HoldStation fights back, from wallet to zkSync’s “GMX”

DeFi 和 公链领域正在迈入一个新时代,AA 钱包和 DEX 成为了竞争的焦点,以太坊退居幕后,其上的各类 Layer 2 将负责迎击 Solana 等异构链的挑战。

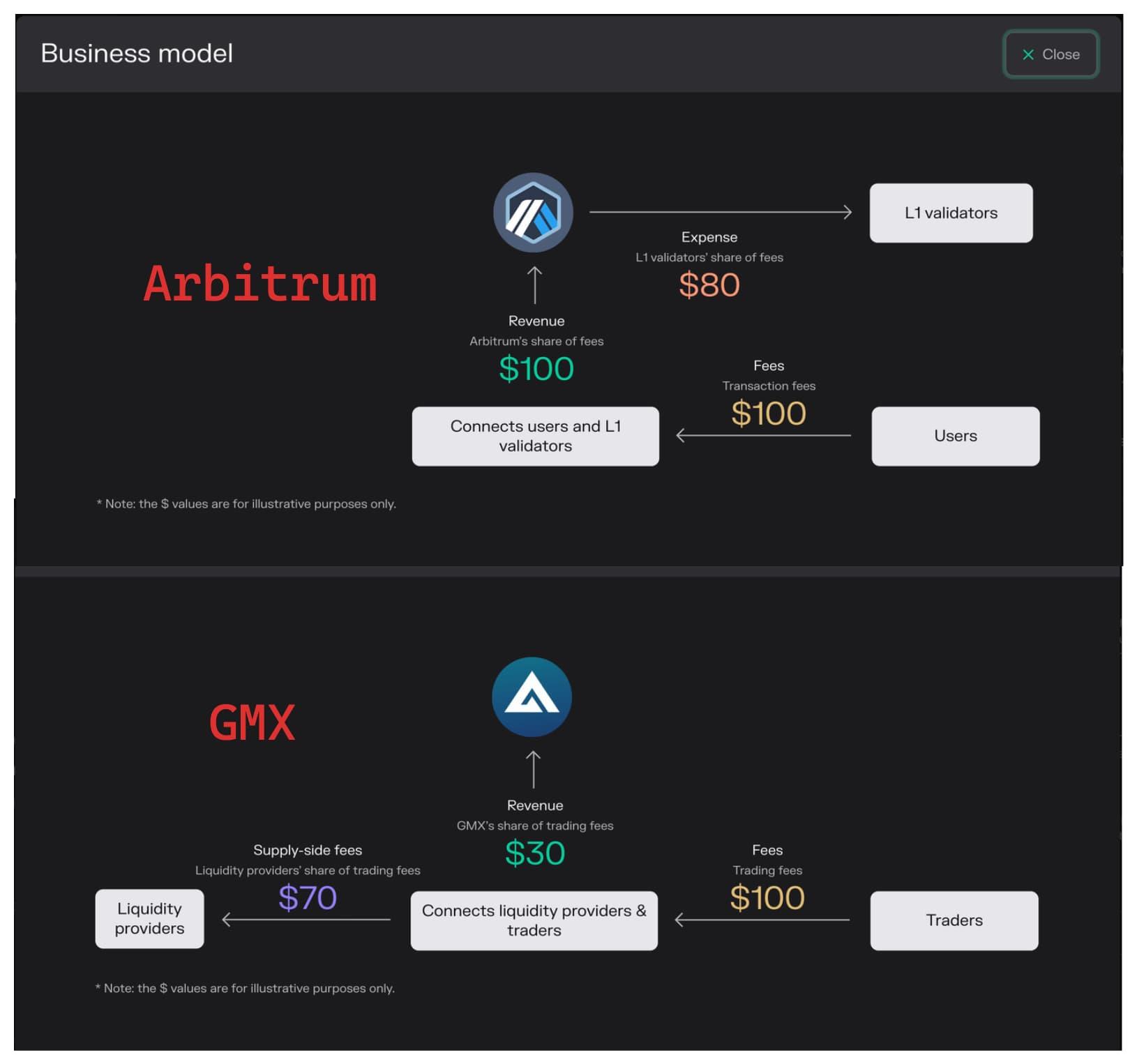

The focus of the battle is on on-chain derivatives DEX and L2 Just like the close cooperation between GMX and Arbitrum, the TVL and transaction volume of both parties have increased, supporting each other.

The ZK system should also take the path of the OP system. zkSync, while improving transaction efficiency and scalability, maintains compatibility with the Ethereum mainnet, greatly reducing transaction costs. This allows dApps on Ethereum to run without sacrificingSafetyWithout the characteristics of blockchain or decentralization, it can be seamlessly migrated to zkSync, continuously strengthening the dominance of the EVM ecosystem in the DeFi field.

类似 GMX 和 Arbitrum 的配合,GMX 甚至可与 dYdX 的分庭抗礼,新兴的全链钱包 HoldStation 在zkSync生态脱颖而出,目前已经支持 12 条 EVM 兼容链。

HoldStation is an upgrade of the traditional wallet, integrating wallet services, oracle, spot andcontract Multiple DeFi components such as DEX transform the wallet into a comprehensive on-chain trading platform.

Web3 users can efficiently manage assets and participate in on-chain interactions in Lego blocks.

在牛市即将爆发的大趋势下,钱包和 DEX 在 2024 年的竞争势必更加激烈,Solana 上 DEX 交易量已经再次短暂超越 EVM 生态,随着竞争的白热化,以太坊要想保持其领先优势,zkSync 等 L2 必须更积极拥抱链上市场。

One-stop on-chain wallet, HoldStation fundamentals

After 2023's exploration, AA (Account Abstraction) wallets have gradually become a consensus in the industry, especially gaining mainstreamexchangeWith the attention of the blockchain industry, Bitget acquired BitKeep and changed its name to Bitget Wallet. OKX directly integrated the Web3 wallet into its own App. The trend of wallets becoming the entrance to large-scale applications is becoming increasingly clear.

AA Wallet is on the eve of an explosion

With Vitalik Buterin’s encouragement of AA wallet, AA wallet has become the most popular development direction at present, but the market still has expectations for specific products.

Among them, the emerging HoldStation is actively planning to create an AA wallet that seamlessly interacts on-chain and off-chain, Web2 and Web3, and does not have the historical burden of the old centralized platform.

The idea behind this is extremely clear:The wallet is not just a simple entry point, but the first stop of user experience.

根据 zkSync 的介绍,AA 功能允许 zkSync Era 上的账户像 EOA 账户一样发起交易的同时,执行复杂的智能合约,从而提升灵活性,HoldStation 选定 zkSync 作为技术平台,正是因为 zkSync 在 ZK 系列 Layer 2 方案中对以太坊的高度兼容性和高运作效率,为 HoldStation 提供了一切必要的开发支持。

-

zkSync Era was the first to natively implement the account abstraction function, and no obvious problems have been found in the current EVM compatibility testing.

-

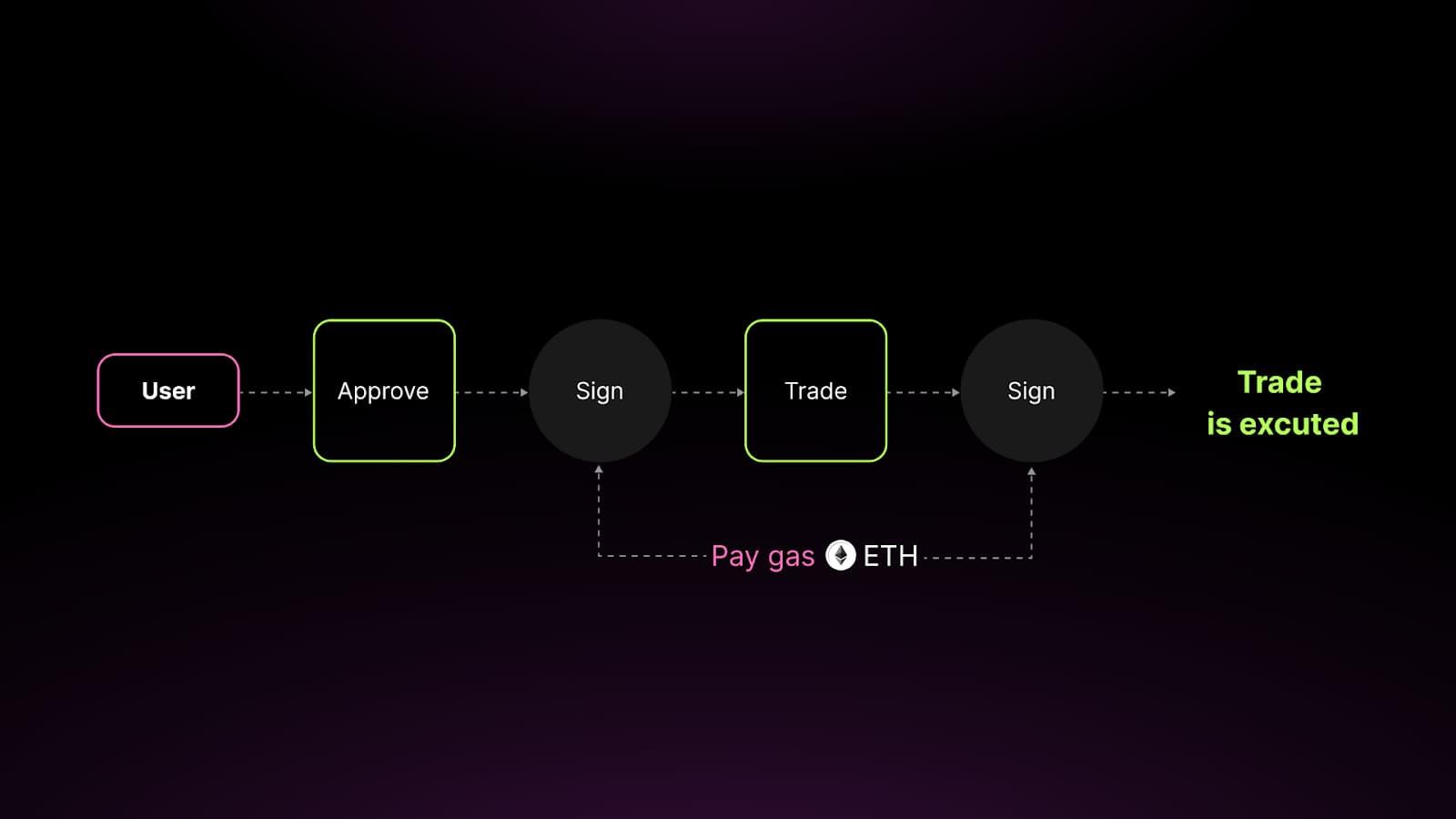

The zkSync system abstracts accounts on it as “Smart Accounts” and introduces “Paymasters” that can sponsor transaction fees for users, such as allowing the use of stablecoins instead of $ETH to pay Gas Fees.

Based on this, HoldStation is not just an on-chain wallet, but more like a one-stop DeFi platform that can provide services to users with efficiency and convenience close to CEX, such as helping users process complex operations in batches and saving Gas Fees at the same time.

DeFi one-stop platform, new ideas for full-chain operation

HoldStation is also supported by the ChainLink BUILD program, which enables the construction of a decentralized DEX oracle based on on-chain data, which can gradually abandon the centralizedexchangerestrictions.

Through multi-faceted optimization solutions, such as MPC technology and Seedless (no private key)SafetyWith the account model and the locally implemented account recovery function, HoldStation improves the user experience in multiple directions.

In HoldStation's design concept, the diversified functions provided by the wallet are to retain users and generate revenue. This is fundamentally different from paid wallets such as Zengo.

In HoldStation’s view, just as GMX successfully attracted users through the Arbitrum ecosystem and ultimately earned fees, thereby expanding its TVL and trading volume, HoldStation also expects similar mutually beneficial cooperation with zkSync.

According to current market data, HoldStation's current $1 billion in trading volume generates $600,000 in transaction fees. With the development of zkSync, HoldStation's profitability will be further enhanced.

DeFi and wallets go both ways

DeFi enters the wallet, but the wallet is only an interactive entrance. Furthermore, HoldStation will integrate various DeFi services into the wallet, correcting the limitation of the wallet as only an interactive entrance in the traditional model. In the specific implementation, HoldStation will reduce the user's participation cost by optimizing the transaction experience, such as providing lower gas fees for stablecoin transactions.

It is particularly worth mentioning that the derivatives trading services launched by HoldStation, including DeFutures linked to multiple assets, can provide up to 500 times leverage, including FMM market-making mechanism and promotion strategy combined with social elements.

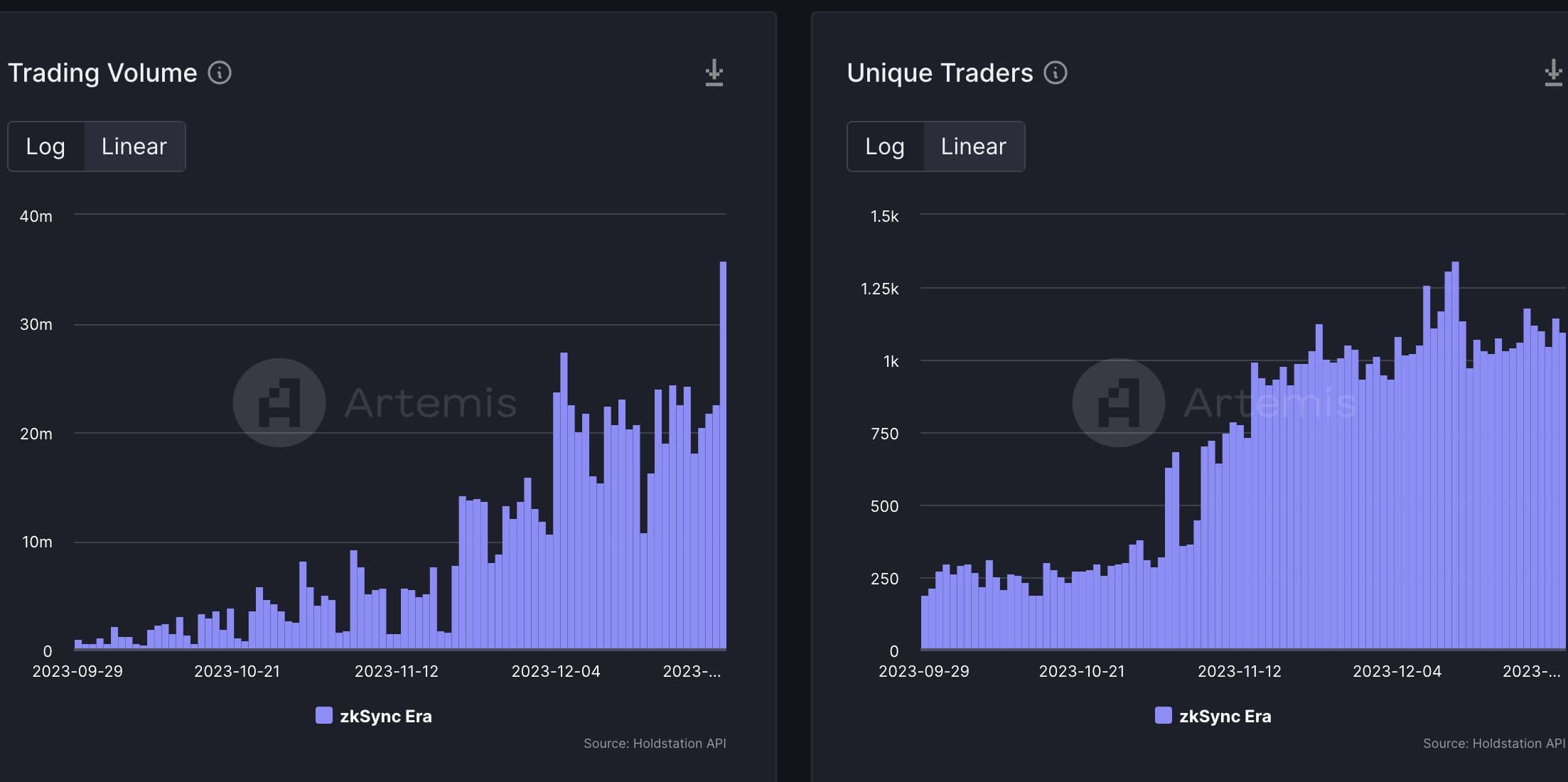

at present,HoldStation has already ranked among the top four on-chain derivatives DEX rankings, with a daily trading volume of around US$30 million and a stable number of traders above 1,000.

From the perspective of its technical architecture, it can be divided into six types: FMM (Flexible Market Making), DPF (Dynamic Price Feed), Asset Class & Leverage, DeFuture Fees (transaction fees), Liquidation (liquidation mechanism) and Margin Requirement (margin mechanism).

-

FMM: Inspired by Dodo, all types of funds and transactions share a common pricing logic to reduce the consumption of Gas Fee.

-

DPF: Working in conjunction with FMM, by integrating multiple data sources, DPF can minimize the impact of incorrect or abnormal trading data to accurately calculate the average price of all assets on the platform.

-

Asset Class & Leverage, HoldStation iscryptocurrencyThe market offers 24/7 trading and supports popular currencies such as BTC, ETH and BNB.Token, and supports various types of asset transactions such as foreign exchange and commodities, and provides a leverage of up to 500 times in foreign exchange transactions.

-

DeFuture Fees,cryptocurrencyThe opening and closing fees are 0.08%, the opening and closing fees for foreign exchange are 0.008%, and the opening and closing fees for commodities are 0.01%. In addition, the opening fees of up to 60% will be returned to the inviter.

-

Liquidation, three liquidation robots will focus on fulfilling limit orders and liquidations. Limit orders will be charged an additional fee of 0.02%, which will be distributed to executors as rewards to promote the decentralization of the network.

-

Margin Requirement, adopts an isolated margin system to separate risks between different positions. Each asset class will set a separate margin, and the system will automatically calculate the liquidation price.

In addition, HoldStation also has a crucialCommunity分润机制,通过这一机制,用户将能分享其他用户产生的利润。据统计,高达80% 的各类交易费用将最终返还给用户,这不仅可以加强社区的共识,也会推动 HoldStation 去中心化程度。

Full SolutionTokenEconomics, HoldStation's Market Expansion Strategy

By taking a solid position in zkSync, HoldStation has initially demonstrated the advancement of its technology and the reliability of its services. In the expected bull market environment in 2024, HoldStation is also at a critical stage of market expansion.

HoldStation's market expansion plan includes several key points: learning from the successful model of existing exchanges and attracting and expanding the market by providing similar on-chain interactive experiences, including generous rebate incentives. In addition, unlike the simple and crude airdrop strategies on Arbitrum or Optimism, HoldStation plans to encourage users to use Smart Accounts and Paymaster functions for precise airdrops to distinguish real users and provide them with unique incentives.

速览 HoldStation 代币经济学

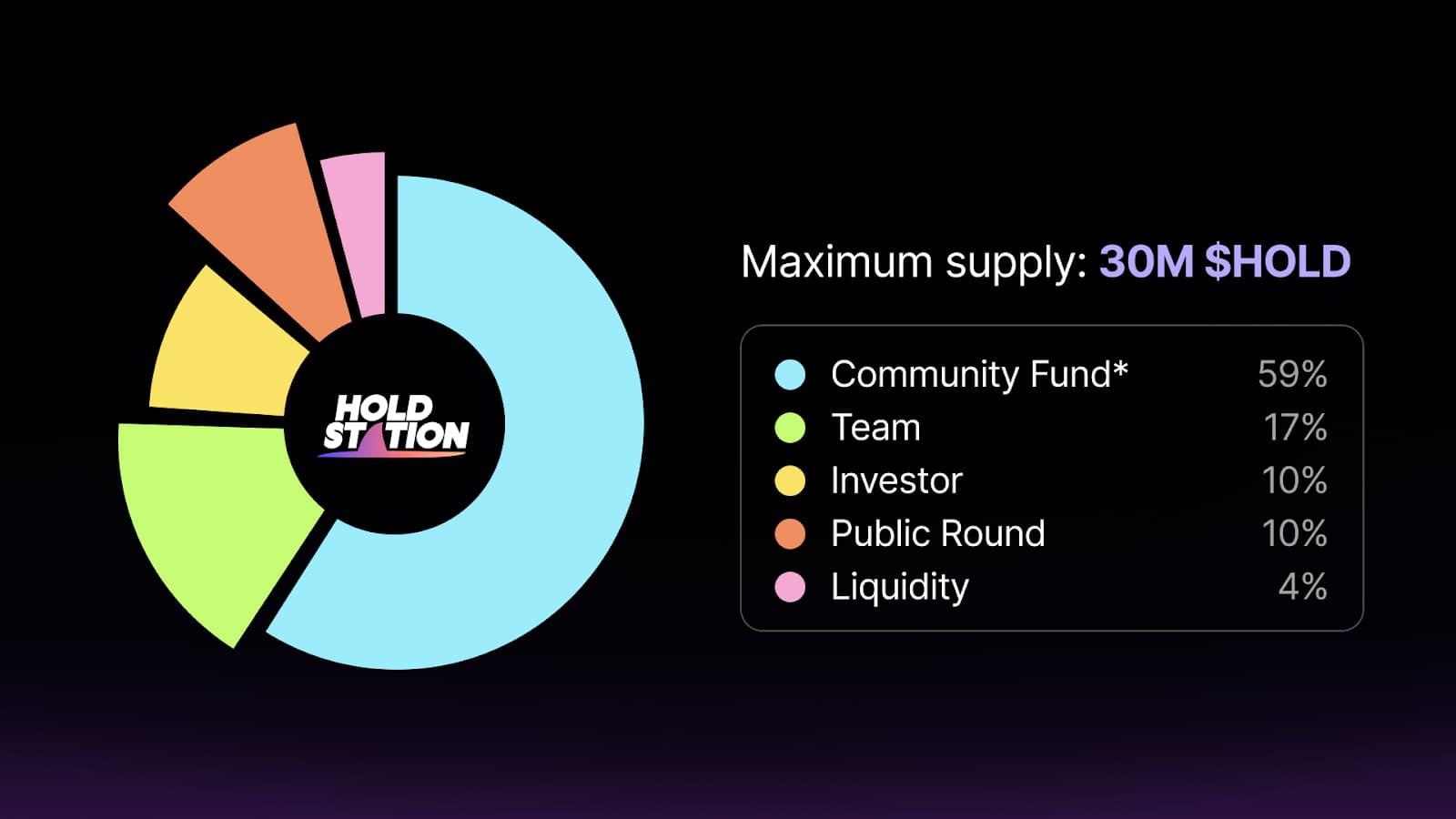

The total issuance of HoldStation is 30 million, and the initial circulation is 17.25%, about 5,173,500 pieces. The public offering round of Holdstation accounts for 10%, which can be fully unlocked on TGE to enhance liquidity.

The community fund accounts for 59%, of which 5.5% can be unlocked during TGE. This part will be mainly used for airdrops and promoting the adoption of DEX in the future.

The team and consultants account for 17%, but there will be a 12-month lock-up period, and then the remaining shares will be released linearly over 60 months.

Initially, liquidity will account for 4% shares, which will be unlocked during the TGE to provide initial liquidity for $HOLD.

Real Benefits Program

For the distribution of tokens, HoldStation focuses on ensuring that the community and individual users will receive fair rewards, and will gradually promote users' understanding of the economic model through detailed token distribution ratios and usage descriptions. The focus is on promoting the empowerment of RealYield for tokens.

-

Transaction fee sharing: 40% is allocated to the staker who invested $USDC, another 40% is allocated to the HOLD holder, and the remaining 20% is allocated to the community treasury;

-

Transaction fee discount. When users choose to use HOLD to pay for Gas fees, they can enjoy 30Xiaobai Navigation% discount, in addition, up to 40% transaction fee discount when staking an additional $HOLD;

-

The token deflation mechanism gradually reduces the circulation of $GOLD in the market through quarterly repurchase and destruction plans, thereby increasing the passive income of token holders.

-

As the future HoldStation DAO Governance tokens that can be used as proof of voting rights;

-

LaunchPad privileges under Fair Launch, $HOLD stakers can receive a token share of at least 2% exclusively in the upcoming Launchpad projects.

But please note that HoldStation plans to promote the implementation of the Fair Launch model in the on-chain market through its LaunchPad. The platform focuses on transparency and fairness to ensure that all users have equal opportunities to participate and their rights and interests are respected during the project launch process.

Not only that, HoldStation’s strategy and its product line have been recognized by the market, thus attracting support from many well-known investors and partners, including VCs such as ViaBTC Capital, DexTool, Pendle founder and Ankr.

Conclusion

As an innovator in the DeFi space, HoldStation has a thorough market expansion strategy that combines user experience, technological innovation, transparency, and token economics.

As it further develops its real income plan, we expect HoldStation to recreate the same glory as GMX in the market.

The article comes from the Internet:HoldStation fights back, from wallet to zkSync’s “GMX”

Related recommendation: Ethereum Dencun upgrade is coming? Testnet will be launched in early 2024

Ethereum developers have tentatively set January 17, 2024 as the first testnet deployment date for the upcoming "Dencun" upgrade in their latest biweekly developer meeting.Blockchain Ethereum developers have tentatively set January 17, 2024 as the date for the next blockchain project in their latest biweekly developer meeting.