Chasing the popularity of Bitcoin and inscriptions, how do these old projects bloom "new flowers"

Written by: Jiang Haibo, PANews

The rise of Bitcoin and the booming development of the inscription ecosystem constitute this yearcryptocurrencyThe mainstream narrative of the world. The rise of Bitcoin is due to the prosperity of the on-chain ecosystem, the expected approval of spot ETFs, the halving expectations, and the Fed’s interest rate cut expectations. At the same time, it has been greatly driven by the entry of institutional investors. These factors have jointly contributed to its significant growth this year.

In addition, the inscription ecology, especially the heterogeneity represented by OrdinalsToken(NFT) and HomogenizationToken(FT) not only brought new vitality and attention to the Bitcoin ecosystem, but also spilled over to other public chains. Almost all leading public chains have developed a set of inscription gameplay. Old projects continue to join in and take advantage of the opportunity to regain vitality.

Bounce’s Bitcoin Ecosystem Project Auction and Layer 2

Bounce Finance is an auction-as-a-service (AaaS) protocol that provides one-stop token issuance services for projects. The platform supports a variety ofBlockchainThe network provides users with the ability to create and participate in various types of auctions, including token and NFT auctions, physical collectibles auctions, advertising space auctions, and more.

Recently, Bounce launched auctions for several Bitcoin ecosystem projects. The valuations were relatively low at the beginning, and the subsequent auctions could use the tokens of the previous projects as "shovels", so these projects performed well. Since its own native token AUCTION was also the golden shovel in the auction, the price of AUCTION also rose.

Take the latest auction of GoDID as an example. GoDID is a market aggregator for decentralized identities (DIDs) and provides services for ENS, Space ID, and Bitcoin Ordinals DIDs. GoDID's token is BDID, of which 20% is allocated to users who use AUCTION to purchase lottery tickets, 40% is allocated to AUCTION pledgers, and 20% is allocated to the USD stablecoin D issued by the previous Launch project BitStable.AII’s pledgers, 5% are allocated to airdrop mining participants who use MUBI, BSSB, AUCTION, and WBTC, among which MUBI and BSSB are auction projects from previous rounds.

In December, Bounce also announced a newBlockchainThe solution is BounceBit, aBinanceBitcoin BTCB and AUCTION's Bitcoin Layer 2, a product scheduled to be launched in 2024.

Uniswap Expands to Rootstock

Uniswap is a leading decentralizedexchange(DEX), over time, Uniswap has launched multiple versions and expanded to multiple chains.

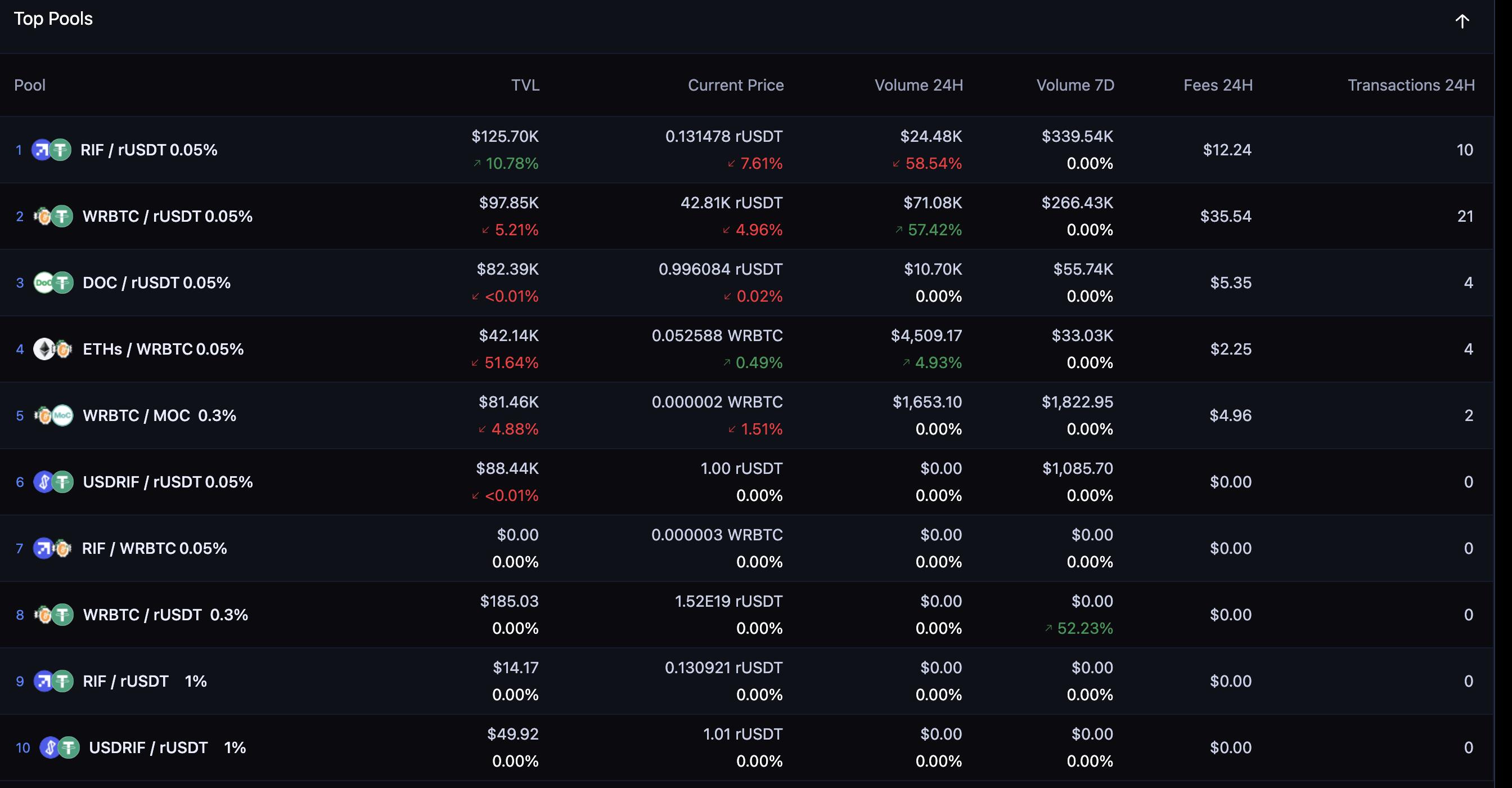

Last week, GFX Labs deployed Uniswap V3 to the Bitcoin sidechain Rootstock through Oku, which is also seen as Uniswap's expansion into the Bitcoin ecosystem. GFX Labs received funding from the Uniswap Foundation to build Oku, a trading front-end based on Uniswap V3. Oku has functions such as order books, price trend charts, transaction records, and limit orders.

Rootstock (RSK) is a sidechain based on the Bitcoin network, compatible with the Ethereum Virtual Machine (EVM), and secured through merged mining with Bitcoin.SafetyRSK introduces a joint guarantor model, which is a group ofCommunityTrusted entities that manage the transfer of assets from Bitcoin to RSK. These guarantors provide additionalSafetyLayer, ensuring assets are between the two networksSafetyLand transfer.

As of December 19, liquidity on Oku was $535,000.

NFT Marketplace Magic Eden

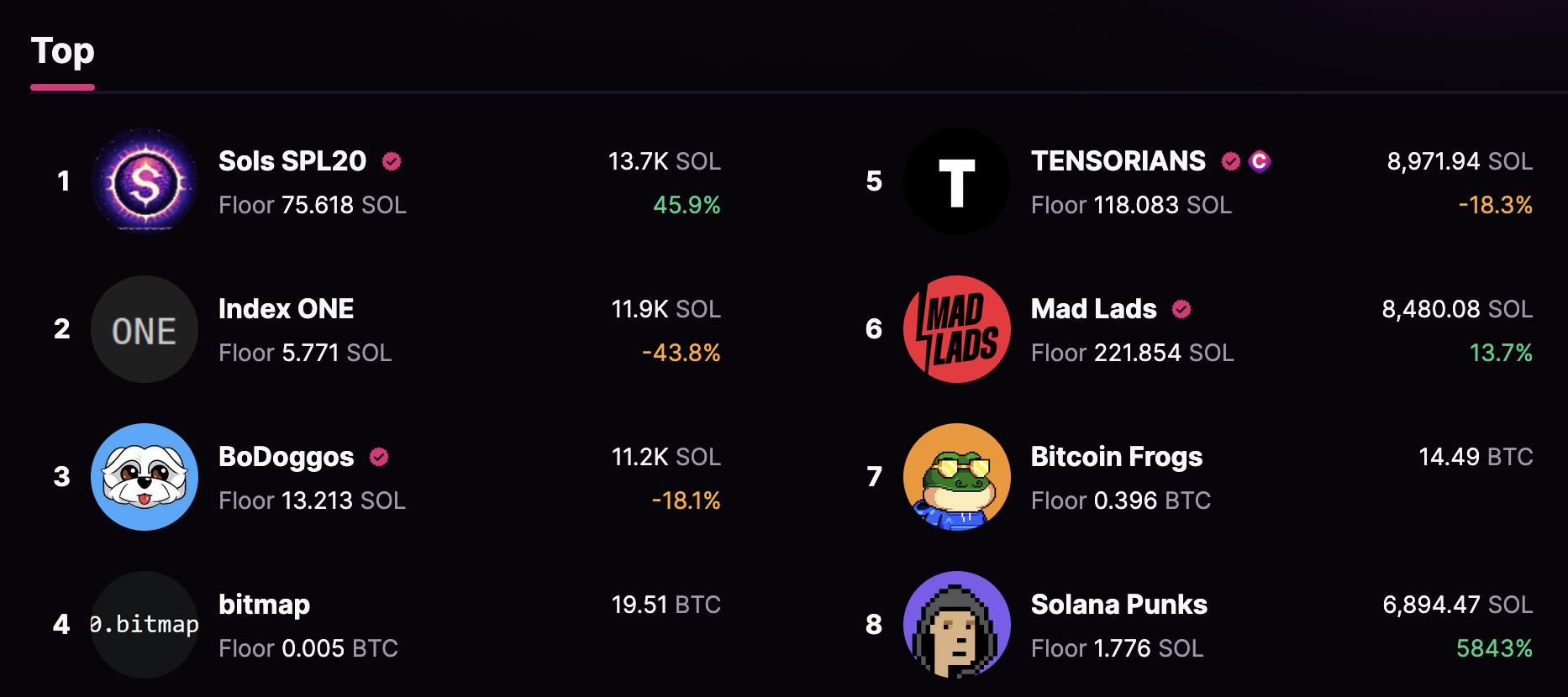

Magic Eden is a project mainly targeting Solana BlockchainNFT Marketplace. It has a large influence in the Solana ecosystem, providing a user-friendly interface that enables artists, collectors, and NFT enthusiasts to easily buy, sell, and explore NFTs. Its features include low transaction fees, high-speed transactions, and a diverse collection of NFTs, which makes it one of the most popular NFT markets in the Solana ecosystem.

In March of this year, with the rise of Ordinals NFT, Magic Eden announced its expansion into the Bitcoin ecosystem as an important step in its multi-chain vision, which further strengthened its position in the multi-chain NFT market.

As shown in the figure below, the transaction volume of Bitcoin ecosystem NFTs such as bitmap and Bitcoin Frogs is also at the forefront in Magic Eden.

Nostr: The combination of decentralized social networking and micropayments

Nostr is a decentralized social protocol supported by Twitter co-founder Jack Dorsey. Its concept originated in November 2020 and aims to build a global, decentralized, and censorship-resistant communication network.

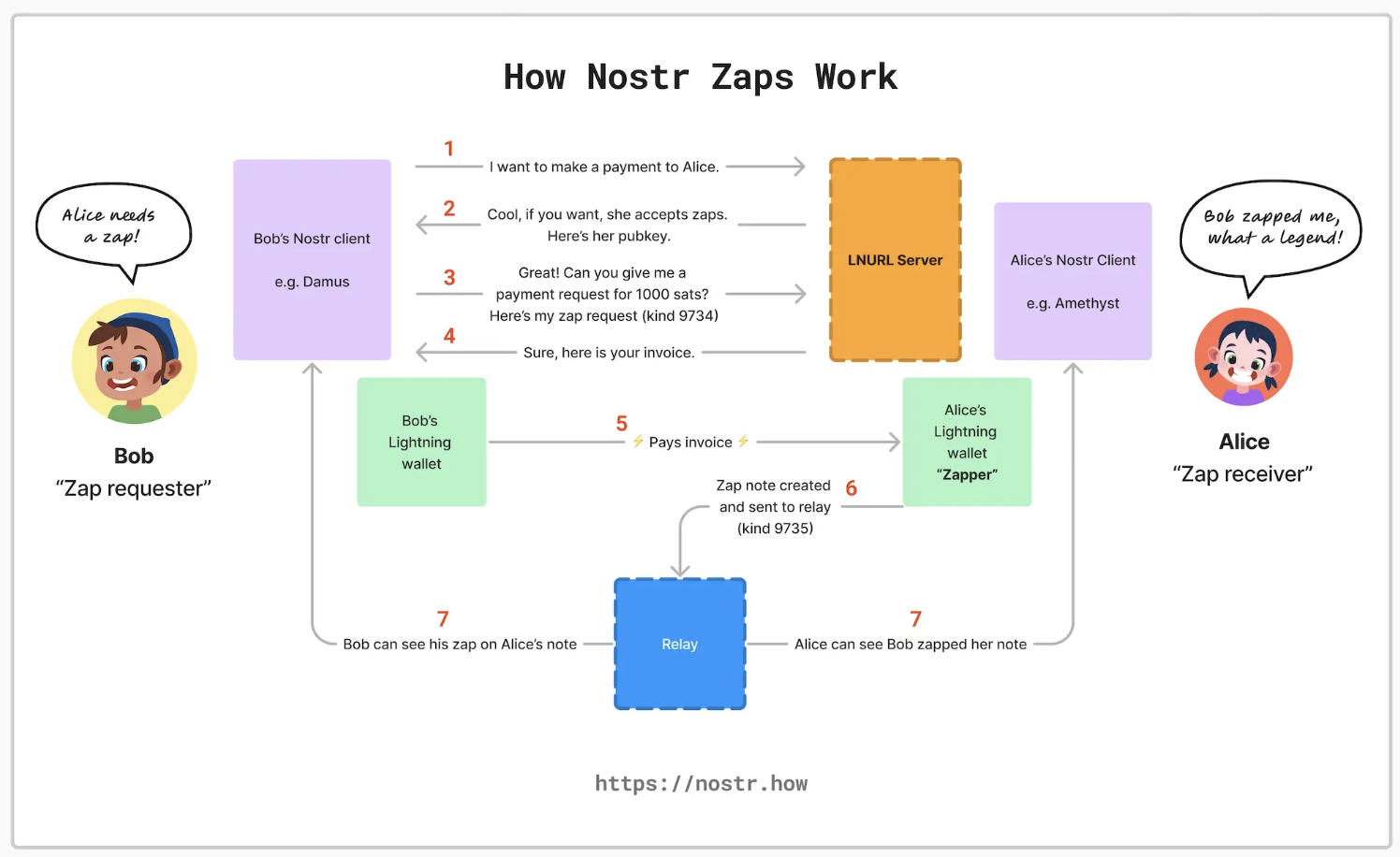

In September this year, Nostr upgraded to NIP-57, adding a small payment function "Zaps", which allows users to make small rewards or payments through the Nostr client, thereby enabling fast and low-cost payments in the Nostr ecosystem. Zaps are mainly implemented through the Lightning Network, which is an efficient and low-cost process.

After the user initiates a Zap request in the Nostr client, if the recipient's LightningwalletZaps are supported, and the LNURL server will respond and confirm the recipient's public key. The client will then create a Zap request containing the key data in the payment, and the LNURL server will respond and provide the required invoice. Once the user completes the payment, the amount is paid directly to the recipient's Lightningwallet.

To date, Zap has processed more than 50,000 payments.

ALEX's B20 and Oracle

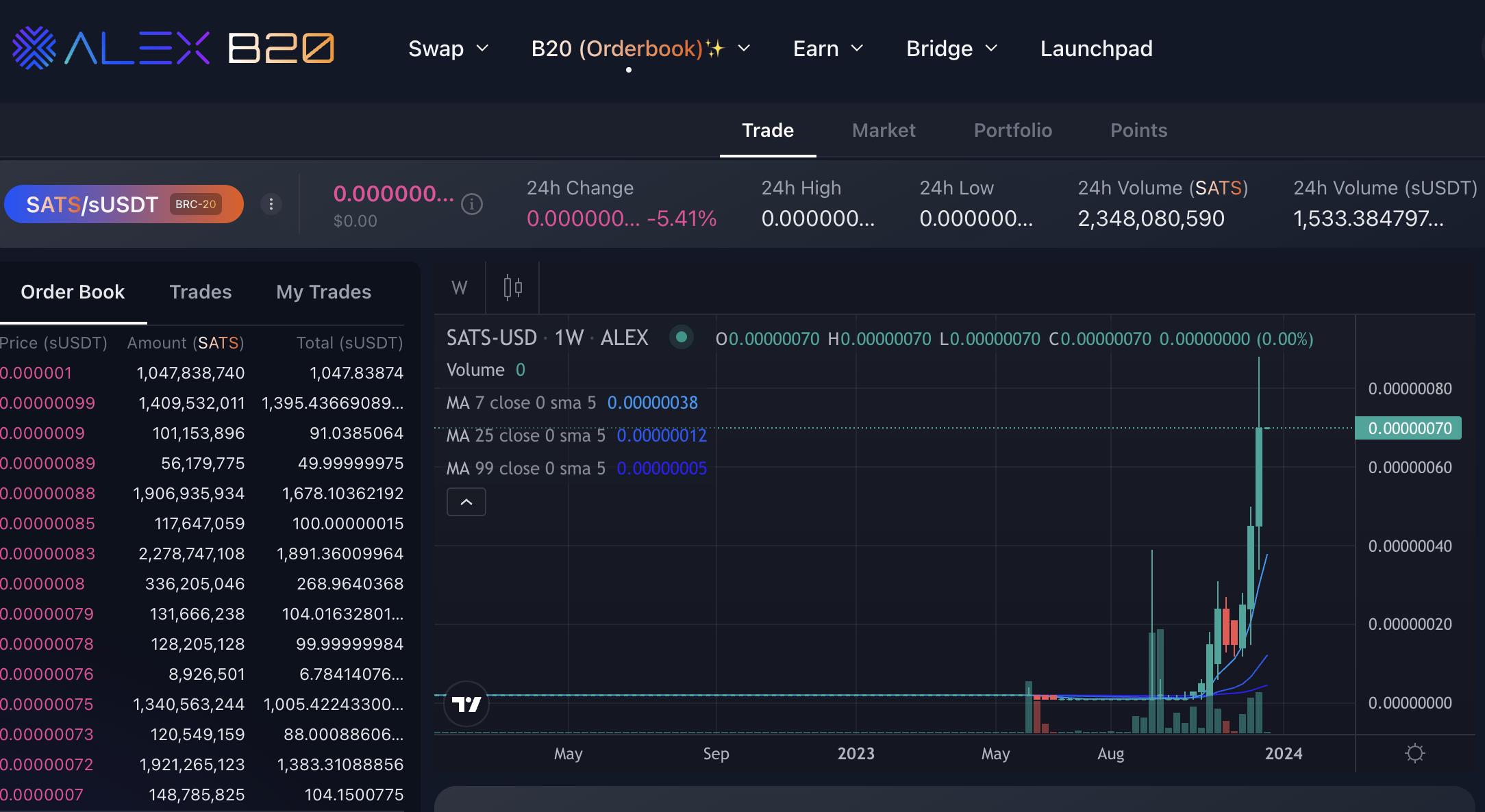

ALEX was originally a DeFi (decentralized finance) platform on Stacks. Its main product is a DEX, and it also has Launchpad, cross-chain bridges, staking, mining, lottery and other functions. DefiLlama data shows that ALEX's TVL is 38.8 million US dollars, accounting for about 82.3% of Stacks TVL. If it is judged only by the positioning of a public chain head DEX, then ALEX's valuation is very limited, especially the liquidity and trading volume are not high.

在铭文火爆之后,ALEX 开发了一个名为 B20 的去中心化交易所,专门用于交易 BRC20 代币,ALEX 还为新加入者提供了 STX 代币以支付生态系统的燃料费。在 B20 中,这些 BRC20 代币可以用 sUSDT 作为基础货币进行交易,sUSDT 是从 BNB 链跨链到 Stacks 的 USDT。

In addition, ALEX plans to launch the first Bitcoin oracle for BRC20 tokens, an effort that is being carried out in conjunction with BRC20 creator and ALEX advisor @domodata and key existing off-chain indexers including BestinSlot, OKX, Hiro, Unisat, etc. It hopes to leverage Stacks’ programmability and ability to read Bitcoin state to lead the decentralized consensus of the BRC20 index, also known as the “indexer of indexers.” The goal of the Bitcoin oracle is to verify each BRC20 event and update the decentralized, on-chaincontractThe global balance in .

Controversy over inscriptions on various public chains

Inscriptions such as Ordinals are prevalent on Bitcoin, with ORDI and SATS both having a market cap of over $1 billion. Projects such as Ordinals allow users to attach data (such as text, images, etc.) to specific parts of a transaction, thereby associating that data with a specific Satoshi. When such a transaction is packaged intoBlockchainWhen a specific Satoshi is created, it carries the data attached by the user. These specific Satoshi can be regarded as unique digital assets, and users can trade them to others to realize the transfer of specific assets.

如果说铭文让原本不支持智能合约的比特币新增了一种资产发行方式,那么在其它链上流行的铭文是否还有意义呢?具不完全统计已发布和准备发布铭文的公链超过 30 个,如以太坊的 ETHS、Solana 的 SOLS、Avalanche 的 AVAV,铸造铭文的过程甚至导致 Arbitrum、TON、IOST 等多个网络短时出现宕机。

On the evening of December 19, the first inscription INJS on Injective caused a farce. Since each INJS casting needs to pay 0.03 INJ to the contract deployer, the project caused dissatisfaction among inscription players. When INJS began to be minted, the official Twitter account of Injective tweeted that users should not participate, and said that the practice of the inscription team charging fees was inappropriate. After that, INJS announced that it would stop minting, and users would be allowed to participate for free in the future. This also reflects the users' pursuit of free launch of inscriptions.

What is the difference between transferring inscriptions on the smart contract chain and transferring money through smart contracts? Taking the inscription project Ethscriptions on Ethereum as an example, EthscrXiaobai NavigationTransfer fees for ethscriptions can be lower than regular smart contract transfers because they reduce transaction costs by using calldata and avoiding traditional smart contract storage and execution. This makes Ethscriptions a more cost-effective way to perform operations on the blockchain.

但是绕过传统的智能合约存储和执行可能会引入新的Safety漏洞或不可预见的行为,特别是在处理复杂的数据结构或逻辑时。另外,如果仅使用 calldata,Ethscriptions 可能无法利用智能合约提供的所有功能和灵活性,可能限制它们在某些应用中的实用性。

summary

In the development of the Bitcoin ecosystem, Bounce's unique auction gameplay has brought a good wealth-creating effect, and it also plans to develop Bitcoin Layer 2; Nostr combines decentralized social networking with micropayments; ALEX has developed the BRC20 trading market and plans to launch the first decentralized Bitcoin oracle; Uniswap and Magic Eden have respectively expanded their trading businesses to the Bitcoin ecosystem.

Inscriptions have been successfully extended to almost all public chains worth paying attention to. For non-smart contract chains such as Bitcoin, inscriptions are even more important. For Ethereum, inscriptions reduce the on-chain storage and execution costs in traditional smart contracts, but may also introduce new security issues, and the functionality is not as flexible as smart contracts.

The article comes from the Internet:Chasing the popularity of Bitcoin and inscriptions, how do these old projects bloom "new flowers"

Related recommendations: Ouyang Jing releases new song "Nobody" and announces Stephen Chow's new NFT

"Nobody" is a preheating for the NFT Nobody series of the same name created by Zhou Xingchi, invited by Ouyang Jing, the first creator of Moonbox. On December 6, the well-known director and actor Zhou Xingchi reposted the MV of the new song "Nobody" by the Chinese-American rapper Ouyang Jing on INS. The copy revealed that Moonbo...