fund will credit the AP with the ETF shares.

1 basket = 0.001 BTC * 10,000 shares = 10 BTC

10 BTC * 100,000BTC/USD = 1,000,000 USD

redemption

To redeem shares of the ETF, an Authorized Participant (AP) must send the ETF shares to the Fund by 4pm EST. The Fund will then instruct its counterparty to sell 10 Bitcoins. Once the Bitcoins are sold, the Fund will issue $1,000,000 to the AP.

1 basket = 0.001 BTC * 10,000 shares = 10 BTC

10 BTC * 100,000BTC/USD = 1,000,000 USD

For us traders, we want to know where Bitcoin must be traded. Of course, the counterparties that help the fund buy and sell Bitcoin can trade on any trading venue they like, but in order to reduce slippage, they must match the fund's net asset value (NAV).

The fund’s NAV is based on the BTC/USD price at 4pm ET on CF Benchmark. CF Benchmark sources prices from Bitstamp, Coinbase, itBit, Kraken, Gemini, and LMAX between 3-4pm ET. Any trader who wishes to perfectly match NAV and reduce execution risk by trading directly on all of these exchanges can do so.

The Bitcoin market is global, and price discovery is primarily inBinance(I guess based in Abu Dhabi). CF Benchmark excludes another large Asian exchange, OKX. This will be the first time in a long time that there will be predictable and persistent arbitrage opportunities in the Bitcoin market. Hopefully, billions of dollars of trading flow will converge within an hour on exchanges that have less liquidity and are more responsive to the prices of their larger Asian competitors. I expect there will be some attractive spot arbitrage opportunities to exploit.

Clearly, if ETFs are wildly successful, price discovery could shift from East to West. But don’t forget Hong Kong and its copycat ETF products. Hong Kong only allows its listed ETFs to be traded on Hong Kong’s regulated exchanges.Binanceand OKX may serve this market, but new exchanges will also emerge.

No matter what happens in New York or Hong Kong, neither city will allow fund managers to trade Bitcoin at the best price, they may only be able to trade on "select" exchanges. This unnatural state of competition will only lead to a more inefficient market, which we as arbitrageurs can profit from.

Here is a simple arbitrage example:

Average Daily Volume (ADV) = (Exchange CF Benchmark Weight * Daily Market Closing (MOC) USD Notional) / CF Benchmark Exchange USD ADV

选择 CF Benchmark 中最不流动的交易所,即那个 ADV 天数最高的交易所。如果买方压力增加,CF Benchmark 交易所的比特币价格将高于币安。如果卖方压力增加,CF Benchmark 交易所的比特币价格将低于币安。然后,在昂贵的交易所卖出比特币,在便宜的交易所买入比特币。您可以通过 ETF 交易与其盘中净资产值(INAV)的溢价或折价来估计创造/赎回流向的方向。如果 ETF 溢价,将会有创造流向。授权参与者(AP)在昂贵的 ETF 上做空,然后在更便宜的净值处进行创造。如果 ETF 折价,将会有赎回流向。AP 在二级市场上以低价购买 ETF,并以较高价格的 NAV 赎回。

To trade this in a price neutral manner, you need to place USD and BTC on CF Base Exchange and Binance. However, as a risk neutral carry trader, your BTC needs to be hedged. To do this, buy BTC with USD and short the BitMEX BTC/USD Bitcoin Coin-based Perpetual Swap on BitMEXcontract. Place some Bitcoins on BitMEX as margin and the rest of the Bitcoins can be spread across related exchanges.

ETF Options

To really make the ETF casino work, we need leveraged derivatives. In the US, the zero-day option (0DTE) market has exploded. Options that expire in one day are similar to lottery tickets, especially when you buy them out-of-the-money (OTM). Now, 0DTE options have become the most traded option instrument in the US. Of course, people like to gamble.

Some time after the ETF is listed, options will start to appear on US exchanges. Now the real fun begins.

It's hard to get 100x leverage in TradFi. They don't have a place like BitMEX that can solve the problem. But OTM options with shorter expiration dates have very low premiums, which creates high leverage or leverage ratios. To understand why, brush up on your theoretical options pricing knowledge by studying the Black-Scholes theory.

Degen traders with brokerage accounts that can trade on U.S. options exchanges will now have a liquid way to make highly leveraged bets on the price of Bitcoin. The underlying of these options will be ETFs.

Here is a simple example:

ETF = 0.001 BTC per share

BTC/USD = $100,000 ETF share price = 100 USD

You think the price of Bitcoin will rise by 25% by the end of the week, so you buy a call option with a strike price of $125. The option is out-of-the-money because the current ETF price is 25% below the current strike price. Volatility is high, but not extremely high, so the premium is relatively low at $1. The most you can lose is $1, and if the option goes in-the-money (over $125) quickly, you can make more profit through the change in the option premium, while you could make a profit of 25% if you had just sold the ETF shares yourself. This is a very crude way to explain leverage.

In the US capital markets, these enthusiastic traders are a serious bunch. With these new highly leveraged ETF options products, they are going to cause some confusion about Bitcoin’s implied volatility and forward structure.

Forward Arbitrage

看涨期权价格 – 看跌期权价格 = 多头远期合约

As traders buying lottery tickets drive up the price of ETF options, the price of out-of-the-money options will rise. This provides an opportunity that can be realized through arbitrage between BTC/USD perpetual contracts (such as those on BitMEX) and ATM forward contracts derived from ETF option prices.

Futures Basis = Futures Price – Spot Price

I expect the ETF ATM forward basis to trade at a premium to the BitMEX futures basis. Here’s how to trade it.

Go short on the ETF ATM forward by selling the ATM call and buying the ATM put.

At the same time, buy the BitMEX Bitcoin/USD fixed-expiry futures contract, which has an expiration date similar to the ETF options.

Wait for prices to converge as they get closer to expiration. This won’t be a perfect arbitrage because BitMEX and the ETF use different trading prices to construct the spot index price of Bitcoin.

Volatility Arbitrage

To a large extent, when you trade options, you are trading volatility. Traders who currently trade Bitcoin options on crypto-native non-US exchanges have different preferences for duration and strike prices than traders who trade ETF options. I predict that the volume of ETF options trading will dominate the flow of global Bitcoin options. As these two groups of traders, US dollar-based traders and non-USD traders, cannot interact on the same exchanges, arbitrage opportunities will emerge.

Direct arbitrage opportunities exist when options of the same maturity and strike price trade at different prices. There will also be more general volatility arbitrage opportunities where parts of the ETF options volatility surface outside the U.S. differ significantly from the Bitcoin volatility surface. It takes more trading experience to spot and exploit these opportunities, but I know there will be a lot of speculators in France arbitraging these markets.

MOC (Market on Close) Flow

The 4pm close of the CF benchmark index will be very important as ETFs will lead to a surge in trading volumes of US listed ETF derivatives. The value of derivatives is derived from their underlying assets. With billions of dollars in notional amounts of options and futures expiring every day, it is critical to match the closing trading price of the ETF to align the net asset value (NAV).

This will produce statistically significant trading activity around 4pm ET and during other trading hours on other trading days. Those who are good at crunching the data set and have good trading bots will make huge profits by arbitrageurizing these market inefficiencies.

ETF Financing (Creating Loans)

Centralized lending platforms, such as Blockfi, Celsius, and Genesis, are very popular among Bitcoin holders who want to borrow fiat currency using their Bitcoin as collateral. However, the dream of an end-to-end Bitcoin economy has not yet been realized. Loyal Bitcoin supporters still need fiat currency to pay for necessities, using that not-so-clean fiat currency.

All of the centralized lending platforms I just mentioned collapsed, and so did many others. It has become much more difficult and expensive to borrow fiat using Bitcoin as collateral. Traditional finance is very accustomed to lending against liquid ETFs. It will now be possible to get large-scale fiat loans at competitive rates, as long as you collateralize your Bitcoin ETF shares. For those who believe in financial freedom, the problem is maintaining control of Bitcoin and taking advantage of this cheaper capital.

The solution to this problem is to trade Bitcoin for an ETF. Here’s how it works.

APs that can borrow in the interbank market will create ETF shares and hedge the Bitcoin/USD price risk. This is creating a lending business. In Delta-One's words, it is the repurchase value of the ETF shares.

Here is the process:

Borrow USD in the interbank market and create ETF shares in cash.

Sell the ETF's ATM call option and buy the ETF's ATM put option to create a synthetic short forward contract.

The act of creating an ETF unit creates a positive carry, i.e. forward basis > interbank USD rate.

Lend ETF shares in exchange for Bitcoin collateral.

Let's bring Chad in and discuss what he needs to do with his Bitcoin:

Chad is a 10 Bitcoin holder who needs to pay his AMEX bill in USD, the champagne in those bars is expensive. Chad contacts his friend Jerome, a wily Frenchman working at SocGen, who was once a major financial back-office replacement, went to jail for aggressive futures trading, but got his job back (you can't fire anyone in France) and is now in charge of running the crypto trading desk. Chad asks Jerome for a Bitcoin to ETF exchange for 30 days. Jerome gives a quote of -0.1%. This means that Chad will exchange 10 Bitcoins for 10,000 shares of the ETF, assuming each share is worth 0.001 Bitcoin, and after 30 days Chad will receive 9.99 Bitcoins back.

During the 30 days that Chad owns 10,000 shares of the ETF instead of 10 Bitcoins, he pledges the ETF shares to his traditional financial stockbroker to obtain a very cheap USD loan.

Everyone is happy. Chad can continue to show off in the club without having to sell his Bitcoin. And Jerome earns the margin.

ETF financing business will gradually become very important and affect Bitcoin interest rates. As this market develops, I will focus on attractive ETF, physical Bitcoin and Bitcoin derivative financing transactions.

Your size is my size

In order for these trading opportunities to persist for long periods of time, and to allow arbitrageurs to execute them at sufficient scale, the Bitcoin spot ETF complex structure must trade billions of dollars of shares per day. On Friday, January 12, total daily volume reached $3.1 billion. This is very encouraging, and as various fund managers begin to activate their vast global distribution networks, trading volumes will only increase. With a liquid way to trade the financial version of Bitcoin within the traditional financial system, money managers will be able to escape the dilemma of the poor returns now provided in this global inflationary environment.

We are in the early stages of this move toward a period of sustained global inflation. There is a lot of noise, but over time managers who run stock-bond correlations will realize that things have changed. Below zero, especially when inflation persists, bonds stop working in a portfolio. The market will slowly realize this, and a sell-off from the over $100 trillion bond market will devastate the nation. These managers must then look for another asset class that has no material correlation to stocks or any traditional financial asset class. Bitcoin accomplishes this task.

Your Size is My Size

In order for these trading opportunities to persist for long periods of time, and to allow arbitrageurs to execute them at sufficient scale, the Bitcoin spot ETF complex structure must trade billions of dollars of shares per day. On Friday, January 12, total daily volume reached $3.1 billion. This is very encouraging, and as various fund managers begin to activate their vast global distribution networks, trading volumes will only increase. With a liquid way to trade the financial version of Bitcoin within the traditional financial system, money managers will be able to escape the dilemma of the poor returns now provided in this global inflationary environment.

We are in the early stages of this move toward a period of sustained global inflation. There is a lot of noise, but over time managers who run stock-bond correlations will realize that things have changed. Below zero, especially when inflation persists, bonds stop working in a portfolio. The market will slowly realize this, and a sell-off from the over $100 trillion bond market will devastate the nation. These managers must then look for another asset class that has no material correlation to stocks or any traditional financial asset class. Bitcoin accomplishes this task.

The article comes from the Internet:Arthur Hayes: Bitcoin ETF will create arbitrage opportunities

This article will introduce the potential investment opportunities in the DePIN track from the perspectives of sensors, servers, wireless networks, and computing resources. Written by: TrendX DePIN, or Decentralised Physical Infrastructure Networks, is a decentralized physical infrastructure network that…