Bitcoin’s first day on the market: an important watershed

Written by: Qin Jin

If calculated by Eastern Time, today is the first day of trading for Bitcoin spot ETFs. It is also a day of historic significance. Yesterday, the U.S. Securities and Exchange Commission officially approved 11 Bitcoin spot ETFs to enter the securities industry.exchangeStart trading. This is an important "watershed" moment between crypto finance and traditional finance.

In the first few minutes of trading, the Bitcoin spot ETF, led by BlackRock IBIT, saw a trading volume of $2.3 billion. As a result, Bitcoin broke through $48,000 last night. For the first time since March 2022, it rose 4.64% during the day.

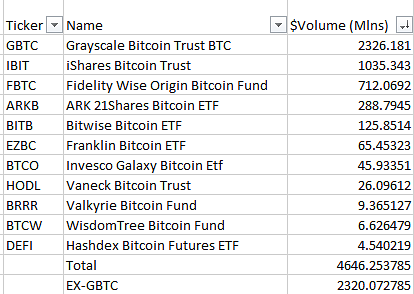

According to the latest data disclosed by Eric Balchunas, senior ETF analyst at Bloomberg, there were 700,000 individual transactions on the first day of Bitcoin listing, twice that of Invesco QQQ Trust. The total daily trading volume reached 4.6 billion US dollars. Among them, Grayscale GBTC's trading volume exceeded 2.3 billion US dollars, accounting for half of the total trading volume. BlackRock IBIT exceeded 1 billion US dollars, and Fidelity FBTC exceeded 710 million US dollars. ARK 21Shares exceeded 286 million US dollars, and Bitwise: exceeded 124 million US dollars. Compared with institutional purchases, this is the power from the grassroots.

Gabor, a strategic advisor at VanEck, is a person who likes to think and is good at expressing himself. He said that this is the first time in history that "Main Street" beat Wall Street. This is the spirit of Bitcoin. The first batch of US Bitcoin ETFs officially began trading after the market opened today. To some extent, it can be understood as the initial public offering of institutional Bitcoin. I hope to see large institutions, investors and traders deploy capital. We make ETFs a reality.

Eric Balchunas said that if the Bitcoin ETF beats the ESG climate ETF to top the list, it will be symbolic of the times, just like the American rock band Nirvana's "Nevermind" beat the famous singer Michael Jackson's "Dangerous" in 1991.

According to the screenshot data provided by Eric Balchunas, ESG climate ETF is the leader among the 25 most successful ETFs in history. BlackRock owns 10 of them. The ESG climate ETF "iShares Climate Conscious & Transition MSCI USA ETF" had a single-day trading volume of US$2.2 billion on its listing.

According to Bloomberg, the ESG sector has achieved record fund size growth in recent years, and BlackRock has captured half of it. Among them, iShares ESG Aware MSCI USA ETF (ESGU), established at the end of 2016, is BlackRock's ESG flagship fund and the world's largest ESG index fund. As of March 31, 2022, the fund's management scale is US$24.88 billion, and the tracking target is the MSCI USA Extended ESG Focus Index.

In the view of Dan McArdle, co-founder of Case4Bitcoin, if the listing of Bitcoin spot ETFs is likened to Bitcoin's IPO with a market value of $900 billion, then the first ETF application was submitted on July 1, 2023, when the market value of BTC was about $1.6 billion. But unlike stocks, the government did not prevent non-rich people from buying BTC due to the "qualified investor" regulations. In other words, most ordinary people have obtained part of the 900 billion market value of Bitcoin.

There are two ways of thinking about Bitcoin. One way of thinking is that we were all seed investors before 2011, Series A investors in 2012, Series B investors in 2015, Series C investors in 2019, and Series D investors in 2023, and now Bitcoin is about to be listed.

We can see both retail and institutional demand just like in the mid-1990s when the first few days around the actual IPO were weird and people tended to correct or pull back as they took profits on their allocated shares and then the stock price would surge again as new demand came in from people who hadn’t participated pre-IPO.

Raoul Pal, former Goldman Sachs executive and founder of RealVision, said it is strange to think of something as revolutionary as Bitcoin in the first way. This comment is more about the process of mass adoption rather than the idea that it really needs approval from an authority. It will continue to be adopted regardless.

He believes that ETFs are more like the fiat currency world andcryptocurrencyTrade transactions between the world. For example, the WTO has attracted a lot of global capital to China and transformed China from an emerging market to the world's second largest economy. Bitcoin has just joined the WTO and is only the beginning of the first stage.

Gabor discussed Bitcoin from the perspective of financial risk aversion. He said that Bitcoin is a doomsday technology. If there is a major market crash or a systemic market crash, Bitcoin can not only support legal savings, but also the entire capital market technology. The combination of Bitcoin and major capital markets is the greatest risk aversion tool ever.

USDT 母公司 Tether CEO Paolo Ardoino 或许也因为比特币现货 ETF 创造历史的在证券交易所开始交易而略感兴奋。他在社交媒体直接发出一个问题:比特币需要多长时间成为世界上交易量最大的资产?

Everything in the world has two sides. Some people support Bitcoin spot ETFs, while others are pessimistic about it.

Vanguard Group, whose asset management scale is second only to BlackRock, does not allow retail investors on its platform to buy Bitcoin spot ETFs because it "does not conform to its own investment philosophy." Fox Business reporter Eleanor Terrett said on X that on Wall Street,cryptocurrencySkepticism remains.

Oliver L. Velez, a self-proclaimed 37-year trader, posted on X and @Vanguard Group that Vanguard is losing a lot of customers just because they don't allow customers to buy Bitcoin spot ETFs with their own money. Can you imagine their large number? You need their permission to buy something with your money. If they don't agree with what you buy, you can't do it. #Bitcoin fixes this.

Look at the Vanguard logo, it’s a picture of their clients taking all their money and setting sail to go somewhere else. It’s a ship called “Opportunity” setting sail, taking theseXiaobai NavigationThe baby boomers are being left behind. This is not going to end well.

An investor claimed that he switched from Vanguard to Fidelity within an hour of the opening of the Bitcoin spot ETF today. He did not understand the logic behind Vanguard's move, and the investor said that he was almost allergic to institutions that imposed their investment philosophy on him.

Peter Schiff, a New York Times bestselling author and well-known gold supporter, said that if buying Bitcoin directly is so complicated, difficult and expensive that new investors need third-party custodians to provide them with spot ETFs, then what is the value of Bitcoin itself? Bitcoin's so-called breakthrough innovation is that it does not require third-party intermediaries or storage fees.

In his view, CNBC pulled out all the stops today to get viewers to buy the newly approved spot Bitcoin ETFs. It was a non-stop parade of crypto industry shills peddling Bitcoin, without any hosts fighting back or inviting opposing voices to defend the bearish case on the air.

Since its birth, Bitcoin has been evolving and growing amidst doubts and praises. Now that it has entered Wall Street as a compliant "Bitcoin Spot ETF", I think it will continue to evolve and grow at the same pace. This is why grassroots investors are so obsessed with Bitcoin.

The article comes from the Internet:Bitcoin’s first day on the market: an important watershed

数字资产中间人实际上是任何人,任何为任何数字资产销售提供便利服务的人。 编译:TaxDAO 主持人:Ian Andrews(Chainalysis首席营销官) 演讲嘉宾:Roger Brown(Chainalysis税务策略全球主管) 日期:2023年10月3…