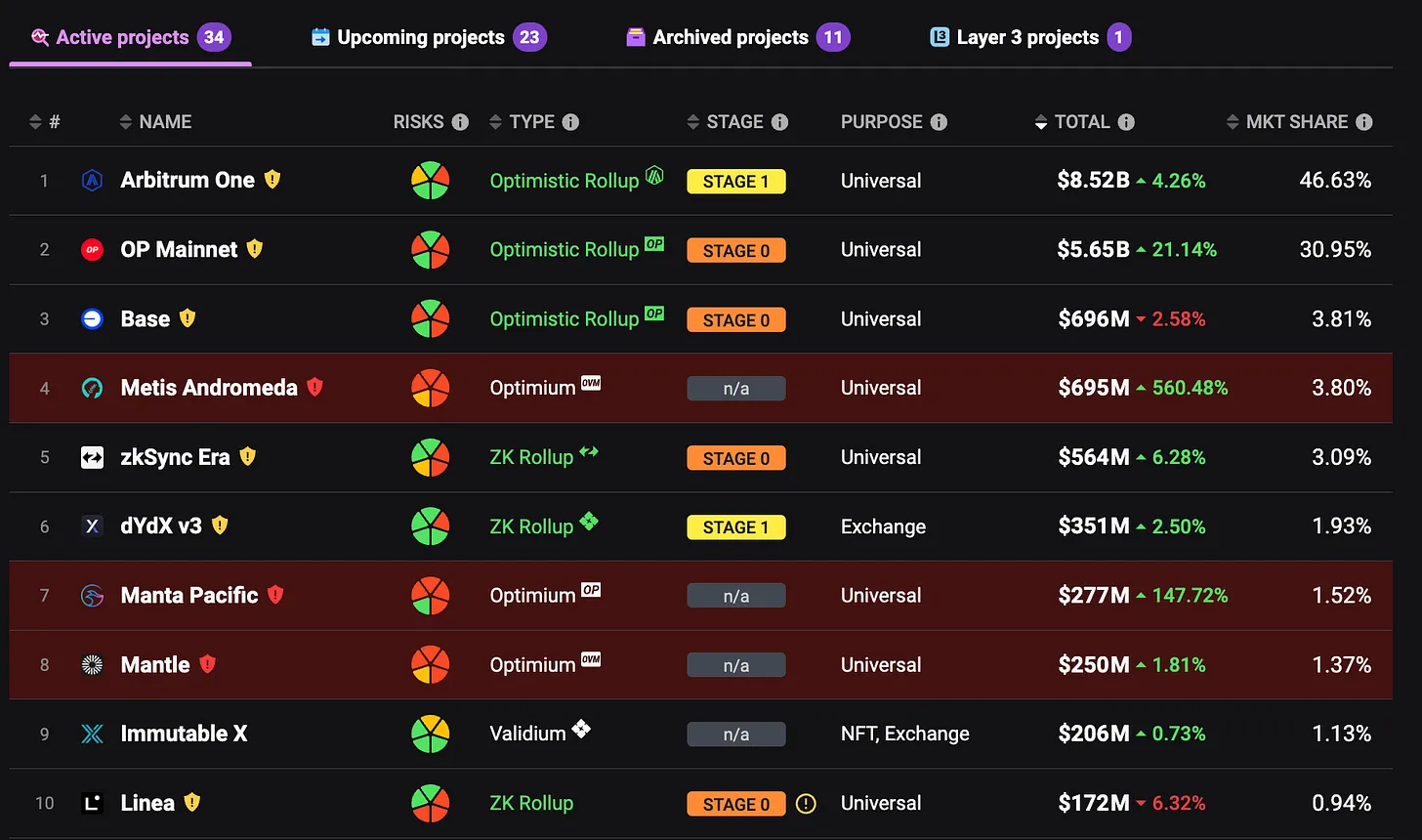

Metis is in the spotlight. Which projects will the 4.6 million ecological incentive fund benefit?

Written by: Francesco

Compiled by: Xiaobai Navigation coderworld

MetisDAOMetis is ushering in a major development in its ecosystem. With the establishment of the Metis Ecosystem Development Fund, a fund of up to 4.6 million METIS will be used to promote project deployment, product development and builder rewards in the ecosystem. This article explores in depth how this fund affects MetisDAOofTokenvalue, and analyzed the development potential of several key protocols in its ecosystem, foreshadowing the active development of the Metis ecosystem in early 2024.

On December 18, MetisDAO announced the establishment of the Metis Ecosystem Development Fund (Metis EDF).

EDF is a fund with 4.6 million METIS that aims to promote development and attract liquidity, activity and adoption in the Metis ecosystem.

The main objectives of EDF will be to:

-

Funding new project deployments

-

Product development for existing dApps: supporting builders through grants

-

Builder mining rewards: Based on the transaction volume generated, up to 4,000 US dollars of METIS per month will be supported for builders

-

Sorter Mining: Locked in Metis POSToken, to help with block production and bootstrap the sequencer.

-

New Product Liquidity: Guiding Liquidity and Ecosystem Composability

-

Support audits to maximizeSafetysex

-

Liquidity mining: suitable for dApps that are about to launch activities or deployments

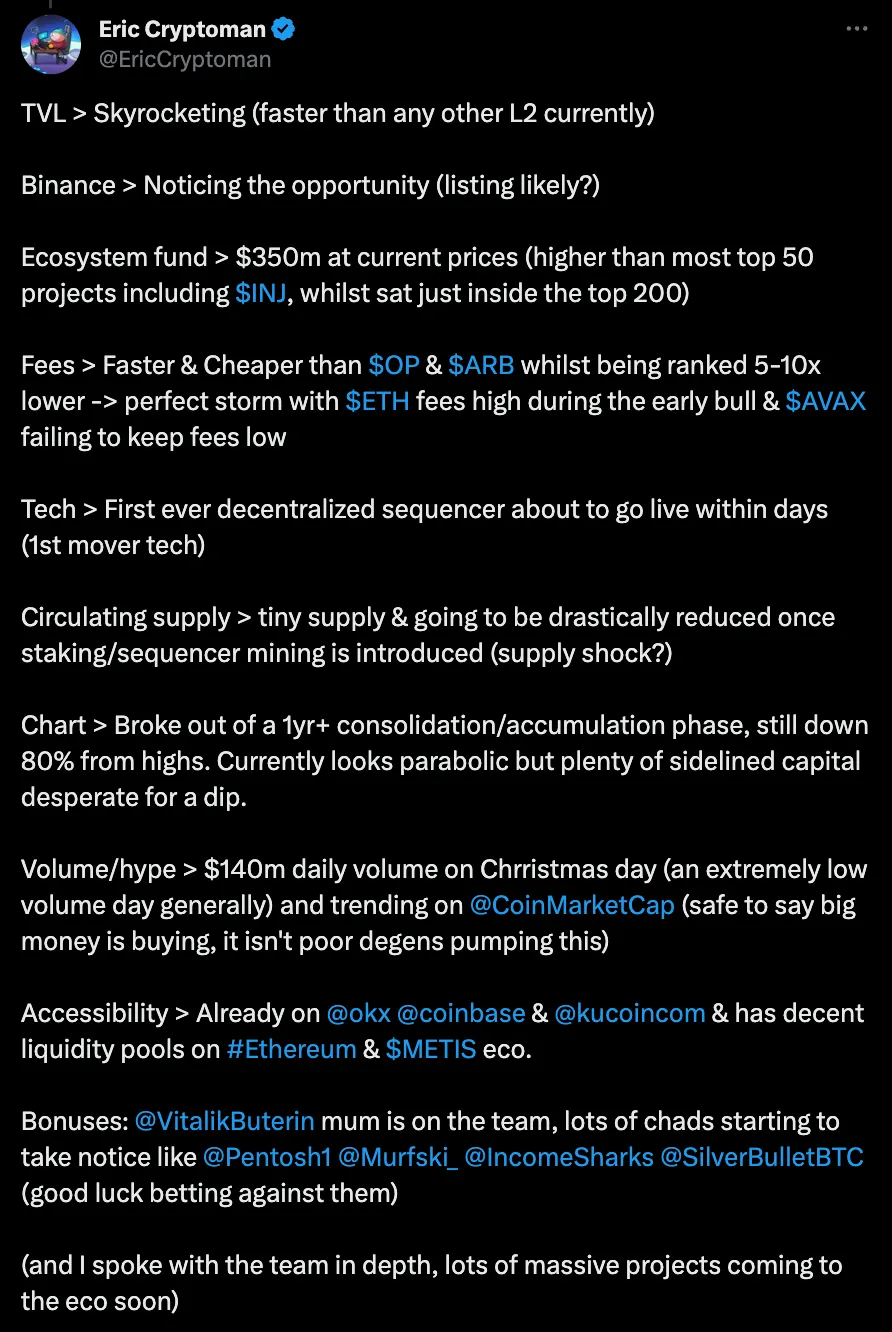

As part of the 2024 roadmap, Metis will be the first Optimistic Rollup to launch a decentralized sorter starting January 3rd.

EDF的创建还提升了Metis代币的价值主张,$METIS持有者在基金管理和去中心化排序器上拥有治理权。 EDF旨在成为生态系统中公共产品发展的资金机制,从长远来看,确保Metis的未来。 这种做法并不是第一次,许多Layer 1使用生态系统基金来促进发展并获得市场份额。 正如预期的那样,该基金激发了人们对 Metis 的新兴趣,许多人从 Solana 的饱和的投资转向新的道路。 在基金使用中,65% 的资金将用于排序器挖矿,激励流动性深度和网络参与度,从而通过交易费用使排序器实现自我可持续发展。仅35%的EDF,或160万$METIS将被分配用于资助生态系统。

At the time of the announcement, the 4.6 million $METIS EDF fund was worth $125 million. Due to the “EDF effect”, the fund is now worth more than $420 million.

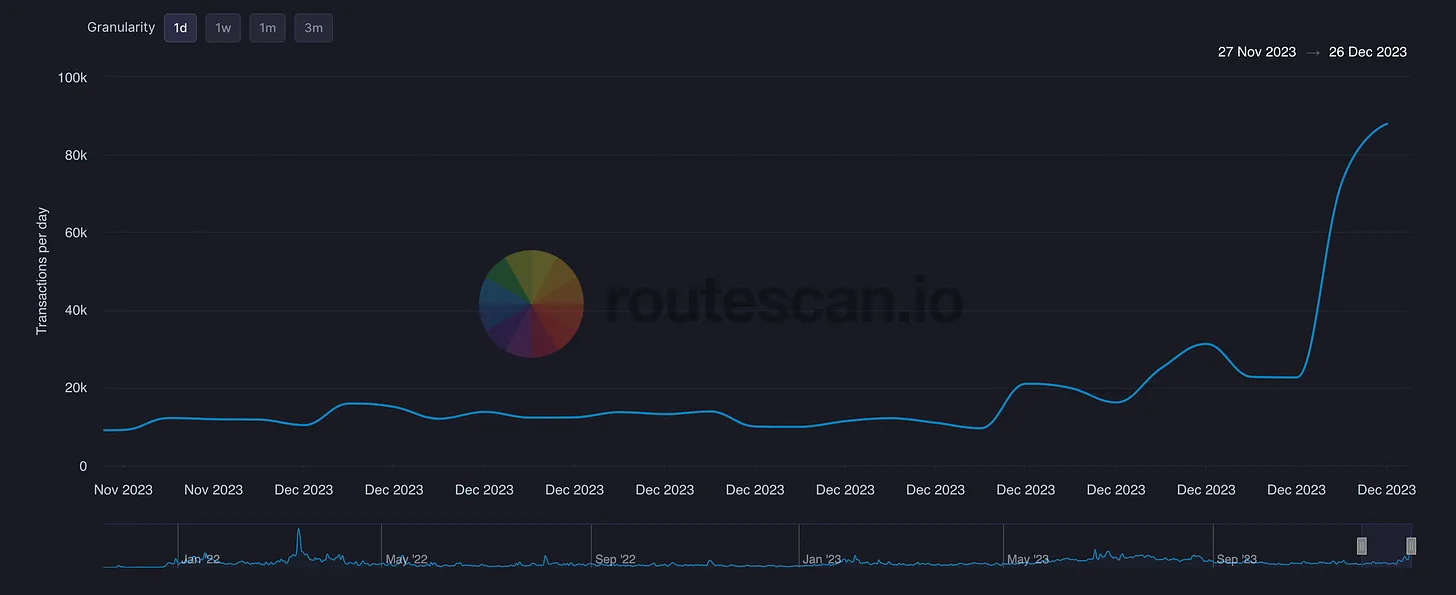

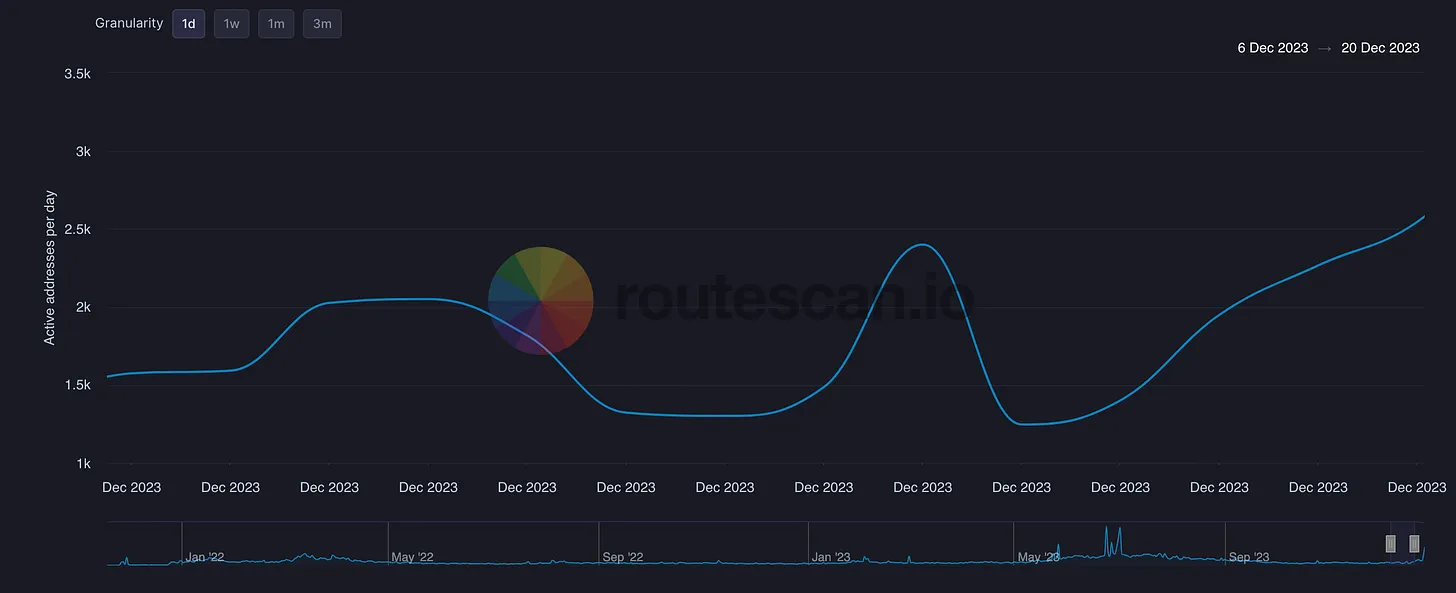

The price increase is reflected in a number of key on-chain metrics, indicating that interest in Metis is increasing significantly:

1. Transaction quantity

2. Daily Active Addresses

With the Metis project now on the horizon, let’s take a look at the top five protocols that could benefit from EDF. But first, some additional hope:

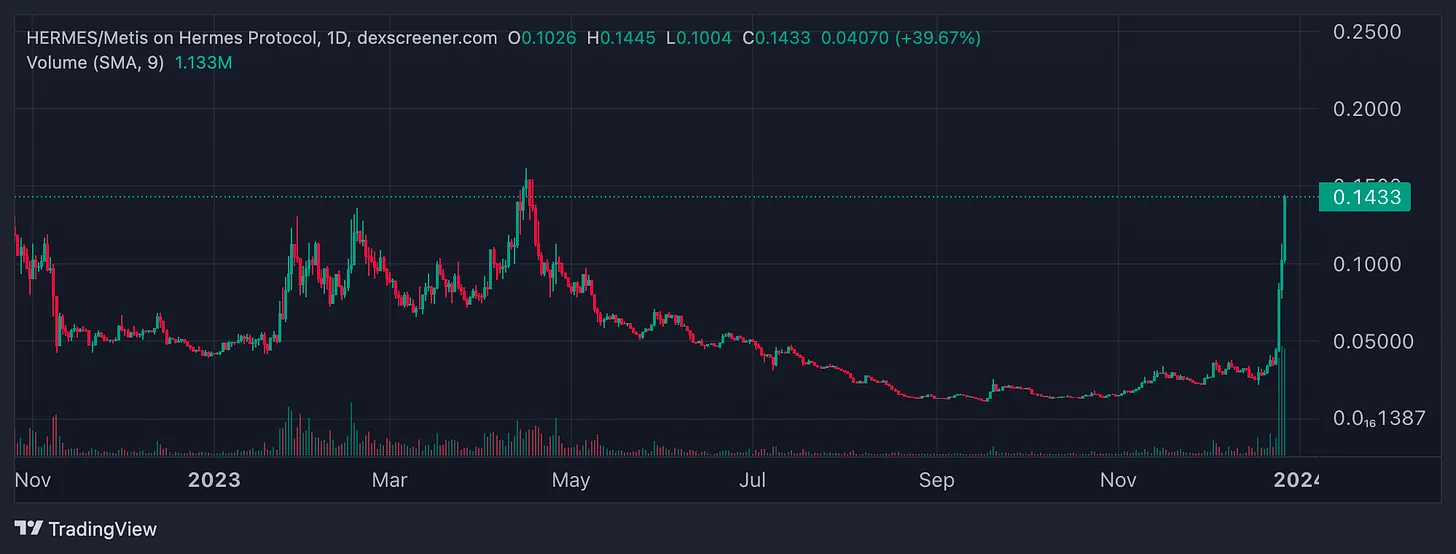

Hermes

Hermes is one of the most famous protocols on Metis. I have introduced Hermes in detail before, so please refer to my article:Introducing Hermes Protocol: Metis’ Leading AMM DEX The Hermes Protocol is the main AMM DEX for Metis, based on Solidly Fork. Launched in March 2022, it allows Metis users to provide liquidity, add new indicators, increase indicator yields, vote on token issuance, and accept bribes. Hermes is based on Andre Cronje's "fee incentive mechanism": every time a transaction occurs, LPs receive HERMES from emissions, while fees are passed on to Stakers and Lockers who voted for the pool, explaining the high annual interest rate. The protocol will benefit from the EDF fund and the upcoming V2 version, which introduces several improvements: in particular, full-chain liquidity, rental liquidity, and yield markets. These expectations are reflected in the recent price increase. However, Hermes, with a market capitalization of $10 million, is still a relatively small market capitalization.

Hummus

Hummus is an efficient one-sided AMM that also has pools that utilize Balancer’s weighted pool mechanism

What's so special about Hummus? Hummus' flexible one-sided staking mechanism allows for maximum capital efficiency and minimal slippage. Their novel approach to LP tokens follows a more flexible architecture. Rather than being part of total liquidity, LPs are recorded with exact token amounts, making it easier to process withdrawals. Just like Hermes, Hummus also benefits from the news from EDF. As the Metis ecosystem will attract a new wave of capital, DEXs are well-positioned to capture these volumes and benefit from the increase in activity and fees.

Netswap

Netswap is a DEX with a constant product liquidity pool, a launchpad, and an integrated staking mechanism for its governance token $NETT.

Netswap supports:

-

Low transaction fees

-

High-speed trading to optimize transactions

-

Designed for scalability

-

Wide range of token support

-

Governance Token $NETT

Neswap is expected to be one of the main beneficiaries as the Metis narrative becomes stronger in 2024. While this is already widely reflected in the token price, future upside should not be ruled out considering the early stages of the Metis ecosystem.

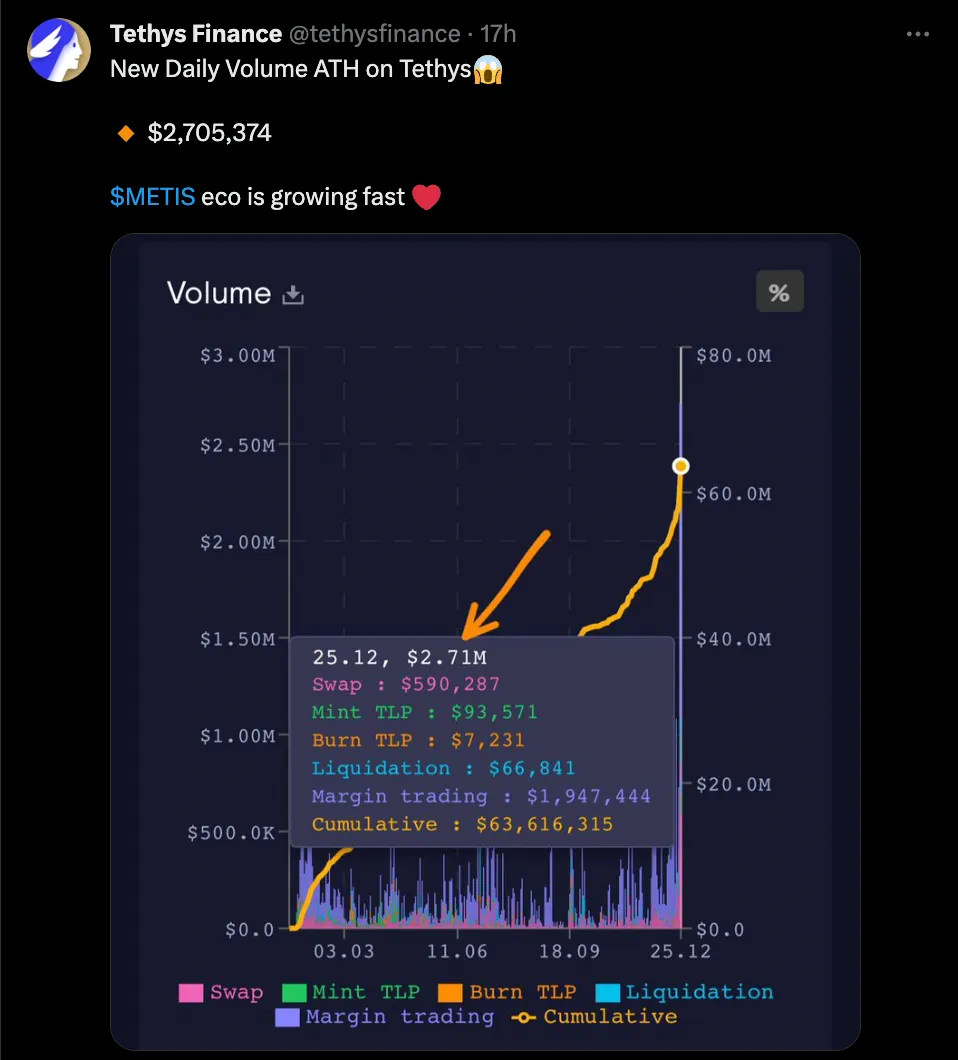

Tethys Finance

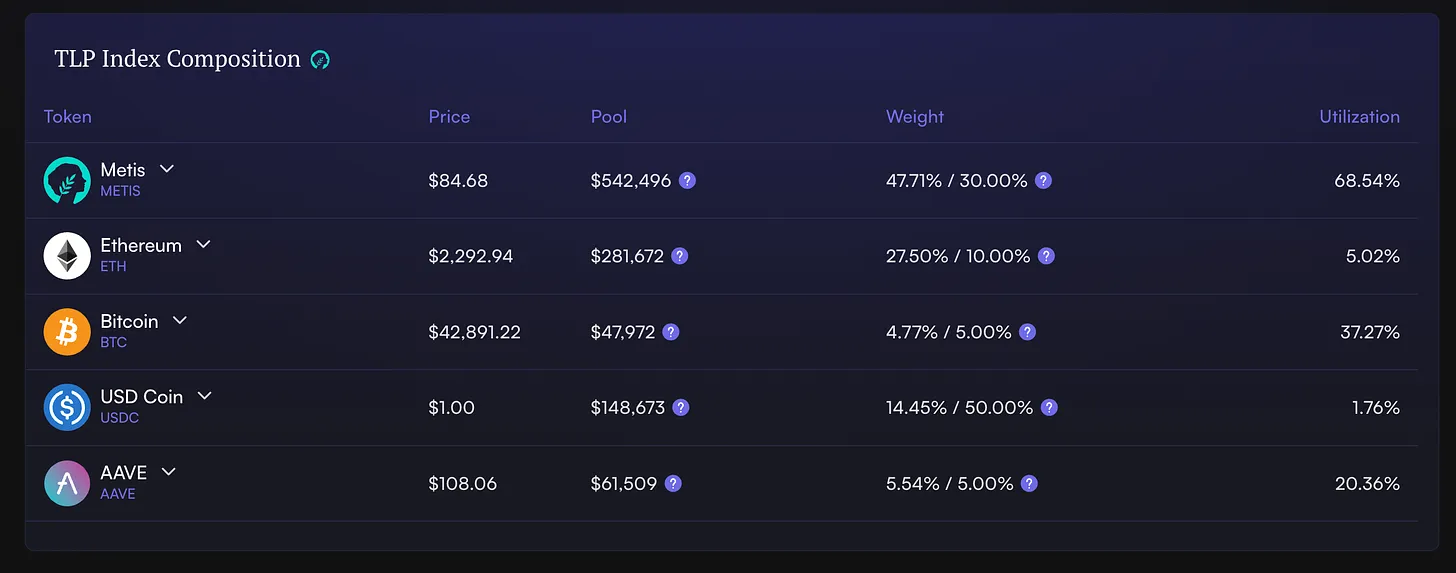

Tethys is a perpetual DEX on Metis that allows users up to 50x leverage. Tethys is based on the GMX model and adopts a dual-token model that allows users to open positions against other traders. The TLP index follows the GLP blueprint, but there are not many stablecoins in its index:

existXiaobai Navigation Driven by EDF, Tethys' daily trading volume has grown rapidly.

Tethys is poised to become the perpetual protocol that will take the lead over Metis. This is fully reflected in the form of price appreciation; nonetheless, Tethys remains an interesting protocol to watch closely.

Revenant

Particularly worth mentioning is the GameFi project: Revenant. Revenant is developing a decentralized gaming ecosystem driven by $GAMEFI to launch a series of play-to-earn games.

The Revenant team is currently building aBlockchainA fighting game with a player-driven economy where users can buy and sell items in the game.

Here are some screenshots taken from their presentation:

It seems that the EDF effect has also affected GAMEFI. This is not a decentralized finance (DeFi) project. As more and more gaming platforms launch their products in 2024, Revenant is taking the lead in Metis.

What happens next?

What to expect from Metis? What is the conclusion?

Of course, it may not be vertical, and prices may not look that attractive right now after last week’s big rally. However, previous examples of Layer 1 development funds deploying have shown that they are an effective tool (at least in the short term) to promote on-chain liquidity and activity.

Whether Metis can maintain this stimulating effect is another matter.

Nevertheless, the EDF (Eco-Development Fund) narrative, coupled with Metis being one of the first to have a decentralized sorterL2One, which could mean that the focus will be on Metis, at least for the first few months of 2024.

The article comes from the Internet:Metis is in the spotlight. Which projects will the 4.6 million ecological incentive fund benefit?

OKX全球首席商务官Lennix Lai就巩固香港在全球金融科技领域的战略地位发表见解,特别谈及数字基础设施和加强金融科技专业人才建设等。 2023年11月6日,全球领先的Web3科技公司和虚拟资产交易所OKX,以钻石赞助商身份在最近的香港金融科技周2023上…